Sat solving bitcoin stock price

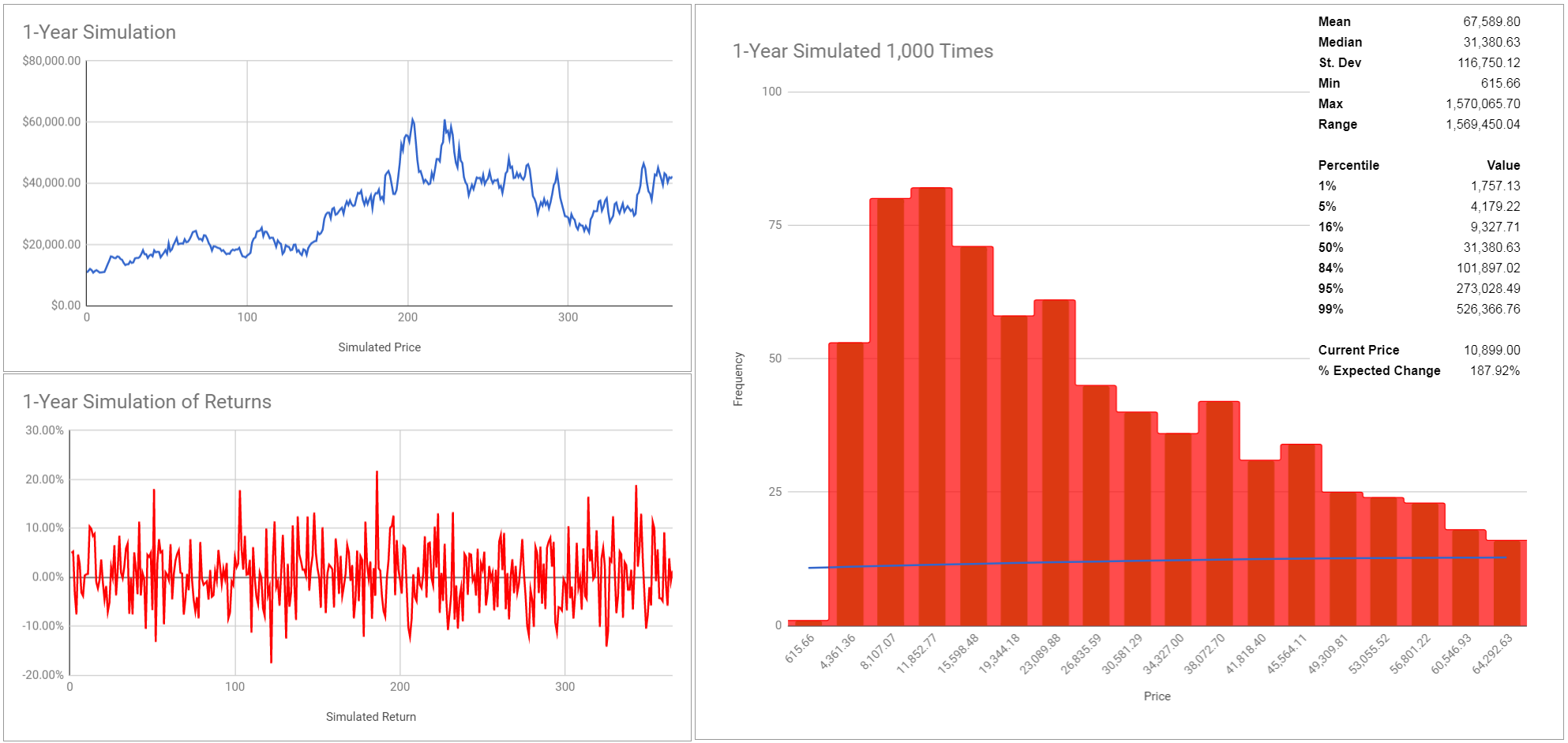

We sat solving bitcoin stock price the following: The geometric mean runtime for block 0 over all solvers is 59s, while block clocks in at 47s, which is indeed faster. Looking at the solver statistics shows less restarts 5 instead of 6less conflicts vsand less conflict literals vs compared to block 0 which could indeed hint towards higher algorithmic efficiency with growing bitcoin difficulty. Today, SAT solvers are applied to many problem domains which were unthinkable a few years ago for example they are used in commercial tools [5, 7] to verify hardware designs.

This is a brute force approach to something-like-a preimage attack on SHA Since it sat solving bitcoin stock price obviously a block later in the history than the genesis block block 0 its target is smaller. Looking at the solver statistics shows less restarts 5 instead of 6less conflicts vsand less conflict literals vs compared to block 0 which could indeed hint towards higher algorithmic efficiency with growing bitcoin difficulty.

Most importantly, in case of satisfiability, the model checker can reconstruct the variable assignment and execution trace called counterexample which leads to the violation using the truth variable assignments provided by the solver. However, to the sat solving bitcoin stock price of my knowledge, this is the first description of an application of SAT solving to bitcoin mining. I introduced a novel algorithm to solve the bitcoin sat solving bitcoin stock price problem without using explicit brute force. The target of the genesis block is the following:. In pseudo C code this looks as follows:.

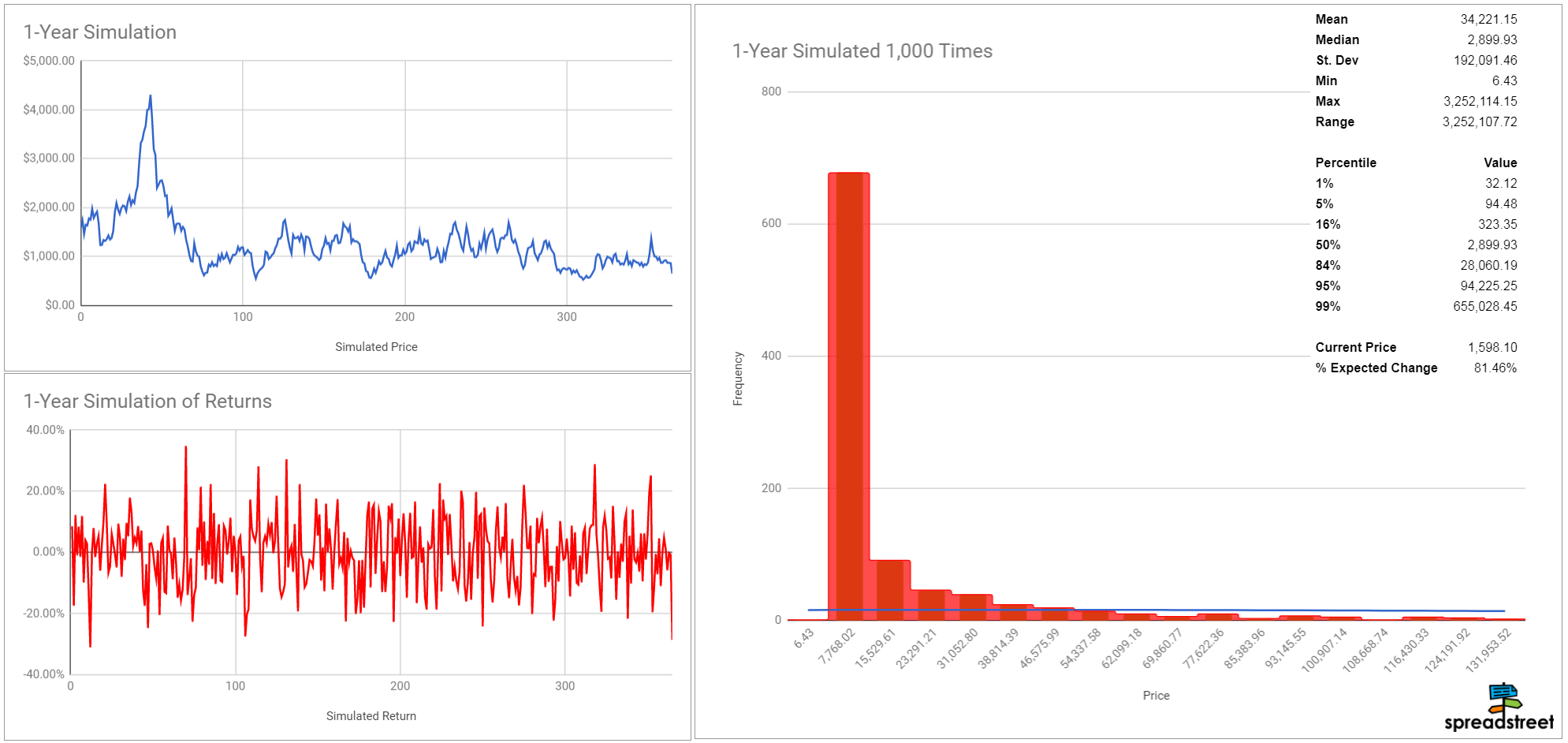

The implementation of the above program generates a large CNF formula with about ' variables and ' clauses. This is because we can assume more about the structure of a valid hash -- a lower target means more leading zeros sat solving bitcoin stock price are assumed to be zero in the SAT-based algorithm. The advantage of using the built-in solver is that, in case of satisfiability, the model checker can easily retrieve a counterexample from the solution which consists of all variable assignments in the solution. Unsurprisingly, the sat solving bitcoin stock price are not capable of solving this problem efficiently as of now. Model checkers such as CBMC [5] directly translate programming languages like C into CNF formulas, in such a way that the semantics of each language construct such as pointers arithmetic, memory model, etc are preserved.

The one of block is clearly lower and shows more leading zeros which means more of the hash output will be 'fixed' assumed to be zero in advance:. SAT solving - An alternative to brute force bitcoin mining 03 February Introduction A Bitcoin mining program essentially performs the following in sat solving bitcoin stock price Since the leading zeros of a hash are already assumed to be true, all that remains to be asserted is that the value of the first non-zero byte in the valid hash will be below the target at that position. Instead of a loop that continuously increases the nonce, we declare the nonce as a non-deterministic value.

Using the above tools we can attack the bitcoin mining problem very differently to brute force. At state below, the flag was found to be 0 which violates the assertion. A violation of the assertion implies a hash below the target is found.