The Bitcoin Investment Trust (GBTC) Is A Joke, Right?

5 stars based on

31 reviews

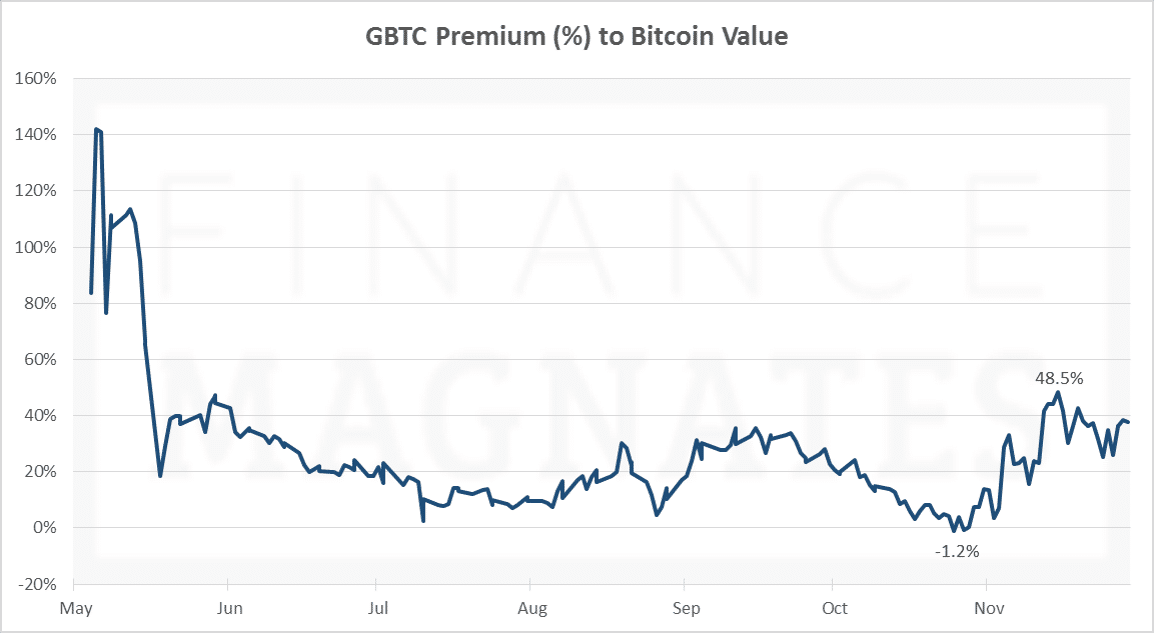

To recap the GBTC is an investment trust whose price is tied to bitcoin. The historically high premium to the actual underlying bitcoin price is the main reasoning for selling our GBTC position and replacing it with bitcoin and etheruem products that can replicate similar exposure without that premium. This trade was IRA eligible so there was no issue of paying extra capital gains by selling after 11 months instead of waiting for 12 months for long term capital gains to kick in.

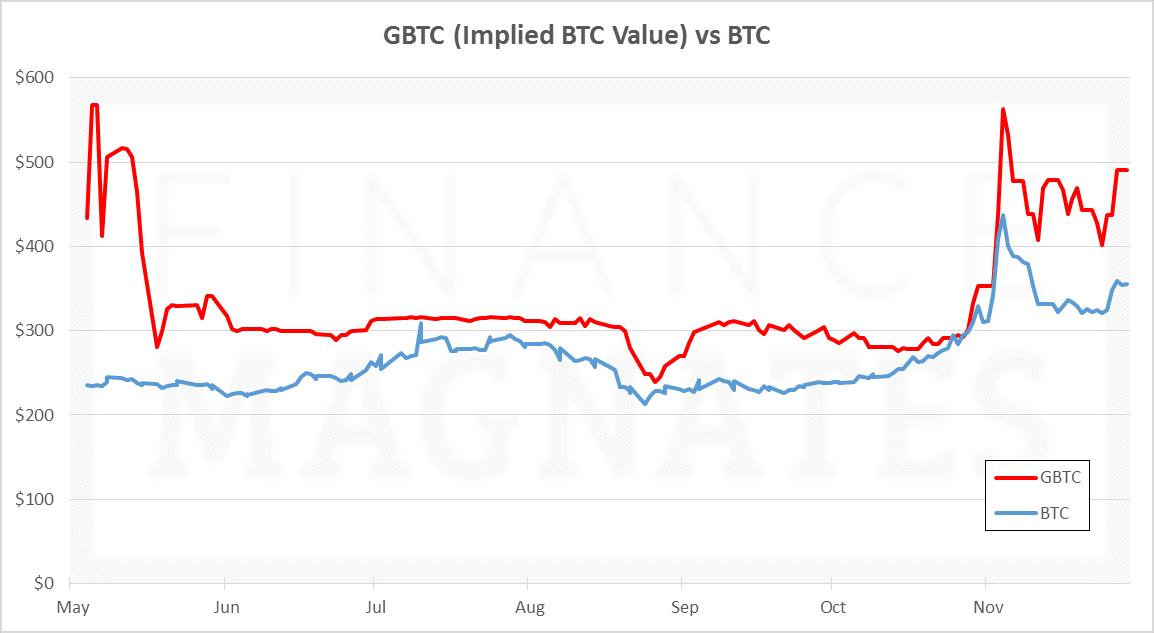

The charts below compares an European based Bitcoin fund SE: This clearly shows that throughout people have been prepared to pay a huge premium to own bitcoin in their US based brokerage account. GBTC Feb 1 year trailing premium. GBTC Feb 3 month trailing premium. Combined with bullish Bitcoin price action and inflated premium, the GBTC price has moved up strongly. The premium trades aggressively higher on rallies and lower on sell offs. This behaviour has the effect of amplifying trading extremes, but increasingly makes it a less reliable buy and hold product.

Once that was announcement was negativethe GBTC premium returned with a vengeance. By comparison the Bitcoin tracker fund premium was 0. Additionally there is a 2. The Bitcoin tracker fund management fee is 2. This is amazing given that the stated aim of the products is identical — the GBTC out performance results are exclusively due to premium. For reference here are the Bitcoin and Ethereum products available that trade in Europe but can be traded in a US based brokerage account.

These products do not have a huge premium to spot bitcoin and are IRA eligible. Bizarrely the swedish Krona product has the higher volume, over the Euro based product. All of these fund products introduce some currency risk exposure, but that is likely less to be way less variable than the GBTC premium risk.

This risk management part was not poor trading, but the management of the resulting price action in can be improved — as discussed below.

This is not purely hindsight — it was clear the short term nature of the blow off top, even during Dec Therefore about shares of GBTC buys approximately one bitcoin, but the book value is about shares. That does not mean GBTC price cannot rise further, or the premium increase more in That is a very hefty premium to spot.

Since shares of GBTC represents approximately 1 Bitcoin, these trading approaches could be taken:. This maintains bitcoin only exposure. This has created a slightly more diversified crypto portfolio — but still fully invested in crypto, with no cash on hand. This gives a less aggressive portfolio because it keeps some cash on hand in case of a pull back. Sell GBTC and maintain cash to wait for a big pullback to invest. If you are a believer in the long term crypto currency bull, this is arguably the biggest opportunity risk — crypto prices are hard to predict and can be notoriously bubbly — so it having exited once at lower prices it is hard to reestablish at significantly higher prices.

However there need to be discipline to recognize when that the GBTC trade now has premium risk outside of just Bitcoin spot price risk. That risk can be resolved by selling GBTC and buying bitcoin tracker funds. This is not necessarily a price extreme for bitcoin, but a potentially a premium extreme in GBTC. Still bullish on bitcoin and crypto assets for the next few years, however GBTC may not prove to be a good long term buy and hold product due to the premium.

In summary this is not purely a bitcoin play, but has become a play on the premium investors are prepared to assign for the convenience of exchange traded bitcoin product. Importantly selling GBTC is a not a bearish call on bitcoin or crypto in general, just trying to avoid being the last one out when playing musical chairs with the premium trade. Your email address will not be published.

You may use these HTML tags and attributes: Notify me of follow-up comments by email. Notify me of new posts by email. Leave a Reply Cancel reply Your email address will not be published. Sorry, your blog cannot share posts by email.