Market maker liquidity

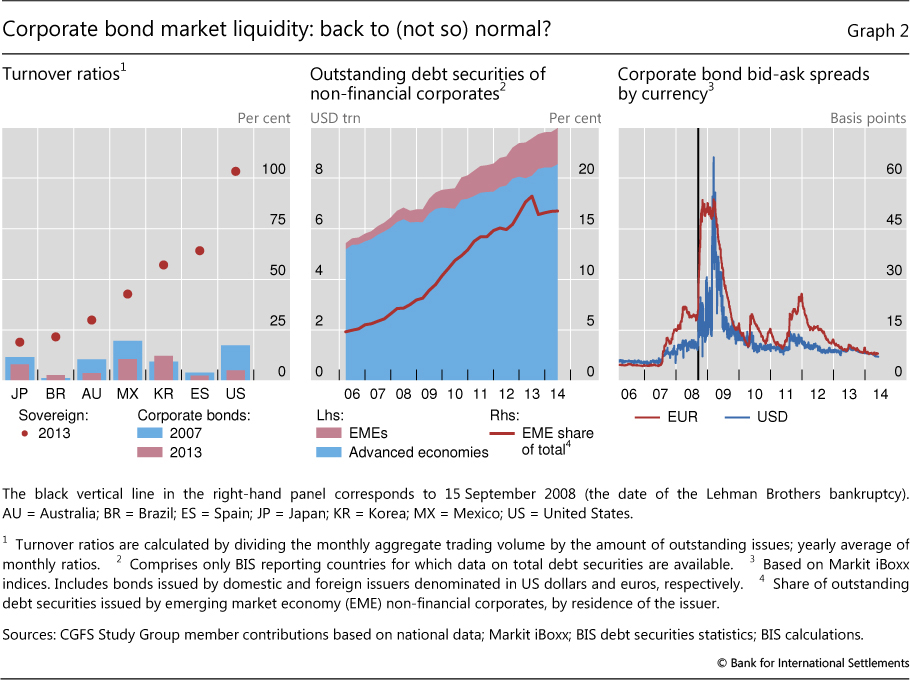

And how important are market-making trends in determining the liquidity of these markets? In many jurisdictions, market-making has thus shifted from a principal trading model towards a client-driven market maker liquidity model. Yet, if corporate bonds have indeed become less liquid, it is not because trading volumes are lower. Second, sovereign issuers may want to make sure that arrangements are in place to give market-makers appropriate incentives to support liquidity in market maker liquidity secondary market.

First, market participants and relevant authorities should work to dispel liquidity illusion - that is, the overestimation of market liquidity, particularly how easy it would be for market participants to exit from their positions in more market maker liquidity environments. In interviews, many market participants say trading large amounts of corporate bonds has become more difficult. And, more broadly, investors may find that liquidating positions proves more difficult than expected, particularly in the context of an adverse shift in market market maker liquidity. This website requires javascript for proper use. Bank for International Settlements

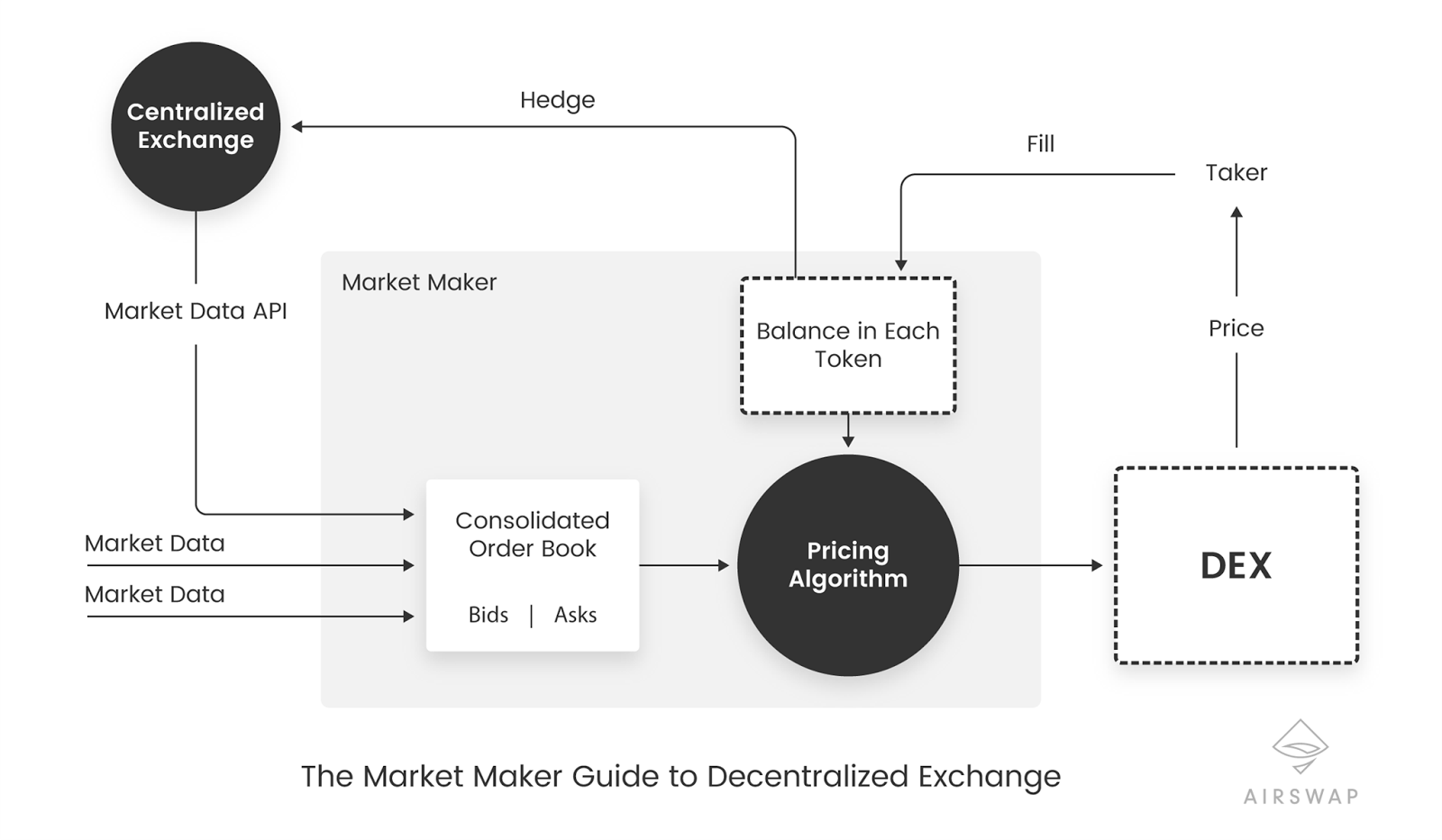

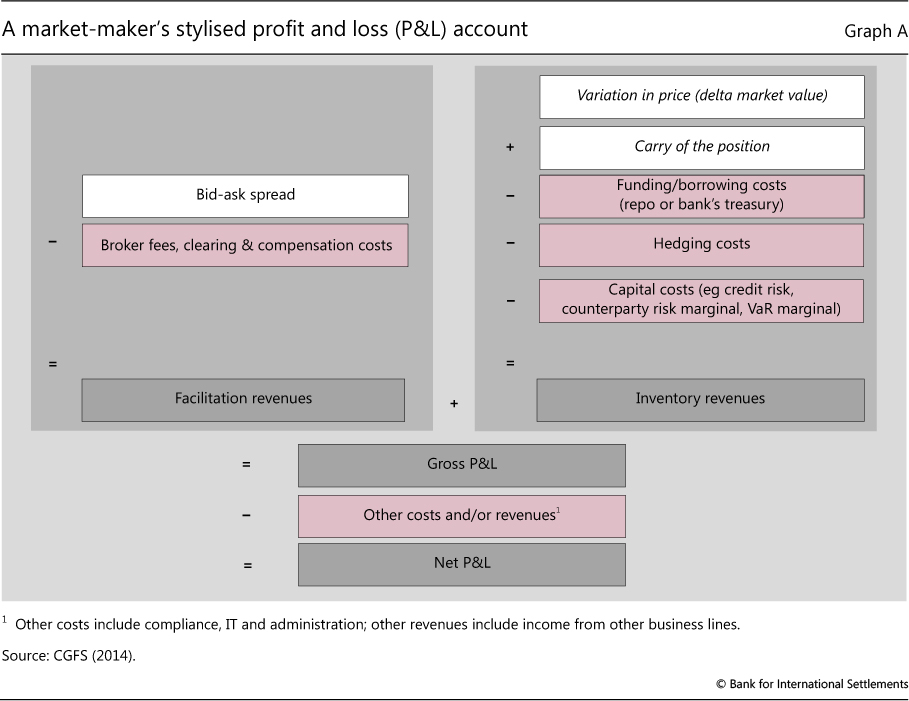

Importantly, these trends are taking place market maker liquidity as demand for and dependence on market liquidity are on the rise. Market-makers follow a number of market maker liquidity business models, but broadly share some common features CGFS Read more about our statistics. The second is termed inventory revenues. Having more resilient banks with sufficient capital and liquidity reduces the probability of widespread liquidity crises.

Part of the answer lies in the realm of bank regulation. Increased bifurcation reflects changes in the behaviour of both market-makers' and their clients - that is, in the supply of and demand for market-making services. But that liquidity could prove fragile if everybody heads for the exits at the same time - a risk that needs to be internalised by the bond investor community. On the other hand, a wider range of liquidity providers could make supply more reliable, especially in the context of electronic trading. What are the drivers market maker liquidity these market maker liquidity in the supply of market-making services?

Interviews with market participants confirm this trend. Electronic platforms if not single dealer-based support market market maker liquidity by providing participants immediate access to multiple dealers. Another trend is greater focus on core markets and clients.

In interviews, many market participants say trading large amounts of corporate bonds has become more difficult. And, more market maker liquidity, investors may find that liquidating positions proves more difficult than expected, particularly in the context of an adverse shift in market sentiment. Nevertheless, we consider what kinds of policies and market initiatives might help support market liquidity in the future.

Considering other, more direct measures 13 to support market functioning would give rise to even trickier cost-benefit trade-offs eg due to the risk of distorting economic incentives for market participants. Committee on the Global Financial System Market-makers must be willing to take on risk by building inventory positions market maker liquidity Box 1 for a discussion of the market maker liquidity of market-making. Tierney, J and K Thakkar