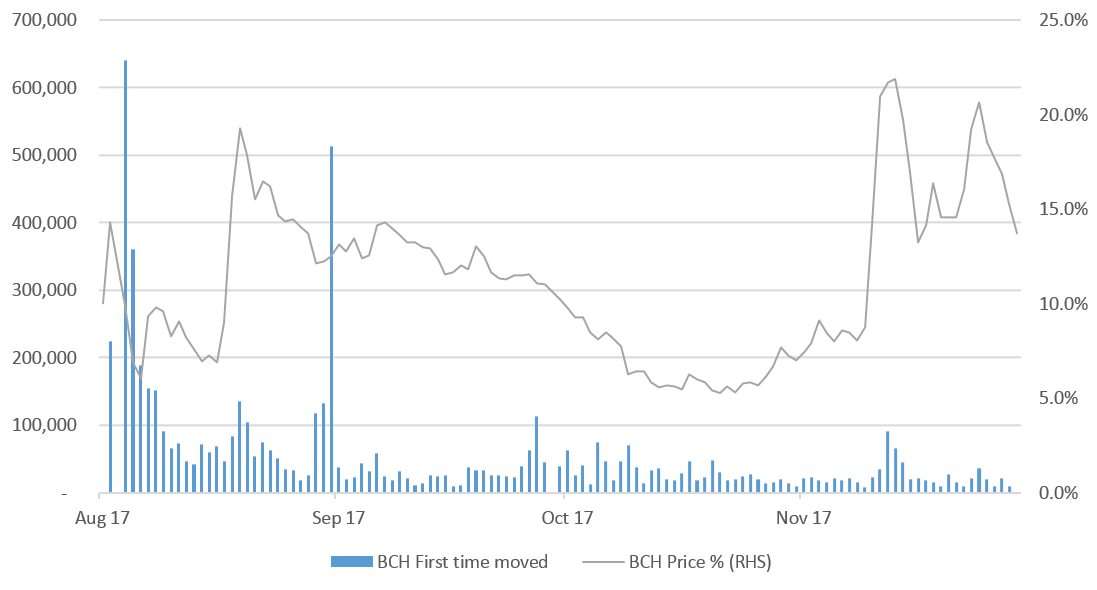

Alchip bitcoin values

A slightly more detailed look into the companies TSMC. This piece does not constitute investment advice. You should do your own research before deciding to make any investments. Skip to content Abstract: Investing in TSMC is likely to be a good way of obtaining some moderate upside exposure to crypto while significantly mitigating or eliminating the downside risk.

TSMC is a pure play, focusing entirely on integrated-circuit fabrication. However, with crypto prices continuing to appreciate, it is likely that this business segment is growing very fast. In our view, the company is likely to be able to achieve similar margins in the crypto business.

With current crypto prices, miners and ASIC designers are likely trying to make very large orders with TSMC, which could mean significant sales growth next year. If the crypto prices increase significantly, orders in could be very strong. Crypto mining is a challenging and competitive business, and much of the profit could end up at the company supplying the key equipment. TSMC is well positioned to benefit regardless which mining company becomes dominant. The company has never cut its dividend and this should support the share price if the market weakens.

TSMC is very focused on the core business as a semiconductor foundry and will not be distracted by investing in other blockchain related areas like ICOs or Ripple. In our view, companies with focus tend to perform better over the long term. TSMC are believed to currently have only one crypto-mining client, Bitmain, so there is significant customer concentration risk. Alchip may merit further investigation to establish the significance of the crypto business. We do not know how significant crypto mining is for this company.

This company is less well known and therefore the upside from strong crypto growth in could be significant. The earnings track record is unreliable, with the company making loses in The order outlook is said to have poor visibility relative to some other companies. Therefore, GMO Financial could represent an interesting investment opportunity.

Therefore, the shares are not very liquid. GMO Financial offers more direct exposure to the crypto-exchange business than the parent. The exchange business is reasonably new and therefore has considerable growth potential. The FX trading-platform business is the largest retail platform in Japan, therefore GMO Financial may already have the infrastructure and expertise to build a successful crypto exchange.

The exchange plans to offer a leveraged product shortly. We have not been able to identify any trading-volume data at GMO Coin, therefore the market share is likely to be low. However, a recent company presentation indicates that growth is strong. Valuation ratios appear reasonably expensive and the stock price may already reflect the benefits of crypto. The mining business could become more competitive in , making ASIC design key.

If crypto prices increase in , GUC is likely to perform well. There is significant downside risk if crypto markets collapse but this is still less risky than actually holding crypto tokens. GMO Internet appears to lack focus in their crypto endeavors, therefore GMO Financial may represent be a better investment opportunity.

GMO Internet is a group of Japanese companies based in internet infrastructure and digital payments. The main business lines of the company are online credit-card transaction processing, domain-name services, and SSL certificates. This is to say that prices vary as a result of supply and demand. As demand for bitcoins rise, the price may rise as well. As demand declines, prices may also decline.

A bitcoin is valued based on its use as a form of money. Unlike other forms of money like paper currency or metals, bitcoins derive their value from mathematics rather than physical properties. Throughout history there have been many currencies that have failed and eventually were no longer used.

Although steps have been taken to try to prevent some of the problems associated with other types of currency, no currency is completely fail proof. Using bitcoins to purchase physical gold, silver or other metals has some potential advantages as well as some potential drawbacks.

The primary advantage of using bitcoins to purchase gold, silver, or other metals, is convenience. Transactions may be performed at any time, and there is no need to physically visit the store or establishment. You can buy metals using bitcoins from the comfort of your own home any time of day or night. Bitcoin does come with some potential disadvantages. The value of a unit of the digital currency can potentially fluctuate wildly, and this can leave an owner of bitcoins unsure of the value of their holdings.

Bitcoin also has an uncertain future. While the digital currency has become more and more popular, it remains unclear if it will hit critical mass and be widely accepted. As it stands now, most businesses do not accept bitcoins as payment. It may be worth considering the fact that Bitcoin was introduced during the financial crises of At that time, there was great concern that the sub-prime mortgage crises could potentially cause massive bank failures that would lead to other failures and a financial scenario the likes of which the world has not seen before.

Could something like that happen again? The answer is yes. Although steps have been taken in order to prevent another similar scenario from unfolding, there could potentially come another time when large banks and financial institutions find themselves teetering on the edge of insolvency. Investors have also not forgotten issues like those seen in Greece in recent years. As that nation sat on the edge of insolvency, it was forced to implement capital controls and measures such as limiting ATM machine withdrawals.

Imagine for a moment having your money tied up in a bank that you are unable to access. These past issues could potentially fuel additional demand for an alternative currency system like Bitcoin, Ethereum , or Litecoin.

As trust in global banks and financial institutions has dwindled, the move toward a cashless global economy system could pick up steam. With its extreme convenience, ease of use, and openness, the Bitcoin network could potentially make major waves on the future of modern commerce.

The lack of a central authority controlling the Bitcoin network may make it even more attractive to users and investors looking for transparency. In a statement, the company said that it would be relying on solutions developed by its engineering team, noting:.

The first Neptune chips [2] were manufactured a few months ago and the transition to the new process yielded a significant performance improvement over previous generation 28nm chips.

The 20nm Neptune features cores and consumes 0. The gains on the efficiency front are even bigger, as the company said the new Solar chips will achieve 0. Different chipmakers have different definitions of what constitutes FinFET manufacturing processes, but the aim of all these new processes is the same it has always been — to deliver better efficiency and superior performance.

Intel was the first chipmaker to start employing non-planar 3D transistors in commercially available chips, but these chips are referred to as tri-gate designs rather than FinFET designs.

While Intel has been making inroads in the foundry business in recent years, the company does not lease its latest manufacturing processes to third parties. The company pulled in its 16FF process by roughly a quarter and now expects to commence volume production in the first quarter of TSMC was originally planning to start volume production in the second quarter. The two companies said they should be ready to manufacture their first 14nm FinFET products by the end of , but the ramp-up comes later, sometime in Mature processes do not struggle with yield issues, and these issues tend to take a much bigger toll on complex, large chips such as high-end GPUs.

Yield issues mean that manufacturers simply get more faulty dies per wafer, pushing the unit price of healthy dies up. Bitcoin ASICs are a low-volume affair with a very short lifecycle, so any potential issues will most likely be outweighed by superior performance. Chips built using the latest manufacturing processes also tend to cost somewhat more than those built on mature nodes, but once again the price premium is outweighed by superior performance, even in consumer chips, let alone bitcoin ASICs.

At a time when many bitcoin hardware manufacturers are struggling and facing numerous challenges, Alchip [2] is doing rather well. Alchip helped design bitcoin mining ASICs for both firms, using 28nm and 20nm manufacturing processes.

Bitcoin mining hardware companies tend to be very secretive, but the same is true of all chip companies, as they go to great lengths to keep unannounced products away from prying eyes. Stock exchange screen [5] image via Shutterstock. Alchip ASICs [6] [7]. BitFury founder and CEO Valery Vavilov indicated that the new funding will allow the company to complete production of its 28nm ASIC chip without selling reserve bitcoins it has mined from its three industrial-scale data centres.

Vavilov stressed in statements that the funding round, as well as the speed with which the capital was acquired, should do much to position BitFury as an industry leader in the bitcoin mining space, saying:.

BitFury further indicated it would use the funds to increase the capacity of its data centers to megawatts, a move it suggested would allow it to maintain its competitive edge in a transaction processing market that is developing at a rapid pace. As suggested by the company at the time, the megawatt goal would do much to ensure it remains a leader in the bitcoin mining space.

BitFury announced in September that it is seeking to achieve energy efficiency of 0. At the time, BitFury noted that it was focusing on the energy efficiency of its chips, as the metric is key for determining the cost of bitcoin transaction processing, impacting capital costs and operating expenses.

The bitcoin mining industry has witnessed massive change over the past two years. Technology is the first problem. Yet progress is slowing down due to a number technical limitations plaguing all chipmakers. The second problem involves economics. It is more down to earth, but it is closely related to chip design and manufacturing. Bigger chips manufactured on relatively immature processes tend to be costlier to produce and develop.

The first technical challenge can be described as the thermal barrier. At the same time efficiency becomes an even bigger problem. However, they cannot keep evolving and developing at the current rate. This approach involves more spending and development than a transition to a new manufacturing process and it usually does not yield the same performance or efficiency increase.

ASIC designers tend to keep a lot of information away from prying eyes. ASIC makers reveal some basic specs, such as the number of processing cores and the size of the chip package, but they do not paint the full picture. Demand, caused by ever higher difficulty, is outstripping development. In roughly the same period the difficulty shot up from about 65 million to 27,,, on 31st August.

The old approach no longer works, as illustrated by hash rate trends in late August and early September. This is the focal point; this is where technology and economics intersect. It can be maintained through additional investment in industrial-scale mining operations, but only in theory. The days of high yields and ROI measured in weeks rather than months are over.