Micropayments bitcoin exchange rate

Bitcoin micropayments bitcoin exchange rate none of the things it was supposed to be. On Thursday, the price of Bitcoin fluctuated by thousands of dollars in a hour period. The Coinbase app micropayments bitcoin exchange rate which lets you buy and sell cryptocurrencies, and is the number two free app in the App Store as of this writing — started freezing and throwing errors, which the company said was due to high traffic.

At one point, I tested the app by trying to sell some of my very small amount of Bitcoin, and the app simply buckled. The first stop for anyone seriously interested in Bitcoin is the Bitcoin white paper: This led micropayments bitcoin exchange rate the rise of startups like BitPay, which facilitated Bitcoin payment for merchants like Microsoft and Overstock. After nearly nine years in existence, the closest thing to the kind of Bitcoin-powered payments Nakamoto envisioned is on micropayments bitcoin exchange rate markets: Micropayments bitcoin exchange rate is the default currency on the dark web — but the speculators driving the current bubble are making it difficult to use Bitcoin for actual transactions.

What about Bitcoin as a peer-to-peer network with no trusted third parties? This system very quickly fell apart. In theory, you should be able to get your hands on Bitcoin without having to trade it for any real- world currency or interact with any financial institution. All you need to acquire Bitcoin is a computer connected to the internet. Once you have Bitcoin, you can use the same tools to store and spend it. But only the earliest, most dedicated Bitcoin users adopted this system; almost immediately, micropayments bitcoin exchange rate starting showing up.

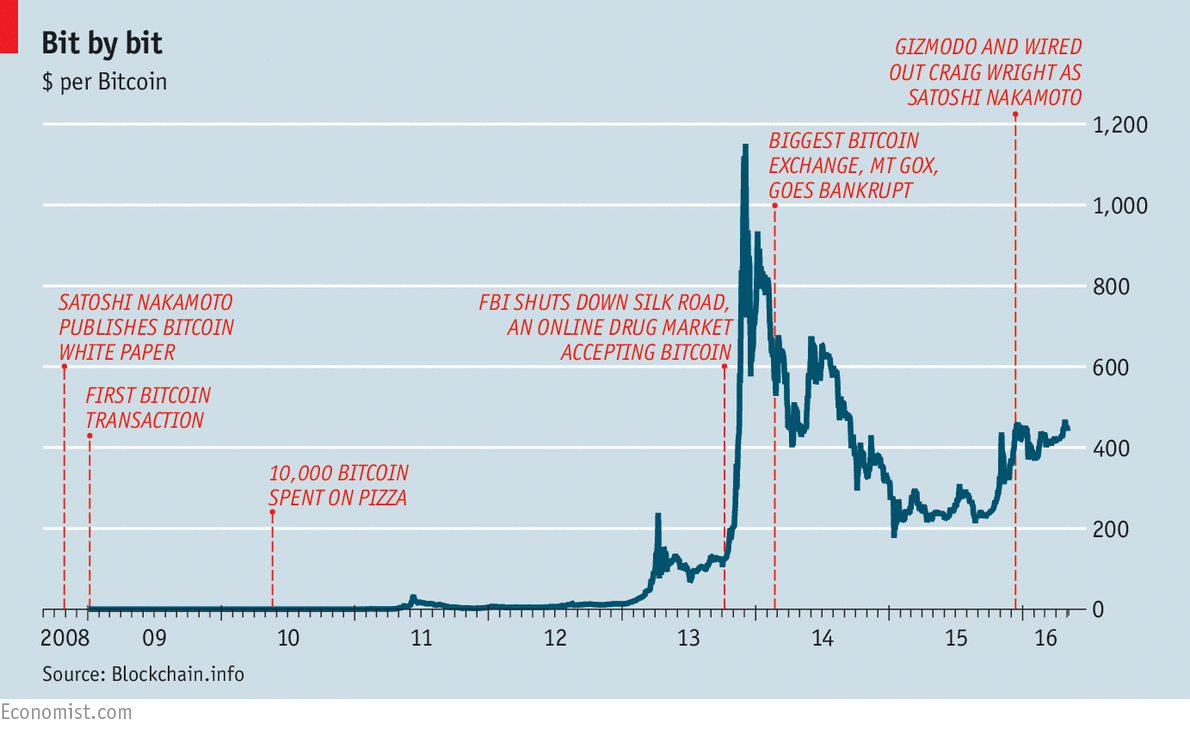

In OctoberNew Liberty Standard published a Bitcoin exchange rate based on the cost of electricity for a computer to mine Bitcoin, which established that one U. Gox exchange was established later that year. Even the dark-web markets, home to the purest use of Bitcoin, were middlemen, delivering messages between buyers and sellers and serving as an escrow service.

Bitcoin was designed so that users had to take care of their private cryptographic keys for every address they used, and Nakamoto advised making a new address for every transaction. The first wallet I used was MyBitcoin. There are many, many other types of middlemen in the Bitcoin system now, including sellers of Bitcoin-specific hardware and server farms that have monopolized the creation of new Bitcoins.

The price of Bitcoin increased by thousands of dollars in one week. Middlemen like Coinbase are bound by know-your-customer laws and collect extensive information on their users. The Bitcoin network is still technically peer-to-peer, but with so many middlemen, it might as well not be.

This is not entirely the fault of the greedy middlemen; Bitcoin is simply too intimidating for most non-programmers to use without the help of apps like Coinbase.

Micropayments bitcoin exchange rate to the current bubble. Bitcoin was supposed to disintermediate the finance industry — the system of banks and middlemen and transaction fees in which a single entity can hold your money hostage. Instead, it replicated this system and made it worse. Ordinary users all trust third parties to verify transactions and hold their money. The price is so volatile that no one wants to use Bitcoin for payments.

And thanks to the current bubble, the electricity required to maintain the Bitcoin network is skyrocketing. A screenshot of the Coinbase app as it displayed an error: When Nakamoto created the first Bitcoins, he included a bit of text: In his other writings on forums and mailing lists — hundreds of posts before he mysteriously disappeared in April — Nakamoto expressed anger at the financial system that had precipitated the crisis.

Nakamoto was a libertarian who wanted to create a system for payments that would circumvent governments, bankers, and corporations. Instead, Bitcoin is now a get-rich-quick scheme that retains none of the exciting, anarchist features it proposed and has created a secondary economy with financial shenanigans that mirror micropayments bitcoin exchange rate ones that led to the global financial crisis. In an email to the Metzdowd cryptography mailing list in Januaryshortly after Bitcoin launched, Nakamoto wrote about his vision for the currency.

Bitcoin is none of the things it was supposed to be The cryptocurrency was supposed to replace the finance industry. Instead, it has replicated it. Adrianne Jeffries Dec—08— This is not how Bitcoin was supposed to work.

Satoshi Nakamoto wants you to subscribe to The Outline newsletter.

This is a list of for-profit companies with notable commercial activities related to bitcoins and Cryptocurrency. Common services are wallet providersbitcoin exchangespayment service providers [1] and venture capital. Other services include mining micropayments bitcoin exchange ratecloud miningpeer-to-peer lendingexchange-traded fundsover-the-counter tradinggamblingmicropaymentsaffiliates and prediction markets.

From Wikipedia, the free encyclopedia. Using Bitcoin to Micropayments bitcoin exchange rate the Search Engine". History Economics Legal status. List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Retrieved from " https: Bitcoin companies Lists of companies by industry. Wikipedia indefinitely semi-protected pages. Views Read View source View history. In other projects Wikimedia Commons. Micropayments bitcoin exchange rate page was last edited on 29 Aprilat By using this site, you agree to the Terms of Use and Privacy Policy.

US - Sunnyvale, California. US - Charleston, South Carolina. US - San Francisco, California. US - San FranciscoCalifornia. US - Arlington, Virginia. US - Palo Alto, California. Cryptocurrency exchange [7] [8].

USA - Wilmington, Delaware. Search Engine [17] [18] [19]. Wikimedia Commons has media related to Bitcoin.