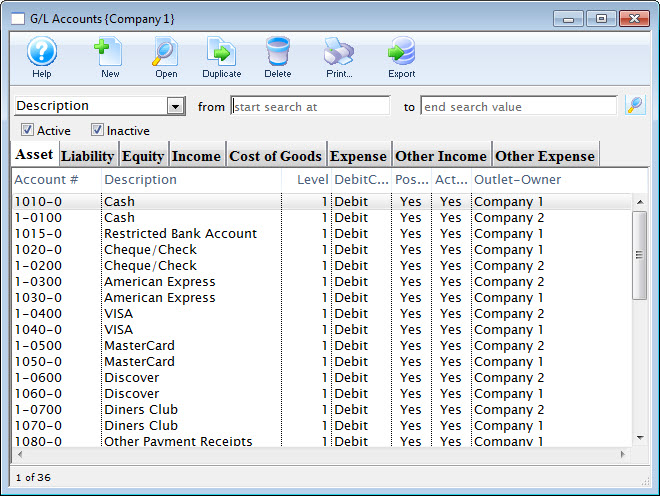

Example of general ledger chart of accounts

This is a suggested Chart of Accounts. If you do not have your own structure you may want to create your nominal accounts from the suggested Chart of Accounts below. Using cost centres and departments with nominal accounts. Sorry, but we can't provide technical support from this email address. If you need assistance, then please contact your business partner.

General Data Protection Regulation. See also Steps in this task Default nominal accounts Report category codes Create nominal accounts Overview Using cost centres and departments with nominal accounts How to set up and enter budgets.

Did you find this helpful? Sorry about that Why wasn't this helpful? Instructions confusing or unclear. Thanks for your feedback. Want to tell us more? Send an email example of general ledger chart of accounts our authors to leave your feedback.

Email our authors Sorry, but we can't provide technical support from this email address. Thanks for taking the time to give us some feedback. Site links Help Videos Guides Sitemap. Help info Page short link Last updated: Example of general ledger chart of accounts Expenses and Adjustments.

Non Trading Income - Investment Income. Bank Charges and Interest. Provision for Doubtful Debts. Heat, Light and Power. Equipment Hire and Rental. Nominal Ledger Suspense Account. Opening Balance - used as required.

You can use periods, commas, or other user-defined symbols to separate the components of the account number. The business unit describes example of general ledger chart of accounts in your organization the transaction will have an impact. It represents the lowest organizational level within your business where you record all revenues, expenses, assets, liabilities, and equities. A business unit can be a department, branch office, truck, and so on.

An object is a description of the transaction and a subsidiary is an expanded description of the example of general ledger chart of accounts account. The object, or major, account is required for transaction entry.

All object accounts must be the same length. To make data entry easier and faster, you might want to use only numbers for the object account. The subsidiary, or minor, account is an optional part of the account. Use the subsidiary when you need detailed accounting activity for an object account. This example shows how you can associate the object account for Cash in Bank with several subsidiary accounts:.

A chart of accounts provides the structure for your general ledger accounts. It lists specific types of accounts, describes each account, and includes account numbers. A chart of accounts typically lists asset accounts first, followed by liability and capital accounts, and then by revenue and expense accounts. To design your chart of accounts, begin your initial design with the major headings of your transactions. Then add your detailed transaction descriptions. After you have a complete list of transaction descriptions, you can assign numeric values to each description.

Allow for growth and example of general ledger chart of accounts by leaving spaces in the account structure. Define the last example of general ledger chart of accounts sheet account as the account for year-to-date net income or loss. Balance sheet accounts must precede income statement accounts.

For example, if revenues begin atdefine object as the net income account. This account must be a nonposting account. The system calculates the net income amount on your balance sheet. You are not limited to one account format when you enter data.

An account can have the formats described in this table: The business unit designates the accounting entity to charge. The object or object and subsidiary designates the type of account to receive the amount, such as asset, liability, revenue, and expense. To enter account numbers in a format other than the standard JD Edwards EnterpriseOne format, you must use the prefix character that is defined in general accounting constants. You assign category codes to accounts to expand your reporting capabilities and group your accounts for reporting purposes.

The character category codes are useful if your business requires an alternate chart of accounts for statutory reporting. You can use the category code and the description instead of the account number and descriptionon trial balance, general ledger, and general journal reports. These category codes let you build summarization logic into your reports.

After you set up values for category codes 21—43, you assign the values to accounts in your chart of accounts. This creates a link between the accounts and the category codes and enables you to print these reports:.

You can set up a version for each of the category codes that you use and specify the category code in a processing option for the program.

If you assign the same category code value to more than one of your accounts, the system adds the amounts in all of the accounts and prints the total amount on the report. Suppose you want to print a report that shows data from all of your receivable accounts.

You assign these values to accounts in your chart of accounts. For example, you assign the value REC01 to category code 21 for each notes receivable account. You can then print selected reports that include all of your receivable accounts. Use the Review and Revise Accounts program P to assign the example of general ledger chart of accounts code values to accounts in your chart of accounts.

For category code 21, assign the value REC01 for notes receivable accounts, REC02 for interest receivable accounts, and so on. To assign a category code, select a notes receivable account on the Work with Accounts form. You assign a level of detail LOD to each account to control how amounts are rolled up, or summarized, into a balance for reporting purposes. Assign the level of detail 3 to title accounts for the balance sheet Assets and Liabilities and Equity. Depending on whether you want the next level of accounts underlined, assign level of detail 3 or 4 to title accounts for the income statement.

Assign a posting edit code to every object example of general ledger chart of accounts object. This code determines whether the account posts to the general ledger and whether it updates the Account Balances table F If you designate an object or object.

Subledgers and subsidiary accounting both provide example of general ledger chart of accounts accounting activity. Subsidiary accounts are a subdivision of your object account.

Subledgers are linked to your business unit. Subledgers give accounting detail without adding accounts to your chart of accounts. For this reason, subledgers are often used for transaction classifications that are not a permanent part of your example of general ledger chart of accounts of accounts, such as detailed travel expenses for account representatives. Subsidiary accounts are permanent. If you want to track revenues and expenses by account representative using subsidiary accounting, you must create a subsidiary account for each account representative and attach it to each appropriate object account for revenues and expenses.

This could mean adding several hundred accounts to your chart of accounts. Subledgers can create additional records in the Account Balances table Fdepending on the posting edit code that you assign to the account.

When you use subledgers to track expenses for account representatives, the system creates a record with a unique subledger for each account in the Account Ledger table F The F table contains only the account, not the subledger. When you use subsidiaries to track expenses for account representatives, the system creates a record with a blank subledger for each account in the F table.

The F table contains an account for each account representative. Subsidiary Format" Section 6. This diagram shows the format requirements: Figure Account numbers Description of "Figure Account numbers". Subsidiary - The What The object.

These characteristics apply to the object. An object can be up to six alphanumeric characters, depending on your organization's setup A subsidiary is optional and can be up to eight alphanumeric characters no spaces The object, or major, account is required for transaction entry. This example shows how you can associate the object account for Cash in Bank with several subsidiary accounts: This example shows types of accounts and their associated headings: If your balance sheet accounts do not precede your income example of general ledger chart of accounts accounts, your financial reports might contain unreliable results.

It is commonly referred to as the short account number and can never be changed. It can be in either of these formats: Typically, the account number from a prior system is used as the third account number. No limitations exist for the characters that you can use, for example. This creates a link between the accounts and the category codes and enables you to print these reports: General Ledger by Category Code R Category Code 21 Suppose you want to print a report that shows data from all of your receivable accounts.

For this example, you would complete these steps: Assign category code values to the remaining accounts in your chart of accounts. You could set up levels of detail as shown example of general ledger chart of accounts this example: Figure Levels of detail Description of "Figure Levels of detail". Posting edit codes exist for these types of accounts: Posting Non-posting or title Budget Inactive Machine-generated One that requires units, not monetary amounts. Subledger and type If you designate an object or object.

You can use a subsidiary account and a subledger in the same transaction, if necessary. These are examples example of general ledger chart of accounts ways in which subledgers differ from subsidiary accounts: Subledger transactions post to the same major account, rather than to different accounts.

Subledgers do not create additional records in the Account Master table F Subledger Accounting When you use subledgers to track expenses for account representatives, the system creates a record with a unique subledger for each account in the Account Ledger table F This example shows the subledgers that represent address book numbers for Smith and Jackson: AIR Air Fare Smith A Blank Blank Blank 2.

Subsidiary Accounting When you use subsidiaries to track expenses example of general ledger chart of accounts account representatives, the system creates a record with a blank subledger for each account in the F table.

A1 Account Representative 1 A2 Account Representative 2 C1 Account Representative 1 C2 Account Representative 2 Types of headings for balance sheets include:

Trading bitcoins Show Me The Videos Hi Sentdex now I am searching your videos to learn more. However, it is available to download and modify the code if needed. Define your own trading strategy and Gekko will take care of everything else.

As a US-based exchange, Bittrex adheres to all United States regulations. I will briefly explain why this happens to be able to find.