Bitbills bitcoin exchange rate

31 comments

Bitcoin mining 2013 worth it

What is a 51 percent attack, and why are Bitcoin users freaking out about it now? Threat of a 51 percent attack was, up until very recently, a theoretical problem that would only come about if one entity came to control more than half of the computing power being used to mine Bitcoin. IO, flirted with, and may have even surpassed, 51 percent. To mine Bitcoin, one just needs to run the Bitcoin software on a computer.

At this point, no ordinary computer is powerful enough to mine Bitcoin. It takes fantastic computing power to compete, the likes of which you can only get by a machine specifically designed for this type of task.

Even with a custom Bitcoin-mining machine, there is still much competition. Many miners have joined forces to form mining pools in hopes of being able to uncover blocks more regularly, then split the reward. The people trying to mine Bitcoin are the same ones tasked with auditing the network by confirming Bitcoin transactions. When the network signs off on the confirmation, the transaction goes through and those who confirmed it receive a small transaction fee.

So, basically, an entity that controls most of the mining power also controls most of the auditing power. If it chooses to act maliciously, that entity could potentially spend the same Bitcoin twice.

All Bitcoin miners are trying to solve a sort of mathematical problem based on the most recently discovered block on the blockchain, which is called the lead block. Even though there are multiple solutions to each problem, the blockchain must remain as one long continuous entity.

Maybe 75 percent of the miners saw your solution first and began hashing on the block you discovered, but only 25 percent saw mine. In all likelihood those 75 percent will determine a solution to your block before the 25 percent determine a solution to mine. Either way, when an acceptable solution is published for either of the blocks, that part of the chain becomes the longest and all miners resume hashing on the longest continuous chain. A selfish miner looking to execute a 51 percent attack starts by solving that problem but not publishing the solution.

While the rest of the network is still searching for that initial solution, the selfish miner begins working on the next problem. If the selfish miner solves the second problem before the rest of the miners solve the first, the network is in deep trouble. The selfish miner continues to secretly get as far ahead as possible.

When the other miners eventually publish a solution to the initial problem, the selfish miners immediately publish their hidden solution causing a fork.

Then, as the network goes to determine which solution came first, the selfish miners publish their second solution making their chain the longest and thus the most legitimate. Not only that, but the selfish miners have a head start in hashing off the second published block.

They might have already found the solution. They might be 20 blocks ahead and no one would know. If this happens, honest Bitcoin miners have no chance to discover new blocks, and all the rewards go to the selfish miner.

Bitcoin Mining is Vulnerable. At the time, it seemed implausible to many that a pool would ever grow to 51 percent. In reality, Bitcoin has proved time and again that it is resilient, and it has overcome many obstacles.

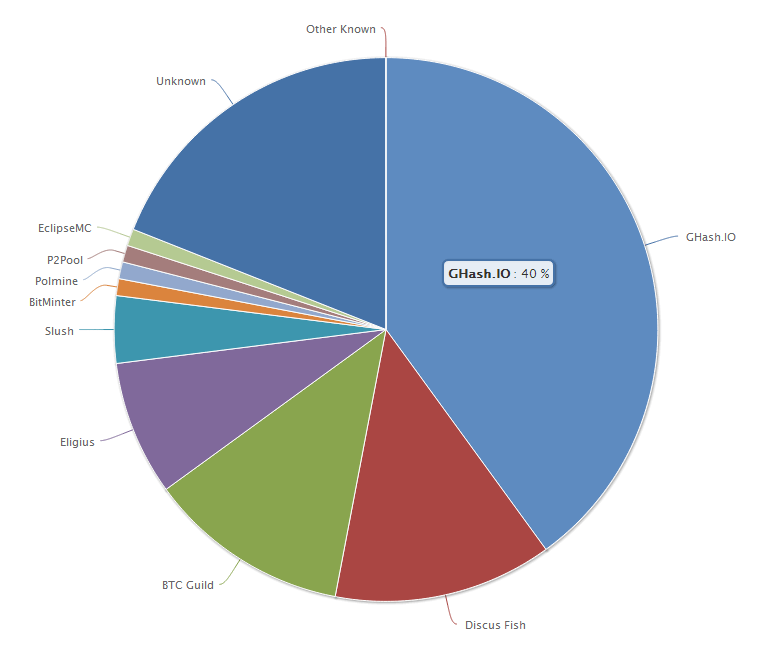

Earlier this year, GHash. IO has not replied to our inquiry as to its apparent change of heart. Smith said the following:. We understand that the Bitcoin community strongly reacts to GHash. However, we would never do anything to harm the Bitcoin economy; we believe in it. We have invested all our effort, time and money into the development of the Bitcoin economy.

We agree that mining should be decentralised, but you cannot blame GHash. IO for being the number one mining pool. Not exactly a confidence-inspiring response, but the situation is not quite dire for the moment, as GHash. IO at closer to 40 percent of the mining power. One way or another, this appears to be an important crossroads for Bitcoin, and an issue so often-discussed that it seemed inevitable that it would one day come to pass. If a greedy attacker is able to assemble more CPU power than all the honest nodes, he would have to choose between using it to defraud people by stealing back his payments, or using it to generate new coins.

He ought to find it more profitable to play by the rules, such rules that favour him with more new coins than everyone else combined, than to undermine the system and the validity of his own wealth.

Actually, this might be a real danger to the cryptocurrency. It works something like this: Smith said the following: Up next after the break: Your complete guide to Bitcoin 2. Recommendations Donald Trump Apple vs.