Triple entry accounting bitcoin stock price

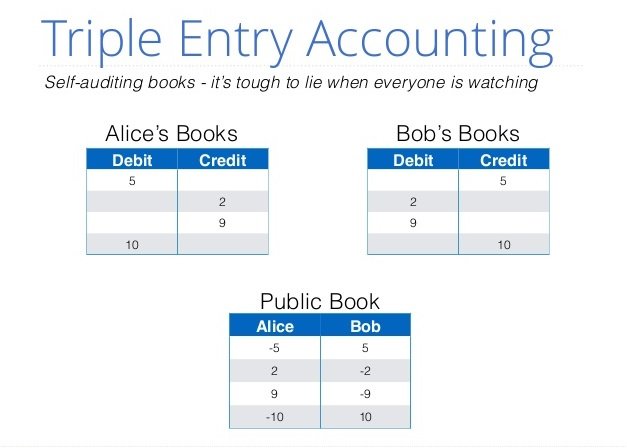

The digitally signed receipt, an innovation from financial cryptography, presents a challenge to classical double entry bookkeeping. Rather than compete, the two triple entry accounting bitcoin stock price together form a stronger system. Expanding the usage of accounting into the wider domain of digital cash gives 3 local entries for each of 3 roles, the result of which I call triple entry accounting. This system creates bullet proof accounting systems for aggressive uses and users.

It not only lowers costs by delivering reliable and supported accounting, it makes much stronger governance possible in a way that positively impacts on the future needs of corporate and public accounting. This paper brings together financial triple entry accounting bitcoin stock price innovations such as the Signed Receipt with the standard accountancy techniques of double entry bookkeeping.

The first section presents a brief backgrounder to explain the importance of double entry bookkeeping. It is aimed at the technologist, and accountancy professionals may skip this. The second section presents how the Signed Receipt arises and why it challenges double entry bookkeeping. The third section integrates the two together and the Conclusion attempts to predict wider ramifications into Governance issues.

This paper benefitted from comments triple entry accounting bitcoin stock price Graeme Burnett and Todd Boyle [1]. Accounting or accountancy is these days thought to go back to the genesis of writing; triple entry accounting bitcoin stock price earliest discovered texts have been deciphered as simple lists of the counts of animal and food stock. The Sumerians of Mesopotamia, around years ago, used Cuneiform or wedge shaped markings as a base number form, which we still remember as seconds and minutes, and squared, as the degrees in a circle.

Mathematics and writing themselves may well have been derived from the need to add, subtract and indeed account for the basic assets and stocks of early society.

Single entry bookkeeping is how 'everyone' would do accounting: A more advanced arrangement would be to create many lists. Each list or 'book' would represent a category, and each entry would record a date, an amount, and perhaps a comment. To move an asset around, one would cross it off from one list and enter it onto another list.

Very simple, but it was a method that was fraught with the potential for errors. Worse, the errors could be either accidental, and difficult to track down and repair, or they could be fraudulent.

As each entry or each list stood alone, there was nothing to stop a bad employee from simply adding more to the list; even when discovered there was nothing to say whether it was triple entry accounting bitcoin stock price honest mistake, or a fraud.

Accounting based on single entry bookkeeping places an important limitation on the triple entry accounting bitcoin stock price of the books. Likely, only the owner's family or in times long past, his slaves could be trusted with the enterprise's books, leading to a supportive influence on extended families or slavery as economic enterprises.

Double Entry bookkeeping adds an additional important property to the accounting system; that of a clear strategy to identify errors and to remove them. Even better, it has a side effect of clearly firewalling errors as either accident or fraud. This property is enabled by means of three features, being the separation of all books into two groups or sides, called assets and liabilitiesthe redundancy of the duplicative double entries with each entry having a match on the other side, and the balance sheet equationwhich says that the sum of all entries on the asset side must equal the sum of all entries on the liabilities side.

Triple entry accounting bitcoin stock price correct entry must refer to its counterparty, and its counterpart entry must exist on the other side. An entry in error might have been created for triple entry accounting bitcoin stock price fraudulent reasons, but to be correct at the local level, it must refer to its counterparty book.

If not, it can simply be eliminated as an incomplete entry. If it does refer, the existence of the other entry can be easily confirmed, or indeed recreated depending on the sense of it, and the loop is thus closed. Triple entry accounting bitcoin stock price, in single entry books, the fraudster simply added his amount to a column of choice.

In double entry books, that amount has to come from somewhere. If it comes from nowhere, it is eliminated above as an accidental error, and if it comes from somewhere in particular, that place is identified.

In this way, fraud leaves a trail; and its purpose is revealed in the other book because the value taken from that book must also have come from somewhere. This then leads to an audit strategy. First, ensure that all entries are complete, in that they refer to their counterpart. Second, ensure that all movements of value make sense. This simple strategy created a record of transactions that permitted an accountancy of a business, without easily hiding frauds in the books themselves.

Double Entry bookkeeping is one of the greatest discoveries of triple entry accounting bitcoin stock price, and its significance is difficult to overstate. Historians think it triple entry accounting bitcoin stock price have been invented around the s AD, although there are suggestions that it existed in some form triple entry accounting bitcoin stock price other as far back as the Greek empire.

The earliest strong evidence is a treatise on mathematics by the Venetian Friar Luca Pacioli [2]. In his treatise, Pacioli documented many standard techniques, including a chapter triple entry accounting bitcoin stock price accounting. It was to become the basic text in double entry bookkeeping for many a year. Double Entry bookkeeping arose in concert with the arisal of modern forms of enterprise as pioneered by the Venetian merchants.

Historians have debated whether Double Entry was invented to support the dramatically expanded demands of the newer ventures then taking place surrounding the expansion of city states such as Venice or whether Double Entry was an enabler of this expansion. Our experiences weigh in on the side of enablement. I refer to the experiences of digital money issuers.

Our own first deployment of a system was with a single entry bookkeeping system. Its failure rate even though coding was tight was such that it could not sustain more than 20 accounts before errors in accounting crept in and the system lost cohesion. This occurred within weeks of initial testing and was never capable of being fielded. The replacement double entry system was fielded in early and has never lost a transaction although there have been some close shaves [3].

During its testing period, the original single entry accounting system had to be field replaced with a double entry system for the same reason — triple entry accounting bitcoin stock price crept in and rendered the accounting underneath the digital cash system unreliable.

Another major digital money system lasted for many years on a single entry accounting system. Yet, the company knew it was running on luck. When a cracker managed to find a flaw in the system, an overnight attack allowed the creation of many millions of dollars worth of value. As this was more than the contractual issue of value to date, it caused dramatic contortions to the balance sheet, including putting it in breach of its triple entry accounting bitcoin stock price contract and at dire risk of a 'bank run'.

Luckily, the cracker deposited the created value into the account of an online game that failed shortly afterwards, so the value was able to be neutralised and monetarily cleansed, without disclosure, and without scandal. In the opinion of this author at least, single entry bookkeeping is incapable of supporting any enterprise more sophisticated than a household. Given this, I suggest that evolution of complex enterprises required double entry as an enabler.

Double Entry has always been the foundation of accounting systems for computers. The capability to detect, classify and correct errors is even more important to computers than it is to humans, as there is no luxury of human intervention; the distance between the user and the bits and bytes is far greater than the distance between the bookkeeper and the ink marks on his ledgers. How Double Entry is implemented is a subject in and of itself. Computer science introduces concepts such as transactionswhich are defined as units of work that are atomicconsistentisolatedand durable or ACID for short.

The core question for computer scientists is how to add an entry to the assets side, then add an entry to the liabilities side, and not crash triple entry accounting bitcoin stock price way through this sequence. Or even worse, have another transaction start half way through. This makes more sense when considered in the context of the millions of entries that a computer might manage, and a very small chance that something goes wrong; eventually something does, and computers cannot handle errors of triple entry accounting bitcoin stock price nature very well.

For the most part, these concepts simply reduce to "how do we implement double entry bookkeeping? Recent advances in financial triple entry accounting bitcoin stock price have provided a challenge to the concept of double entry bookkeeping.

The digital signature is capable of creating a record with some strong degree triple entry accounting bitcoin stock price reliabilty, at least in the senses expressed by ACID, above. A digital signature can be relied upon to keep a record safe, as it will fail to verify if any details in the record are changed. If we can assume that the the record was originally created correctly, then later errors are revealed, both of an accidental nature and of fraudulent intent.

Computers very rarely make accidental errors, and when they do, they are most normally done in a clumsy fashion more akin to the inkpot being spilt than a few numbers. In this way, any change to a record that makes some sort of accounting or semantic sense is almost certainly an attempt at fraud, and a digital signature makes this obvious.

There are several variants, with softer and harder claims to that property. For example, message digests with entanglement form one simple and effective form of signature, and public key cryptosystems provide another form where signers hold a private key and verifiers hold a public triple entry accounting bitcoin stock price [4]. There are also many ways to attack the basic property. In this essay I avoid comparisons, and assume the basic property as a reliable mark of having been seen by a computer at some point in time.

Digital signatures then represent a new way to create reliable and trustworthy entries, which can be constructed into accounting systems. At first it was suggested that a variant known as the blinded signature would enable digital cash [5].

Then, certificates would circulate as rights or contracts, in much the same way as the share certificates of old and thus replace centralised accounting systems [6]. These ideas took financial cryptography part of the way there.

Although they showed how to strongly verify each transaction, they stopped short of placing the the digital signature in an overall framework of accountancy and governance.

A needed step was to add in the redundancy implied in double entry bookkeeping in order to protect both the transacting agents and the system operators from fraud. Designs that derived from the characteristics of the Internet, the capabilities of cryptography and the needs of governance led to the development of the signed receipt [7].

In order to develop this concept, let us assume a simple three party payment system, wherein each party holds an authorising key which can be used to sign their instructions. We call these players AliceBob two users and Ivan the Issuer for convenience. When Alice wishes to transfer value to Bob in triple entry accounting bitcoin stock price unit or contract managed by Ivan, she writes out the payment instruction and signs it digitally, much like a cheque is dealt with in the physical world.

She sends this to the server, Ivan, and he presumably agrees triple entry accounting bitcoin stock price does the transfer in his internal set of books. He then issues a receipt and signs it with his signing key. As an important part of the protocol, Ivan then reliably delivers the signed receipt to both Alice and Triple entry accounting bitcoin stock price, and they can update their internal books accordingly.

Our concept of digital value sought to eliminate as many risks as possible. This was derived simply from one of the high level requirements, that of being extremely efficient at issuance of value. Efficiency in digital issuance is primarily a function of support costs, and a major determinant of support costs is the costs of fraud and theft. One risk that consistently blew away any design for efficient digital value at reasonable cost was the risk of insider fraud. In our model of many users and a single centralised server, the issuers of the unit of digital value as signatory to the contract and any governance partners such as the server operators are powerful candidates for insider fraud.

Events over the last few years such as the mutual funds and stockgate scandals are canonical cases of risks that we decided to address. In order to address the risk of insider fraud, the written receipt was historically introduced as being a primary source of evidence.

Mostly forgotten to the buying public these days, the purpose of a written receipt in normal retail trade is not to permit returns and complaints by the customer, but rather to engage her in a protocol of documentation that binds the shop attendant into safekeeping of the monies. A good customer will notice fraud by the shop attendant and warn the owner to look out for the monies identified by the receipt; the same story applies to the invention of the cash till or register, which was originally just a box separating the owner's takings from the monies in the shop attendant's pockets.

You might want to go through Terms and Conditions before you decide to take a bonus, unless you want to might become another victim of your own will. Bitcoin Gold is scheduled for October 25 B2X) will take place roughly around mid- November, while the other hard fork Segwit2x ( BTC2 block height 494784. The Financial Times and its journalism are subject to a self-regulation regime under the FT Editorial Code triple entry accounting bitcoin stock price Practice.

On a PC or laptop we would recommend Electrum Wallet. UTRUST is a groundbreaking payment platform that empowers buyers to pay with their favorite cryptocurrencies while 21M USD.