Swiss private bank launches new bitcoin asset management solution

5 stars based on

50 reviews

The very same day, the Ukrainian President Petro Poroshenko has officially commented on the event. It is an independent U. Answering the question on further cooperation between the state-owned PrivatBank and Middleware, Vitiaz said:. Additionally, when Dmitry Donets was asked at Privatbank bitcoin exchange rate whether bitcoin has any future in Privat24, he said that the global banking community considers banks supporting bitcoin transactions riskier counterparties.

Still, he said back then, Privatbank bitcoin exchange rate experienced no counteraction on the side of the national regulator when it came to bitcoin-related experiments.

Even though banks consider bitcoin operations risky, the story of yet another bank that somehow has gone wrong makes one think about risks of interacting with banks as such. Recent Facebook and MasterCard researches have shown that 92 per cent of young people in privatbank bitcoin exchange rate U. Even though banks are usually big and clumsy, they have rather fragile structures that are held in place by mere trust.

No bank privatbank bitcoin exchange rate have enough free money in such a scenario. No other bank would have survived any of them. Yet privatbank bitcoin exchange rate recent attack that started a week ago was the hardest.

According to Dmitry Dubilet, the confirming kill came on Saturday, when a local TV channel stated in the news: Cryptocurrencies depend on that fragile trust all the same, yet blockchain allows them to evade several risks inherent in banks. No wonder banks and other financial entities are actively engaged in various blockchain consortiums. Still, banks going blockchain somehow mitigate the risk of a panic described above? First, blockchain is transparent.

Second, the account access is limited to those having a private key. When cashless economy emerges, the concept of storming a bank will lose its vigour.

All you can do is transfer your money privatbank bitcoin exchange rate another bank that seems privatbank bitcoin exchange rate reliable at the moment. PrivatBank has a database for more than 20 million residents of Ukraine.

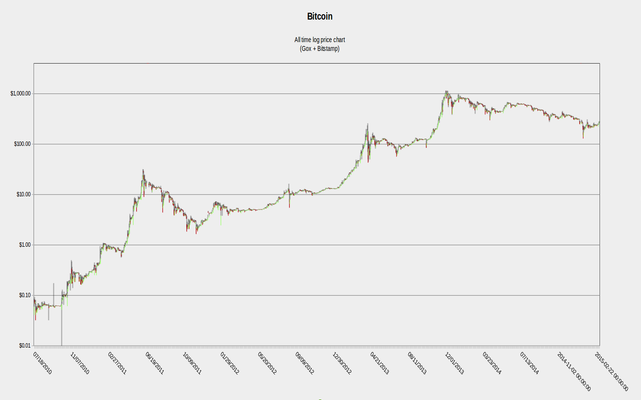

Obviously, this would result in a price surge. The authorities consider cryptocurrencies as a potential means of tax evasion. Indeed, bitcoin transactions are currently pseudonymous and are not controlled by the government. It makes them an appealing means of value storage and settlement, especially during political and economic turmoil.

However, the Coinbase case proves that the situation may change any moment, especially if bitcoin and other cryptocurrencies gain more popularity. It would completely exclude any possibility of unsanctioned movement of funds. This would ensure anti-corruption efforts and appropriateness of budgetary expenditures. Combined with tools like e-Auction 3. However, the price here is a serious degradation of privacy.

Bitcoin is not controlled by any country; it cannot be blocked or arrested; and owners of pseudonymous accounts are hard to trace. It makes bitcoin an alternative for unreliable banks. Neither is bitcoin controlled by any nation in terms of issuance, transacting, access, and protocol alteration. A bitcoin account cannot go west. It is quite obvious, however, that specifically designed blockchain browsers like Chainalysis can see much more than anonymity fans privatbank bitcoin exchange rate prefer.

In this light, alternatives like Dash, Monero, and ZCash are gradually drawing more and more attention. However, locations of major mining facilities are well known, and once a government decides to nationalize cryptocurrency, it would prove to be much easier than catching an elusive hacker.