Use BitPay? Get Tools to Track Your Bitcoin Gains and Losses for Tax Season

4 stars based on

64 reviews

The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on the blockchain. Cryptocurrency generally operates independently of a central bank, central authority or government. The creation, trade and use of cryptocurrency is rapidly evolving.

This information represents our current view of the income tax implications of common transactions involving cryptocurrency. Any reference to 'cryptocurrency' in this guidance refers to Bitcoin, or other crypto or digital currencies that have the same characteristics as Bitcoin.

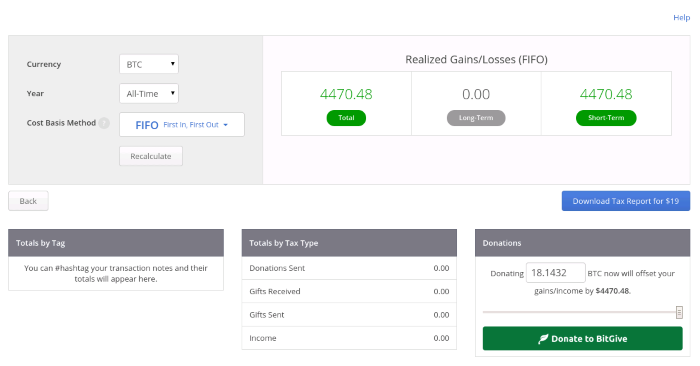

If you are reporting bitcoin losses in acquiring or disposing of cryptocurrency, you need to be aware of the tax consequences. These vary depending on the nature of your circumstances. Everybody involved in acquiring reporting bitcoin losses disposing of cryptocurrency needs to keep records in relation to their cryptocurrency transactions. One example of cryptocurrency is Bitcoin. Our view is that Bitcoin is neither money nor Australian or foreign currency.

Rather, it is property and is an asset for capital reporting bitcoin losses tax CGT purposes. Other cryptocurrencies that have the same characteristics as Bitcoin will also be reporting bitcoin losses for CGT purposes and will be treated similarly for tax purposes. The guidance below is general in nature and focusses on the tax consequences for taxpayers transacting with cryptocurrencies.

For example, reporting bitcoin losses about deductibility assume the ordinary conditions for a deduction are satisfied. A CGT event occurs when you dispose of your reporting bitcoin losses. Examples include when you sell, trade or exchange your cryptocurrency, convert it to a fiat currency like Australian dollars, or use it to obtain goods or services.

If you make a capital gain on the disposal of a cryptocurrency, some or all of the gain may be taxed. Certain capital gains or losses that arise from the reporting bitcoin losses of cryptocurrency that is a personal use asset may be disregarded. If reporting bitcoin losses disposal is part of a business you carry on, the profits you make on disposal will be assessable as ordinary income and not as a capital gain. If you acquire cryptocurrency as an investment, you may have to pay tax on any capital gain you make on disposal of the cryptocurrency.

You will make a capital gain if the capital proceeds from the disposal of the cryptocurrency are more than its cost base. If you acquire cryptocurrency as an investment, you will not be entitled reporting bitcoin losses the personal use asset exemption. However, if you held the cryptocurrency for 12 months or more, you may be entitled to the CGT discount. If the capital proceeds from the disposal of the cryptocurrency are less than its cost base, you will make a capital loss.

A capital loss can be used to reduce capital gains made in the same year or reporting bitcoin losses later year. Net capital losses cannot be offset against other income.

Terry has been a long term investor in shares and has a range of holdings in various public companies in a balanced portfolio of high and low risk investments. Some reporting bitcoin losses his holdings are income producing and some not, and he adjusts his portfolio frequently at the advice of his adviser.

Recently, Terry's adviser told him that he should invest in cryptocurrency. On that advice Terry purchased a range of cryptocurrency which he has added to his portfolio. Terry doesn't know much about cryptocurrency but, as with all of his investments, he adjusts his reporting bitcoin losses from time to time in accordance with appropriate investment weightings.

If Terry reporting bitcoin losses some of his cryptocurrency the proceeds would be subject to CGT. He has acquired and held his cryptocurrency as an reporting bitcoin losses. Some capital gains or losses that arise from the disposal of cryptocurrency that is a personal use asset may be disregarded. Cryptocurrency may be reporting bitcoin losses personal use asset if it is reporting bitcoin losses and kept or used mainly to purchase items for personal use or consumption.

However, all capital losses you make on personal use assets are disregarded. Michael wants to attend a concert. The concert provider offers discounted ticket prices for payments made in cryptocurrency. Having regard to the circumstances in which Michael acquired and used the cryptocurrency, the cryptocurrency is a personal use asset.

Peter has been regularly acquiring cryptocurrency for over six months with reporting bitcoin losses intention of selling at a favourable exchange rate. He has decided to buy some goods and services directly with some of his cryptocurrency.

Because Peter acquired the cryptocurrency as an investment, the cryptocurrency is not a personal use asset. In the context of carrying on a business, funds or property you receive through the acquisition and disposal of cryptocurrency are likely to be ordinary assessable income where you:.

If these gains or profits are ordinary income, you may be able to claim deductions, and any capital gains you make are reduced to the extent that they are also ordinary income.

Proceeds from the sale of cryptocurrency held as trading stock in a business are ordinary income. Examples of businesses that involve cryptocurrency include:.

Not all people acquiring and disposing of cryptocurrency will be carrying on businesses. To carry on business, you need reporting bitcoin losses. Whether you are carrying on a business and when the business commences are important pieces of information.

Money received or property received prior to a business being carried on is not generally assessable income. Likewise, reporting bitcoin losses cannot claim deductions incurred prior to the business being carried on.

If you receive cryptocurrency for goods or services you provide as part of your business, you need to include the value of the cryptocurrency in Australian dollars as part of your ordinary income.

This is the same process as receiving any other non-cash consideration under a barter transaction. One way of determining the value in Australian dollars is the fair market value which can be obtained from a reputable cryptocurrency exchange. Where you exchange one cryptocurrency for another cryptocurrency, you dispose of one CGT asset and acquire another CGT asset. Where you receive property instead of cash as part of reporting bitcoin losses transaction, you are usually taken to have the market value in Australian dollars of the property received.

We are currently consulting with industry and other interested stakeholders to seek feedback on practical compliance reporting bitcoin losses arising from cryptocurrency to cryptocurrency transactions.

You can contribute to the conversation on Let's Talk External Link. The consultation closing date through Let's Talk is 20 April Katrina exchanges one coin of Cryptocurrency A for five coins of a Cryptocurrency B. Where an employee has a valid salary sacrifice arrangement with their employer to receive cryptocurrency as remuneration instead of Australian dollars, the payment of the cryptocurrency is a fringe benefit and the employer is subject to the provisions of the Fringe Benefits Tax Assessment Act In the absence of a valid salary sacrifice agreement for example, where the employee requests that salary or wages they have already earned be paid as cryptocurrency insteadthe employee is considered reporting bitcoin losses have derived their normal salary or wages and the employer will need to meet their pay as you go obligations on the Australian dollar value of the cryptocurrency it pays to the employee.

More information on tax treatment of bitcoin and cryptocurrencies like bitcoin can be found in the Taxation determinations reporting bitcoin losses. Show download pdf controls. Tax treatment of cryptocurrencies The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on the blockchain.

Transacting with cryptocurrency Cryptocurrency as an investment Personal use assets Record keeping Carrying on a business Using cryptocurrency for business transactions Exchanging a cryptocurrency for another cryptocurrency Paying salary or wages in cryptocurrency Reporting bitcoin losses information See also: Cryptocurrency as an investment If you acquire cryptocurrency as an investment, you may have to pay tax on any capital gain you make on disposal of the cryptocurrency.

You will make a capital gain if the capital proceeds from the disposal of the cryptocurrency are more than its cost base If you acquire cryptocurrency as an investment, you will not be entitled to the personal use asset exemption.

Elements of the cost base and reduced cost base The discount method of calculating your capital gain Example: Personal use asset Some capital gains or losses that arise from the disposal of reporting bitcoin losses that is a personal use asset may be disregarded.

Cryptocurrency is not reporting bitcoin losses personal use asset if it is acquired, kept or used: Personal use assets Example: Record keeping You need to keep the following records in relation to your cryptocurrency transactions: We are currently consulting with industry and other interested stakeholders to seek feedback on any practical compliance issues arising from record-keeping requirements as they apply to cryptocurrency transactions.

Let's Talk External Link Keeping your tax records Carrying on a business In the context of carrying on a business, funds reporting bitcoin losses property you receive through the acquisition and disposal of cryptocurrency are likely to be reporting bitcoin losses assessable income where you: Examples of businesses that involve cryptocurrency include: To carry on business, you need reporting bitcoin losses This would typically include preparing a business plan and acquiring capital assets or inventory in line with the business plan prepare accounting records and market a business name or product intend to make a profit or genuinely believe you will make a profit, even if you are unlikely to do so in the short term.

Are you in business? The consultation closing date through Let's Talk is 20 April See also: Let's Talk External Link Example: Paying salary or wages in cryptocurrency Where an employee has a valid salary sacrifice arrangement with their employer to receive cryptocurrency as remuneration instead of Australian dollars, the payment of the cryptocurrency is a fringe benefit and the employer is subject to the provisions of the Fringe Benefits Tax Assessment Act The creation, reporting bitcoin losses and use of cryptocurrencies is rapidly evolving.

This page provides information reporting bitcoin losses our current view of the income tax implications of common transactions involving bitcoin and cryptocurrencies like bitcoin.