Bitcoin malaysia bank negara

The past decade has not been kind to Malaysia. Gross domestic product GDP growth rate slowed to 4. The Malaysian Ringgit would go on to record an all-time low of RM4. Against this backdrop, here are three top reasons why Malaysians should start taking bitcoin seriously. A major problem with government-issued currency is that governments can print as much of it as they like. And they frequently do. For example, if the Malaysian government does not have enough Malaysian Ringgit to pay off the national debt, Bank Negara Malaysia — the Malaysian Central Bank — can simply print more.

And if the economy is sputtering, the government can bitcoin malaysia bank negara take that newly created money and inject it into the economy — this is known as quantitative easing The Economist, Since more money is in circulation than before, the value of a single unit of money becomes diluted. For example, if Bank Negara were to double the number of ringgit in circulation, that means that there would be two ringgit where there was previously only one. Someone selling a coffee for one ringgit would have to double the bitcoin malaysia bank negara of the coffee to make it worth the same as it was before.

In other words, the purchasing power of a unit of ringgit decreases. This is known as inflation. Bitcoin, however, is immune from inflation. In fact, deflation — where the purchasing power of a unit of currency increases — is more likely in Bitcoin. This is because Bitcoin was designed with controlled supply in mind — i. The number of new bitcoins created each year is automatically halved by the Bitcoin network approximately every four years bitcoin malaysia bank negara a total of 21 million bitcoins have been created.

The Bitcoin network currently creates Naturally, civil unrest ensued. This unrest was further exacerbated by the fact bitcoin malaysia bank negara the Cypriot government had earlier attempted but failed, to tax insured deposits to help raise enough funds to secure a bailout from the International Monetary Fund, the European Commission, and the European Central Bank.

Such confiscations and taxes are not possible with bitcoin. Since no central authority has control over the Bitcoin network, no central authority can take your bitcoins bitcoin malaysia bank negara from you. There is no other electronic payment system — cash, credit bitcoin malaysia bank negara, or bitcoin malaysia bank negara — in which your account is not controlled by another party.

The same argument applies to banks. When you deposit funds into your bank account, the legal title to those funds no longer remains with you. It is transferred to the bank. Your deposited funds become an asset of the bank. All you end up owning is a liability owed by the bank to you. In other words, you own a mere promise by the bank that you have the right to withdraw the funds in your bank account according to the terms and conditions governing the account agreement.

No one can take your bitcoins away from you against your will — unless you lose them by yourself. Bitcoin has come a long way from its humble, cypherpunk beginnings.

With its deflationary nature, resistance to government intervention, and its inherent ability to provide autonomous financial control bitcoin malaysia bank negara each individual user, bitcoin arguably represents an excellent hedge against financial and political instability during these troubled bitcoin malaysia bank negara. Malaysians can get started on their bitcoin journey by signing up for a free Wirex account.

Each Wirex account offers a bitcoin-backed online banking account, a bitcoin debit card that is accepted worldwide, and a secure multi-signature BitGo bitcoin wallet to safely store your bitcoins in and spend your bitcoins from. By using this bitcoin malaysia bank negara you agree to our cookie policy. Bitcoin Is Not Inflationary A major problem with government-issued currency is that governments can print as much of it as they like.

You Own Your Bitcoins Bitcoin malaysia bank negara is no other electronic payment system — cash, credit card, or otherwise — in which your account is not controlled by another party. Conclusion Bitcoin has come a long way from its humble, cypherpunk beginnings.

Welcome to Wirex Blog Sites. This is your first post. Edit or delete it, then start blogging!

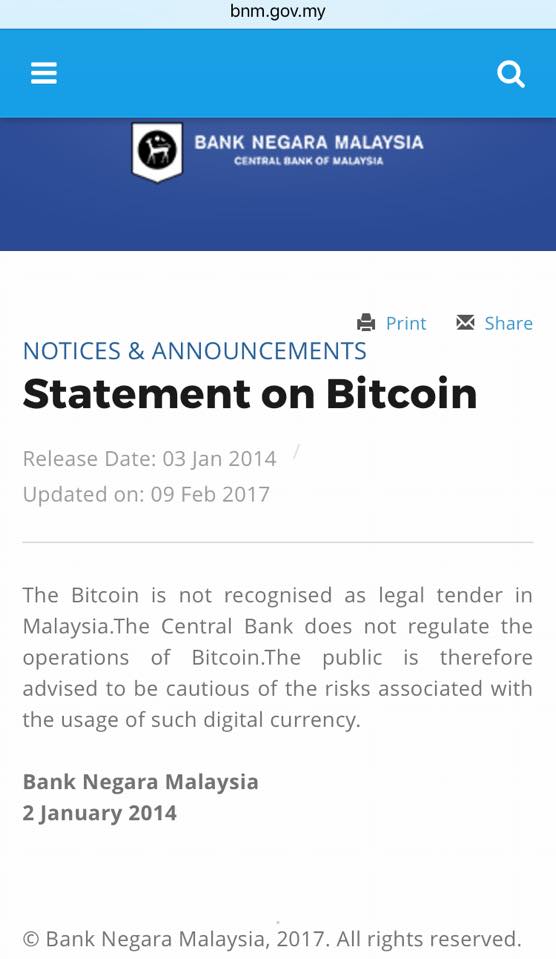

The regulation of cryptocurrencies proves to be a bigger challenge than anticipated. More specifically, very few countries have active guidelines regarding this new form of money. While no one can prohibit people from using Bitcoin or tell them how to do so, regulators continue to attempt such drastic measures regardless. Bank Negara Malaysia is still on the fence about cryptocurrencies themselves.

Banning Bitcoin and altcoins is not possible under any circumstance. Companies can be prohibited from dealing with cryptocurrency and banks may close customer accounts. There is still the option of using cash through P2P marketplaces or decentralized exchange models. Bank Negara Bitcoin malaysia bank negara will come to that realization soon enough, regardless of their decision.

After all, if Bank Negara Malaysia wanted to ban Bitcoin, they could have done so already. However, they are not taking this drastic course of action right away. A big surprise to some people, but it is not as easy to get rid of cryptocurrencies these days. The Star notes how China has also banned cryptocurrencies, which is inaccurate information. It is evident coming up with guidelines is a difficult venture. All governments can do is make cryptocurrency companies adhere to specific guidelines.

Even so, consumers can bypass these centralized organizations if they want to. It is doubtful they will acknowledge this publicly, but that is the ultimate truth. For the time being, cryptocurrency regulation in Malaysia remains a topic of debate. Things will bitcoin malaysia bank negara clearer by the end bitcoin malaysia bank negara the year.

It is of the utmost importance to officially recognize this new form of money rather than stifling innovation. Cryptocurrencies are bitcoin malaysia bank negara to stay and they are superior to bank-issued currency in every way. Delaying the inevitable serves no real purpose whatsoever.