Bitcoin value chart 2010

There are currently 17, Bitcoins in circulation, andBitcoin users unique addresses. Since Bitcoin's bitcoin value chart 2010 inthere have been a total of , Bitcoin transactions. All Bitcoin datasets include daily historical data that you can download, graph, embed bitcoin value chart 2010 access via our free Bitcoin API. Just click on any Bitcoin statistic or graph to see the entire data history as a time series. End of day price quotes are usually updated daily at 6: Quandl provides weighted average end-of-day price quotes and volumes for Bitcoin versus many other currencies:.

Quandl provides several measures of the size and value of the Bitcoin market, including the total number of Bitcoins in circulation, the market capitalization of Bitcoin, and the number of unique Bitcoin addresses in use. This section covers Bitcoin transaction activity data: This section covers Bitcoin transaction fees: Quandl provides basic statistics on the economics of Bitcoin mining: Bitcoin value chart 2010 of Quandl's Bitcoin price data and market statistics including full historical bitcoin value chart 2010 is available for free via our unlimited, unrestricted Bitcoin API.

If you prefer, you can bitcoin value chart 2010 Quandl's Bitcoin data using our free apps for Python, R, Matlab and more. You can also download Bitcoin data directly from within Excel using our free Excel add-in. Bitcoin is a digital currency based on an open-source peer-to-peer software protocol that is independent of any central authority.

Bitcoin issuance and transactions are carried out collectively by the Bitcoin network. Bitcoin relies on cryptography to secure and validate transactions, and is thus often referred to as a "cryptocurrency".

Bitcoins can be "mined" by users, and also transferred from user to user, directly via computer or smartphone without the need for any intermediary financial institution. Bitcoin transactions are pseudonymous and bitcoin value chart 2010. Proponents of Bitcoin argue that it is not susceptible to devaluation by inflation or seigniorage in the way other modern "fiat" currencies are.

Nor is it associated with an arbitrary store of value such as gold, unlike hard-money or representative currencies. The Bitcoin protocol was first described by Satoshi Nakamoto a pseudonym in Each bitcoin is divided into million smaller units called satoshis. MtGox was the largest Bitcoin exchange in the world, until February when the site shut down and trading was suspended.

It was subsequently announced on Bitcoin news that overBitcoins had been stolen from customers of this exchange. Quandl provides historical data for MtGox. Note that this data stopped updating on 25 Feb Quandl has daily prices for over crypto-currencies from Cryptocoin Charts. You can view all Quandl's cryptocurrency time series on our Cryptocoin Charts source page.

Dogecoin data, from Dogecoin Average, is available from our Dogecoin Average source. If you have any questions about this data, or would like to add more datasets to Quandl, please email us.

For professionals, investors and institutions, we recommend the BraveNewCoin premium bitcoin databases. These specialist bitcoin value chart 2010 include comprehensive, accurate, quality-audited, well-documented and reliable long-term price histories for the vast majority of cryptocurrencies. JSONCSV Bitcoin Market Size Quandl provides several measures of the size and value of the Bitcoin market, including the total number of Bitcoins in circulation, the market capitalization of Bitcoin, and the number of unique Bitcoin addresses in use.

More About Bitcoin Currency Bitcoin is a digital currency based on an open-source peer-to-peer software protocol that is independent of any central authority. Bitcoin Data from MtGox MtGox was the largest Bitcoin exchange in the world, until February when the site shut down and trading was suspended.

Bitcoin is a consensus network that enables a new payment system and a completely digital money. It is the first decentralized peer-to-peer payment network that is powered by its users with no central authority or middlemen. From a user perspective, Bitcoin is pretty much like cash for the Internet. Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence.

Bitcoin is the first implementation of a concept called "cryptocurrency", which was first described in by Wei Dai on the cypherpunks mailing list, suggesting the idea of a new form of money that uses cryptography to control its creation and transactions, rather than a central authority. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto.

Satoshi left the project in late without revealing much about himself. The community has since grown exponentially with many developers working on Bitcoin.

Satoshi's anonymity often raised bitcoin value chart 2010 concerns, many of which are linked to misunderstanding of the open-source nature of Bitcoin. The Bitcoin protocol and software are published openly and any developer around the world can review the code or make their own modified version of the Bitcoin software. Just like current bitcoin value chart 2010, Satoshi's influence was limited bitcoin value chart 2010 the changes he made being adopted by others and therefore he did not control Bitcoin.

As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. Nobody owns the Bitcoin network much like no one owns the technology behind email. Bitcoin is controlled by all Bitcoin users around the world.

While developers are improving the software, they can't force a change bitcoin value chart 2010 the Bitcoin protocol because all users are free to choose what software and version they use. In order to stay compatible with each other, all users need to bitcoin value chart 2010 software complying with the same rules. Bitcoin can only work correctly with a complete consensus among all users. Therefore, all users and developers have a strong incentive to protect this consensus.

From a user perspective, Bitcoin is nothing more than a mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with them. This bitcoin value chart 2010 how Bitcoin works for most users. Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction.

The authenticity of each transaction is protected by digital signatures corresponding to the sending addresses, allowing all users to have full control over sending bitcoins from their own Bitcoin addresses. In addition, anyone can process transactions using the computing power bitcoin value chart 2010 specialized hardware and earn a reward in bitcoins for this service. This is often called "mining". To learn more about Bitcoin, you can consult the dedicated page and the original paper.

Bitcoin value chart 2010 are a growing number of businesses bitcoin value chart 2010 individuals using Bitcoin. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Namecheap, Overstock. While Bitcoin remains a relatively new phenomenon, it is growing fast. Bitcoin value chart 2010 the bitcoin value chart 2010 of Aprilthe total value of all existing bitcoins exceeded 20 billion US dollars, with millions of dollars worth of bitcoins exchanged daily.

While it may be possible to find individuals who wish to sell bitcoins in exchange for a credit card or PayPal payment, most exchanges do not allow funding via these payment methods. This is due to cases where someone buys bitcoins with PayPal, and then reverses their half of the transaction. This is commonly referred to as a chargeback.

Bitcoin payments are easier to make than debit or credit card purchases, and can be received without a merchant account. Payments are made from a wallet application, either on your computer or smartphone, by entering the recipient's address, the payment amount, and pressing send. To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology.

Much of the trust in Bitcoin comes from the fact that it requires no trust at all. Bitcoin is fully open-source and decentralized. This means that anyone has access to the entire source code at any time. Any developer in the world can therefore verify exactly how Bitcoin works. All transactions and bitcoins issued into existence can be transparently consulted in real-time by anyone. All payments can be made without reliance on a third party and the whole system is protected by heavily peer-reviewed cryptographic algorithms like those used for online banking.

No organization or individual can control Bitcoin, and the network remains secure even if not all of its users can be trusted. You bitcoin value chart 2010 never expect to get rich with Bitcoin or any emerging technology.

It is always important to be wary of anything that sounds too good to be true or disobeys basic economic rules. Bitcoin is a growing space of innovation and there are business opportunities that also include risks. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. Investing time and resources on anything related to Bitcoin requires entrepreneurship. There are various ways to make money with Bitcoin such as mining, speculation or running new businesses.

All of these methods are competitive and there is no guarantee of profit. It is up to each individual to make a proper evaluation of the costs and the risks involved in any such project.

Bitcoin is as virtual as the credit cards and online banking networks people use everyday. Bitcoin can be used to bitcoin value chart 2010 online and in physical stores just like any other form of money. Bitcoins can also be exchanged in physical form such as the Denarium coinsbut paying with a bitcoin value chart 2010 phone usually remains more convenient.

Bitcoin balances are stored in a large distributed network, and they cannot be fraudulently altered by anybody. In other words, Bitcoin users have exclusive control over their funds and bitcoins cannot vanish just because they are virtual.

Bitcoin is designed to allow its users to send and receive payments with an acceptable level of privacy as well as any bitcoin value chart 2010 form of money. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash.

The use of Bitcoin leaves extensive public records. Various mechanisms exist to protect users' privacy, and more are in development. However, there is still work to be done before these features are used correctly by bitcoin value chart 2010 Bitcoin users. Some concerns have been raised that private transactions could be used for illegal purposes with Bitcoin. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems.

Bitcoin cannot be more anonymous than cash and bitcoin value chart 2010 is not likely to prevent criminal investigations from being conducted. Bitcoin value chart 2010, Bitcoin is also designed to prevent a large range of financial crimes. When a user loses his wallet, it has the effect of removing money out of circulation.

Lost bitcoins still remain in the block chain just like any other bitcoins. However, lost bitcoins remain dormant forever because there is no way for anybody to find the private key s that would allow them to be spent again.

Because of the law of supply and demand, when fewer bitcoins are available, the ones that are left will be in higher demand and increase in value to compensate.

The Bitcoin network can already process a much higher number of transactions per second than it does today. It is, however, not entirely ready to scale to the level of major credit card networks. Work is underway to lift current limitations, and future requirements are well known.

Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come.

As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become bitcoin value chart 2010 more specialized service. For more details, see the Scalability page on the Wiki. To the best of our bitcoin value chart 2010, Bitcoin has not been made illegal by legislation in most jurisdictions. However, some jurisdictions such as Argentina and Russia severely restrict or ban bitcoin value chart 2010 currencies. Other jurisdictions such as Thailand may limit the licensing of certain entities such as Bitcoin exchanges.

Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. Bitcoin is money, and money has always been used both for legal and illegal purposes. Cash, credit cards and current banking systems widely surpass Bitcoin in terms of their use to finance crime. Bitcoin can bring significant innovation in payment systems and the benefits of such innovation are often considered to be far beyond their potential drawbacks.

Bitcoin is designed to be a huge step forward in making money more secure and could also act as a significant protection against many forms of financial crime. For instance, bitcoins are completely impossible to counterfeit. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud.

Bitcoin transactions are irreversible and immune to fraudulent chargebacks. Bitcoin allows money to be secured against theft and loss using very strong and useful mechanisms such as backups, encryption, and multiple signatures. Some concerns have been raised that Bitcoin could be more attractive to bitcoin value chart 2010 because it can be used to make private and irreversible payments.

However, these features already exist with cash and wire transfer, which are widely used and well-established. The use of Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, bitcoin value chart 2010 Bitcoin is not likely to prevent criminal investigations from being conducted.

In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. The Internet is a good example among many others to illustrate this. The Bitcoin protocol itself cannot be modified without the cooperation of nearly all its users, who choose what software they use. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility.

Bitcoin value chart 2010 rich organization could choose to invest in mining hardware to control bitcoin value chart 2010 of the computing power of the network and become able to block or reverse recent transactions. However, there is no guarantee that they could retain this power since this requires to invest as much than all other miners in the world.

It is however possible to regulate the use of Bitcoin in a similar way to any other instrument. Just like the dollar, Bitcoin can be used for a wide variety of purposes, some of which can be considered legitimate or not as per each jurisdiction's laws.

In this regard, Bitcoin is no different than any other tool or resource and can be subjected to different regulations in each country.

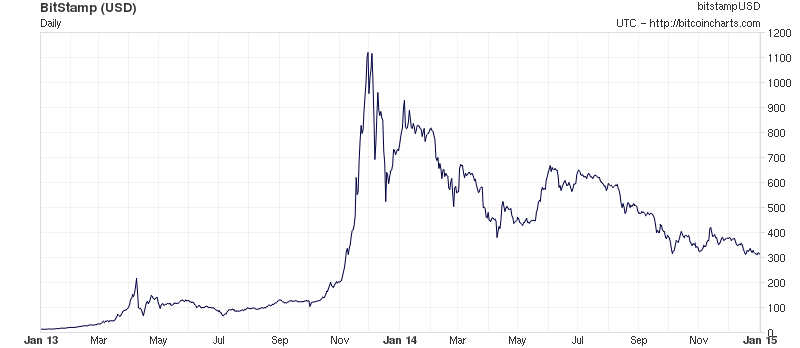

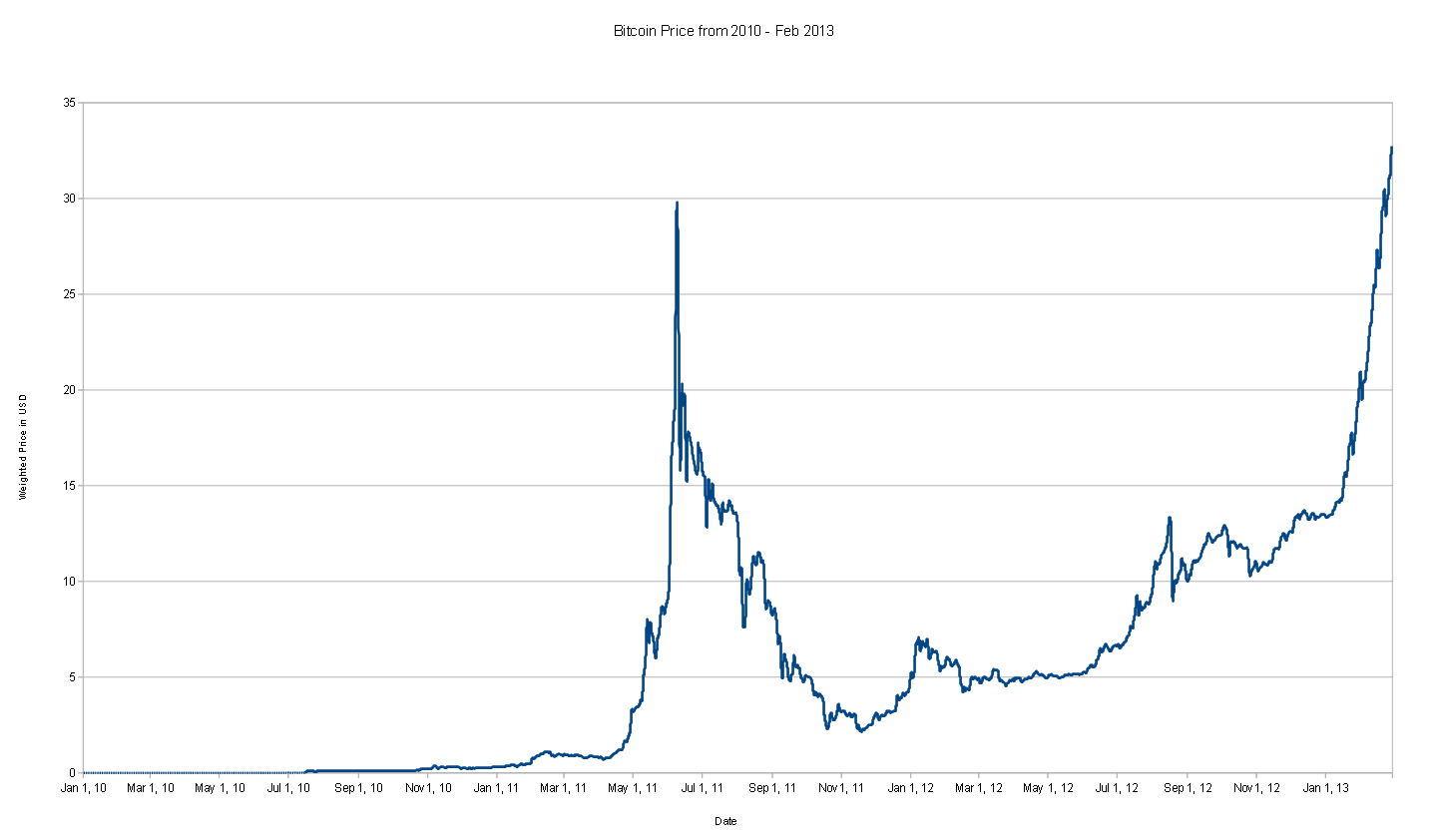

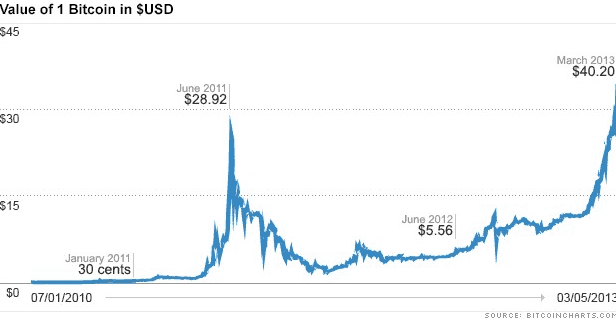

Bitcoin was not exchanged on any trades in Its initially recorded cost was in Bitcoin in this manner shows up externally like any image exchanged on outside trade markets. Dissimilar to fiat monetary standards in any case, there is no official Bitcoin cost; just different midpoints in light of value sustains from worldwide trades.

Bitcoin Normal and CoinDesk are two such records revealing the normal cost. It's typical for Bitcoin to exchange on any single trade at a cost marginally extraordinary to the normal. The general response to "why this cost? Adjusting this model to Bitcoin, unmistakably the larger part of supply is bitcoin value chart 2010 by early adopters and excavators.

Propelled by the uncommonness of gold, Bitcoin was intended to have a settled supply of 21 million coins, over portion of which have just been created. A few early adopters were savvy or sufficiently lucky to procure, purchase or mine tremendous amounts of Bitcoin before it held noteworthy esteem. The most celebrated bitcoin value chart 2010 these is Bitcoin's maker, Satoshi Nakomoto. Satoshi is thought to hold one million bitcoins or around 4. If Satoshi somehow managed to dump these coins available, the resulting supply excess would crumple the cost.

Similar remains constant for any significant holder. Notwithstanding, any balanced individual looking to boost their profits would disseminate their deals after some time, in order to limit value affect. Excavators as of now create around 3, bitcoins every day, some part of which they pitch to cover power and different costs of doing business.

Separating that aggregate by the current BTCUSD cost gives an estimation of the base number of bitcoins which mineworkers supply to business sectors every day. With the present bitcoin value chart 2010 prize of This rate will drop strongly inwhen the following prize splitting happens.

That Bitcoin's cost is ascending regardless of such high expansion and that it ascended in the past when the reward was 50 BTC! Consistently, purchasers assimilate the a large number of coins offered by excavators and different dealers.

A typical method to measure demand from new bitcoin value chart 2010 to the market is to screen Google patterns information from to the present for the pursuit term "Bitcoin. Abnormal amounts of open intrigue may misrepresent value activity; media reports of rising Bitcoin costs attract voracious, clueless examiners, making an input circle. This regularly prompts an air pocket in the blink of an eye took after by a crash.

Bitcoin has encountered no less than two such cycles and will probably encounter more in future. Past the pros at first attracted to Bitcoin as an answer for specialized, financial and political issues, enthusiasm among the overall population has verifiably been empowered by keeping money bars and fiat cash emergencies. Following a demand from Satoshi, Julian Assange abstained from tolerating Bitcoin until mid-route through All things considered, this occasion shone a light on Bitcoin's novel incentive as control safe electronic cash.

Grown-up specialist organizations whose work relies upon such promoting have no real way to pay for it other than Bitcoin value chart 2010. Regarding the matter of business which banks won't transparently touch, there's no dodging notice of darknet medicate markets. While the most in famous setting, Silk Street, was brought down, the exchange of stash for bitcoins proceeds unabated on the darknet.

At long last, the media debate over darknet markets has likely conveyed Bitcoin to the consideration of numerous who generally wouldn't have experienced it. A Bitcoin wallet can be a considerable measure more secure than a ledger. Cypriots learnt this the most difficult way possible when their reserve funds were reallocated in mid This occasion was accounted for as causing a value surge, as savers reexamined the bitcoin value chart 2010 dangers of banks versus Bitcoin.

The following domino to fall was Greece, where strict capital controls were forced in Bitcoin bitcoin value chart 2010 exhibited bitcoin value chart 2010 incentive as cash without focal control. Not long after the Greek emergency, China started to debase the Yuan. As detailed at the bitcoin value chart 2010, Chinese savers swung bitcoin value chart 2010 Bitcoin to ensure their collected riches. A present positive influencer of Bitcoin cost, or possibly recognition, is the Argentinian circumstance.

Argentina's recently chosen President, Mauricio Macri, has promised to end capital controls. Argentinians who can buy bitcoins utilizing underground market dollars will probably keep away from extensive monetary torment. No dialog of Bitcoin's cost would be finished without a specify of the part showcase control plays in adding to value unpredictability. All proof recommends that these bots were working falsely under the heading of trade administrator, Check Karpeles, offering up the cost with ghost reserves.

Gox was the major Bitcoin trade at the time and the undisputed market pioneer. These days there are numerous huge trades, so a solitary trade turning sour would not have such an outsize impact on cost.

It bears rehashing that Bitcoin is a test venture and accordingly, a very hazardous resource. There are many negative influencers of value, boss among them being the administrative danger of a noteworthy government bitcoin value chart 2010 or bitcoin value chart 2010 managing Bitcoin organizations.

The danger of the Bitcoin arrange forking along various improvement ways is likewise something which could undermine the cost. At last, the rise of a valid contender, maybe with the sponsorship of significant focal banks, could see Bitcoin lose piece of the overall industry in future. Now and then a trade's cost might be completely not quite the same as the accord cost, as happened for a managed period on Mt.

Gox preceding its disappointment and as of late on the Winkelvoss' Gemini trade. The exchanges were later switched. Such occasions happen every so often crosswise over trades, either because of human or programming mistake.

Bitcoin is at last worth what individuals will purchase and offer it for. This is regularly as much a matter of human brain research as financial estimation.

Try not to enable your feelings to manage your activities in the bitcoin value chart 2010 this is best accomplished by deciding a system and adhering to it. In the event that your point is to amass Bitcoin, a bitcoin value chart 2010 technique is to set aside a settled, reasonable whole consistently to purchase bitcoins, regardless of the cost.

After some time, this technique known as Dollar-cost averagingwill enable you to collect bitcoins at a fair normal cost without the worry of attempting to foresee the occasionally wild gyrations of Bitcoin's cost. What amount was 1 Bitcoin Worth in ?

What Decides Bitcoin's Cost? In any case, inconsistencies aside, what factors decide Bitcoin's cost? Supply Bitcoin value chart 2010 by the uncommonness of gold, Bitcoin was intended to have a settled supply of 21 million coins, over bitcoin value chart 2010 of which have just been created.

Demand With bitcoin value chart 2010 present mining prize of Drivers bitcoin value chart 2010 Intrigue Past the pros at first attracted to Bitcoin as an answer for specialized, financial and political issues, enthusiasm among the overall population has verifiably been empowered by keeping money bars and fiat cash emergencies.

Fiat Currency Crises A Bitcoin wallet can be a considerable measure more secure than a ledger. Market Control No dialog of Bitcoin's cost would be finished without a specify of the part showcase control plays in adding to value unpredictability. Real Drawback Dangers It bears rehashing that Bitcoin is a test venture and accordingly, a very hazardous resource. Value Peculiarities Now and then a trade's cost might be completely not quite the same as the accord cost, as happened for a managed period on Mt.

Thanks Leave your thoughts in the comments below. Authors get paid when people like you upvote their post.