What Does Bitcoin Have to Do to Achieve Broad Acceptance?

5 stars based on

65 reviews

Well, to answer our own question, it depends. Currencies in common use such as Euros, Dollars and Rands for example, are all considered fiat i. Bitcoin on the other hand operates autonomously, and is instead based on a hard-coded mathematical algorithm which allows for distributed decentralised consensus on the ownership and transfer of value.

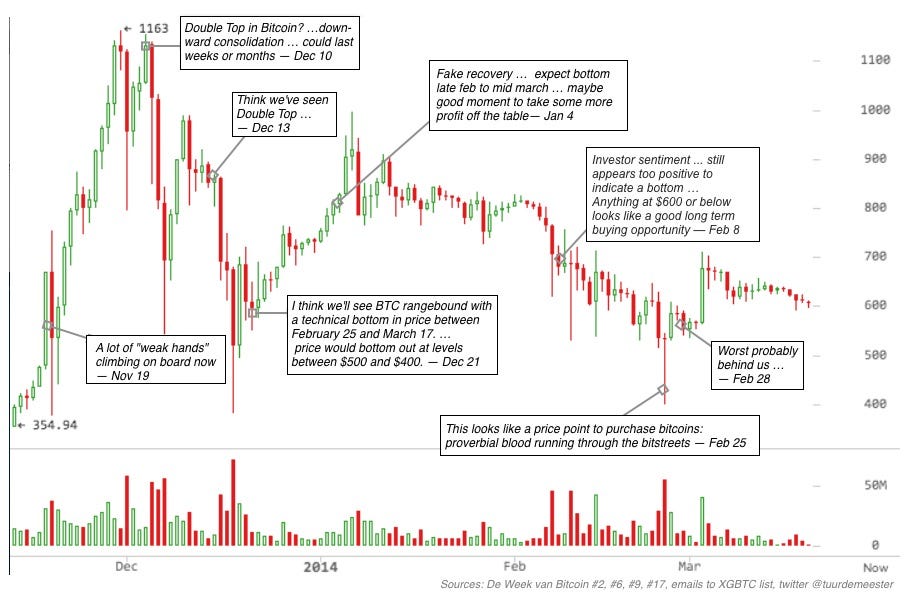

The technology removes the necessity for any institution to place itself in between the transfer of value from one party to another, and achieves this through its verifiable distributed public ledger otherwise known as a blockchain. Based on Bitcoin bitcoin economist 2013 dodge data sincethe evidence on its pricing in that time does appear to show that, when there is increased uncertainty associated with global macroeconomic and financial stability, the volume of Bitcoin trading and its USD price do seem to increase.

It thus does seem to already have been used as a safe haven in a number of circumstances. To this end we observe some selected events in Figure 1 below. Global market price of Bitcoin in U. S Dollars, Jan — Oct Therefore, the secondary axis is not the actual volumes traded but still a good indication of the movements bitcoin economist 2013 dodge volume traded.

L[3]. As noted by some commentators around the time of the Cypriot banking crisis:. With fears spreading that even insured deposits might not be safe in similar nations hit by banking crises, those looking for a haven to store their wealth have fled to the complicated world of digital cash. In AugustChina begun significantly devaluing their currency the Yuan which appeared to spark fears of a loss in purchasing power, bitcoin economist 2013 dodge in a rise in the value of Bitcoin:.

Finally, towards the end of May and beginning of Juneuncertainty surrounding Brexit began as polling at the time showed voters leaning toward leaving the European Union EU:.

And finally, once the final referendum decision bitcoin economist 2013 dodge reached which resulted in Britain leaving the EU, analysts pointed toward Brexit for the bitcoin economist 2013 dodge reason behind the surge in value of Bitcoin:.

There is thus a fair amount of evidence that Bitcoin has been used as a safe haven in a number of instances. Having observed the global market, we now turn to South Africa for a look at Bitcoin exchange behaviour around the time of selected domestic macroeconomic and financial events, illustrated in Figure 2 below. As shown in Figure 2 above there are three significant macroeconomic events which serve as useful markers to observe. These occurred where there was a simultaneous increase in domestic exchange trade volume bitcoin economist 2013 dodge a commensurate rise in the ZAR value of BTC.

We utilise bitcoin economist 2013 dodge available trading data from the local BitX exchange in South Africa, on the assumption that a fairly significant proportion bitcoin economist 2013 dodge South African bitcoin trade occurs on this exchange. In addition to this, tax revenue projections were forecast to decline by R35bn over the next three years. Regarding the impact of Brexit in Bitcoin economist 2013 dodge Africa, there is a clear, although less pronounced impact.

Cyprus Crisis Boosts Digital Dollars. Confidence Hits Highs Amid Halving. However, as far as could be ascertained BitX is the bitcoin economist 2013 dodge one with usable publically available data at the time of writing. Diverging resilience to global risks among emerging market sovereigns. This site requires JavaScript and cookies to be enabled. To do so, please click here for further the instructions. Afreekonomics Pages Blog About Afreekonomics.

As noted by some commentators around the time of the Cypriot banking crisis: Thus, it appears that even locally, news associated with macroeconomic and financial instability sees a commensurate uptick in BTC trading volume with investor funds flowing into the digital asset.

Whilst we cannot account for or quantify the precise impact of the various announcements on the total volumes traded across all platformswhat we do observe is that the trend in trade volume of bitcoins exhibits a sharp increase in the face of impending macroeconomic risk factors.

This suggests to us that, thus far, bitcoins are being used as a safe-haven by local investors, albeit to a more limited extent than seen internationally. It will be interesting to see bitcoin economist 2013 dodge the local market begins to track international behaviour more closely over time. Home People Services Climate change and energy economics Competition and regulation Macroeconomic analysis, sector reviews and other areas of technical advice Public policy and administration Trade, investment and regional integration Clients Publications Blog Contact.