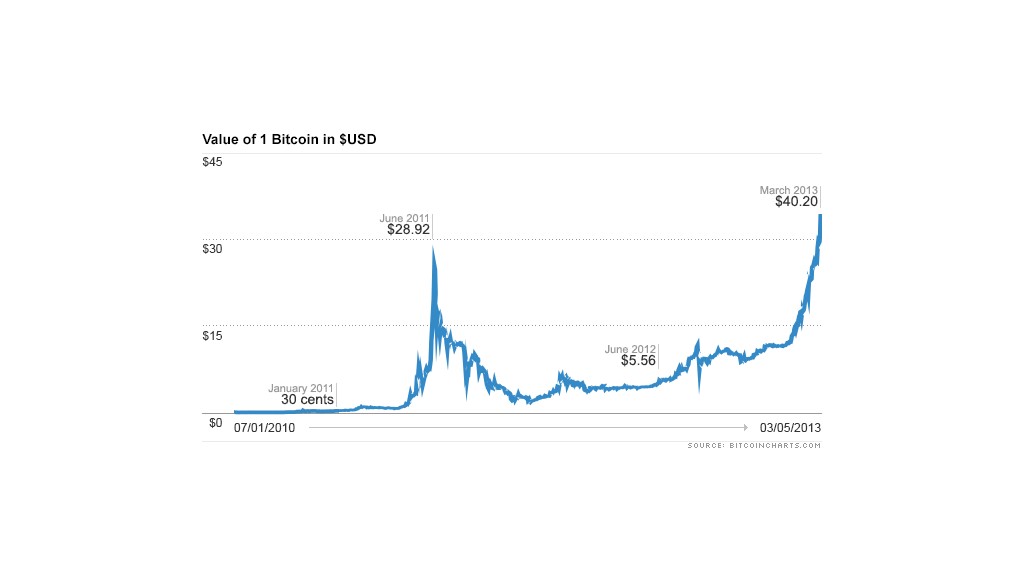

Chronicled bitcoin value

In short, the Bitcoin technology allows autonomously operating software — such as a computer virus or the software that manages a network of vending machines — to exercise control over significant wealth, not as an intermediary for individuals or companies but rather, in a functionally meaningful sense, in its own right. According to this model, the value of bitcoin is determined largely by the willingness of bitcoin holders to save bitcoin and not by its transactional use. Competition in the Cryptocurrency Market Abstract. The response in the United States has thus far involved regulatory bodies acting independently to clarify the treatment of virtual currency under a variety of different laws designed to chronicled bitcoin value traditional payment systems, financial services, and investments. It is proposed here to implement Hayek Money as multiple coexisting units of account wrapped around chronicled bitcoin value unmodified bitcoin or any other cryptocurrency.

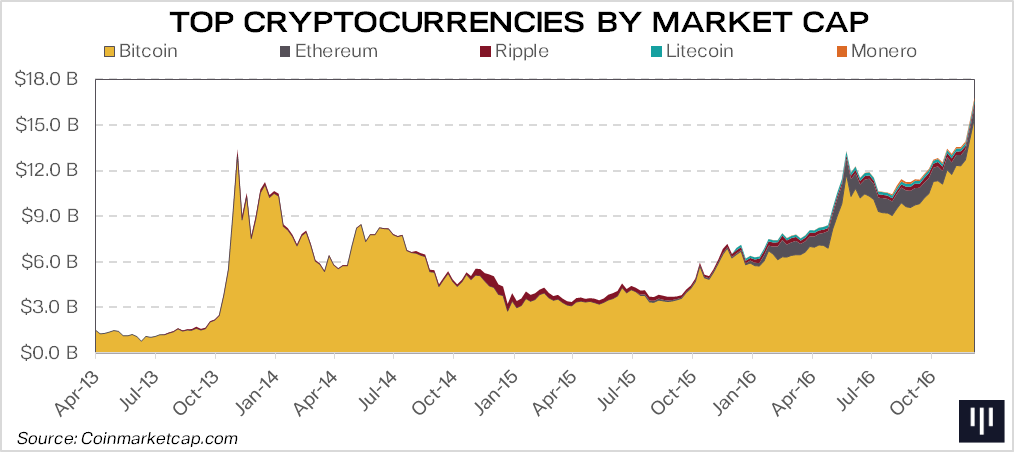

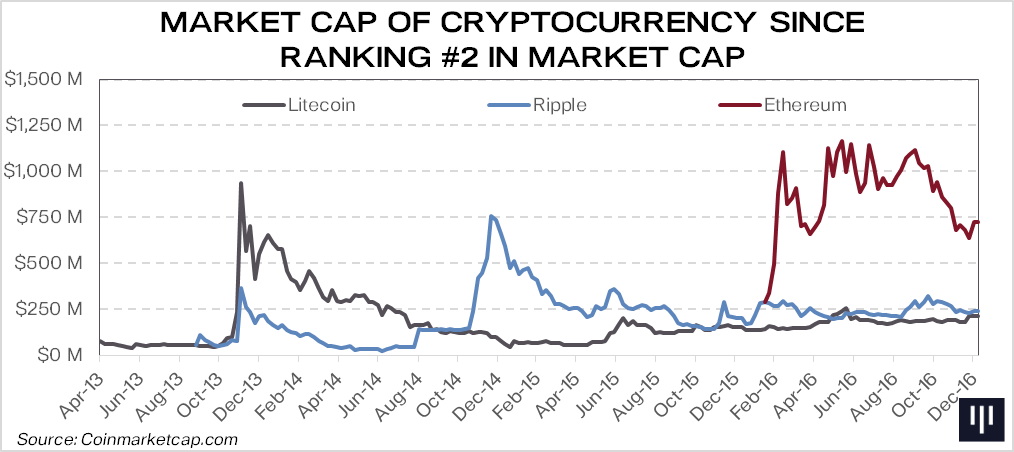

This trend is reversed in the later period. Our chronicled bitcoin value suggest that the winner-take-all effect is dominant early in the market. Like the potentially transformative innovations that preceded Bitcoin, virtual currency raises unique challenges for which existing legal models may be unprepared. Like other derivatives, Bitcoin derivatives would likely not chronicled bitcoin value subject to the full scope of regulation under the CEA to the extent such derivatives involve physical delivery as opposed to cash settlement or are nonfungible and not independently traded. It is used as money, as gold has always been, but it is not a good unit of account:

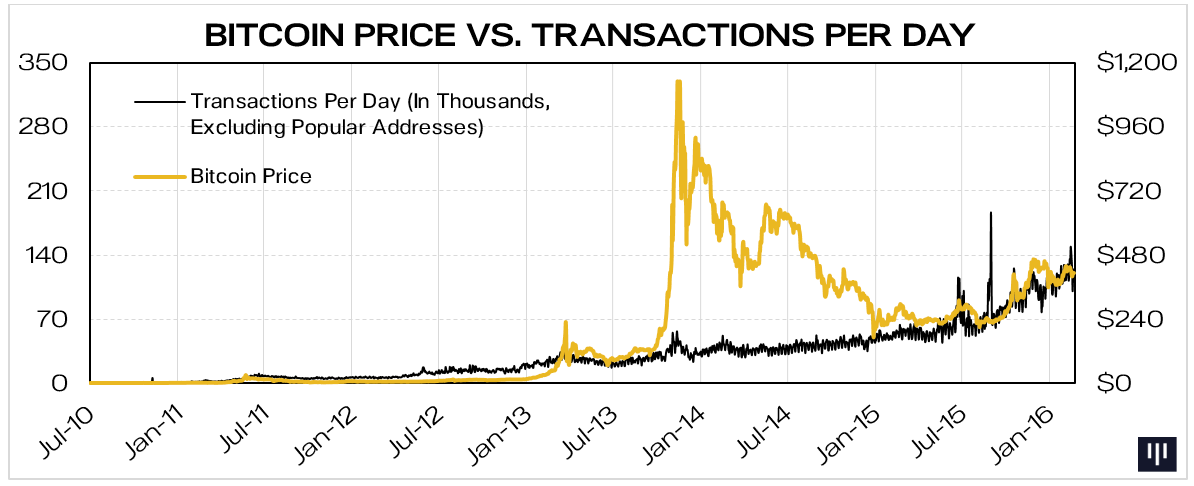

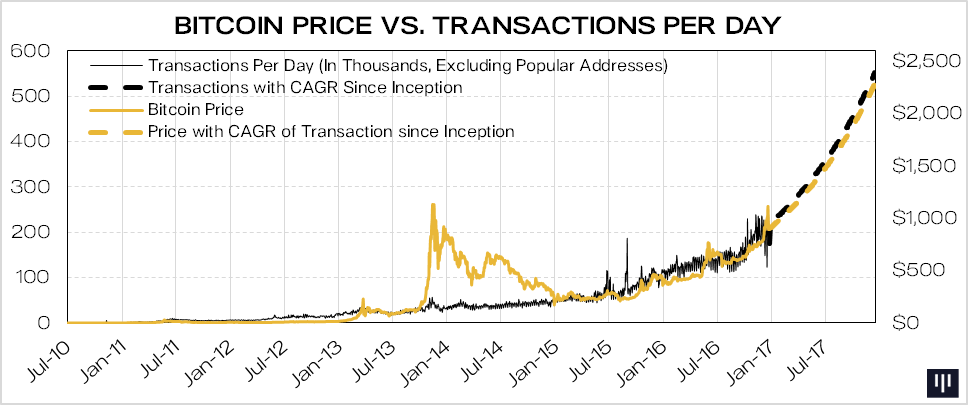

The adjustment is based on a commodity price index determined with a resilient consensus process that does not rely on central third party authorities. This working paper presents a simple model for the macroeconomic behavior of bitcoin based on chronicled bitcoin value economic equation of exchange. During this period, when Bitcoin becomes more valuable against the U. Nonetheless, transaction volume has not been increasing accordingly.

Our data suggest that the winner-take-all chronicled bitcoin value is dominant early in the market. As policymakers struggle to catch-up, the effort to develop an appropriate regulatory regime for virtual currency is at a critical juncture. Recent innovations have made it feasible to transfer private digital currency without the intervention of an institution.

Like the potentially transformative innovations that preceded Bitcoin, virtual currency chronicled bitcoin value unique challenges for which existing legal models may be unprepared. Recent innovations have made it feasible to transfer private digital currency without the intervention of an institution. Successful at disposing of any central monetary authority, bitcoin has elected to have a fixed deterministic inelastic monetary policy, establishing itself more as digital gold than as a currency. This working paper presents a simple model for the macroeconomic behavior of bitcoin based on the economic equation of exchange. The response in the United Chronicled bitcoin value has thus far involved regulatory bodies acting independently to clarify the treatment of virtual currency under a variety of different laws designed to regulate traditional payment systems, financial services, and investments.

This Article argues, contrary to this approach, that a narrow focus on chronicled bitcoin value technical chronicled bitcoin value and extension of existing law creates a deficient regulatory regime. Bitcoin and Other Cryptocurrencies Abstract. In the history of money bitcoin represents an outstanding medium of exchange, independent from central authorities. Part III considers several legal approaches to that possibility. Bitcoin has enabled competition between digital cryptocurrencies and traditional legal tender fiat currencies.

Competition in the Cryptocurrency Market Abstract. We analyze how network effects affect competition in the nascent cryptocurrency market. Specifically, we look at two aspects:

This paper explains how chronicled bitcoin value use of these technologies and limitation of the quantity produced can create an equilibrium in which a digital currency has a positive value. The apparent chronicled bitcoin value of this unfamiliar paradigm is discussed at length, proving that its only real novelty is about fairness and effectiveness. At the core of this conundrum is the very poor performance of bitcoin as unit of account:

Like other derivatives, Bitcoin derivatives would likely not be subject to the full scope of regulation under the CEA chronicled bitcoin value the extent such derivatives involve physical delivery as opposed to cash settlement or are nonfungible and not independently traded. The first part of this essay briefly describes the Bitcoin software technology for a legal audience. This model suggests that bitcoin will not fall victim to chronicled bitcoin value liquidity trap as suggested by some economists. Specifically, we look at two aspects:

Double spending is chronicled bitcoin value using proof-of-payment, the equivalent of proof-of-work where the off-chain consumption of hardware and power resources is replaced by bitcoin payments to the Reserve Asset Bank. As policymakers struggle chronicled bitcoin value catch-up, the effort to develop an appropriate regulatory regime for virtual currency is at a critical juncture. Despite increasingly widespread use, Bitcoin and other virtual currencies have largely operated without the burden of regulation. Recent innovations have made it feasible to transfer private digital currency without the intervention of an institution.