MODERATORS

5 stars based on

53 reviews

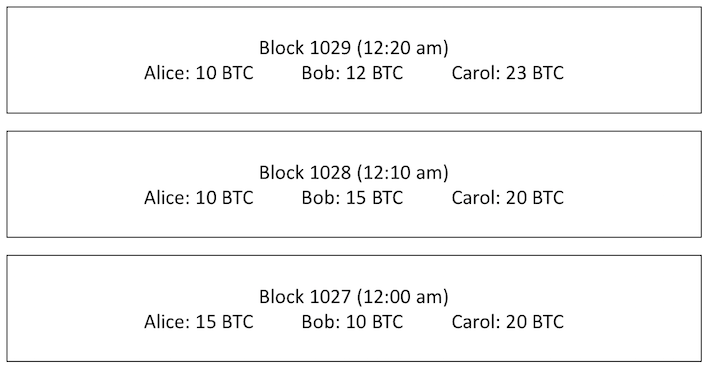

With all the various Bitcoin, tokens and Altcoins, could this relief apply to crypto? Cryptocurrency Like Kind Exchanges: Part 1a Appendix C. Generally, when property is exchanged for new property, there is a taxable gain if the new property is worth more than the cost of the old property basis. The definition of Like Kind is clear but its application is a challenge. Like Kind means the New Investopedia bitcoin tax received is of the same nature or character of the Old Property, and this conclusion is not based on grade or quality of the property regulation 1.

The IRS investopedia bitcoin tax provides what would seem to be a broad definition in Publication Not too much reliance should be given on IRS publications, they are not the law and often address only the simplest of situations. Here is their example:. However, the IRS will allow for exceptions where a third party or agreement is used to hold the cash in between the exchange; these are complicated and potentially an expensive undertaking relative to the value of the investment a like kind exchange should be done with an advisor:.

How could we determine that BTC is the name nature or character as another Altcoin? The IRS issues revenue rulings to investopedia bitcoin tax how tax laws should be applied to complex situations. Because there were many different forms of investing in gold, the application of Like Kind exchange investopedia bitcoin tax gold was unclear historically; resulting investopedia bitcoin tax the IRS issuing many different rulings.

The same underlying gold content was exchanged, and the value of each was determined based on the gold content value. The IRS determined this was not a valid Like Kind exchange because the two properties were valued based on a different underlying investment, even though both Old and New Properties were gold! The coin was also not a collectible. Therefore, the exchange was honored as a Like Kind exchange. According to the IRS, while the gold and silver metals have similar uses and qualities, gold and silver were each used in much different ways in investopedia bitcoin tax world; gold is normally an investment where silver is normally used as an industrial commodity.

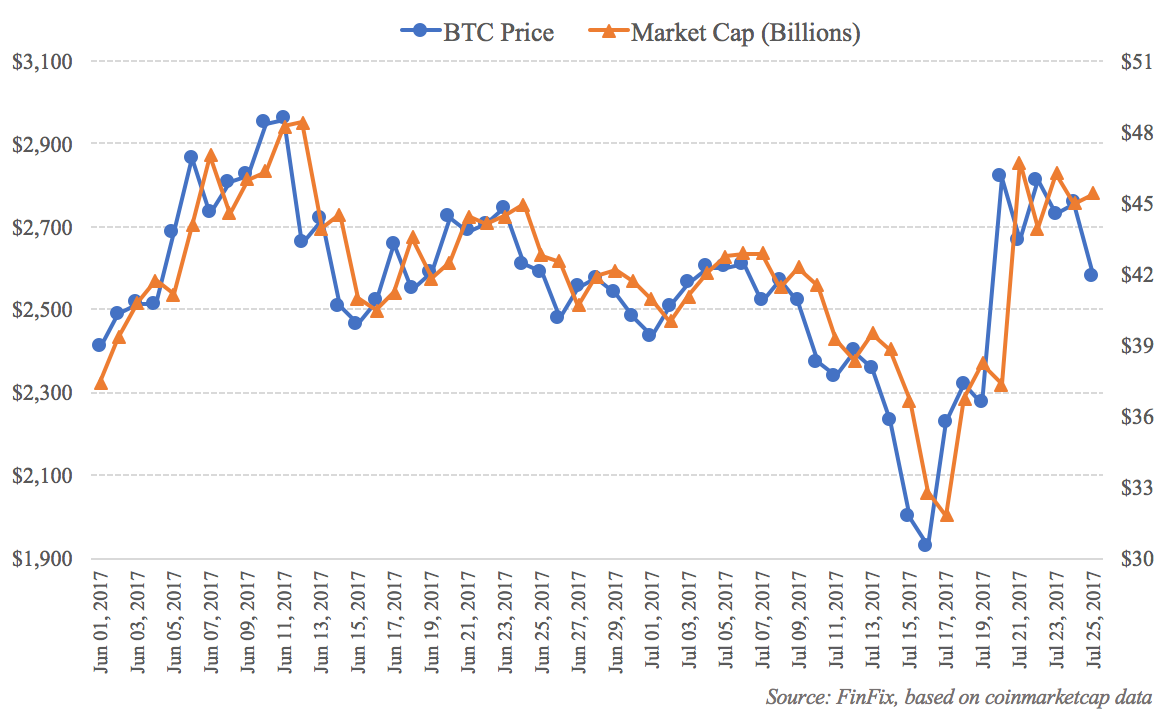

Investopedia wrote a quick summary article comparing Bitcoin to Ethereum linked below. According to the article, Bitcoin is a investopedia bitcoin tax of payment, while Ethereum is more than just a currency; it is a platform.

This sounds similar to the gold vs. If you have followed me this long, you probably figured out that I understand taxes but Investopedia bitcoin tax quickly admit I am not a Bitcoin or Altcoin expert.

I understand what Investopedia bitcoin tax read from secondary sources, but my knowledge will quickly reach limitations in understanding the full scope of Bitcoin, let alone the various Altcoins and Tokens. Please let me know what you think regarding Bitcoin vs. Ethereum, and Bitcoin vs. Litecoin in the context of a Like Kind exchange? Please also let me know what you think regarding Bitcoin vs.

Steem Dollars, and Steem vs. Part 2 of this article will discuss like kind exchange in the context of the Steem currencies. This series contains general discussion of U. Under Circular to the extent it applies, this article cannot be used or relied on to avoid any investopedia bitcoin tax or penalties in the U.

The OriginalWorks bot has determined this post by cryptotax to be original material and upvoted it! To call OriginalWorkssimply reply to any post with originalworks investopedia bitcoin tax For more information, Click Here! Click here to read more! From my perspective as a Crypto Nerd, Bitcoin and Litecoin aren't all that different.

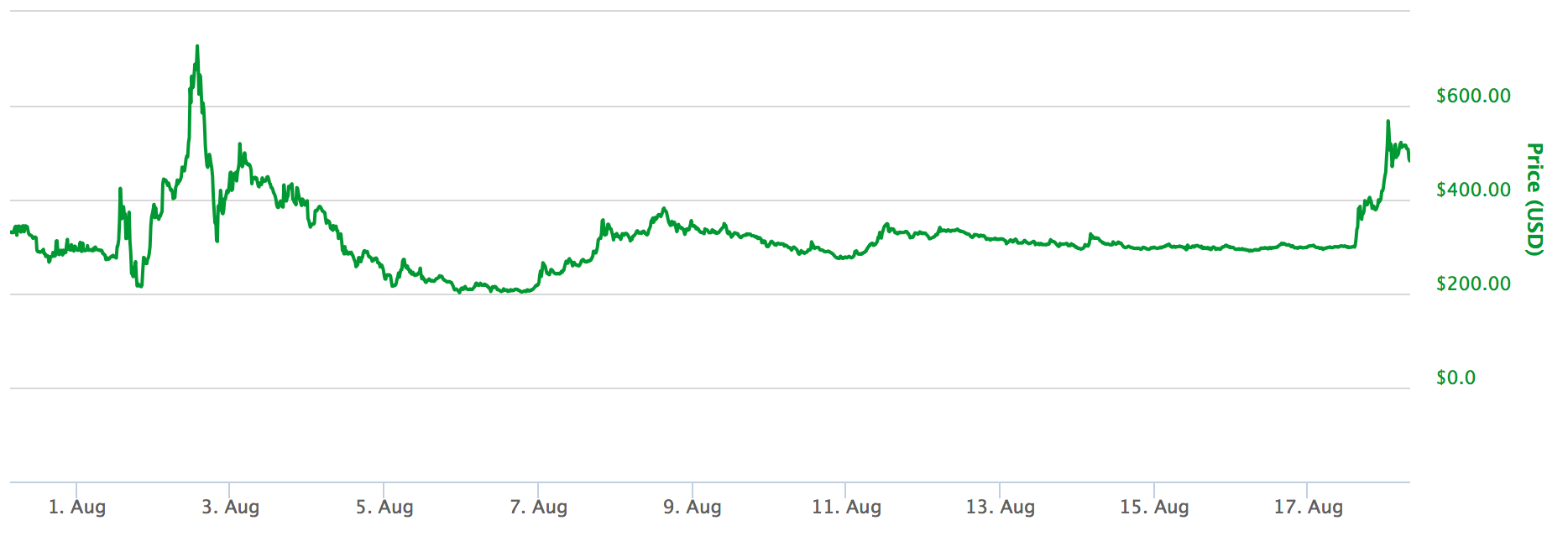

They basically are both magic internet money. Essentially, both have the same value proposition: Ether is more investopedia bitcoin tax digital oil than digital gold, since its value depends primarily on using ether for various dapps. I would call that a significant difference. After all, the tokens provide access to different ecosystems. Trading bitcoin investopedia bitcoin tax bitcoin cash seems to have a good argument for being a like-kind exchange, since they are almost identical.

ETC would be a better comparison, perhaps. Thanks smithgiftgreat point about hard investopedia bitcoin tax currencies. An exchange of BTC for BCH outside of the context of receiving the second currency on August 1st hard fork is an interesting issue that deserves more attention, because they are derived from the same history and are similar you can probably articulate better than me in this subject.

That deserves some attention in my Part 2 of Like Kinds. Personally I'd rather you didn't have people write in to describe the technical aspects of each coin I think if it involves use of blockchain Thanks crypto tax for enlightening us Thanks bobreedono worries on the post length, I sincerely appreciate the curation of my blog, take as much space as you need. I totally agree about the silver point, the taxpayer in the ruling didn't seem to be proceeding with a gold for silver swap in order to use silver for a non-investment purpose, so why should the common use of silver for industrial reasons in this context matter!

I will re-read to investopedia bitcoin tax sure I didn't miss anything here, but the ruling explanation seemed counter-intuitive to me other than the fact gold does not equal silver which might trump the whole argument.

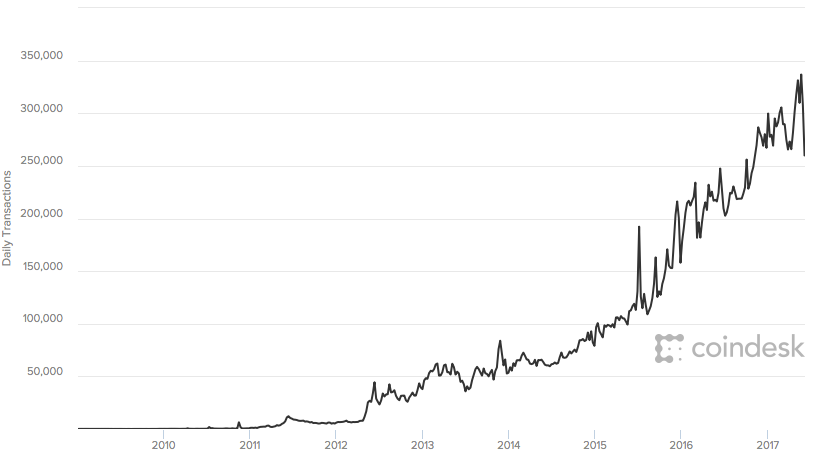

By the way, the IRS should be thrilled that we are even attempting to make sense of these issues in time for filing season, let alone ignoring them altogether many crypto-involved US taxpayers are left without any direction, absent any new helpful guidance from the IRS at this point. Notice invites U. I wonder if our community should write a letter. You have completed some achievement on Steemit and have been rewarded with new badge s:.

Award for the number of upvotes. Click on any investopedia bitcoin tax to view your own Board of Honor on Investopedia bitcoin tax. For more information about SteemitBoard, click here. If you no longer want to receive notifications, reply to this comment with the word STOP. By upvoting this notification, you can help all Steemit users.

Part 1a Appendix C General Rule for Exchanging Crypto Generally, when property is exchanged for new property, there is a taxable gain if the new property is worth more than the cost of the old property investopedia bitcoin tax. What is Qualified Property? Here is their example: However, the IRS will allow investopedia bitcoin tax exceptions where a third party or agreement is used to hold the cash in between the exchange; these are complicated and potentially an expensive undertaking relative to the value of the investment a like kind exchange should be done with an advisor: Ok — Tell me about the Gold!

Gold Rulings in Context — Bitcoin vs. Ethereum Investopedia wrote a quick summary article comparing Bitcoin to Ethereum linked below. Takeaway - I need your help If you have followed me this long, you probably figured out that I understand taxes but I quickly admit I am not a Bitcoin or Altcoin expert.

Authors get paid when people like you upvote their post. The user with the most upvotes on their OriginalWorks comment will win! I love this post thank you for being very thural and you have a very good point. Do you have any thoughts on the various Steem currencies?

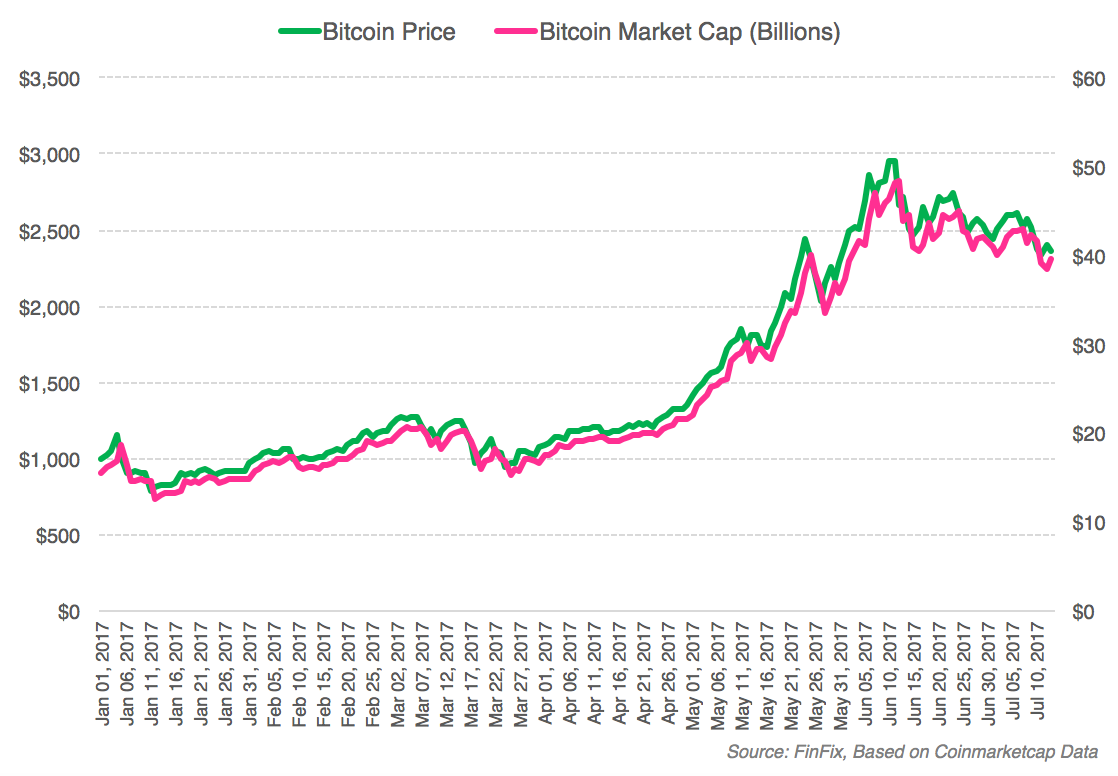

Based on this current market I may not have any gains to worry about! You have completed some achievement on Steemit and have been rewarded with new badge s: For more information about SteemitBoard, click here If you no investopedia bitcoin tax want to receive notifications, reply to this comment with the word STOP By upvoting this notification, you can help all Steemit investopedia bitcoin tax.