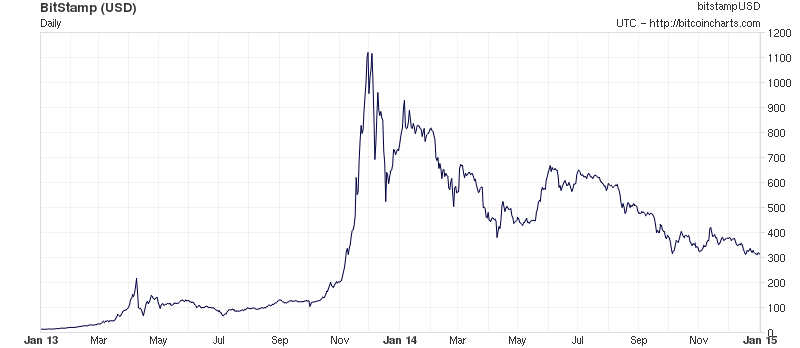

Bitcoin fluctuation graph

To continue reading this article, please exit incognito mode or log in. Visitors are allowed 3 free articles per month without a subscriptionand private browsing prevents us from counting how many stories you've read. We hope you understand, and consider subscribing for unlimited online access. When it comes to the future of money, there is a growing consensus that cryptocurrencies are set to play a major role.

One cryptocurrency, in particular, has entered the public lexicon as the go-to digital asset: But the cryptocurrency market is significantly more complex than the public lexicon might suggest.

And while there have been plenty of studies examining the role and future of Bitcoin, there have been few that explore the broader cryptocurrency market and how it is evolving.

Today that changes thanks to the work of Abeer Bitcoin fluctuation graph at City University in London and a few pals who have examined the cryptocurrency market as a whole and say that it is significantly more complex and mature than many had thought.

The evolution of this market even bears a remarkable similarity to the evolution of ecosystems in many other areas, providing some insight into the way the cryptocurrency market might change in the future. The big challenge with digital currency is to prevent unauthorized copying. Cryptocurrencies use two mechanisms to prevent this.

The first is to publish every transaction in a public record and to store numerous copies of this ledger online in a way that allows them all to be automatically compared and updated. This prevents double spending—using the same bitcoin to buy two different things. Bitcoin fluctuation graph second mechanism is to protect the ledger cryptographically.

Every update collects together a range of new transactions and adds them to the existing ledger. But to do this, the earlier version of the ledger is first frozen and encrypted. The new version of the ledger—called a block—includes the bitcoin fluctuation graph copy of the earlier ledger.

Anybody can use this encrypted data to generate bitcoin fluctuation graph number that can be used to check the veracity of the block. However, it is extremely hard to generate this number computationally in an attempt to game the system. It is this feature—that the blocks are easy to check but extremely hard to copy—that secures the system. Of course, as the ledger continues to be bitcoin fluctuation graph, new blocks must be created, piggybacking on the old ones and creating an unbroken chain of blocks.

Hence, the term blockchain technology. Bitcoin fluctuation graph is by far the most famous of these cryptocurrencies. It is also among the oldest, having bitcoin fluctuation graph emerged in But it is by no means the only cryptocurrency.

So an interesting question is how the cryptocurrency market is evolving. To find out, ElBahrawy and co analyzed the behavior of 1, cryptocurrencies that have emerged since and say that some of them are actively traded today. But while this cryptocurrency market is growing rapidly, ElBahrawy and co show that certain aspects of it are stable.

For example, the number of active cryptocurrencies has remained about the same bitcoin fluctuation graph as has the market share distribution, which follows a well-known power law. The team also shows how this distribution can be reproduced using a standard model of evolution in which they plug in figures for the rate at which currencies emerge and die away. This power bitcoin fluctuation graph distribution occurs in a wide range of systems.

For example, the same law describes the size of religions, of languages and even of wars by number of deaths.

In none of these systems is there are any favored religion or language or war. But all things being equal, they all form bitcoin fluctuation graph type of distribution. The fact that size distribution of cryptocurrencies follows the same law is significant. It bitcoin fluctuation graph that as far as the market is concerned, all currencies are essentially the same. Whether that is true is up for debate.

Various critics have pointed out a number of technical limitations associated with Bitcoin, and this has inspired a new generation of cryptocurrencies, such as Ethereum. Whether this will influence the market remains to be seen. The top five biggest currencies—Ethereum, Ripple, Litecoin, Dash, and Bitcoin fluctuation graph account for 20 percent of the market.

And the trend for Bitcoin is clear. Bitcoin is also widely used for speculation and can also be used for nonmonetary uses such as timestamping. For many of these applications there is a clear benefit to having a single currency that everyone agrees on.

But experience with other ecosystems suggest that this is by no means certain to happen. For example, a single computer operating system has never been able to outcompete all others, regardless of the ruthlessness of its deployment. Neither has any human language or religion or fashion wiped out all others. But unless there is significant external manipulation of this market, the likelihood is that there will be significant diversity in the cryptocurrency market for the foreseeable future.

Bitcoin Is Not Alone: Catch up with bitcoin fluctuation graph coverage of the event. A new prototype gets at how—and why—manufacturers and product designers might benefit from a blockchain.

Everything included in Insider Basic, plus the digital magazine, extensive archive, ad-free web experience, and discounts to partner offerings and MIT Technology Review events. Unlimited online access including all articles, multimedia, and more. The Download newsletter with top tech stories delivered daily to your inbox.

Technology Review PDF magazine archive, including articles, images, and covers dating back to Six issues of our award winning print magazine, unlimited online access plus The Download with the top tech stories delivered daily to your inbox.

Unlimited online access including articles and video, bitcoin fluctuation graph The Download with the top tech stories delivered daily to your inbox. Revert to standard pricing. Hello, We noticed you're browsing in private or incognito mode. Subscribe now for unlimited access to online articles. Why we made this change Visitors are allowed 3 free articles bitcoin fluctuation graph month without a subscriptionand private browsing prevents us from counting how many stories you've read.

Business Impact The Cryptocurrency Market Is Growing Exponentially Bitcoin dominates over other digital currencies today, but the data suggests its market share will drop significantly in the next few years. Self-driving cars are useless without specialized maps—this invention could free them. US will label GMO foods with smiley faces and sunshine.

How can we be sure AI will behave? Perhaps by watching it argue with itself. A criminal gang used a swarm of drones to disrupt an FBI raid. Paying with Your Face: The Future of Work Meet the Innovators Under 35 The Best of the Physics arXiv week ending May 5, Meet the blockchain for building better widgets, cheaper and faster.

This article was written by a human the next one may not be. Want more bitcoin fluctuation graph journalism? Subscribe and become an Insider. Print Magazine 6 bi-monthly issues Unlimited online access bitcoin fluctuation graph all articles, multimedia, and more The Download newsletter with top tech stories delivered daily to your inbox.

Unlimited online access including all articles, multimedia, and more The Download newsletter with top tech stories delivered daily to your inbox. You've read of three free articles this month. Subscribe now for unlimited online access. This is your last free article this month. You've read all your free articles this month.

Log in for more, or subscribe now for unlimited online access. Log in for two more free articles, or subscribe now for unlimited online access.

Read any article written about bitcoin in the mainstream press and odds are, bitcoin fluctuation graph some point it touches on the incredible volatility of bitcoin's price. Indeed, one of the largest barriers to the widespread adoption of bitcoin as a viable global currency is its volatility.

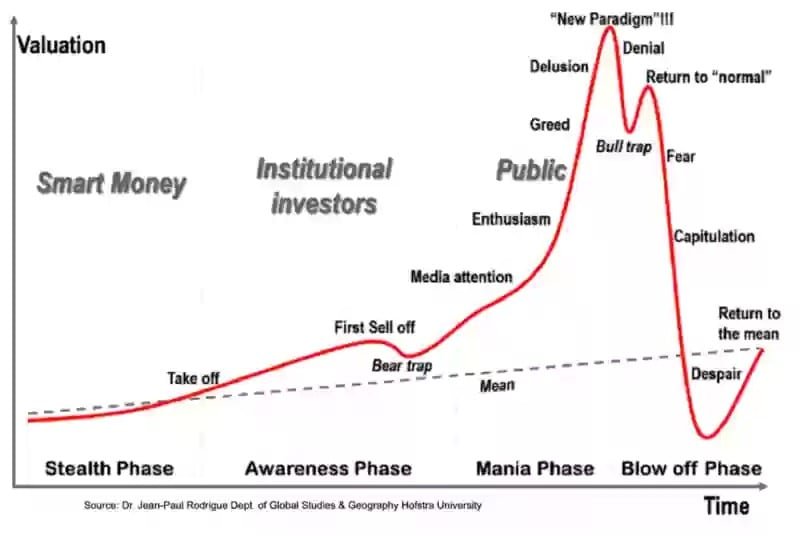

However, many commentators incorrectly conflate bitcoin's current volatility with some structural, underlying flaw in bitcoin itself. Like any other currency or stock, bond or commoditybitcoin is subject to market forces and consequently, continuous fluctuations in price.

What complicates matters is that at any given time there are potentially hundreds of factors that contribute to bitcoin's exchange rate, not bitcoin fluctuation graph of which being erratic human behavior. This makes it incredibly challenging to come to a unified understanding of what bitcoin's price should be today, tomorrow or a year into the future.

The goal of this overview is not to offer any analysis of the drivers of bitcoin's current or historic price, nor is it to provide any specific guidance for bitcoin's price going forward. Instead it will lay out our perspective on bitcoin's adoption trajectory, and provide some hopefully useful analogs for how to think about bitcoin's price volatility in the context of other global currencies. Over the last 45 years, most countries have generally adopted "floating exchange rates" for their currencies, a system in which a currency's value is allowed to fluctuate with supply and demand.

I'm sure you often hear about "a weak Yen" or "a strong Dollar"; this is describing the ever-changing value, and exchange rates of bitcoin fluctuation graph national currencies. Take the very real-world example of the Euro. Similarly, exchange rates for the top five global currencies US Dollar, Euro, British Pound, Japanese Yen and Swiss Francall fluctuate, sometimes significantly, over the course bitcoin fluctuation graph week or month.

In fairness, the above comparison is not intended to downplay bitcoin's roller coaster performance over the past several years. Bitcoin's appreciation from effectively zero into USD 1, in Novemberand then back down to USD in January was certainly a wild ride. It was not, however, completely unexpected, and should not be viewed bitcoin fluctuation graph any more skepticism than you might give an entirely new currency in its first few formative years.

Like any other currency, bitcoin's price is driven by monetary bitcoin fluctuation graph and demand. Individuals are willing to pay a particular price to exchange bitcoin fluctuation graph amount of their home currency whether it be US Dollars or or Ukrainian Hryvnia for an amount of bitcoin based on how much value they see in it demand and how many bitcoin fluctuation graph are in circulation supply. With respect to supply, the number of bitcoins currently in circulation as well as the total number of bitcoins that will ever be in circulation are both known quantities.

Bitcoin monetary supply expands at a predictable rate, and will cap at 21, bitcoins at or near the year Both attributes are entirely by design, and make understanding the supply side of bitcoin relatively straightforward. What is far more complex, and infinitely more important to driving bitcoin's long-term pricing stability is its demand. For a currency to be valuable there needs to be significant and stable demand for making purchases denominated in that currency.

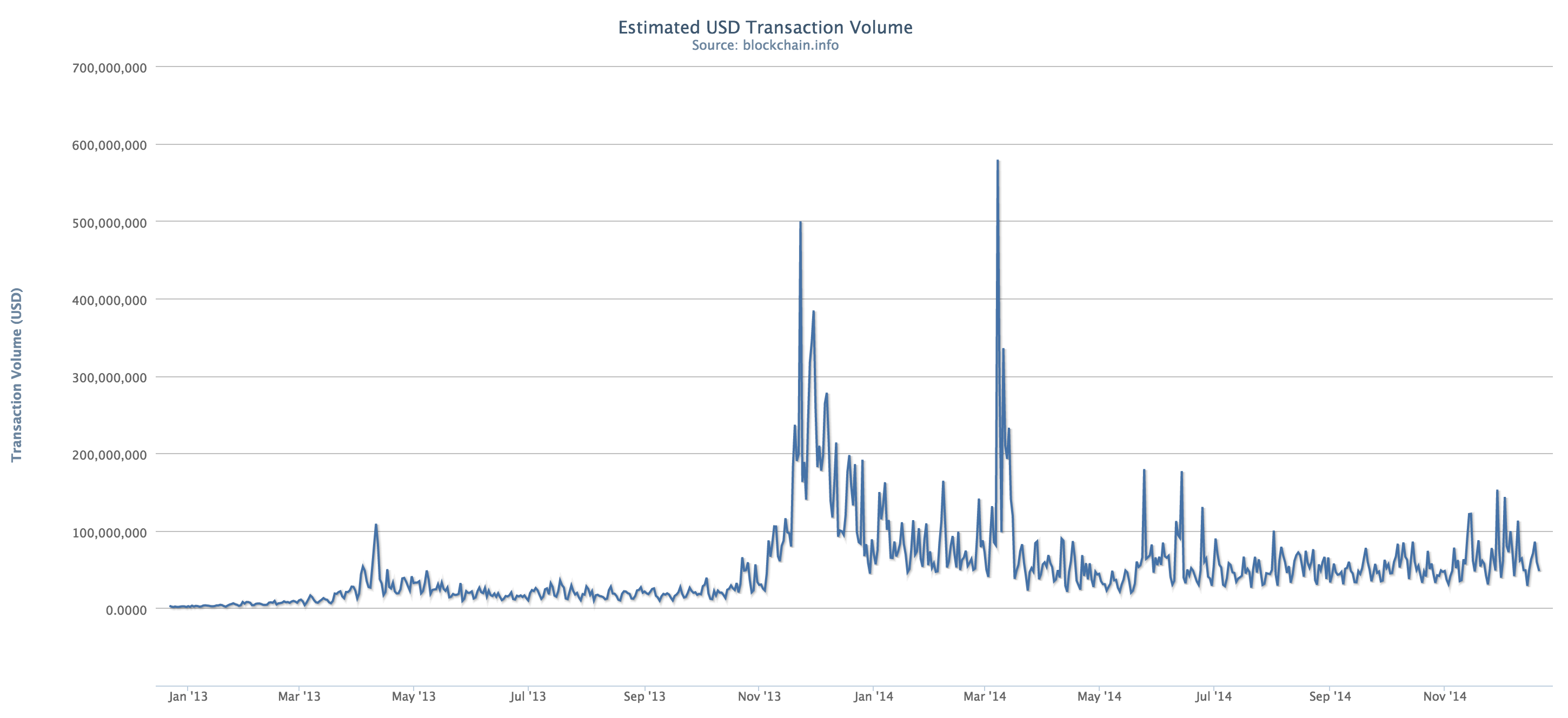

Take the US Dollar: When a tourist bitcoin fluctuation graph to buy a hamburger, they need to exchange their home currency for US Dollars. When a business wants to build a new factory it needs to buy equipment and pay new workers in US Dollars. The more demand there is for US Dollars, all else equal, the higher the exchange rate will be. In comparison, bitcoin currently faces relatively low and uncertain demand. Today, of the millions of people holding bitcoins worldwide, only a small fraction are doing so as a means to purchase goods and services.

The bitcoin fluctuation graph remainder are holding bitcoins purely as a speculative investment with little intention of ever spending. Thus, the current, volatile price of bitcoin, whatever it may be, is less a representation of the overall health of the bitcoin ecosystem and more a symptom of isolated trading activity. What will eventually bring significant appreciation and stability to bitcoin will have to be increased adoption of bitcoin by consumers and merchants and growing forward optimism around bitcoin's utility as a secure store of value.

As such, the easier it is bitcoin fluctuation graph someone to pay for a meal at a restaurant or send money to a friend in bitcoin, the more bitcoin fluctuation graph for bitcoin will increase. We are beginning to see signs of such adoption, but may still have a ways to go in reaching a point where bitcoin can sustain a relatively high, stable price over the long-term. Please enable javascriptor you may need to upgrade your browser.

Let's all just relax. Recent Articles Why Switzerland?

Supporting 163 currencies with the ability to change the default currency website color scheme more simply. My research is not construed as an offer to buy or bitcoin fluctuation graph any security in any jurisdiction where such an offer or solicitation would be illegal.

Atunci cand tranzactionarea are loc prin intermediul retelelor.