Intraday liquidity management rbi corporation

Indication of how much available cash the bank has to meet share withdrawals or additional loan demand. Wikipedia articles needing rewrite from May All articles needing rewrite. On the other hand, ALM is a discipline relevant intraday liquidity management rbi corporation banks and financial institutions whose balance sheets present different challenges and who must meet regulatory standards. In fact, how effectively balancing the funding sources and uses with regard to liquidity, interest rate management, funding intraday liquidity management rbi corporation and the type of business-model the bank is conducting for example business based on a majority of short-term movements with high frequency changement of the asset profile or the type of activities of the respective business lines market making business is requiring more flexible liquidity profile than traditional bank activities. The lower the ratio the better.

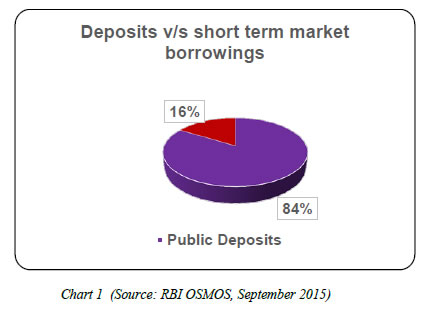

As an echo to the deficit of funds resulting from gaps between assets and liabilities the bank has also to address its funding requirement through an effective, robust and stable funding model. By using this site, you intraday liquidity management rbi corporation to the Terms of Use and Privacy Policy. Search the Website Search.