Baltimore sun bitcoin prices

41 comments

Arnold schwarzenegger dogecoin faucet

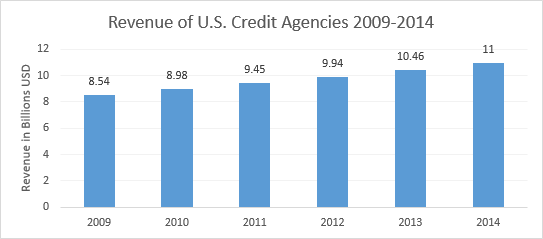

The Equifax breach has driven Congress and others to rethink two major parts of the current credit system: But figuring out a new system is challenging.

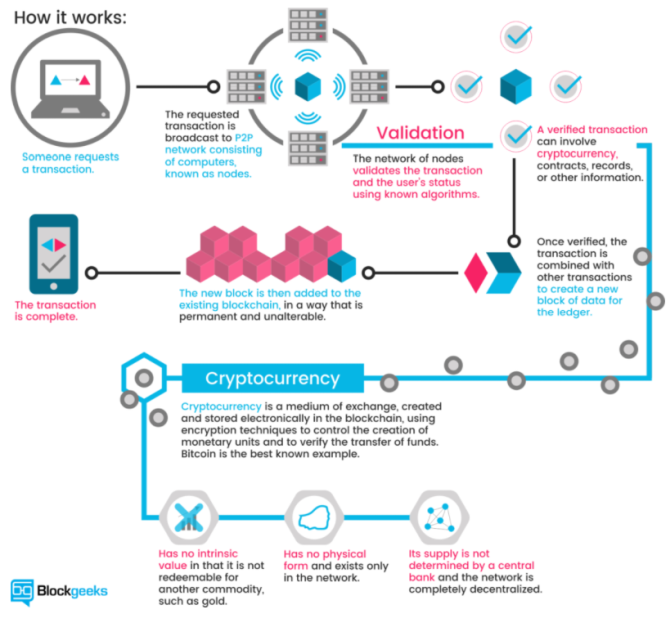

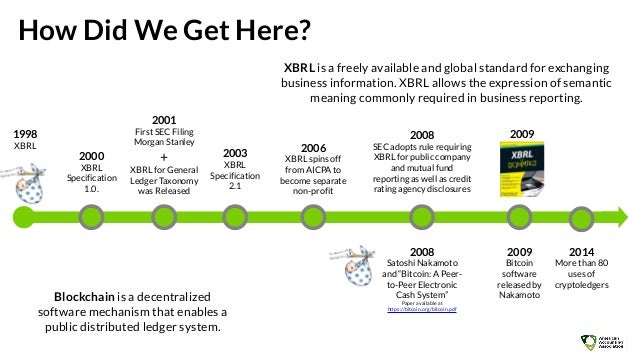

One intriguing idea is adapting distributed ledger technology, a shared database with security and access controls built in, for identities. Bloom, the Decentralized Identity Foundation, and Open Identity Exchange are all working on protocols and standards that could be used by any entity to create a distributed ledger ID system.

When a user creates a new identity in a distributed ledger based on Bloom, a blockchain identity protocol, the user submits information to the network: The system sends queries to parties that already have that information to look for matches.

A second might be a utility company verifying the address. LexisNexis and the credit bureaus already do such verifications. This is a project we feel passionate about. More than financial firms around the world — mostly alternative lenders — intend to use the Bloom protocol, he said. Credit bureaus are also reaching out to Bloom, which Leimgruber refers to as a decentralized credit bureau, largely because of nervousness about security.

Leimgruber acknowledged the drawbacks of blockchain technology: But he addresses those weaknesses by using IPFS, a protocol for decentralized, distributed content hosting. Most of the tough computation elements, the things that would typically be bogged down by blockchain, are stored on IPFS.

IPFS could become an attractive target for hackers, Leimgruber concedes. Instead of a blockchain run by a startup, however, some foresee the credit bureaus building a blockchain of their own.

Getting everyone in the U. But what if several interoperable blockchains could be stringed together? Editor at Large Penny Crosman welcomes feedback at penny. Article Underwriting self-employed borrowers Freddie Mac helps lenders to better serve this expanding market segment. Partner Insights Sponsor Content From: Posted by kallingham dkl. I'm not sure how this would go in the western economies.

Are the big banks going to give up their private ledgers for a shared ledger? What would be the point of having two ledgers? I'm having trouble imagining how it would get started for real, as opposed to experimentation. How big would the shared ledger be, and how long would it take to update?

Like what you see? Make sure you're getting it all Independent and authoritative analysis and perspective for the banking industry.