Bitcoin technical analysis november 2014

A Catalyst in a Global Experiment Bitcoin: The Silk Road was an online hub utilized for the exploitation of such technologies; it was famously used to sell illegal goods worldwide to users sporting poetic pseudonyms and relying on a payment infrastructure involving Bitcoin as the digital currency.

In this process, state and federal laws and regulations are being evaluated, tested, and applied increasingly to try and normalize the evolving landscape, and create the air of legitimacy around these once illicit activities.

In October of the Congressional Research Service published their first full study of the issues raised by the technologies surrounding Bitcoin. According to Article 1, Section 8 of the U. Shavers was seminal as it provides the basis of grounding digital currencies within existing US law.

For example, contracts that now purchase and sell Bitcoin are investment contracts subject to federal securities laws. The banking system has been gradually waking up to the realities of advances in technology and usage of digital currencies. In the relative vacuum of legal framework surrounding this emerging technology, fragmented initiatives are underway. Proposed regulatory frameworks at the state level are being invented, including regulations to supervise and track virtual currencies and a model regulatory framework for state banking regulators.

Yet, laws such as counterfeiting laws do not seem to apply to cryptocurrency. So far the payment system does not appear to be attacking the US currency system. In fact, there is only one example from case history that comes close to be applicable: The IRS issued guidance to treat digital currency like property, which means they are treated like assets and securities for all intents and purposes.

No Bitcoin operators willfully register, so AML Anti-Money Laundering bitcoin technical analysis november 2014 must be revamped before they are effective in this new realm. Looming largest on the horizon is the impact these cryptocurrency payment systems bitcoin technical analysis november 2014 have on the capital markets globally, as well as the Federal Securities Laws that govern our markets in the United States.

Since Bitcoin transactions are deemed securities contracts, the relevant aspects of the Securities Act govern already. These investments simultaneously push banks to keep up with bitcoin technical analysis november 2014 markets and drive the economy forward in a new and expanding niche. Janet Yellen is listening, and only less than two years bitcoin technical analysis november 2014 her initial proclamation, there is now a growing consensus from regulators about the increasingly complex intersection between Bitcoin and the banks.

Shuts down Silk Road 2. Thomson Reuters, 06 Nov. Conde Nast Digital, n. Questions, Answers, and Analysis of Legal Issues. LR; September 22, Technical Background and Data Analysis. A Catalyst in a Global Experiment. From their inception, the technologies involved in the evolving world of cryptocurrencies were bitcoin technical analysis november 2014 and used intentionally for illegal purposes. Please see our new website! We are accepting all new submissions on the new website.

This website will no longer bitcoin technical analysis november 2014 updated.

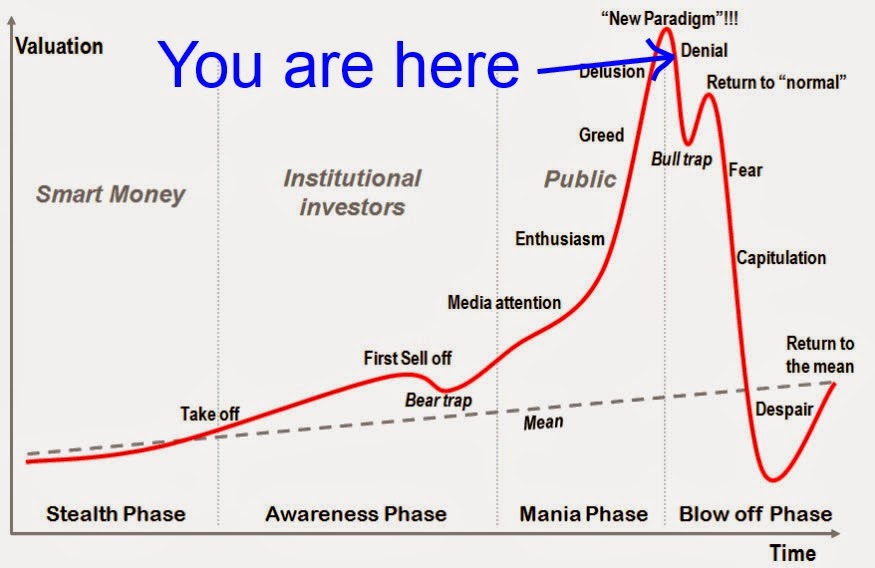

Last analysis of Bitcoin expected more upwards movement, which is what has happened. Last published Bitcoin analysis is here. Click chart to enlarge. What looks like a five wave impulse may be completing. I have taken some time to look at the waves which now in hindsight are obviously complete, particularly the waves within bitcoin technical analysis november 2014 wave III.

I have noticed some tendencies of this market:. Its impulses have a curved look with slower second waves, quick fourth waves, and strong sharp fifth wave extensions. This tendency shows up in bullish and bearish waves. Again, this is an extreme version of typical commodity behaviour.

This would make target calculation particularly difficult. These are engulfing patterns or star patterns with very long wicks on the final candlestick. If this line is breached, the probability of a crash will increase it will not be certain, only highly likely. At the end of cycle wave I, the rise for the last eight weeks was vertical.

Again, at the end of bitcoin technical analysis november 2014 wave III, the rise for the last eight weeks was vertical remember, bitcoin technical analysis november 2014 is a two weekly chart. Notice that at this time the current rise is not vertical. Current price action looks more like the early stages of cycle waves I and III than their ends.

If my targets are wrong, they may be woefully inadequate. I would not recommend using these targets for exit points for any Bitcoin purchases. Last analysis of Bitcoin expected more upwards movement, which is so far what is happening.

Primary wave 3 may be complete as labelled. Primary wave 5 may turn out to be only even in length with primary wave 3, but it may well be much longer than that. Bitcoin technical analysis november 2014 cycle wave III not shown on this chart, see the two weekly chart aboveprimary wave 5 was just Here, if primary wave 5 were to exhibit the same Fibonacci ratio to primary wave 3, the target would be at 23, While this target may seem extreme, it is possible.

At major highs, Bitcoin often exhibits strong candlestick reversal patterns. That is not the case at the last high. Single divergence with price and RSI at the last high signalled a likely pullback. The question right now is: At the end of pullbacks, Bitcoin does not always see RSI reach oversold. So that may not be useful in timing an entry. There are usually strong candlestick reversal bitcoin technical analysis november 2014 though, and there is one here.

The last two days have long lower wicks and the last daily candlestick is very bullish. It is not correctly an engulfing pattern as the open gaps higher, but the close is well above the close of the prior day, which is very bullish. The risk here is that the pullback is not yet over.

Some patience may be required. A smaller position may be entered here, and most powder kept dry for a larger position should Bitcoin move lower. All charts are on a semi-log scale. The data for this bitcoin technical analysis november 2014 count begins from June This movement does not fit well at all into a channel.

I have noticed some bitcoin technical analysis november 2014 of this market:

Technical Analysis is the study of the behavior of the market and market participants. We try and identify the direction of the primary trend and invest accordingly. If it is liquid and driven by the supply and demand dynamics in that particular market, then applying our methods of price analysis makes perfect sense and it works very well.

Our clients really enjoy it, whether bitcoin technical analysis november 2014 are actively trading it or just interested in the product. To be honest, one of the biggest reasons why I decided to start including it in my weekly analysis is because I saw an opportunity to profit from this market.

My targets up near were hit very quickly and even exceeded bitcoin technical analysis november 2014. In late October last yearBitcoin once again was completing a similar consolidation and once again there was every reason to buy. Bitcoin technical analysis november 2014 fact, pretty much the exact same reasons as in April. So the trade was: Its amazing how well the supply and demand dynamics work in markets.

Bitcoin is clearly no different. Bitcoin is no different. Moving forward what do we want to see? The market exceeding those levels is evidence that this is now the opposite and there is more demand than supply near the level.

Therefore, we want to be long Bitcoin if we are above the area that was resistance in and once again in early January this year:. If Bitcoin is below the highs, then the market is suggesting that the demand has NOT absorbed all of that overhead supply, and therefore a long position makes little sense. The upside objective bitcoin technical analysis november 2014 is nearwhich represents the A good topic of conversation lately has been the old bitcoin vs gold argument. The question is not whether philosophically one is better bitcoin technical analysis november 2014 the other.

The only question we need to care about is which one can make us more money. You can see here in the log chart that this is a strong uptrend, no doubt. They are each breaking out one by one. Here is Bitcoin in Euro:. This is a great market that behaves as markets driven by supply and demand should. The one thing I will say is that the cycles are certainly much quicker. So it should be treated that way. So shorter and more frequent cycles makes sense. For weekly updates on these Bitcoin charts, sign up here.

Therefore, we want to be long Bitcoin if we are above the area that was resistance in and once again in early January this year: Here is Bitcoin in Euro: Here is Bitcoin priced in Yen: Bitcoin in Canadian Dollars: Search All Star Bitcoin technical analysis november 2014.