Swiss binary trading robot

40 comments

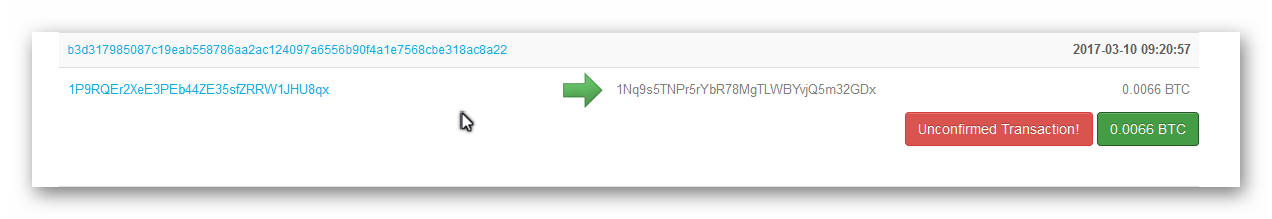

Official scam urlbitcointraderobotco

Gox was a bitcoin exchange based in Shibuya , Tokyo , Japan. In February , Mt. Gox suspended trading, closed its website and exchange service, and filed for bankruptcy protection from creditors. New evidence presented in April by Tokyo security company WizSec led them to conclude that "most or all of the missing bitcoins were stolen straight out of the Mt. Gox hot wallet over time, beginning in late The Gathering Online fantasy-based card game service, to let them trade "Magic: The Gathering Online" cards like stocks.

The Gathering Online eXchange". He reused the domain name in to advertise his card game The Far Wilds. In July , McCaleb read about bitcoin on Slashdot , [21] and decided that the bitcoin community needed an exchange for trading bitcoin and regular currencies. On July 18, Mt. Gox launched its exchange and price quoting service deploying it on the spare mtgox.

On 19 June , a security breach of the Mt. Gox bitcoin exchange caused the nominal price of a bitcoin to fraudulently drop to one cent on the Mt. Gox exchange, after a hacker allegedly used credentials from a Mt. Gox auditor's compromised computer to transfer a large number of bitcoins illegally to himself. He used the exchange's software to sell them all nominally, creating a massive " ask " order at any price. Within minutes the price corrected to its correct user-traded value.

Gox still had control of the coins, the move of , bitcoins from "cold storage" to a Mt. Gox address was announced beforehand, and executed in Block In October , about two dozen transactions appeared in the block chain Block [31] that sent a total of 2, BTC to invalid addresses.

As no private key could ever be assigned to them, these bitcoins were effectively lost. While the standard client would check for such an error and reject the transactions, nodes on the network would not, exposing a weakness in the protocol.

As a result, transactions from Mt. Gox to those accounts were cancelled by Dwolla. The funds never made it back to Mt. Gox help desk issued the following comment: Gox as we have never had this case before and we are working with Dwolla to locate your returned funds. In March , the bitcoin transaction log or " blockchain " temporarily forked into two independent logs, with differing rules on how transactions could be accepted.

Gox bitcoin exchange briefly halted bitcoin deposits. Gox suspended trading from 11—12 April for a "market cooldown". Around mid-May , Mt. Gox traded , bitcoins per day, per Bitcoin Charts. Gox, alleging a breach of contract. Gox's North American services. Gox failed to allow it to move existing U. Gox suspended withdrawals in US dollars on June 20, Gox transactions pressured Mt. Gox from then on to close its account.

Gox announced that it had "fully resumed" withdrawals, but as of September 5, , few US dollar withdrawals had been successfully completed. On August 5, , Mt. Gox announced that it incurred "significant losses" due to crediting deposits which had not fully cleared, and that new deposits would no longer be credited until the funds transfer was fully completed. Wired Magazine reported in November that customers were experiencing delays of weeks to months in withdrawing cash from their accounts.

Customer complaints about long delays were mounting as of February , with more than 3, posts in a thread about the topic on the Bitcoin Talk online forum. On 7 February , Mt. Gox halted all bitcoin withdrawals. Since the transaction appears as if it has not proceeded correctly, the bitcoins may be resent.

Mt Gox is working with the bitcoin core development team and others to mitigate this issue. On 17 February , with all Mt. Gox withdrawals still halted and competing exchanges back in full operation, the company published another press release indicating the steps it claimed it was taking to address security issues.

On 20 February , with all withdrawals still halted, Mt. Gox issued yet another statement, not giving any date for the resumption of withdrawals. Gox headquarters in Tokyo continued. Citing "security concerns", Mt. Gox moved its offices to a different location in Shibuya. Bitcoin prices quoted by Mt. Gox paying its customers. On 23 February , Mt.

On 24 February , Mt. Gox suspended all trading, and hours later its website went offline, returning a blank page. Six other major bitcoin exchanges released a joint statement distancing themselves from Mt.

Gox, shortly before Mt. Gox's website went offline. On 25 February , Mt. Gox reported on its website that a "decision was taken to close all transactions for the time being", citing "recent news reports and the potential repercussions on Mt Gox's operations".

Gox was "at a turning point". From 1 February until the end of March, during the period of Mt. On 28 February Mt. Gox filed in Tokyo for a form of bankruptcy protection from creditors called minji saisei or civil rehabilitation to allow courts to seek a buyer, reporting that it had liabilities of about 6. Gox also faced lawsuits from its customers. On 9 March , Mt. Gox filed for bankruptcy protection in the US , to halt U. On 20 March , Mt. Gox reported on its website that it found On April 14, Mt.

Gox gave up its plan to rebuild under bankruptcy protection, and asked a Tokyo court to allow it to be liquidated. In a 6 Jan interview, Kraken bitcoin exchange CEO Jesse Powell discussed being appointed by the bankruptcy trustee to assist in processing claims by the , creditors of Mt. Gox computer system to increase the balance in an account -- this charge was not related to the missing , bitcoins. Gox, and moving it into an account he controlled, approximately six months before Mt.

Gox failed in early By May , creditors of Mt. Gox went bankrupt, which they asked be paid to them. In March , the trustee Kobayashi said that enough BTC has been sold to cover the claims of creditors. From Wikipedia, the free encyclopedia. Currency Bitcoin Website www. New Challenges and Responses". Retrieved 9 December — via Google Books. The Wall Street Journal. Analytics and Case Studies". How to Survive Our Faster Future". The New York Times.

Gox abandons rebuilding plans and files for liquidation: Retrieved 9 December Retrieved 10 December Most or all of the missing bitcoins were stolen straight out of the Mt. Consumers, Lifestyles and Markets". Retrieved 24 February Retrieved 28 April Gox bitcoin exchange closure could help legitimize the currency".