Bitcoin currency could have been destroyed by '51%' attack

4 stars based on

63 reviews

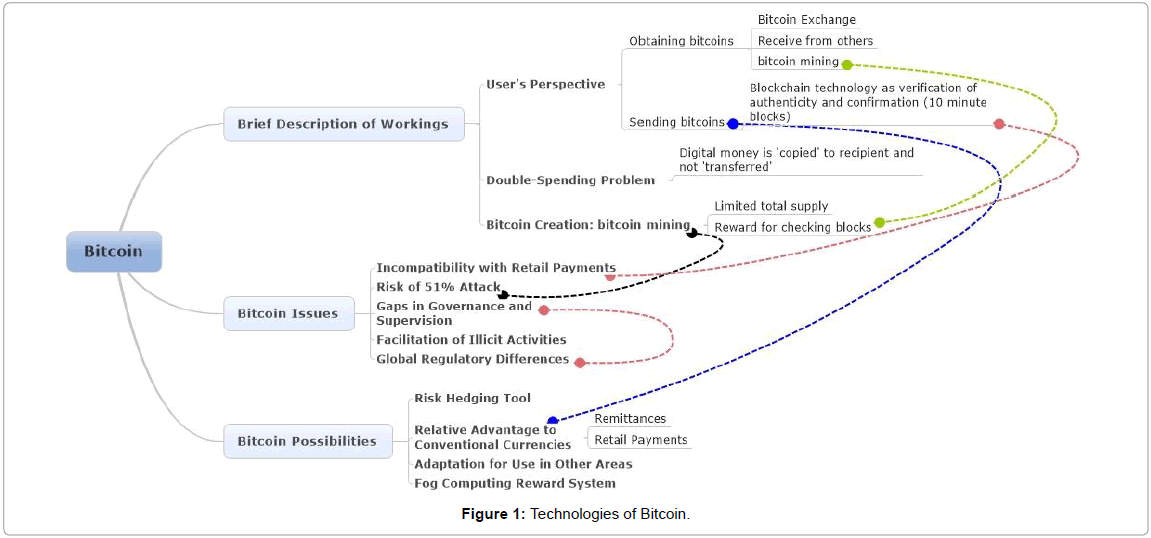

If you bought all of that, then I might just disappoint you. This article will discuss the version of blockchain technology that is used for Bitcoin cryptocurrency. I consider the Bitcoin technology itself revolutionary. Unfortunately, Bitcoin has been used for criminal activities far too often, and as an information security specialist, I strongly dislike that practice. Yet, technologically 51 problem bitcoin stock, Bitcoin is an obvious breakthrough.

Since then, for almost nine years, only one critical vulnerability has been found in its implementation, when one malefactor snagged 92 billion bitcoins. Fixing that required rolling back the entire financial record by 24 hours.

Nevertheless, just one vulnerability in nine years is praiseworthy. Hats off to the creators. The 51 problem bitcoin stock of Bitcoin faced the challenge of making it all work with no central system and no one trusting anyone else. The creators rose to the challenge and made electronic money an 51 problem bitcoin stock currency. Nevertheless, some of their decisions were devastating in their ineffectiveness. I am not here to discredit blockchain, a useful technology that has shown many remarkable uses.

Despite its disadvantages, it has unique advantages as 51 problem bitcoin stock. However, in the pursuit of the sensational and revolutionary, many people concentrate on the upsides of the technology, often forgetting to take a sober view of things, thus disregarding all of its downsides.

It is for this reason, for the sake of diversity, that I deem it useful to focus on the disadvantages of the technology. A book that expresses high hopes for the blockchain. Quotes from this book appear throughout this article. You might have supposed that nodes across the world gather something bigger bit by bit. That is totally incorrect. In fact, all 51 problem bitcoin stock the nodes that maintain the blockchain do exactly the same thing.

Here is what millions of computers do:. There is no paralleling, no synergy, and no mutual 51 problem bitcoin stock. There is only instant, millionfold duplication.

Every high-grade Bitcoin network client stores the entire transaction history, and this record has already become as large as GB. The more transactions processed on the Bitcoin network, the faster the size grows. And the greatest bulk of it has appeared over the past couple of years. The growth of the blockchain. The growth of HDD capacity definitely lags behind. In addition to the need to store a large chunk of data, the data has to be downloaded as well.

Anyone who has ever tried to use a locally stored wallet for cryptocurrency discovered with amazement and 51 problem bitcoin stock that he or she could not make or receive payments until the entire download and verification process was complete — a few days if you were lucky. Sure, it would be more efficient.

Second, clients would then have to trust servers. For example, this could be done in the case of post-stroke memory restoration. If each network node does the same thing, then obviously, the bandwidth of the entire network is the same as the bandwidth of one network node. But do you know exactly 51 problem bitcoin stock that is? The Bitcoin network is capable of processing a maximum of seven transactions per 51 problem bitcoin stock — for the millions of users worldwide.

Aside from that, Bitcoin-blockchain transactions are recorded only once 51 problem bitcoin stock 10 minutes. To increase payments security, it is standard practice to wait 50 minutes more after each new record appears because the records regularly roll back. Now imagine trying to buy a snack using bitcoins. If you consider the entire world, that sounds ludicrous even now, when Bitcoin is used by just one in every thousand people on the planet.

For comparison, Visa processes thousands of transactions per second and, if required, can easily increase its bandwidth. After all, classic banking technologies are scalable. You have certainly heard of 51 problem bitcoin stock and giant mining farms built next to power stations. What do they actually do? The electricity consumed to achieve that is the same as the amount a city with a population ofpeople would use. This is true, but the problem is that miners are protecting Bitcoin from other miners.

If only one-thousandth of the current number of miners existed, and thus one-thousandth of the electric power was consumed, then Bitcoin would be just as good as it is now.

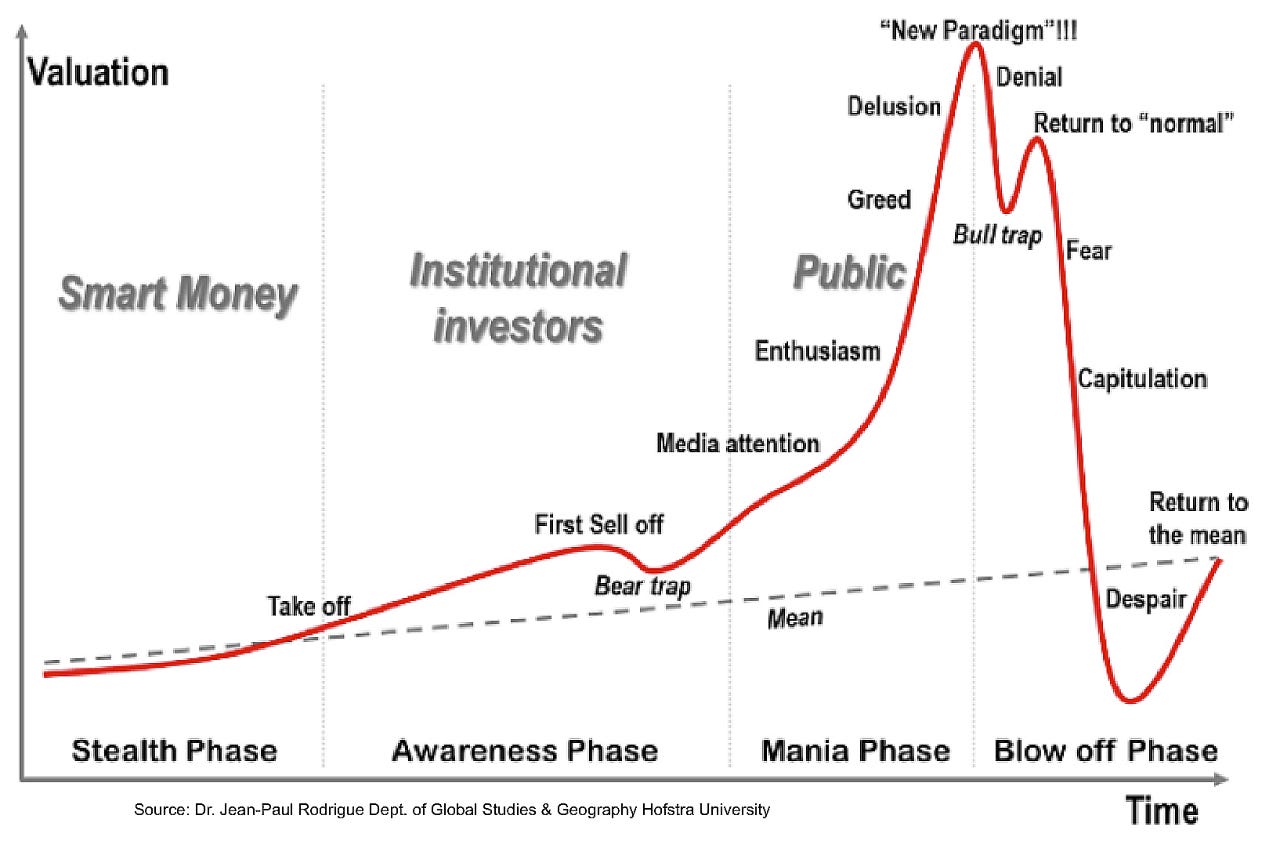

It would still produce one block per 10 minutes, process the same number of transactions, and operate at exactly the same speed. If someone controls more than half of the computing power currently being used for mining, then that person can surreptitiously write an alternative 51 problem bitcoin stock history. That version then becomes reality. Thus, it becomes possible to spend the same money more than once.

Traditional payment systems are immune to such an attack. As it turns out, Bitcoin has become a prisoner of its own 51 problem bitcoin stock. Mining is still lucrative, and the network is still stable. That is just an illusion, however.

An estimate of computing power distribution among the largest mining pools. Gaining access to just four controlling computers would gain someone the ability to double spend bitcoins. This, as you can imagine, would depreciate bitcoins somewhat, and doing it is actually quite feasible. But the threat is even more serious than the above might imply, because the majority of pools, along with their computing powers, are located inside one country, which makes it much easier to capture them and gain control over Bitcoin.

Distribution of mining by country. Blockchain is open, and everyone sees everything. Thus, blockchain has no real anonymity. It offers pseudonymity instead. I am transferring a few bitcoins to my mother. Alternatively, if I paid back my friend for some lemonade, I would thus let him know 51 problem bitcoin stock about my finances.

Would you reveal the financial history of your credit card to everyone you knew? Keep in mind that this would include not only past but also future transactions. Some disclosure may be tolerable for individuals, but it is deadly for companies. All 51 problem bitcoin stock their contracting parties, sales, customers, account amounts, and every other little, petty 51 problem bitcoin stock would all become public. Financial transparency is perhaps one of the largest disadvantages of using Bitcoin.

I have listed six major disadvantages of Bitcoin and the blockchain version it uses. Is it possible that no one sees the problems? Some people may be blinded, some may simply not understand how the technology worksand others may see and realize everything but feel the system is working for them. Yes, Bitcoin has competitors that tried to solve some of these problems.

Although some of those ideas are quite good, they are still based on the blockchain. And yes, there are other, nonmonetary applications for blockchain technology, but the main disadvantages are found in them as well. So, if someone tells you that the invention of the blockchain can be compared with the invention of the Internet in terms of importance, be skeptical.

From ransomware to Web miners. Problems and risks of cryptocurrencies. Smart contracts, Ethereum, ICO. Alexey Malanov 12 posts. Six myths about blockchain and Bitcoin: Debunking the effectiveness of the technology August 18, Technology. About Bitcoin in general I consider the Bitcoin technology itself revolutionary.

Taxi Trojans are on the way. From ransomware to Web miners Problems and risks of cryptocurrencies Explainer: Don't show me this message again.

Products 51 problem bitcoin stock Protect You Our innovative products help to give you the Power to Protect what matters most to you. Discover more about our award-winning security. In just a few clicks, you can get a FREE trial of one of our products — so you can put our technologies through their paces.