Fastest bitcoin mining rig builder

28 comments

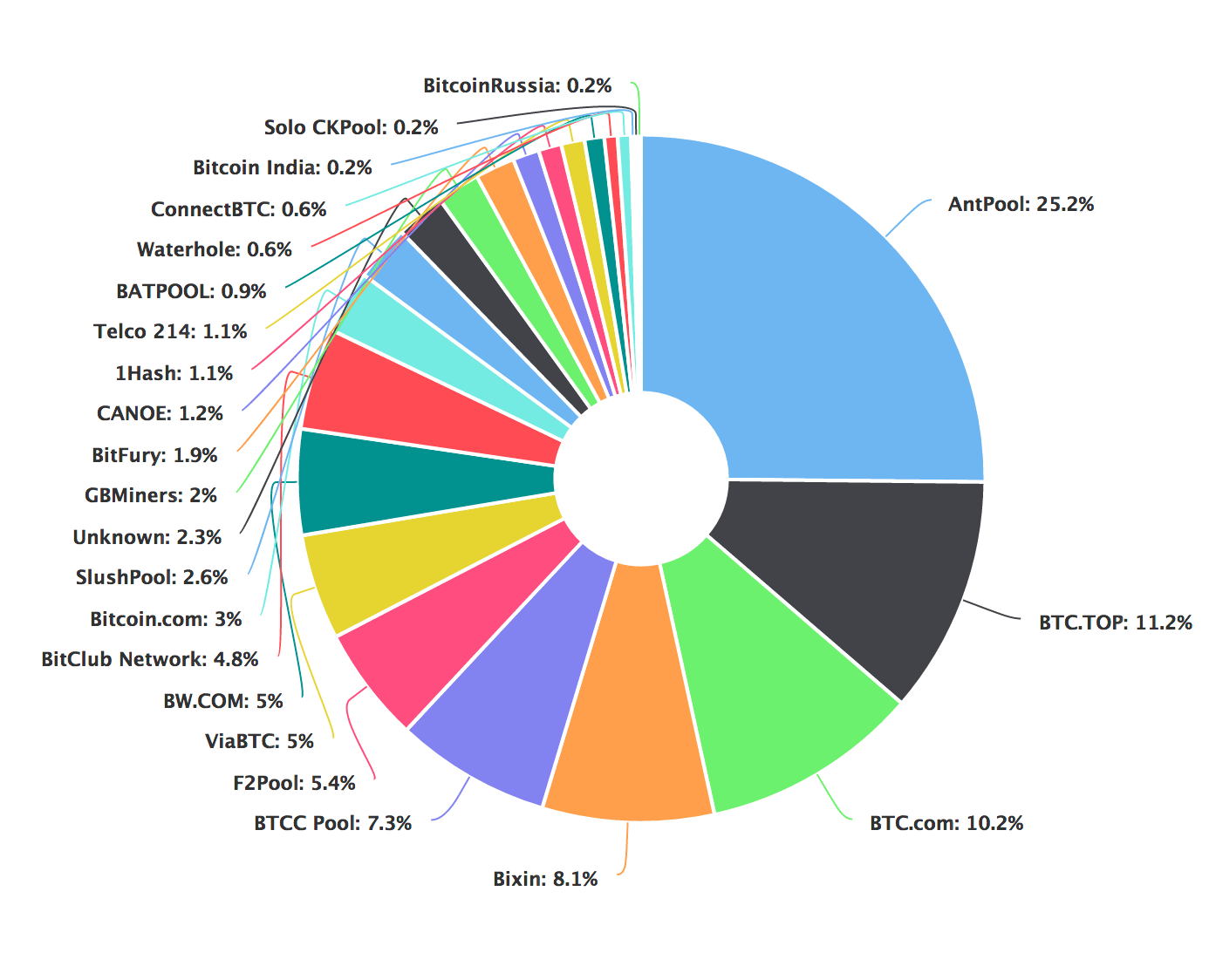

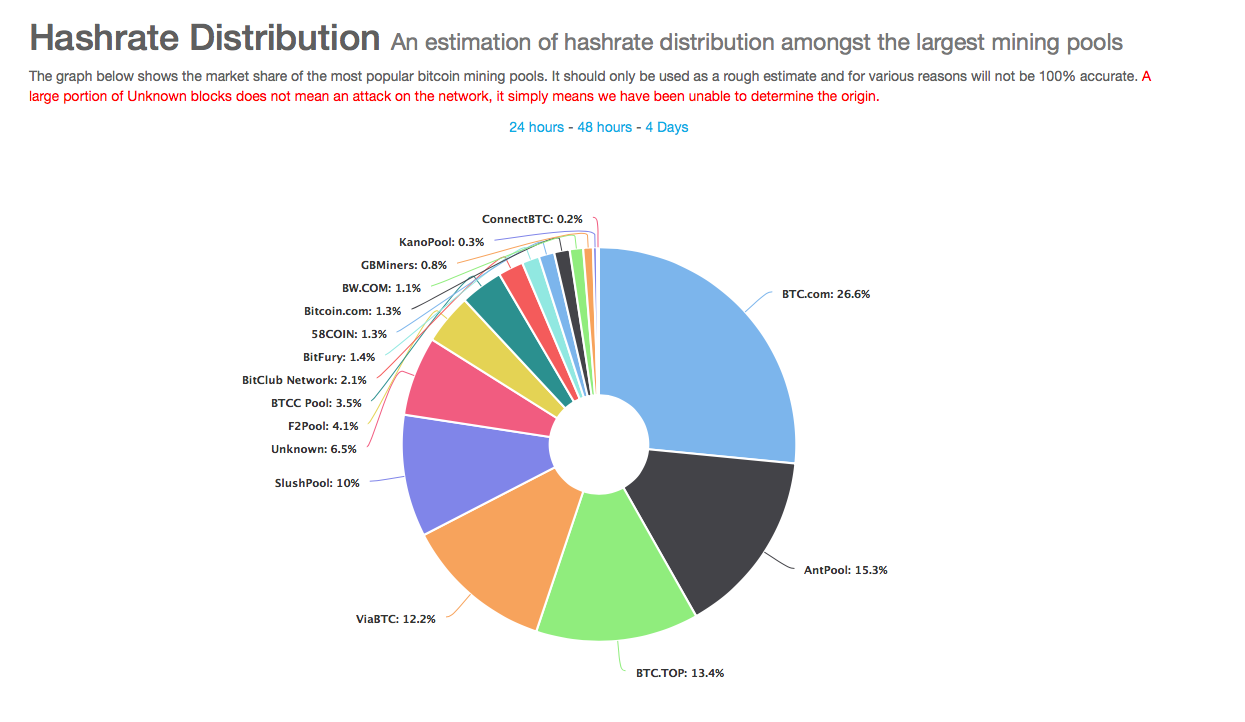

Csrf token missing kraken seats

Similarly, the main 8 pools control the same fraction of mining power in Bitcoin. Pools dictate the transaction sets in new blocks, not miners. Pools are subject to continuous DDoS attacks. If a big pool goes down, the security of the network is significantly compromised. High variance of returns, hard for users to plan economically. Decentralized mining pools for Bitcoin e.

We essentially replace the centralized pool operators by smart contracts, which is run and managed in a decentralized way on the blockchain. Although being decentralized, our pools can guarantee the same variance in payments as centralized pools.

The decentralized formation of SmartPool does not require any infrastructure to operate the pool. SmartPool may take negligible to almost zero fees to maintain the pool front-end and to develop new features.

We use Ethereum smart contracts to build a decentralized pooled mining protocol called SmartPool. Our solution implicitly replaces the centralized pool operator by network participants who run the Ethereum network. SmartPool includes several novel data structures and design choices which make its protocol secure and efficient. Specifically, we devise a new mechanism to verify and record miners' contributions to the pool without centralized operators.

SmartPool's efficient probabilistic verification drastically reduces both the number of messages and the costs to run the pool for miners. Using a novel data structure called the augmented Merkle tree, SmartPool's batched share submission and efficient payment scheme remove any incentive for submitting invalid batches. Want to learn more? His research is on cryptocurrencies, smart contract security and distributed consensus algorithms. He is a lead developer of Oyente, the first security analyzer for smart contracts, which is now open-source.

Yaron Velner is a postdoctoral researcher in the Hebrew University of Jerusalem. His research is focused on aspects of game theory incentives in blockchain protocols and formal verification of smart contracts.

He holds a Phd in computer science from Tel Aviv University. Yaron is also an experienced software developer with over 10 years of experience as a senior software engineer and a technical leader at EZchip semi-conductors recently acquired by Mellanox technologies.

At EZchip he was a member in the data structure and algorithm team, which developed novel data structures for IP routing. Victor Tran is a senior backend engineer and Linux system administrator. He has experience in developing and building infrastructure for multiple social marketing platforms and advertising networks. He is interested in building high performance multi-platform applications.

Victor co-founded and was CTO of several startups in social marketing. He built and maintained platforms which handled millions of monthly active users. One of his platform was in Alexa top 20 in the US for several months.

Vitalik is the Founder and Chief Scientist of Ethereum. He is also both the Founder and a writer for Bitcoin Magazine, a venture that marked the beginning of his career in crypto in He is interested in creating secure, efficient, and trustworthy systems and advises a number of projects in the crypto space. Prateek Saxena is a research professor in computer science at National University of Singapore.

He works on blockchains and computer security, and his research has influenced the design of browser platforms, web standards and app stores widely used today. An efficient and decentralized mining protocol for existing cryptocurrencies based on Ethereum smart contracts.

Normal centralized pools are not ideal because of: SmartPool enables an efficient way to mine blocks in a decentralized manner between miners. Everyone can propose their own transactions in a block, thus eliminating the censorship on transactions.

SmartPool requires negligible to no fees from miners. We are excited about Proof of stake as much as anyone else, but it will take roughly one more year for PoS to come. Until PoS is officially rolled out, SmartPool is still relevant and makes mining in Ethereum much more decentralized.

The adoption of Ethereum based decentralized pools for other cryptocurrencies would increase Ether volume usage as ZCash and Bitcoin miners would have to interact with the corresponding Ethereum contracts and directly benefit Ethereum miners.

Ethereum first, ZCash and Bitcoin will be supported later if funding allows. We would also provide a generic interface to allow porting to almost all cryptocurrencies.

We have considered this option, and decided against it. SmartPool is a community project, not for profit. SmartPool will be run for-and-by the community. We feel that having a separate token or currency associated with it may ultimately limit its adoption. SmartPool's goal is decentralization, and the best way to get there is to scale without creating auxiliary incentive structures around it. We will still issue tokens for each donation though. The tokens are only to recognize donors' contributions to SmartPool, thus may or may not have financial values in the future.

If you are a miner, it is pretty straightforward. You just need to install an update to your miner software which we provide to interact with the contracts. More details will be released later on. If you are not a miner but a cryptocurrency advocate, please consider donating to support the SmartPool development. SmartPool is a non-profit open source project. It is technically impossible to use P2Pool solution for Ethereum.

Moreover, our solution also performs better than P2Pool for other currencies. SmartPool leverages the security of Ethereum blockchain for its operation. Previous decentralized Bitcoin pools e. P2Pool used a separate side-chain which doesn't have as strong a backing infrastructure as Ethereum today. SmartPool's design scales ad-infinitum.

SmartPool is a versatile concept. It can support mining for more than one cryptocurrency. It is appealing both for Bitcoin which has dominated by large mining farms as well as for other cryptocurrencies like Monero and ZCash which have many more solo miners.

We already have a proof of concept for a SmartPool-based mining pool for Bitcoin. We aim to build production-ready and compatible system so everyone can use and launch their own decentralized pools.

Depending on our funding, we plan to launch and maintain SmartPool-based pools for Ethereum and other cryptocurrencies too. First beta pool for Ethereum on testnet: First working pool for Ethereum: The SmartPool project is funded by the community and run by the community.

Thus, we will do a crowdfund and ask for donations from the public. We will keep updating our funding status. Depending on how much we get, our promised deliverables vary as follows.

Less than 5, ETH: Implement SmartPool for Ethereum and release all software as open source i. In addition to what we have promised, we will launch a decentralized pool for Ethereum and maintain it until Ethereum moves to proof of stake.

More than 10, ETH: Pay to the devs please check out our team. Equipment and other expenses: GPU renting, basic infrastructure, social media promotion, etc. There is no financial benefit at the moment.

Although we issue tokens for each donation, the tokens are only to represent contributions to SmartPool. Our first priority is to promote decentralized mining and have a running pool with significant hash power. Compensating token holders will be considered, but will not be our main focus.

Transaction Censorship and Single Point of Failure Pools dictate the transaction sets in new blocks, not miners. Mining Solo is Difficult for Small Miners High variance of returns, hard for users to plan economically. Centralized Pools Take High Fees to cover for their operation costs and gain profits. Decentralize Pools by Leveraging Smart Contracts We essentially replace the centralized pool operators by smart contracts, which is run and managed in a decentralized way on the blockchain.

Mitigate Transaction Censorship Threat Miners can propose their own sets of transactions. Guarantee Low Variance Although being decentralized, our pools can guarantee the same variance in payments as centralized pools. Low Fees The decentralized formation of SmartPool does not require any infrastructure to operate the pool. How is it different from or better than normal pools? Ethereum is moving to Proof-of-stake, how does SmartPool benefit Ethereum?

What are the supported cryptocurrencies? Everyone is doing an ICO for their project. Will SmartPool have one too? How does one participate then?