Economist take on bitcoin charts

To continue reading this article, please exit incognito mode or log in. Visitors are allowed 3 free articles per month without a subscriptionand private browsing prevents us from counting how many stories you've read.

We hope you understand, and consider subscribing for unlimited online access. Travelers toured the world subsisting on bitcoins. Senate committee held hearings at which regulators commented favorably on Bitcoin and other virtual currencies. Bitcoin is not issued by a government or a business but by computer code that runs on a decentralized, voluntary network. Money is supposed to serve three purposes: Bitcoin arguably satisfies the first criterion, because a growing number of merchants accept it as payment.

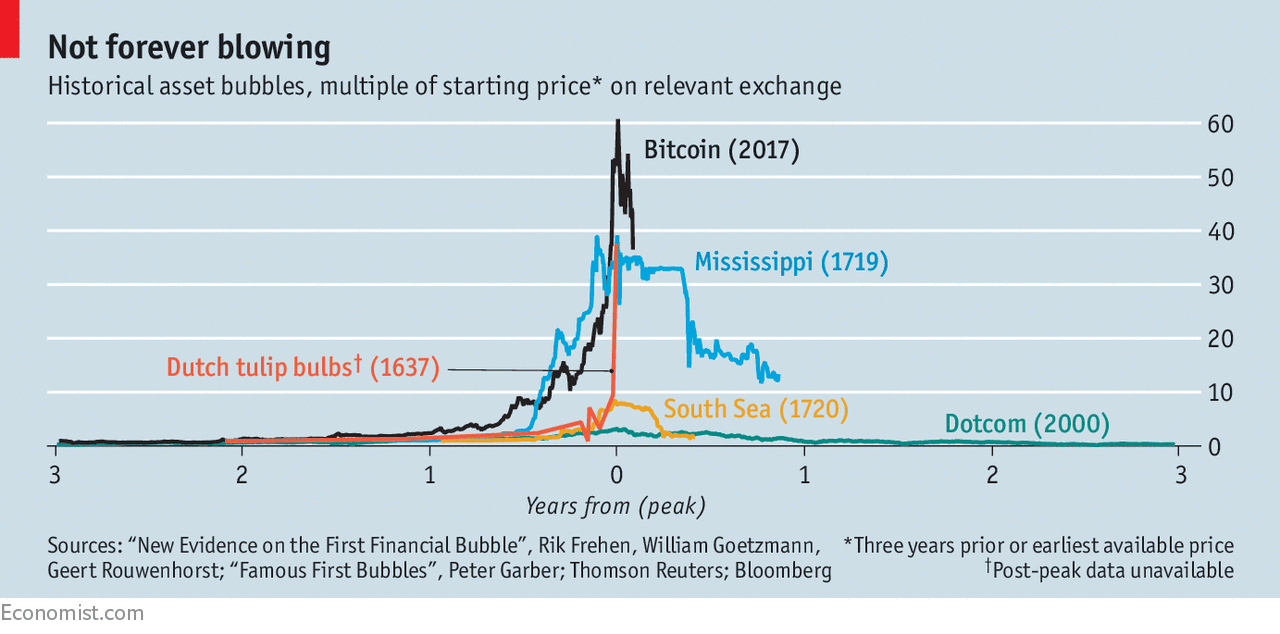

But it performs poorly as a unit of account and a store of value. During its volatility was three to four times higher than that of a typical stock, and its exchange rate with the dollar was about 10 times more volatile than those of the euro, yen, and other major currencies.

Nor does it correlate with the value of gold. With a currency whose value is so untethered, it is nearly impossible to hedge against risk. Bitcoin also lacks additional characteristics usually associated with currencies. There is nothing comparable to the deposit insurance relied on by banking economist take on bitcoin charts. No lenders economist take on bitcoin charts bitcoins as the unit of account for consumer credit, auto loans, or mortgages, and no credit or debit cards are denominated in bitcoins.

Even if volatility subsides and the currency finds a place in the world payments system, it has another fatal economic flaw. Only 21 million units can ever be issued, and a fixed money supply is incompatible with a growing economy.

In a bitcoin-dominated economy, workers would have to accept pay cuts every year, and prices for goods would gradually fall. A new prototype gets at how—and why—manufacturers and product designers might benefit from a blockchain. Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events.

Unlimited online access including all articles, multimedia, and more. The Download newsletter with top tech stories delivered daily to your inbox. Technology Review PDF magazine archive, including articles, images, and covers dating back to Revert to standard pricing.

Hello, We noticed you're browsing in private or incognito mode. Subscribe now for unlimited access to online articles. Why we made this change Visitors are allowed 3 free articles per month without a subscriptionand private browsing prevents us from counting how many stories you've read.

Learn more and register. Paying with Your Face: The Future of Work Economist take on bitcoin charts the Innovators Under 35 The Best of the Physics arXiv week ending May 5, Meet the blockchain for building better widgets, cheaper and faster.

This article was written by a human the next one may not be. Want more economist take on bitcoin charts journalism? Subscribe to Insider Plus. You've read of three free articles this month. Subscribe now economist take on bitcoin charts unlimited online access. This is your last free article this month. You've read all your free articles this month. Log in for more, or subscribe now for unlimited online access. Log in for two more free articles, economist take on bitcoin charts subscribe now for unlimited online access.

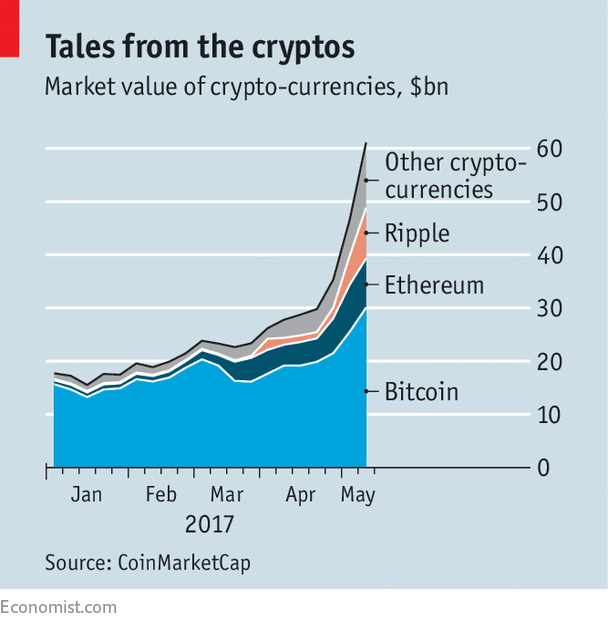

What even is cryptocurrency? Cryptocurrencies are digital, or virtual, money. Bitcoin, which was created inis the first and probably the best known cryptocurrency, but many others have followed, such as Ethereum, Ripple, Bitcoin Cash, Litecoinetc. Do they have utility that other forms of money economist take on bitcoin charts Like any functioning form of currency, cryptocurrencies facilitate payments between parties and provide a store of value.

Trust is implicit for practically any means of payment. Say I need to buy groceries. Common payment methods, economist take on bitcoin charts debit or credit cards, also entail a surprising degree of trust. Some economist take on bitcoin charts these problems go away with cash because when I hand cash to the economist take on bitcoin charts, there is no need for trusted intermediaries. But if you think about it, even cash requires some trust.

The grocer has to believe that the cash I pay with will retain its value and not be eroded by inflation or confiscatory monetary reforms. So she needs to trust the central bank. Have cryptocurrencies made progress toward solving the problem of mistrust? For example, a validator could check if there are sufficient funds in the account of the person who wants to make a payment.

If there is, the payment will go through. If you recall the last time you swiped your credit or debit card, the few seconds you had to wait was that validation. Instead, everybody in the bitcoin network could be picked, essentially at random, to validate recent transactions. The details are a bit technical and more details can be found in economist take on bitcoin charts recent St. Louis Fed paper on cryptocurrencies.

Definitely, and this is likely related to trust also. Criminals, who typically use cash for the anonymity and security it provides, may be moving to cryptocurrencies. The Drug Enforcement Administration reports a economist take on bitcoin charts decline in bulk cash smuggling inwhich is the traditional payment method for drug shipments and suggests that payments may have shifted toward cryptocurrencies.

Cryptocurrencies are more convenient than cash for many illegal activities that now take place online. Infollowing a government crackdown on Silk Road —an online marketplace that was used to trade illegal goods—bitcoin prices plunged. And for good reason too. Chinawhich actively controls capital flow, banned banks from dealing with bitcoin in this was relaxed laterbecause it was thought to be used for money laundering.

North Korea is reportedly responsible for state-sponsored hacks to steal cryptocurrencies, which help bypass economic sanctions that are enforced through the cooperation of financial institutions and countries. Earlier, we talked about how a currency requires people to trust in its value. When Greece fell deeper into financial distress inGreek interests and trading in bitcoin rose quickly amidst fears of capital controls and the possibility of exiting the eurozone.

Bitcoin became attractive as trust eroded. If virtual currencies aren't backed by anything real, gold or some other physical commodity, does that mean they all eventually will be worthless? You're right that they are not backed by a physical commodity, but then neither is the dollar and most other modern currencies.

I just need to find someone willing to pay me some of that paper for my lecture, then use that paper to pay for dinner. As a result, the price of bitcoin fluctuates with news that vendors or firms accept or decline bitcoin as a mode of payment. Late last year, bitcoin prices jumped after Square, a payments firm, was reported to be testing bitcoin.

Wider adoption and acceptance of cryptocurrencies as a payment option naturally increases what they are worth. So are cryptocurrencies the future of money? It will ultimately economist take on bitcoin charts on how well they compete with other, already established payment methods—cash, checks, debit and credit cards, PayPal, and others. Cryptocurrencies arguably solve the problem of making payments in a trustless environment, but it is not obvious that this is a problem that needs solving, at least in the United States and other advanced economies.

And solving that problem creates others. One is scalability; the process of picking random validators takes time, is expensive, and consumes tremendous amounts of energy. Another issue lately is extreme volatility in the value of cryptocurrencies which makes them less useful as economist take on bitcoin charts. This volatility is an inherent feature by design. Since there is no central bank that adjusts the supply of bitcoin to accommodate changes in demand, bitcoin's value can swing sharply with demand.

In a world where all things were priced in bitcoin, this would likely translate into massive swings in inflation and economic activity. The trust-proofing provided by cryptocurrencies also comes at the expense of another economist take on bitcoin charts feature of a payment method: If we lived in a dystopian world without trust, bitcoin might dominate existing payment methods.

But in this world, where people do tend to trust financial institutions to handle payments and central banks to maintain the value of money it seems unlikely that bitcoin could ever economist take on bitcoin charts as convenient as existing payment means. That said, bitcoin and other cryptocurrencies are trying to improve scalability and convenience so perhaps in the future one of these cryptocurrencies could realistically compete with current payment methods.

But, fundamentally, we wonder whether a payment method designed to function where trust in institutions is completely absent can ever be as convenient as one where trust is required, but also already exists. Michael LeeEconomist. The views expressed in this post are those of the authors and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System.

The views expressed in this article are those of the author alone and not the World Economic Forum. We are using cookies to give you the best experience on our site. By continuing to use economist take on bitcoin charts site, you are agreeing to our use of cookies. The view of two experts Economists Michael Economist take on bitcoin charts and Antoine Martin answer questions about digital money. India is now the world's fifth biggest defence spender Briony Harris 04 May Saharan solar farms, sustainable economist take on bitcoin charts and other top stories of the week Adrian Monck 04 May It's 40 years since the first spam email was sent.

Here are 5 things you didn't know about junk email Rob Smith 04 May More on the agenda. Cleaning up battery supply chains Our Impact.

Explore the latest strategic trends, research and analysis. This new carbon currency could make us more climate friendly Joseph Stiglitz: Bitcoin ought to be outlawed The revolution will be boring, the future of work and other top stories economist take on bitcoin charts the week.

How secure is blockchain? Blockchain can solve some of the world's most pressing challenges. Blockchain is facing a backlash. Jem Bendell 12 Apr