Bitcoin payment services directive

He also warned of losses from investments in cryptocurrencies. At present, however, Bitcoin will continue to be treated as an asset rather than a legally-recognised currency. Under rules introduced in cryptocurrency exchanges that want to operate in Japan must now come under regulatory supervision of the Japan Financial Services Agency. New York Department of Financial Services New York was the first state to propose regulation of Bitcoin July and released a comprehensive framework for regulating digital currency firms in the State of New York.

The framework contains consumer protection, anti-money laundering compliance and cyber security rules tailored for digital currency companies, as well as a requirement to apply for a licence. Internal Revenue Service The IRS answered some common questions about the tax treatment of virtual currency transactions in a notice in This included confirming that for federal tax purposes, virtual currency is treated as property.

General tax principles applicable to property transactions apply to transactions using virtual currency. The notice also set out that under currently applicable law, virtual currency is not treated as currency that could generate foreign currency gain or loss for US federal tax purposes.

Russia Various In early the Russian President Vladimir Putin stated that legislative regulation will definitely be required in future. He also explained that the Russian central bank has sufficient authority to regulated cryptocurrency at present. At the time of writing, it is expected that a bill regulating cryptocurrency and ICOs will be enacted by mid Further reading Click here for a full report Click here for a full report. Close Find a lawyer.

The Bank does not yet consider cryptocurrencies systemically important but is keeping them under review. The FCA does not currently regulate Bitcoin or other cryptocurrencies or exchanges.

Bitcoin and other cryptocurrencies are treated as currencies, so are not within the scope of VAT — i. Published a paper on Virtual Currencies in February which stated that the ECB does not regard virtual currencies, such as Bitcoin, as full forms of money as defined in economic literature. In July , the EBA published a list of 70 risks largely focussing on user risks connected with investing in digital currencies and has advised that consumers should only buy virtual currencies if they are aware of the risks.

Published a call for evidence on investment using virtual currency or distributed ledger technology in April In accordance with BaFin's decision on units of account within the meaning of section 1 11 sentence 1 of the German Banking Act or KWG , Bitcoins and other virtual currencies that have similar characteristics are financial instruments. New York Department of Financial Services.

New York was the first state to propose regulation of Bitcoin July and released a comprehensive framework for regulating digital currency firms in the State of New York. The IRS answered some common questions about the tax treatment of virtual currency transactions in a notice in Commissioner Jonathan Hill , responsible for Financial Stability, Financial Services and Capital Markets Union, said, "This legislation is a step towards a digital single market; it will benefit consumers and businesses, and help the economy grow.

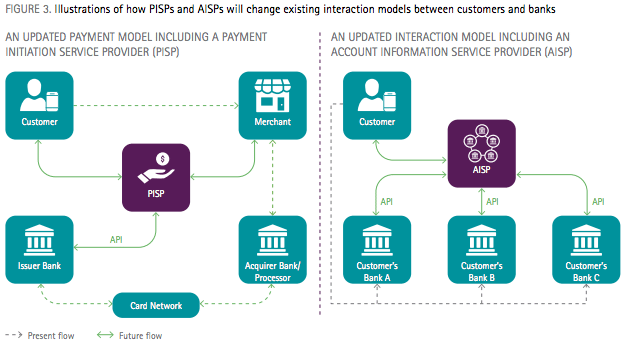

Member states will have two years to incorporate the directive into their national laws and regulations. Banks need to adapt to these changes that open many technical challenges, but also many strategic opportunities, such as collaborating with fintech providers, for the future. From Wikipedia, the free encyclopedia.

This article needs to be updated. Please update this article to reflect recent events or newly available information.

Retrieved 20 March Official Journal of the European Union. Retrieved 2 August Council adopts updated rules". Retrieved from " https: