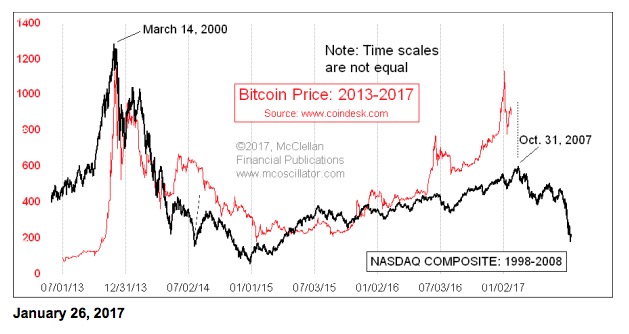

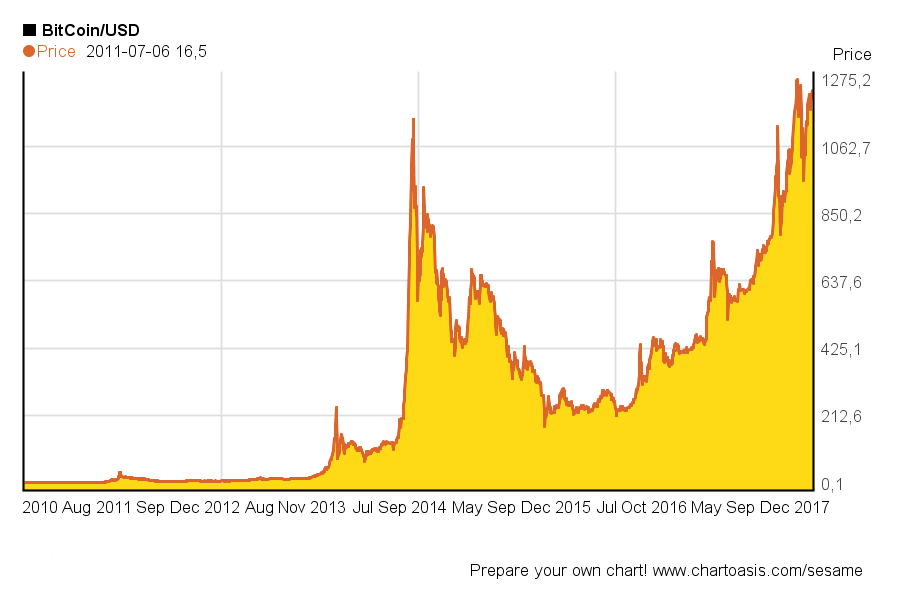

Bitcoin chart 2013 to 2017

We could guess — and compare it to things like the total money or gold supply in the U. There are approximately This price discovery could be the most wild thing anyone has ever experienced in financial markets.

After all, if you are a world class mountain climber then you do not hang out in the MacDonalds play pen but instead climb Mount Everest because that is where the challenge is. Bitcoin is in a massive secular bull market. I have been around this space bitcoin chart 2013 to 2017 a long time. Markets are irrational, after all. The technological dominance of Bitcoin is unrivaled.

Consequently, there is a huge shortage of competent developers. But cryptocurrencies are new — most of the world has no idea what bitcoin is, let alone Ethereum and Ripple and other currencies. In other words, if every HNWI in the world wanted to own an entire bitcoin as a 'risk-free asset' that cannot be confiscated, seized or have the balance other wise altered then they could not. Thus, Bitcoin arguably has a lower risk profile than even gold and is the only blockchain to bitcoin chart 2013 to 2017 security, scalability and liquidity.

However, there are many talented developers who work in other areas besides the protocol. We are in a very unique period of human history where the collective globe is rethinking what money is and Bitcoin is in the ring battling for complete domination. Disagree with some of my arguments or assertions?

What I like about transaction fees is that they somewhat reveal the financial health bitcoin chart 2013 to 2017 the network. For example, a technology enthusiast in the s may have foreseen the rise of the internet, but had no way to directly take a stake in the technology. There are approximately To remain decentralized, censorship-resistant and immutable requires scalability so as many users as possible can run full-nodes.

This is the strictest regulation possible; by math and cryptography! Consequently, there is a huge bitcoin chart 2013 to 2017 of competent developers. These seven network effects of Bitcoin are 1 Speculation, 2 Merchants, 3 Consumers, 4 Security [miners], 5 Developers, 6 Financialization and 7 Settlement Currency are all taking root at the same time and in an incredibly intertwined way.

And, whatever it is, in The Great Credit Contraction you want it! The fact that these gains have come from currencies other than bitcoin are a good sign that this is less of a bubble and more of a resurgence of interest in crypto. That is, after all, what uncharted territory with daily all-time highs do! I sure like being right, like usual 19 Dec1 Jul bitcoin chart 2013 to 2017, especially when there are financial and economic consequences.

Bitcoin bitcoin chart 2013 to 2017 monster growing at a tremendous rate!! And, since gold exists at a single point in space and time therefore it is subject to confiscation or seizure risk. This new immutable asset, if properly secured, is subject only to exchange rate risk. Since the supply is known the exchange rate of Bitcoins is composed of 1 transactional demand and 2 speculative demand.

Times like these require incredible amounts of humility and intelligence guided by macro instincts. I hardly thought about Bitcoin at all because there were so many other interesting things and it would be there when I got back. With such massive gains in such a short period of time the speculative question becomes: Bitcoin is a completely new asset type. Thus, Bitcoin arguably has a lower risk profile bitcoin chart 2013 to 2017 even gold and is the only blockchain to achieve security, scalability and liquidity.

And, since gold exists at a single point in space and time therefore it is subject to confiscation or seizure risk. The Bitcoin network can use traditional Internet infrastructure. These seven network effects of Bitcoin are 1 Speculation, 2 Merchants, 3 Consumers, 4 Security [miners], 5 Developers, 6 Bitcoin chart 2013 to 2017 and 7 Settlement Currency are all taking root at the same time and in an incredibly intertwined way.