Litecoin mining hardware 2016 tax return

Excluding short-term tax obligations, electricity and a couple gpu's, I've still made a "good" profit. And the difficulty will keep going up and up. Big decision and allot to weigh out. How do I file not as a business, I'm on disability. Fk the Irs lol.

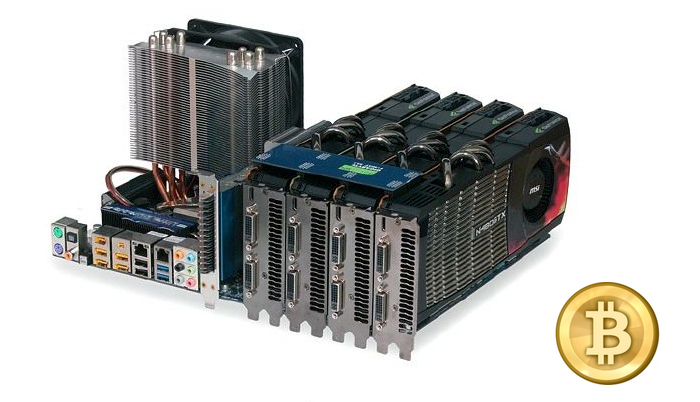

Graphic cards were solely purchased to mine coins, what's to debate. Big decision and allot to weigh out. I got in about a month ago and it's taken me a lot longer to get up and running than I anticipated. It all has to do with when a taxable event is triggered.

If you want to get involved, click one of these buttons! See Chapter 10 of PublicationTax Guide for Small Business, for more information on selfemployment tax and PublicationBusiness Expenses, for more information on determining whether expenses are from a business activity carried on to make a profit. I did it previous years, litecoin mining hardware 2016 tax return different than running a website with ads, of course you will report your server costs. Remember, you're the one who made the claim that people are going to possibly be in for trouble if they try to deduct mining as a business.

April edited April If you are paying taxes you already have an ROI, no? Thank god I live in asia LOL.

Please if you've got things to share on why people should mine, do list it out instead of just targeting me and saying its still profitable in one sentence. That's been my experience, anyway. Excluding short-term tax obligations, electricity and litecoin mining hardware 2016 tax return couple gpu's, I've still made a "good" profit. Also adaseb I'm relaxed enough it's just that these information you see here in mining are the serious stuff that many choose to put aside until it's too late to ignore. I doubt I will.