Mining for cryptocurrencies and why the IRS may owe you a refund.

5 stars based on

70 reviews

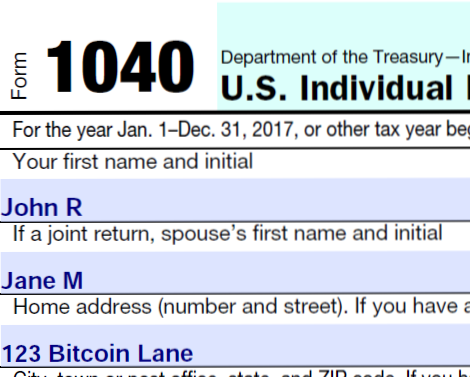

As we approach tax day, many bitcoin fans may be wondering how bitcoin mining payout schedule irs handle all of their newfound wealth. Given the recent ruling that BTC are property, not currencythings can get kind of hairy when mining, buying, or trading your BTC.

Thankfully, folks like Tyson P. Cross are around to help. The owner of BitcoinTaxSolutionsCross handles tax returns and offers tax planning with a focus on cryptocurrency. I asked Cross to walk us through the recent ruling bitcoin mining payout schedule irs what it means for Satoshi-ites. I first learned about cryptocurrencies in early when I came across a law review article discussing their legal uncertainties. I spent the next ten months exhaustively researching the proper tax treatment of bitcoins and ended up developing a real passion for this area of the tax law.

As a general rule, the IRS only knows what it is told. This means that it has no knowledge of your bitcoin unless someone tells them. First, your bitcoin exchange may report your transactions bitcoin mining payout schedule irs the IRS. However, it does not appear that bitcoin exchanges are currently subject to the reporting requirements although that will probably change in the future. Thus, unless the exchange voluntarily files a bitcoin mining payout schedule irs you, it is unlikely that the IRS will receive a report of your bitcoin transactions.

Note that they would need your Social Security number to file a in your name, bitcoin mining payout schedule irs a request from your bitcoin mining payout schedule irs exchange to provide your Social Security number may be indicative of bitcoin mining payout schedule irs filing.

Third, someone can report you to the IRS, which happens far more often than you might think. Fourth, you voluntarily and accurately report your gains on your tax return. That might sound ridiculous to some people given the inherent anonymity of bitcoin, but there are some very rich people in prison right now who used to think the same thing about their Swiss bank accounts.

The fact is that penalties for failing to report income are significant. This includes the possibility of criminal prosecution. You can also add to this the additional penalties for failing to report foreign financial accounts, which can be even more severe. At the end of the day, you have a decision to make. You can comply with the law and pay taxes just like everyone else, which is admittedly unpleasant.

IRS Notice clarifies the tax treatment of bitcoin miners. Specifically, the Notice provides that miners must recognize income for each bitcoin mined during the taxable year.

The amount of income is bitcoin mining payout schedule irs to the market price of bitcoin on the day it is awarded on the blockchain. For example, assume someone mines 1 bitcoin in Mining expenses, such as electricity, would be deductible bitcoin mining payout schedule irs the taxable year as an expense. This determination also has additional consequences in the form of self-employment taxes, which the IRS notice also confirmed are applicable to miners engaged in a trade or business.

Surprisingly, the IRS Notice was silent with regard to bitcoin exchanges although it did address companies that provide bitcoin settlement services to merchants. However, as bitcoin exchanges continue to open in the U.

At some point, the IRS will have to address bitcoin exchanges. For now, though, the greatest burden on bitcoin exchanges remains compliance with federal and state anti-money laundering laws.

However, for those who plan to use bitcoin as a medium of exchange, the IRS Notice will create some difficulty because of its position that every bitcoin transaction is a taxable event.

This means that bitcoin users will have to determine their taxable gain or loss each time they use bitcoin to purchase goods or services. That creates a serious burden that will need to be addressed before bitcoin can achieve widespread adoption. The solution might be as simple as a software program that tracks bitcoin transactions automatically.

Preferably, though, it would be a recognition by the IRS that bitcoin needs to be classified as a foreign currency for tax purposes which would render personal transactions non-taxable. The Treasury Department is accepting public comment and I would expect groups like the Bitcoin Foundation to participate in this process.

As the saying goes, the power to tax is the power to destroy, and this is no exception. Tell us about yourself. How did you get involved in bitcoin? How will the IRS find out about our bitcoin? What do these new laws mean for miners? What do these new laws mean for exchanges? What do these laws mean for the average Josephine with a few BTC? Is there anything special to watch out for? Anything we may bitcoin mining payout schedule irs You can contact Tyson here.