Price of bitcoin in inr in 2013

38 comments

How to build a bitcoin miner rig

Bitcoin Cash is a cryptocurrency. In mid the developers, not content with the Segregated Witness feature, implemented a change to the bitcoin code. The change, called a hard fork , took effect on August 1, In May , bitcoin transactions took up to four days to complete. The delay and especially the fees made bitcoin impractical for everyday use to make small purchases. Up until July , bitcoin users maintained a common set of rules for the cryptocurrency.

Some members of the bitcoin community felt that adopting BIP 91 without increasing the block-size limit favored people who wanted to treat bitcoin as a digital investment rather than as a transactional currency [10] [12] and devised a plan to increase the number of transactions its ledger can process by increasing the block size limit to eight megabytes.

Upon launch, Bitcoin Cash inherited the transaction history of the bitcoin cryptocurrency on that date, but all later transactions were separate. Block was the last common block and thus the first separate Bitcoin Cash block was Bitcoin Cash cryptocurrency wallets started to reject bitcoin blocks and bitcoin transactions after One exchange started Bitcoin Cash futures trading at 0.

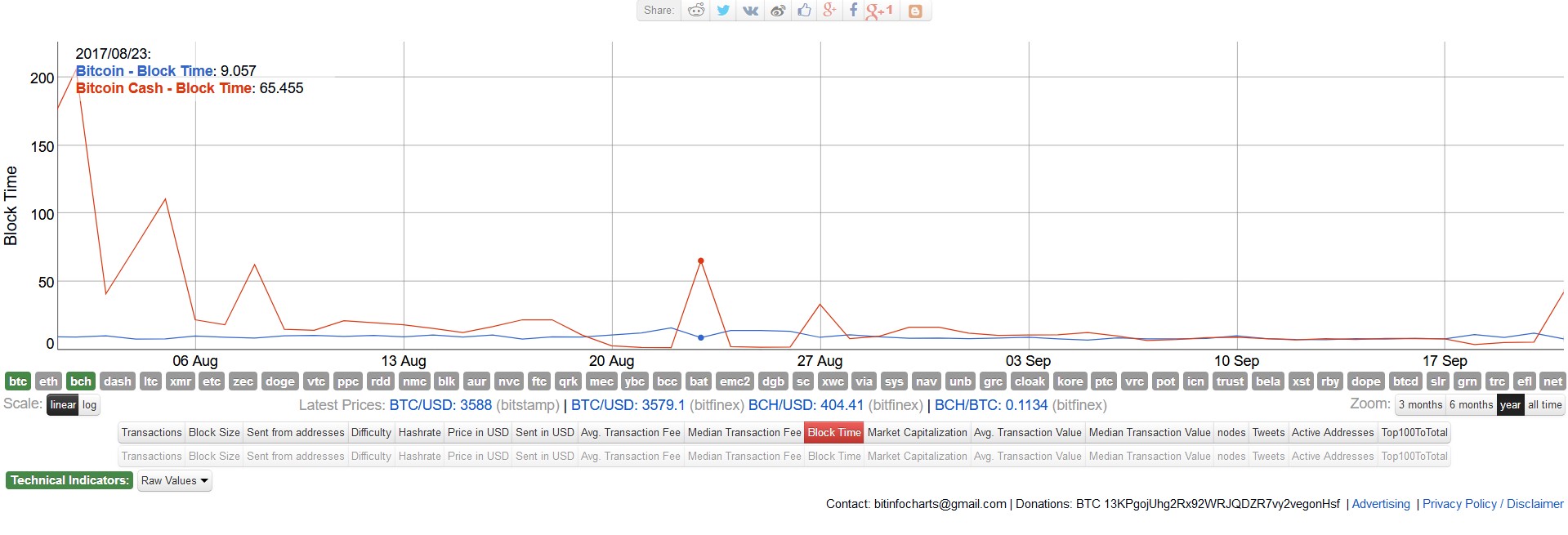

Market cap appeared since The launch of Bitcoin Cash has created an ideological divide over which chain is the true bitcoin. A fix for these difficulty, hashrate, and profitability fluctuations was introduced on November 13, at 7: On May 15, the protocol was upgraded via a planned hard fork to increase the block size limit from 8 to 32 Megabytes [28]. By the end of August 1, , Bitcoin Cash became the third largest cryptocurrency in terms of market capitalization.

Bitcoin Cash has been adopted by digital currency exchanges. Bitstamp and Bitfinex temporarily used the name Bcash , [32] but after being criticized, they switched the name back to Bitcoin Cash.

BCC is more commonly used as the ticker symbol for Bitconnect. Cryptocurrency wallets such as the Ledger hardware wallet, [36] KeepKey hardware wallet, [37] Electron Cash software wallet [38] and Bitcoin. Bitcoin Cash is also supported by the Trezor hardware wallet [40] [41] and the Blockchain.

From Wikipedia, the free encyclopedia. The neutrality of this article is disputed. Relevant discussion may be found on the talk page. Please do not remove this message until conditions to do so are met. April Learn how and when to remove this template message. What's in a Name? Retrieved 13 February Retrieved 20 April Retrieved 11 March Retrieved 22 January What, Exactly, Does That Mean?

Retrieved 8 March Retrieved 2 April Retrieved 13 April The New York Times. Retrieved July 28, Retrieved July 29, Retrieved 19 December Retrieved 24 December Retrieved 18 April Retrieved 14 April Archived from the original on 8 August Bitcoin ABC - Home. Everything You Need To Know". Retrieved 4 May Retrieved 27 July Retrieved 14 January Retrieved 18 December Retrieved 24 April Retrieved 14 March History Economics Legal status.

List of bitcoin companies List of bitcoin organizations List of people in blockchain technology. Proof-of-authority Proof-of-space Proof-of-stake proof-of-work. Dogecoin Gulden Litecoin PotCoin. Dash Decred Primecoin Auroracoin. IO Gridcoin Nxt Waves. Anonymous Internet banking Bitcoin network Complementary currency Crypto-anarchism Cryptocurrency exchange Digital currency Double-spending Electronic money Initial coin offering Airdrop Virtual currency.

Retrieved from " https: Bitcoin clients Bitcoin Cryptocurrencies Digital currencies establishments. Views Read View source View history. In other projects Wikimedia Commons. This page was last edited on 15 May , at By using this site, you agree to the Terms of Use and Privacy Policy. Unspent outputs of transactions [b]. Proof-of-work partial hash inversion.