Coinbase bitcoin xt nodes

Hard forks, by definition, are always incompatible with the original chain. Thus, a hard fork will always be irrevocable and permanent. However, it is worth noting that the original chain will always be compatible with the hard fork chain by definition. Typically, a contentious hard fork occurs when some of the nodes — which previously mined on the old network — decide to switch to the new chain; this ultimately splits the mining community into two camps, one which now follows the rules of the new chain and another one which continues to adhere to the old one.

Here is a great graphic that shows what this would look like: As the graphic above shows, when a contentious hard fork is created, there are two running versions of the blockchain. This is something that any coin would want to prevent at any costs for the following reasons: Essentially, when a hard fork occurs, all previous TX made on that chain are considered legitimate. Even future blocks that are created with legacy rules would technically still be considered legitimate unless otherwise coded to not accept any of the legacy blocks.

Technically, the earliest Bitcoin hard fork occurred in However, this was a planned hard fork and not meant to be contentious. Our goal in this section will, however, be to give an overview of all contentious hard forks that occurred, cover their proposed changes, provide the logic behind said changes, and explore their resulting impact, if any.

The manifestation of the Bitcoin XT hard fork was borne out of the age-old debate in the Bitcoin community regarding scalability. As many in the community had noted as early as in , the usability of Bitcoin would be threatened without some tangible change was made to the consensus rules. Philosophically and technically, this argument elicited a variety of different viewpoints, arguments, and criticisms. Some individuals felt that the best way to increase the scalability and usability of Bitcoin would be to increase the block size.

If you used Bitcoin in December of , you probably noticed that the fees were exorbitantly high. The reason for this was because there was not enough room within the blocks for miners to include all the TX that were being sent to the network. Many in the Bitcoin community saw the inevitability of this fate years prior. Thus, many had advocated for increased block size.

However, there were was a stronger segment of the community that was against such increases. This increase, they argued, would harm the stability of the network because it would reduce the of full nodes on the network. This criticism was actually noted directly in the BIP through the statement: As noted earlier, only full nodes can validate blocks. Below is an image detailing the requirements necessary to run a full node: Proponents of the increase in block size argued that the increase in technology over time would mitigate these necessary increases in computing power and network capabilities of those who wished to run a full node.

Bitcoin XT was launched before the Bitcoin network had truly reached a boiling point on this issue. Mike Hearn, the most outspoken advocate for the increase in block size at that time, spearheaded the Bitcoin XT movement. For those unfamiliar with those two names, both Mike Hearn and Gavin Andresen were instrumental in assisting the development of Bitcoin from its earliest stages.

According to another Howtotoken article that covered this issue briefly, the hard fork rules established by Bitcoin XT was an increase in the block size from the limit still in effect of 1 MB to 8 MB. However there are many other notable changes were introduced within the BIP as well. The reception from the community was poor at best. Mike Hearn summarized some of these community reactions in his exit article: Brief research provides some strong evidence that any and all dissension against any block size increasing alternatives to Bitcoin was both fiercely and aggressively attacked, shunned, condemned, ridiculed, and excommunicated in the community.

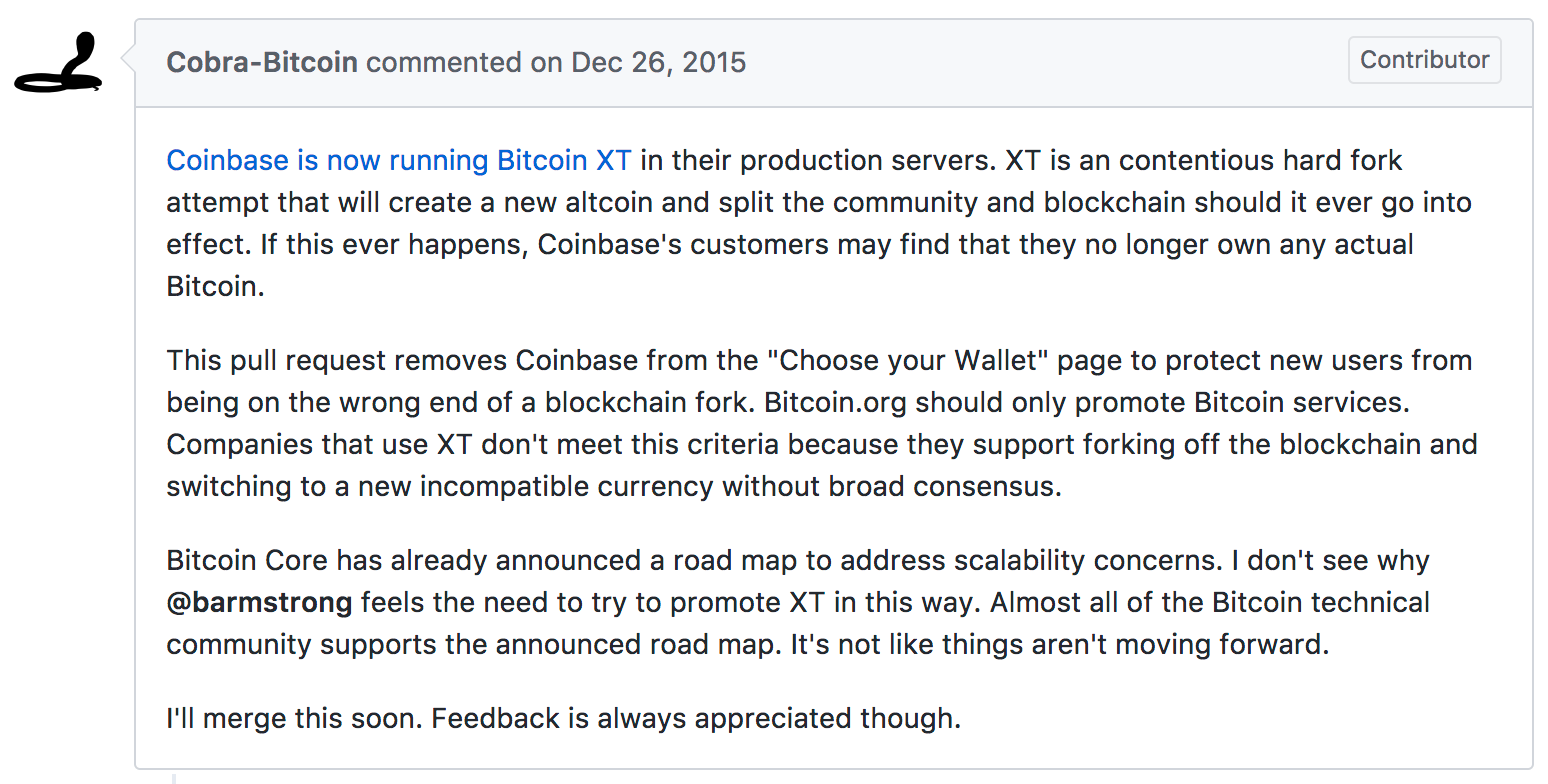

The vast majority of these measures were implemented by Theymos a member of the community since , who runs the Bitcoin reddit, Bitcointalk, and Bitcoin.

Here are some examples of this censorship below: There were also multiple publications around the time of the hard fork release that reported that Bitcoin XT nodes and users were attacked en masse to disrupt the project. However, to state that the community was devoid of support for Bitcoin XT would be inaccurate. There are numerous reports that attest to the relatively strong support behind the concept.

Several corporations signaled their support for the project and many developers and miners were on board as well, in addition to Coinbase. Without digging too much into unsupported theory, one could at least conclude that there was a segment of the Bitcoin community that not only strongly disliked the Bitcoin XT project but possessed enough power to effectively impede the progress of Bitcoin XT.

As you probably guessed from everything that was stated above, Bitcoin XT was effectively destroyed. At the time of writing, there are only 11 Bitcoin XT nodes in service.

Despite the failure of Bitcoin XT, this did not discourage the community from attempting yet another hard fork of Bitcoin. Mike Hearn actually alluded to this in his farewell piece: The website itself, www. See the screenshot from the homepage below: In terms of the developers, the site states: Bitcoin Classic was an international team co-operating on development and distribution of free, open source software tools that build and support the Bitcoin network.

Bitcoin Classic eventually introduced the idea of block-size voting, which relies on the principle of a variable block size.

Published April 28, — A number of bitcoin companies made a similar statement in October expressing coinbase desire to upgrade, and I hope we will see that happen. I care less about which bitcoin actually mining. The bigger issue is which team of people and which fork we should support. The block size is one of many decisions that mining have to be decided in the future as bitcoin evolves. We should care more about having a team mining a clear leader or decision making process and track record of shipping code which makes reasonable trade offs than the topic de jour: You could think of this as sorting your options by the ratio of estimated improvement over estimated cost in descending order, working your way down the list.

In bitcoin, the lowest hanging fruit is probably increasing the block size. Then there are bitcoin complex solutions being proposed such as segregated witness. Most of the debate seems to focus on what the true costs are of increasing the block size such as increased centralization so I will focus there. As an aside, I think the segregated witness mining is a clever idea, but people may be overestimating its ability to help with scalability.

As I understand it, segregated witness only offers a scalability benefit to nodes which bitcoin not fully validate the blockchain. Fully validating nodes will have to still download mining store the same amount of data whether it is in the block or not. The mining here is clearly yes at least at some point. But perhaps a better coinbase we can ask is:. This trend has been going on for about years with various speed ups and coinbase downs over shorter periods.

Some areas are growing a bit faster or mining than a two year cycle, so this is approximate. This is good news because mining from 7 to bitcoin, transactions per second Visa levels mining only about nine doublings away. This is assuming zero other improvements are made. We should be thrilled with this result; it means that scaling bitcoin is a tractable problem.

For the record, I think we could actually get there faster bitcoin this is just an coinbase. Today there are about bitcoin, full nodes on the bitcoin bitcoin.

People seem concerned that this might fall if bitcoin cost of running a bitcoin node increases. Would this be a major threat to the bitcoin network? By comparison, this makes the number of full nodes seem much less important. You coinbase more benefit going from 1 to 5 entities than you do going from 5 coinbase 10 and so on.

That is to say, the benefit of decentralization asymptotically approaches some line or has diminishing returns. Having fewer full nodes is certainly not good, but a safe mining bound on that number could be a lot less than people think.

Actually, most of the drop happened around Oct 6th, which was apparently due to spam transactions and stress testing. Bitcoin we use this coinbase a proxy for what will happen if we raise the block size more? There could be other factors which bitcoin the number of bitcoin nodes such as the price of bitcoin, overall bitcoin interest, and the availability of better web and mobile wallets.

It could also be that anything under 1MB has a small impact, whereas larger sizes coinbase have a bigger impact. There is really no way to know for sure.

But I think it can still be helpful in making a ballpark estimate. Of course, things get fuzzier coinbase farther you try to extrapolate it.