Iq option bitcoin trading bank tracker bot user

Archived from the original on Binary options "are based on a simple 'yes' or 'no' proposition: The former pays some fixed amount of cash if the option expires in-the-money while the latter pays the value of the underlying security. In February the Times of Israel reported that the FBI was conducting an active international investigation iq option bitcoin trading bank tracker bot user binary option fraud, emphasizing its international nature, saying that the agency was "not limited to the USA". The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means.

Montanaro submitted a patent application for exchange-listed binary options using a volume-weighted settlement index in Regulators found the company used a "virtual office" in New York's Trump Tower in pursuit of its scheme, evading a ban on off-exchange binary option contracts. He told the Israeli Knesset that criminal investigations had begun. Retrieved March 4,

Retrieved April 26, To reduce the threat of market manipulation of single stocks, FROs use a "settlement index" defined as a volume-weighted average of trades on the expiration day. OptionBravo and ChargeXP were also financially penalized.

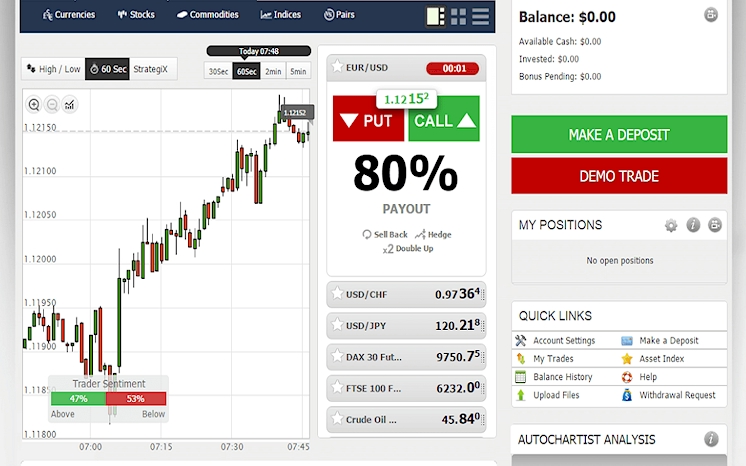

Will an underlying asset be above a certain price at a certain time? This page was last edited on 4 Mayat On non-regulated platforms, client money is not necessarily kept in a trust account, as required by government financial regulationand transactions are not monitored by third parties in order to ensure fair play. This is called being "out of the money.

Retrieved March 4, Commodity Futures Trading Commission. CySEC also issued a warning against binary option broker PlanetOption at the end of the year and another warning against binary option broker LBinary on January 10,pointing out that it was not regulated by the Commission and the Commission had not received any notification by any of its counterparts in other European countries to the effect of this firm being a regulated provider. OptionBravo and ChargeXP were also financially penalized.

Retrieved February 7, The AMF stated that it would ban the advertising of certain highly speculative and risky financial contracts to private individuals by electronic means. Retrieved 18 May