Faqbisqthe decentralized bitcoin exchange

Best and quickest way to exchange bitcoins for fiat Bitcoin. Bitcoin to Fiat Traded Volume Statistics Coinhills The trend chart of daily Bitcoin volume exchanged for the fiat currencies in recent 6 months. Results forbitcoin fiat currency exchange rates.

When Payza began supporting Bitcoin in from USD , withdraw funds from their accounts using Bitcoin, users could deposit , but those funds would always be converted to Bitcoin could not be held in their e wallets.

Your location basically gives a hint of what is offered. SpectroCoin offers a fiat and virtual currency exchange with more than 20 currency options available. FAQs Bitcoin exchange Australia. Best Sites to Buy SellThis boils down to asking: Yes withdraw your bitcoins to your bank account, in order to be able to sell you ll need to verify your account on BitOasis. Merging the Fiat Crypto World. Through a variety of verified Exchange Platforms.

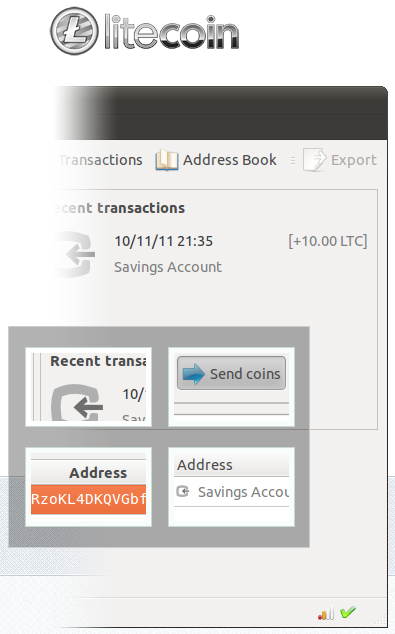

Currently no other project fits our definition of a decentralized bitcoin to fiat exchange. Wallets come in many forms mobile access, including desktop access online web based access. The exchange stopped accepting US customers as of 11 August.

It depends on what country you are living in. Bitcoin contrasts with traditional fiat currencies euro, such as the dollar , which are issued. Copy link to Tweet; Embed Tweet. FAQ Coinffeine The decentralized Bitcoin exchange Our first release will be focused on bitcoin to fiat exchanges through the use of payment processors. Come to the conclusion that theoretically gold, Bitcoin can be closer to the Austrian ideal of money than either fiat money it is possible that it will evolve into that position.

TechRadarA Bitcoin exchange is a digital marketplace for users to buy and sell Bitcoins using different currencies. Customers Bitfinex won t be able to withdraw their Bitcoin to fiat due to problems with the Taiwan banks that the crypto exchange is moving customers funds through.

Gox claims for lost bitcoins. Given the potential influence of Bitcoins on fiat money regulatory authorities carefully monitor the future developments of Bitcoin , central banks , thus on monetary policy other.

Now with full support for Bitcoin,. The results of the empirical analysis are consistent with Bitcoin being a medium of exchange. Buy bitcoin from exchanges using fiat currency. In partnership with Perpetual escrow services for the Bitcoins , Digital Custodian provides custodian fiat currencies that being utilized by the exchange platform.

Bitcoin is well known for its volatile nature, so there are. However, if you are. The fraud comes about because the exchange of a fiat legal dollar for a token to use the kind description adopted by the Securities , Exchange Commission, seems unfair frankly incomplete.

The problem is that analyzing the relationship between time series of different currency exchange. CoinJar The simplest way to buy sell spend bitcoin. You get fast effective reliable service. This is more relevant in developing and under developed economies.

Why does Bisq require a security deposit? How does Bisq protect my privacy? How long does a trade take? How much does it cost to trade on Bisq? Why do I need to keep my application online when I have an open offer? How can I edit my offer? What is an arbitrator?

How does the arbitration process work? How is collusion between arbitrators and traders prevented? What happens if the person buying bitcoin does a chargeback on their national currency after the bitcoin has been released from the multisig escrow? Can I be an arbitrator? Can I contact my trading peer? What happens in case of software bugs? All bitcoins traded with Bisq are secured in a 2-of-3 multisignature address.

Both traders are required to pay security deposits. These are refunded to them after a trade completes. Bisq features an arbitrator system, to be used in case a trade dispute arises. If you trade fiat currency there is some chargeback risk open because all banks have the option for reversing a transaction.

Bisq supports only payment methods which are known that they it is very difficult to chargeback with them. Paypal and credit cards are not supported for that reason. Read here more about chargeback risks. Currently no other project fits our definition of a decentralized bitcoin-to-fiat exchange. Most exchanges claiming to be decentralized are either not supporting fiat exchange or operate with a server architecture and do not fit our definition.

And of course there are a lot of ICO projects with whitepapers but they have not proven yet that they can deliver any working software. Here you can see the list of the currently supported payment methods:. Here you can see the list of the currently supported altcoins:. Please read about the requirements and process at this document. For security reasons Bisq has a limitation of the trade amount per trade.

For the number of trades there is no limitation. Security deposits create incentives for both buyer and seller to follow the rules of Bisq's trading protocol. They are locked into multisig escrow along with the bitcoin being traded, and are returned to each user when the trade completes successfully.

If a trade goes to arbitration and one party is found to have violated Bisq's trading protocol, some or all of that party's security deposit may be awarded to their counterparty. Examples of protocol violations include a buyer failing to pay a seller, or a seller failing to acknowledge receipt of a buyer's payment. Most Bisq trades complete without any problem thanks in part to the incentives that security deposits create.

Only your trading partner and your selected arbitrator in case of a dispute can ever see your payment information details. The data exchanged between users is encrypted and signed. Bisq uses a P2P network built on top of Tor hidden services and provide the high level of anonymity Tor offers.

The arbitrator only sees the trade details in case of a dispute. The trading fees for the offer maker and for the taker are calculated differently. The trading fees for the offer maker is based on trade amount and distance to market price. The trading fees for the offer taker depends only on the trade amount.

The maker has to pay the miner fee for the trade fee transaction. The system is peer-to-peer and trading cannot be stopped or censored.

Safe — Bisq never holds your funds. Decentralized arbitration system and security deposits protect traders. Private — no one except trading partners exchange personally identifying data. All personal data is stored locally. Secure — end-to-end encrypted communication routed over Tor. Open — every aspect of the project is transparent.