Bitcoin miner co to jest yahoo

30 comments

Blockchain graph database opening

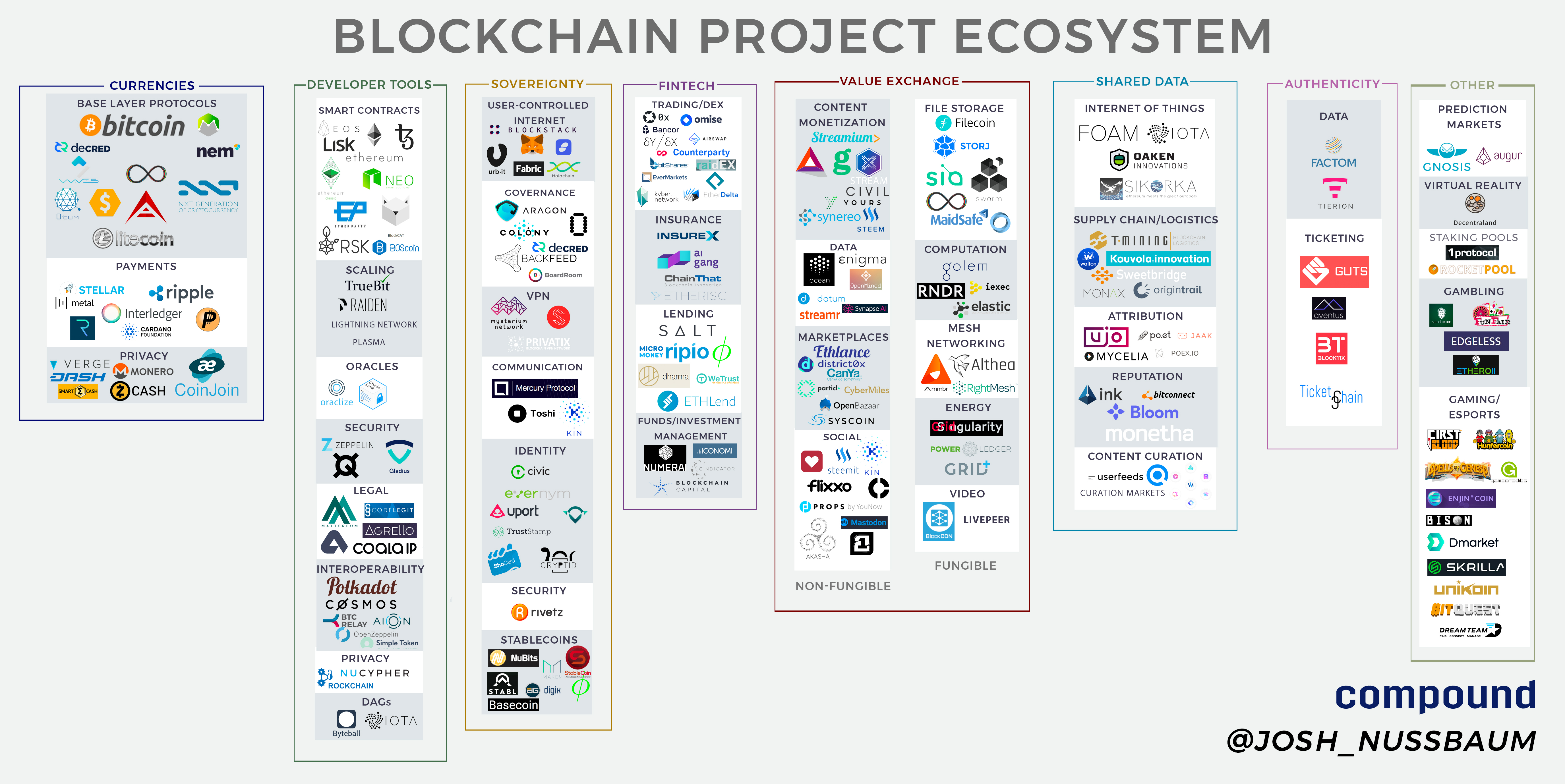

Blockchain technology, cryptocurrencies, and token sales are all the rage right now. However, as I wrote about a few months ago, the rise of Ethereum with its Turing-complete scripting language and the ability for developers to include state in each block, has paved the way for smart contract development.

There are certainly many projects that fall into the gray area and could fit into multiple categories. For the most part, these projects were created with the intention of building a better currency for various use cases and represent either a store of value, medium of exchange, or a unit of account.

Projects within this category are primarily used by developers as the building blocks for decentralized applications. In order to allow users to directly interact with protocols through application interfaces for use cases other than financial ones , many of the current designs that lie here need to be proven out at scale. Protocol designs around scaling and interoperability are active areas of research that will be important parts of the Web3 development stack.

In my opinion, this is one of the more interesting categories at the moment from both an intellectual curiosity and an investment standpoint. For example, building a decentralized data marketplace could require a a number of Developer Tools subcategories such as Ethereum for smart contracts, Truebit for faster computation, NuCypher for proxy re-encryption, ZeppelinOS for security, and Mattereum for legal contract execution to ensure protection in the case of a dispute.

Because these are protocols and not centralized data silos, they can talk to one another, and this interoperability enables new use cases to emerge through the sharing of data and functionality from multiple protocols in a single application. Preethi Kasireddy does a great job of explaining this dynamic here.

This category is fairly straightforward. Many projects are already starting to integrate the 0x protocol and I anticipate this trend to continue in the near future.

Both the Lending and Insurance subcategories benefit from economies of scale through risk aggregation. By opening up these markets and allowing people to now be priced in larger pools or on a differentiated, individual basis depending on their risk profile , costs can decrease and therefore consumers should in theory win.

As the team at Blockstack describes in their white paper: These centralized services are a prime target for hackers and frequently get hacked. Sovereignty is another area that I find most interesting at the moment. A key design of the Bitcoin protocol is the ability to have trust amongst several different parties, despite there being no relationship or trust between those parties outside of the blockchain.

Transactions can be created and data shared by various parties in an immutable fashion. Through blockchains and cryptoeconomics, the time and complexity of developing trust is abstracted away, which allows a large number people to collaborate and share in the profits of such collaboration without a hierarchical structure of a traditional firm. Today, middlemen and rent seekers are a necessary evil in order to keep order, maintain safety, and enforce the rules of P2P marketplaces.

But in many areas, these cryptoeconomic systems can replace that trust, and cutting out middlemen and their fees will allow users to exchange goods and services at a significantly lower cost. The projects in the subcategories can be broken down into two main groups: Markets that allow users to exchange goods and services that are fungible will commoditize things like storage, computation, internet connectivity, bandwidth, energy, etc. Companies that sell these products today compete on economies of scale which can only be displaced by better economies of scale.

By opening up latent supply and allowing anyone to join the network which will become easier through projects like 1Protocol this no longer becomes a daunting task, once again collapsing margins towards zero. This allows aggregators like Kayak and other companies in the space to displace traditional travel agents by building a front end on top of these systems that users can transact on.

In shared data blockchain protocols, users can take these types of datasets with them as other applications hook into shared data protocols, reducing barriers to entry; increasing competition and as a result ultimately increasing the pace of innovation.

The other way to think about shared data protocols can be best described using a centralized company, such as Premise Data , as an example. The company uses machine learning to extract insights and then sells these datasets to a range of customers. Rather than finding and hiring people to collect these datasets, a project could be started that allows anyone to collect and share this data, annotate the data, and build different models to extract insights from the data.

In theory, the result would be more contributors and higher quality datasets as the market sets the going rate for information and compensates participants accordingly relative to their contribution. The challenge I foresee will be in sales and business development.

Most of these companies sell their dataset to larger organizations and it will be interesting to see how decentralized projects distribute theirs in the future. Ultimately, cryptocurrencies are just digital assets native to a specific blockchain and projects in this category are using these digital assets to represent either real world goods like fair tickets or data.

Hence why, for sensitive data or markets for goods which have traditionally been rife with fraud, it would make sense to use a blockchain to assure the user of their integrity. Compound is an investor in Blockstack and two other projects mentioned in this post which have not yet been announced. Joshua Nussbaum is a partner at the New York-based venture firm, Compound.