Bitcoin is surging in price and popularity but so are the

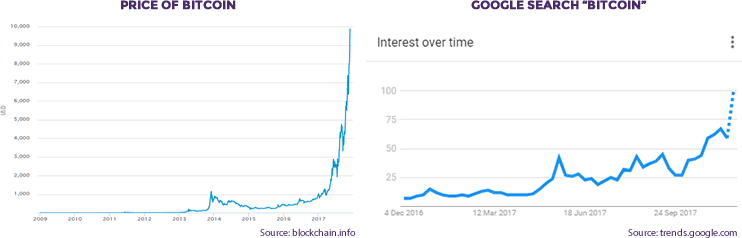

After an intensive period of growth, the price of one Bitcoin surpassed the price of an ounce of gold. That seems like ancient history. The not-Bitcoin cryptocurrency that could help replace Uber. But is the rally over, or has it only just begun? And what has propelled the explosive growth in the first place? In the world of cryptocurrencies, answering these questions is anything but easy. To start, it's important to understand that Bitcoin, while still the biggest cryptocurrency around, is not the only — arguably not even the biggest — driver of growth anymore.

A couple of years ago, one Bitcoin was worth a little over a hundred dollars. The digital coin market cap is a frequently quoted number that means nothing and everything, depending on your viewpoint. But it may never happen, and even if it does, Bitcoin might be left behind. Bitcoin is still by far the most promising as both a digital currency and a payment platform. But the new breed of digital coins are very different.

Litecoin, an early Bitcoin competitor, has once again taken the spotlight after having recently adopted SegWit, a software update that solves the scaling problem that has been dividing Bitcoin's community for years.

Ethereum is a modern cryptocurrency which promises advanced features such as smart contracts. It wants to become a blockchain-based foundation for what is essentially a new type of internet.

How's that for ambition? When the price of a commodity or a stock rises, you can usually point to some sort of reason. But is this a bubble? Are the gains real? And are the bitcoin whales in for a sad Christmas? First we must understand what drives bitcoin price and, in particular, this boom. The common understanding for current growth leads us back to institutional investors preparing for the forthcoming BTC futures exchanges.

The primary theory about the astonishing rally being put forward by investors on social media is that bitcoin will soon benefit from big institutional money injections via the introduction of the first BTC futures products. This ability makes bitcoin far more palatable to big investors who are currently flooding the market to make profits if and when the bitcoin price falls. This group of enthusiasts bought and held bitcoin and will not sell it at any current price.

The common understanding for current growth leads us back to institutional investors preparing for the forthcoming BTC futures exchanges. The primary theory about the astonishing rally being put forward by investors on social media is that bitcoin will soon benefit from big institutional money injections via the introduction of the first BTC futures products.

This ability makes bitcoin far more palatable to big investors who are currently flooding the market to make profits if and when the bitcoin price falls. This group of enthusiasts bought and held bitcoin and will not sell it at any current price.

More and more bitcoin fans are entering into this group and they are driving up demand increases. We see a common thread between these points: All cryptocurrency movements are based on domain specific media and conversations between traders. Bitcoin traders, it can be said, are now akin to the jolly colonists selling stocks under buttonwood tree.