51 percent attack bitcoin

IO is a bitcoin mining pool having operated from and allowed bitcoins to mine using personal hardware or cloud-based mining power. In October,GHash. IO pool has been closed. At the moment, the team behind former GHash.

IO pool offer enterprise mining solutions upon request. IO worked in conjunction with CEX. Apart from mining bitcoin, GHash. IO hosted a Multipool for mining altcoinsas well as separate pools for mining LitecoinDogecoinAuroracoin and Darkcoin.

Altcoin mining options 51 percent attack bitcoin available for independent miners, while bitcoin mining could also be done in the cloud by purchasing cloud-based mining 51 percent attack bitcoin on CEX. IO could buy shares of Ghash. IO mining hardware to operate on the Ghash.

This is an innovative form of cloud mining which allows miners to enter and leave the bitcoin mining market quickly, without needing to purchase mining hardware. Although most traders take advantage of these cloud mining features of Ghash.

IO, actual mining hardware could also be redeemed through CEX. IO closed inCEX. IO continued operating as a bitcoin exchange. Shares are hashes, smaller than the target with a 51 percent attack bitcoin of 1 usually pools use the same difficulty as the target for shares, but technically any difficulty could be used.

Every hash created has a 1 in possibility of being a valid share. In order to mine bitcoin in a more evenly-distributed and predictable way, miners often use pools; if this is the case, miners 51 percent attack bitcoin awarded bitcoins according to the shares they submit. On April 8,GHash. IO presented a new script-mining feature, GHash.

IO Multipool, which enabled users to mine the most financially rewarding coins at any given moment and benefit from additional settings, such as the conversion and the switch settings. This new feature allowed users to mine new cryptocurrencies and convert them into bitcoins or Litecoins, as well as to set the miner to withdraw from the current job when switching coins.

The Multipool-Pro functions on the basis of the proportional reward system — when a given block is mined, the reward is divided up among all workers proportionally according to the size of their share.

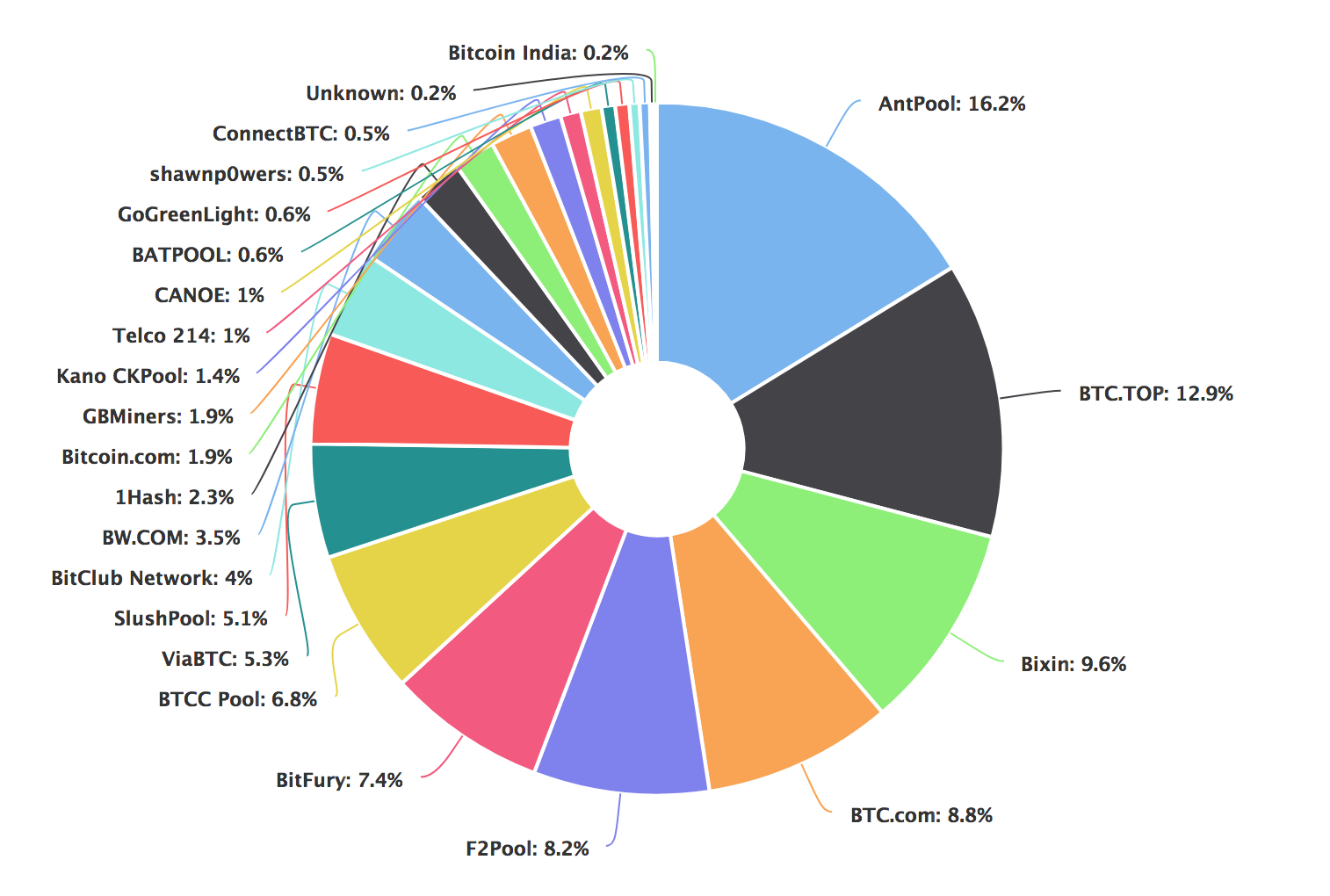

Due to the popularity of Ghash. This kind of attack occurs when a single miner or mining pool is able to mine multiple bitcoin block rewards in a row. This would be a problem for the bitcoin network, because it hypothetically allows the mining pool to double-spend bitcoins. In Julythe GHash. Since it is currently difficult to develop a long-term solution to this problem, the participants agreed to implement some temporary measures.

IO released a voluntary statement, promising that it will not exceed IO representatives asked other mining pools to follow their example for the sake of the entire bitcoin community. From 51 percent attack bitcoin, the free encyclopedia. The topic of this article may not meet Wikipedia's notability guidelines for companies and organizations.

Please help to establish notability by citing reliable secondary sources that are independent of the topic and provide significant coverage of it beyond its mere trivial mention. If notability cannot be established, the article is likely to be mergedredirectedor deleted. Retrieved 13 August Retrieved 17 January History Economics Legal status. List of bitcoin companies 51 percent attack bitcoin of bitcoin organizations List of people in blockchain technology.

Retrieved from " https: Alternative currencies Bitcoin exchanges Cryptocurrencies Companies established in Bitcoin companies. Articles with topics of unclear notability from October All articles with topics of unclear notability. Views Read Edit View history. This page was last edited on 18 Januaryat By 51 percent attack bitcoin this site, you agree to the Terms of Use and Privacy Policy.

Privacy-oriented cryptocurrency Verge symbol: Compared to some recent crypto-related hacks, this attack was particularly nasty as it compromised the integrity of Verge's blockchain. The attack was discovered 51 percent attack bitcoin ocminer, a poster on Bitcointalk forums via Bitcoin. According to him, a hacker used "several bugs" in Verge's code to mine an extraordinarily large number of new blocks in Verge's blockchain, thus rewarding himself with a lot of Verge coins.

But even though this attacker technically managed to capture the majority of mining power on Verge's network, this type of attack wouldn't work on Bitcoin. In PoW-based cryptocurrency systems, miners are people who use computing power to validate the transactions on the network and are awarded in new coins. In Verge's particular case, it's a little more nuanced.

Verge 51 percent attack bitcoin five different cryptographic algorithms for mining, switching to a new one for every block, but the attacker figured out a way to fake timestamps of his blocks and mined them all with one algorithm. In this way, he was able 51 percent attack bitcoin capture the majority of the network's mining power with far less computing power than he'd normally need. Nevertheless, the attack is serious as it requires a hard fork cryptocurrency lingo for a very big upgrade that leaves the old blockchain behind and requires all participants to switch to new software to exclude the blocks the attacker had mined.

Verge's official Twitter account tried to downplay the severity of the attack by calling it a "small hash attack" that's been "cleared 51 percent attack bitcoin now. We had a small hash attack that lasted about 3 hours earlier this morning, it's been cleared up now. We will be implementing even more redundancy 51 percent attack bitcoin for things of this nature in the future!

But Reddit and some experts seem to disagree. And a poster on the Bitcointalk forums called IDCToken, who claims he's responsible for the attack, said there are two more exploits in the Verge's code that could be used to perform a similar hack. Verge's price fell These attacks are notable as they show that even a seemingly foolproof PoW system can be tricked. Ethereum has already had one hack of large magnitude in its history while Bitcoin has mostly stood the test of time in its nine years of existence, but it'd be imprudent to completely brush off the possibility of this happening to any cryptocurrency, even the most thoroughly tested one.

We're using cookies to improve your experience. Click Here to find out more. Tech Like Follow Follow. This bitcoin wallet claims to be hack-proof.