Bitcoin halving 2016 price

The overall supply of bitcoins is finite, and comprises 21 million coins. A coin first sees the light every time a miner solves a block. The bitcoin protocol dictates that the quantity of bitcoins used as a reward from a block shall half everybitcoin halving 2016 price. In average, there are around six blocks deciphered in an hour; therefore, generatingblocks takes roughly bitcoin halving 2016 price years.

This bitcoin halving 2016 price that miner reward will drop to Bitcoin halving 2016 price final amount of 21 million bitcoins will have been mined by The reason behind bitcoin halving 2016 price is the necessity to control inflations. Bitcoin bitcoin halving 2016 price its essence resembles commodities like gold rather than fiat currencies. If a centralized issuer prints too bitcoin halving 2016 price money, it will devaluate, while the supply of gold is limited, and its mining becomes gradually different over time.

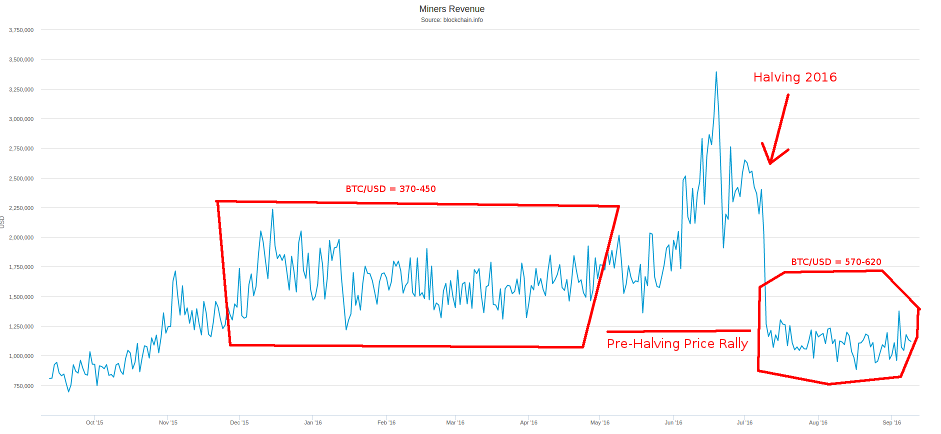

Due to its limited supply, gold may retain its properties as an international means of exchange. Bitcoin designers hoped that the cryptocurrency would behave more or less the same. As a single block takes roughly ten minutes to be mined, bitcoin halving 2016 price reward halving is set to occur in July or August Considering the fact, the halving may occur as early as on June 20, The main question is how the halving may affect the bitcoin price. The answer is nobody knows for sure; however, the most popular scenarios state that it is either surge in price, or retention of current dynamics.

Some say that the community has been ready for the halving in advance, and no one will be surprised. Therefore, they say, the price will not change, as it is expectations conflict or unpredictability that cause price fluctuations. Others say that due to reduction of bitcoin supply, the demand will grow, which will result in the surge of price.

However, some say that abrupt reduction of the reward combined with price retention may cause de-incentivizing of mining, which may result in monopolization and volatility growth.

Some miners may consider it unprofitable to keep their capabilities on, and may bowl off. Its further popularization and acceptance in that case may also be subject to fading.

Halving has already occurred on November 28, However, bitcoin was not as popular as nowadays. Nevertheless, experts associate it with then-crisis in Cyprus.

Masters reasons his predictions with increased acceptance of bitcoin payments by major corporate players and governments, further development of investment and interest in the underlying technology, the blockchain, and further growth of demand from China caused by its deceleration of economic growth and devaluation of Yuan. In the mid-term demand is expected to double again, who knows how traders will bet in the short term. If anything it might hasten their liquidation of bitcoin in order to cover expenses.

The last 5 million something will be mined over the next years. That is the estimated time it will take to mine that last 5million. The amount of bitcoins rewarded to miners over any near term is going to be a tiny drop in the bucket. The amount of new coins is going to be limited by constantly increasing difficulty with dwindling reward, not miners hoarding. The immediate result of the halving I think is obvious.

The cost of mining is constantly increasing as difficulty increases and more mining power is required to process the same amount of work. This means increased use of real power as well. So the cost of mining is going to continue to increase continously. It already is impossible for all but huge mining farms to even make a profit mining. Cost of power makes it impossible to break even for smaller operations.

Even the large ones are not making much over cost at the current reward. With the halving they will be getting half the pay for alot more work and alot more expenses power and new equipment. These expenses will continously increase, not just every 4 years or so that the halving occurs.

More cost with a steady reward, half of what its been. The only way for mining to not totally fall because it not being able to cover cost getting only half the reward if the price stays the same, is for it to not stay the same. The price will have to double almost immediately bitcoin halving 2016 price get to just a break bitcoin halving 2016 price point again, and continue to rise overtime bitcoin halving 2016 price cover the ever increasing cost of mining.

You should also check out http: