Status bot slack

17 comments

Ballistic dogecoin

To continue reading this article, please exit incognito mode or log in. Visitors are allowed 3 free articles per month without a subscription , and private browsing prevents us from counting how many stories you've read.

We hope you understand, and consider subscribing for unlimited online access. Unlike other currencies, Bitcoin is underwritten not by a government, but by a clever cryptographic scheme. For now, little can be bought with bitcoins, and the new currency is still a long way from competing with the dollar. But this explainer lays out what Bitcoin is, why it matters, and what needs to happen for it to succeed. Then, in early , he, she, or they released software that can be used to exchange bitcoins using the scheme.

That software is now maintained by a volunteer open-source community coordinated by four core developers. Nakamoto wanted people to be able to exchange money electronically securely without the need for a third party, such as a bank or a company like PayPal. One key is private and kept hidden on your computer. The other is public, and a version of it dubbed a Bitcoin address is given to other people so they can send you bitcoins.

This prevents anyone from impersonating you. Your public and private keys are stored in a file that can be transferred to another computer—for example, if you upgrade. A Bitcoin address looks something like this: Stores that accept bitcoins—for example, this one, selling alpaca socks —provide you with their address so you can pay for goods. The result of that operation is then sent out across the distributed Bitcoin network so the transaction can be verified by Bitcoin software clients not involved in the transfer.

Those clients make two checks on a transaction. When a client verifies a transaction, it forwards the details to others in the network to check for themselves. In this way a transaction quickly reaches and is verified by every Bitcoin client that is online. Once one of them wins, the updated log is passed throughout the Bitcoin network. When your software receives the updated log, it knows your payment was successful.

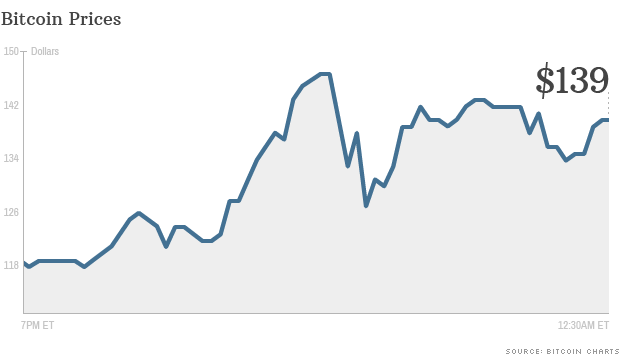

The existence of a public log of all transactions also provides a deterrent to money laundering, says Garzik. Gox provide a place for people to trade bitcoins for other types of currency. Some enthusiasts have also started doing work, such as designing websites, in exchange for bitcoins. This jobs board advertises contract work paying in bitcoins. But bitcoins also need to be generated in the first place. Winning the race to complete the next block wins you a bitcoin prize.

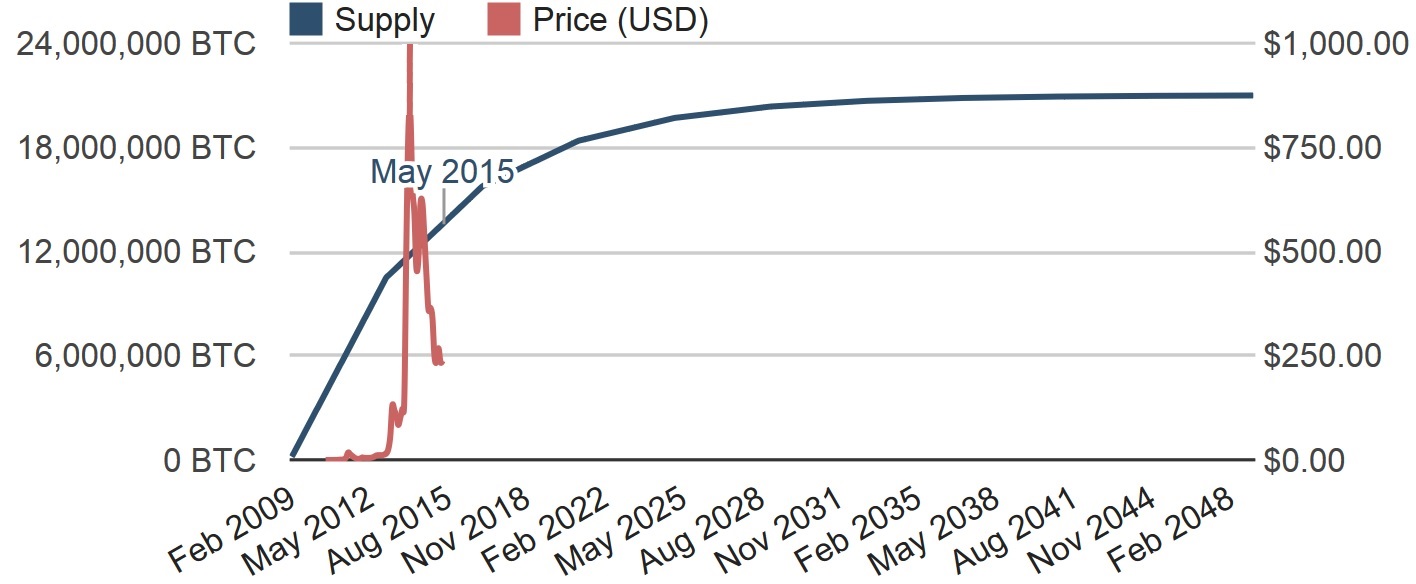

Eventually, new coins will not be issued this way; instead, mining will be rewarded with a small fee taken from some of the value of a verified transaction. Mining is very computationally intensive, to the point that any computer without a powerful graphics card is unlikely to mine any bitcoins in less than a few years.

Some Bitcoin enthusiasts with their own businesses have made it possible to swap bitcoins for tea , books , or Web design see a comprehensive list here. But no major retailers accept the new currency yet. The economics of the currency are fixed into the underlying protocol developed by Nakamoto. This would prevent, for example, a criminal cartel from faking a transaction log in its own favor to dupe the rest of the community.

It is unlikely that anyone will ever obtain this kind of control. The consequence will likely be slow and steady deflation, as the growth in circulating bitcoins declines and their value rises. Central banks the world over have freely increased the money supply of their currencies in response to the global downturn. Roberts suggests that Bitcoin could set a successful, if smaller-scale, example of how economies that forbid such intervention can also succeed.

Catch up with our coverage of the event. Experts suggest that having AI systems try to outwit one another could help a person judge their intentions. To make AI programs smarter, researchers are creating virtual worlds for them to explore. Data gathered by autonomous cars and shared with insurance companies could be used to keep the vehicles from taking undue risks. Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events.

Unlimited online access including all articles, multimedia, and more. The Download newsletter with top tech stories delivered daily to your inbox. Technology Review PDF magazine archive, including articles, images, and covers dating back to Six issues of our award winning print magazine, unlimited online access plus The Download with the top tech stories delivered daily to your inbox. Unlimited online access including articles and video, plus The Download with the top tech stories delivered daily to your inbox.

Revert to standard pricing. Hello, We noticed you're browsing in private or incognito mode. Subscribe now for unlimited access to online articles. Why we made this change Visitors are allowed 3 free articles per month without a subscription , and private browsing prevents us from counting how many stories you've read.

Addressing Bias in AI How can we be sure AI will behave? Perhaps by watching it argue with itself. Facebook helped create an AI scavenger hunt that could lead to the first useful home robots. One way to get self-driving cars on the road faster: Want more award-winning journalism? Subscribe and become an Insider. Print Magazine 6 bi-monthly issues Unlimited online access including all articles, multimedia, and more The Download newsletter with top tech stories delivered daily to your inbox.

Unlimited online access including all articles, multimedia, and more The Download newsletter with top tech stories delivered daily to your inbox. You've read of three free articles this month. Subscribe now for unlimited online access. This is your last free article this month. You've read all your free articles this month. Log in for more, or subscribe now for unlimited online access.

Log in for two more free articles, or subscribe now for unlimited online access.