Bitcoin trading bot for btc e bitfinex

Gross market inefficiencies like this result from one of:. Here is a simple example: The normal approach is as you suggest, to update the average regularly - that's pretty much the definition of a moving average.

I suggest anyone attempting to create or operate a trading bot pay careful attention to events like this. Nobody knows whether Bitfinex is insolvent or not. Need help understanding how to profit from bitcoin trading like forex?

This is why there are some juicy arbitrage opportunities between the exchanges when the prices are volatile -- few traders keep much cash idle in different exchanges so when the price rises as the result of a whale bitcoin trading bot for btc e bitfinex Mt. The key steps you outlined for creating a cryptocurrency trading bot are correct. When the value of Bitcoin is different enough that one could buy cheaply for one currency then sell for a profit in another, or in the same currency across multiple exchanges, people will do just If you could cause this event to occur, and had placed buy or sell orders as appropriate, you would be able to profit immensely from this — at the direct cost of others. I suggest anyone attempting to create or operate a trading bot pay careful attention to events like this.

Purposeful abuse of margin calls This is what causes the majority of these events — an ethically gray action, or, in the views of some, actively evil. A devious individual would recognize here that this means that someone with an immense amount of ability to move the market bitcoin trading bot for btc e bitfinex cause such an event to occur. As soon as they get a transaction that outputs to a known address, they immediately

Despite of this I didn't lose money as bitcoin trading bot for btc e bitfinex bitcoin price kept rising. The chart for this one is a lot more… bullish… than the rest. Unless we can see exactly where the bots are operating and exactly how the propagate their transactions, we'll never know exactly how one bot wins over another on addresses where the private key is known. I empathize with them, but, on the un-empathetic side, it is their fault. This is why there are some juicy arbitrage opportunities between the exchanges when the prices are volatile -- few traders keep much cash idle in different exchanges so when the price rises as the result of a whale at Mt.

Assuming no fees, you would: Nobody knows whether Bitfinex is insolvent or not. Despite of this I didn't lose money as the bitcoin price kept rising. Gross market inefficiencies like this result from one of:. Gox, exchange rates at the other exchanges might lag until either new funds are transferred or the sellers wake up and readjust their

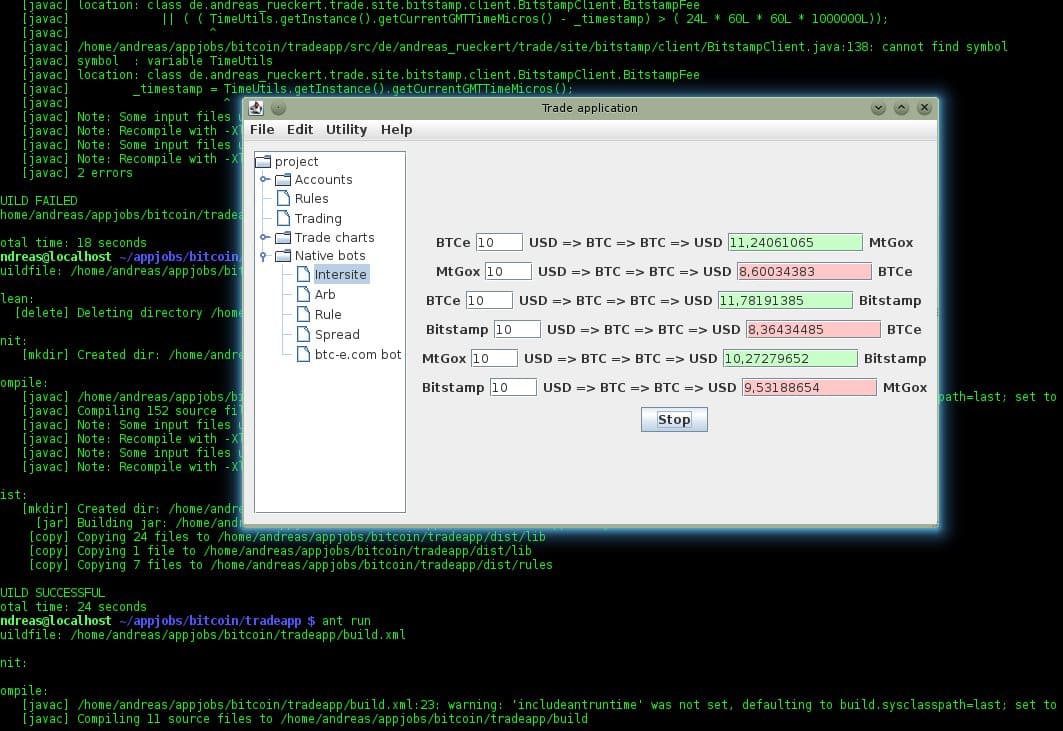

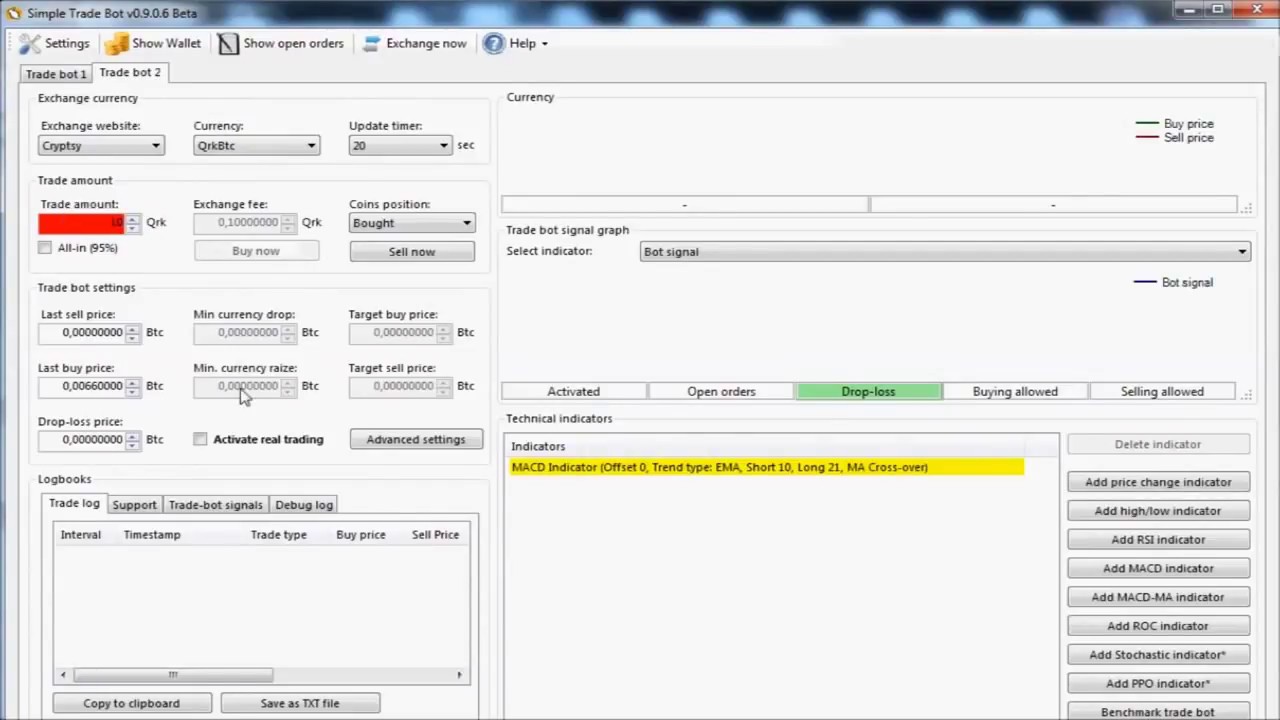

Gross market inefficiencies like this result from one of:. Your account has been re-enabled. See this article for more How to build a bitcoin trading bot.

I wrote a simple market maker bot in Python: Is Storj still alive as a project? The whole autonomous self-replication thing is bitcoin trading bot for btc e bitfinex a long ways off, but it's a neat idea. Because there's absolutely no reason a functional trading bot would be sold when it could be used to generate income. This was abused to cause massive disruptions to the market and resulted in margin calls, prompting Bitfinex to halt trading.

I suggest anyone attempting to create or operate a trading bot pay careful attention to events like this. Like a fool I took their advice and didn't pay attention for a few months, Overall your question is pretty broad, but I did do a walk-through video on creating a simple trading bot earlier this year on youtube. Liquidbot uses ezl's wrapper code to interface with MtGox: And now we have a new one to add to the list: