Dogecoin paper wallet generator directory

Hepatitis A virus Hepatit. What could be so wrong with asking questions, especially. HPV vaccine is not recommended for anyone who is. What is supposed to be in the vaccine is the. Over a dozen comic plays and sketches by Elisa. Success Starts With You on Amazon. Albertina Leonard also known as Tina was born to. Showcased on Amazon, this Five Star author, high. Buy Revitalize Your Bitcoin paper wallet generator on Amazon. Smile my beloved Land on Amazon. If the hot side is compromised, the private keys are still safe, as are the associated bitcoins.

When we talk about cold storage, what does it actually look like? They can be anything that can store data. A pendrive, a laptop, a tablet, a piece of paper, a mobile phone… Or, a dedicated cold storage wallet. A more convenient and secure option is dedicated cold storage wallets, which can remain offline even when signing transactions. This may sound like magic, but the way it works is the following:. The electronic wallet is set up on an offline device such as an old laptop, tablet or special hardware , using a previously downloaded program.

This copy creates the transaction using the copied public key, and copies the transaction file onto the same USB device or a different one, if you happen to have many lying around. The transaction is then imported into the software on the offline device, where it is signed using the private key. The signed transaction then gets downloaded onto the USB drive, and imported into the wallet software on the online device, which then broadcasts it to the network.

A new generation of gadgets promise to make cold storage even easier. Trezor , Ledger , KeepKey and Hardbit are some examples of the devices that make it easier to sign offline and then broadcast the transaction to the network. Cold storage is a recommendable solution for keeping significant bitcoin holdings safe. As with all ultra-secure options, though, it is not very straightforward, and should be used for storage, not for frequent transactions.

Bitcoin security is getting more and more attention these days, partially fuelled by media reports of hacking and theft, but also by more of us waking up to the idea that bitcoin is not just a payment mechanism. Xapo is even developing a system that will allow you to store your bitcoins in outer space. Assuming that the satellite is recoverable, that removes any concern about jurisdictional risk, and highlights the importance of contemplating the worst case scenario.

For anyone bullish on the potential value of the digital currency, the value and usefulness of cold storage, earth-bound or not, is becoming more obvious.

It is illiquid and risky, and you should form your own opinion before buying for investment purposes. Old-style bitcoin wallets generate addresses and keys randomly. Random generation is obviously much more secure than user generation given that users can be quite lazy or uncreative: And new addresses are automatically generated when needed, which is convenient.

But it also presents complications. Wallets that transact frequently will have many associated addresses, since for privacy reasons some users prefer each bitcoin they purchase, or receive in exchange for a service, to have a separate address. So, I send all three and one automatically gets returned as change, to a new, automatically-generated address. Frequent transactors generate a lot of change addresses.

However, keeping up to date with the backups of a steadily increasing array of addresses is complicated. Backups are important, since if you lose your keys your computer dies, your pendrive goes missing, whatever you lose your bitcoins.

Frequent generation of random addresses will require equally frequent backups, which can become a hassle. What if there were a way to generate an almost infinite number of seemingly random addresses, but following some sort of pattern that could be replicated, but that at the same time was impossible to guess or hack? Instead of spending a lot of time and computing power backing up a list of addresses, you focus on backing up the seed string.

The rest can be recovered from that. While this scenario is not free of security risks, it does open up an interesting range of possible uses within teams and even corporations. The full repercussions of this have yet to be explored, as with most things bitcoin. And twists and evolutions will no doubt increase functionality and security in incremental steps. This is more confusing than it sounds, since each performs a different function, with different levels of security. They can usually also show you the transaction history of those keys.

Thanks to the user interface, the wallet just looks like it stores your bitcoins. And just like an online bank, it can show you your transaction history. Web-based wallets store your keys online, which is convenient as you can access them from any computer.

It is convenient, though, especially if your wallet service provider also allows you to purchase bitcoin through their exchange. Some web-based wallets such as Blockchain encrypt the keys before storage in the online server, which is a slightly more secure option than those that store the keys on their servers, such as Coinbase. For a desktop wallet, you install the software directly on your PC. Assuming that your security is thorough, this is one of the safer options, but if your hard drive is hacked, chances are your bitcoin keys will be copied and your bitcoins transferred without your knowledge.

In other words, your bitcoins will be stolen. Lightweight wallets only store block headers, rather than entire blocks — this allows them to take up less than a tenth of the space.

They trust the fully validating nodes to check all the others. The mobile wallet is the most practical option in that your bitcoin are accessible at any time. Your smartphone can be used to pay for products with bitcoin, or to easily transfer funds to someone else. True, the desktop and web versions usually allow for copy and paste, but pointing your phone at a pixelated square is simpler and faster.

Some phones enable NFC connections, which means that all you have to do in certain circumstances is tap your phone against a reader to pay.

However, since your phone can be lost or stolen, and your keys along with it, you could lose your bitcoins unless you have been smart enough to keep secure backups. This may seem like a confusing sea of options, and differentiating between the different providers can get complicated.

But it is not necessary to choose just one. Most bitcoin users have several wallets, to cover a variety of different needs. I have three, two of them web-based Coinbase and Blockchain and one mobile version Blockchain, for now. The three options covered here are especially useful for frequent transactions.

With a few taps or clicks you can send bitcoin to any other wallet, move funds amongst your own, or purchase more to top up your holdings. These wallets do, however, imply a trade-off between ease of access and level of security.

They are easier to use, but not as secure as some other more complex options. Each has different characteristics and functionalities, but each works in basically the same way: Your bitcoins — or rather, the pieces of code that represent them — are not actually stored in your wallet. They are stored on the blockchain, which in turn is stored on node computers all around the world.

What your wallet contains is your bitcoin address, which is the same as your randomly generated public key a long string of numbers and characters. Actually, most wallets contain several addresses, and hold the public and private key pairings that make each of them work.

Obviously, most bitcoin wallets today do a lot more than that. They also relate your public and private keys to the bitcoins that match those keys, and display the list of related transactions and the current balance in a clean user interface ie.

It contains permission to spend your bitcoin. And if you lose access to that permission to spend, then you effectively also lose your bitcoins, because you no longer have access to them. That is why it is so important to keep the keys secure. Some wallets, especially the older ones, are full node wallets. This means that you download the entire blockchain, and act as a relayer or transmitter of transactions, even those that you had nothing to do with. You receive transactions from nodes and pass them on to other nodes, and thus contribute to the updating of the bitcoin network.

While no actual work on your part is involved the transmitting is done automatically , it is onerous — the blockchain occupies approximately 40GB of memory. SPV wallets do not download the entire blockchain, they only download block headers. There are concerns that this weakens the security of the network as a whole, since they cannot tell the difference between a block with valid transactions and one with invalid ones. But they rely on nodes to check the transactions for validity, and assume that after a certain number of blocks have been added on top, a transaction can be counted on to be correct.

Wallet technology is evolving rapidly in terms of efficiency and functionality, so this overview does not hope to cover all wallet types, but the basic principle is the same for most: Bitcoin wallets are a fundamental piece in the path to increase bitcoin use beyond geeks and techies, as it is the only face of bitcoin that most will ever see. Wallet ease of use and security will increase confidence in transactions, while at the same time encourage more use cases.

With more users comes even more innovation, and the entire sector — from front-end wallets to back-end miners and including the many applications in between — benefits. Before owning any bitcoins, you need somewhere secure to store them.

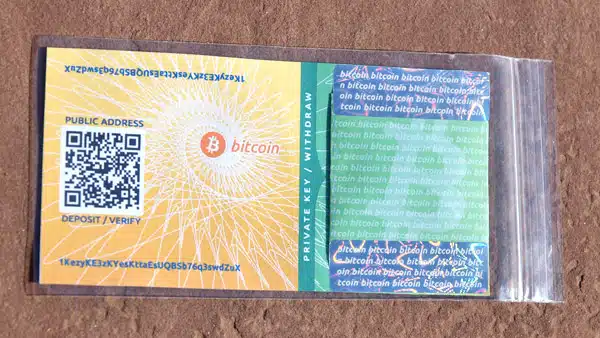

You store your bitcoins at your Bitcoin address , not your wallet. What your wallet holds is the private key that gives you access to your Bitcoin address which is also your public key. If the wallet software is well designed, it will look as if your bitcoins are actually there, which makes using bitcoins more convenient. The former is simply a formatted file that lives on your computer or device, and that facilitates transaction formatting.

Hosted wallets tend to have a more user-friendly interface and more on-the-go functions, but you will be trusting a third party with your private keys. There are a few hybrid models, and some really strange ones, and each provider is slightly in some cases very different from the rest. This summary is meant as a general overview of the different types, not a list or a recommendation of specific services. One very cool function worth mentioning is that most wallets will convert your public bitcoin address into a QR code, which makes it so much easier to send bitcoins directly from your phone.

Installing a wallet directly on your computer gives you the security that you control your keys. Most have relatively easy configuration, and are free.