Reddit buy bitcoin canada

26 comments

Bitcoin exchange uk paper

Preface This guide is not intended to be complete by any means. It's intended to help you get started in learning about how to trade and analyse charts. The best exchanges for our purposes at time of writing are Poloniex, Bittrex, Kraken. Position - A position is the amount of a security, commodity or currency that is owned a long position or borrowed and then sold a short position by an individual, institution or dealer investopedia. Long - When you go 'long' on a currency you believe it will go up in value.

To go long you buy some amount of the currency and hold on to it, you plan to sell it when it is higher. John thinks BTC will rise. Short - When you go 'short' on a currency you believe it will go down in value. To go short you borrow some amount of the currency from the exchange and sell it instantly.

Then when the price is lower you buy that same amount you borrowed and give it back to the exchange with fees. Mark thinks BTC will fall. Trade Volume - This is the amount of trade done on a currency in the last 24 hours, often shown in BTC.

High volume is good, low volume bad. It is an important metric as it can show you the amount of interest there is versus other coins. It also shows that trade is actually being done with the currency, there's no point buying a currency if there's no one to buy it from you later.

It is called a trap because a bullish investor fooled by it will buy bad stock that will continue to decline. Bear Trap - A bear trap is an inaccurate signal that a rising stock is going to stop increasing and start decreasing when it is actually going to keep rising or stabilise. They are the cryptocurrency equivalent of an IPO. A large amount or all of the currency is sold at a certain time to raise money for development.

Margin - Margin trading is essentially trading with borrowed funds. Exchanges vary in how they handle this and how much money you can trade with on loan but the basics of it are usually the same. You must have a certain amount of money on your account as collateral, the more collateral you have the larger the loans you can take.

If you make a loss you lose some of your collateral or all of it if you get liquidated. Liquidation - Most exchanges employ a policy of forced liquidation in the event your collateral does not cover your current loss on margin trades.

Volatility - This refers to how often the price of a currency is changing. The opposite of volatile is stable. If a coin is very stable then the price stays the same and there is not much profit to be made from it I'm looking at you LTC. Therefore a coin must have some volatility to be worth trading.

Weak Hands - This is a condition that predominantly affects newbie traders. They buy a currency and it suffers a small dip, they see it and they panic-sell all their coins often at a loss. Later that day the price of the currency increases. If they hadn't been so nervous they would have profited. A lot of people have weak hands, this can sometimes lead to a currency plummeting from only minor dips in price. FOMO - Fear of missing out. Wikipedia describes it as "a pervasive apprehension that others might be having rewarding experiences from which one is absent".

In the context of trading it can mean making bad decisions from fear of missing out on an opportunity eg. People spread FUD to lower the price of something or to encourage people to use a competitor instead. More common on smaller cryptocurrencies that have less activity but also at times when a currency has a lot of movement. Do your own research, make your own decisions. Mary doesn't care about you. Whales - These are traders with a lot of money and coins.

Because of the small market size of some currencies they can have a huge effect on the currency. Pump and Dump - This is a method whales can use to manipulate a specific currency. You do not have to be "in on" a pump and dump to profit from one if you recognise it happening. If you think the coin isn't worth its current price then short it.

If you see a dump happen and you think the coin will go back up then buy it while it's cheap. Arbitrage - The practice of taking advantage of a price difference between two or more exchanges.

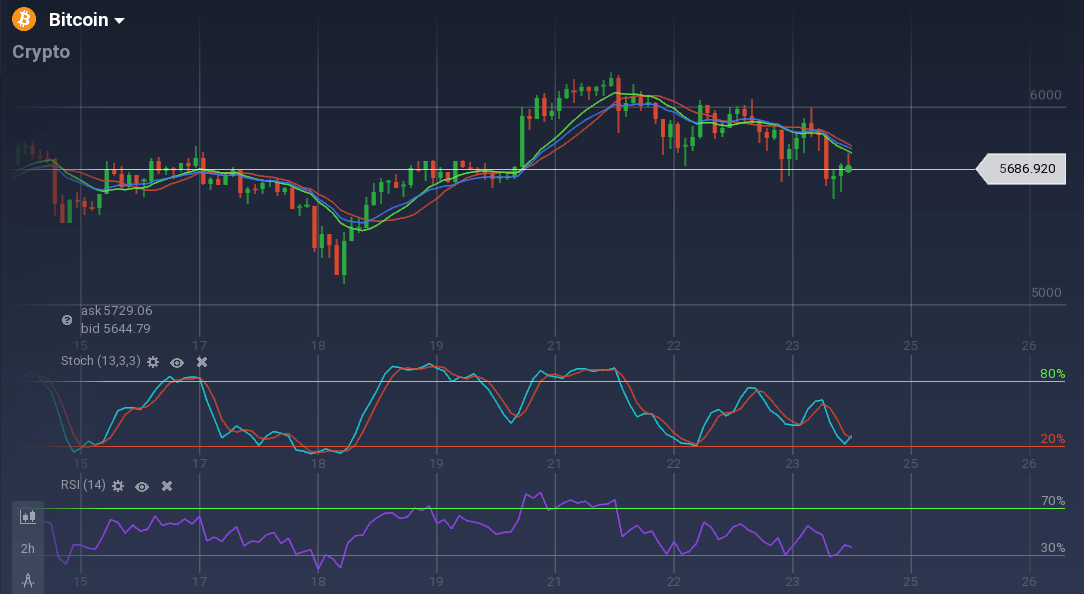

There is a lot of arbitrage strategies but here is a simple one for the sake of explanation: There are risks involved in this form arbitrage but some strategies are almost risk free. In the example if the trader fails to move his currency between the exchanges fast enough the prices may change and he may make a loss. Blackbird is an interesting project based on arbitration on cryptocurrency markets: Graphs and Charts To be a good cryptotrader you have to be able to read the graphs and charts.

This is the most common chart you will see. The X-axis from left to right represents time, the Y-axis up and down represents price. The vertical bars are called candlesticks. The taller the stick the bigger the change. Open means the price at the start of the hour or whatever each stick represents , close means the price at the end of the hour.

The high and the low as explained previously are the highest price and lowest price within the hour. The market depth graph can help visualise the demand for a currency and where the price might be headed. The X-axis shows the price or the currency, the Y-axis shows the amount of the currency.

The green represents the buy orders and the red represents the sell orders. I got this graph from Poloniex, other places might have different colours. If there is a lot of buy orders the green part of the graph will be bigger and we can say the price may rise. If there is a lot of sell orders the red side will be bigger and we can say that the price may fall. This graph can be misleading however. Credit to James Logan for some of this: Talk about how great the developers are, shittalk coins that compete with them, argue about how the features the coin provides are the future.

Try to make your arguments as persuasive as possible. It might also be worth making a weak point, getting in an argument then backing up your weak point with a stronger one you have prepared. Step 3 - Buy in a way that makes the stats look appealing pump What I mean by this is buy and sell repeatedly to increase volume. Step 4 - Shill coin pump Shortly after your initial investment in a coin you should start doing this. Step 5 - Gradually sell your position dump I say gradually because for maximum profit you want to sell as much of your coin as possible at a high price, if you dump all your coin suddenly you may not get the optimal profit.

You should be doing it once you think your shilling is getting closer to a peak. You might also benefit from counter-shilling shilling for the price to go down. Links and Resources I highly recommend reading the guides on the exchanges you choose to use, they are often really good and detailed. Be aware that not every market operates the same.

CoinMarketCap is a good site for looking at different currencies: CoinGecko is also good for comparing currencies, also has stats for social popularity of a currency. The Blockfolio app is handy for keeping track of your holdings: Google Talks on Investment: Join Crypto Traders Room chatroom: Source for the tutorial: You have completed some achievement on Steemit and have been rewarded with new badge s:.

Click on any badge to view your own Board of Honor on SteemitBoard. For more information about SteemitBoard, click here. If you no longer want to receive notifications, reply to this comment with the word STOP.

By upvoting this notification, you can help all Steemit users. Trading is not for the faint hearted. I take no responsibility for any losses you may incur. Do not trade more than you can comfortably lose. Trading can be addictive, like gambling, try to control your impulses. The best exchanges for our purposes at time of writing are Poloniex, Bittrex, Kraken Position - A position is the amount of a security, commodity or currency that is owned a long position or borrowed and then sold a short position by an individual, institution or dealer investopedia.

To go long you buy some amount of the currency and hold on to it, you plan to sell it when it is higher Ex: The highest price the coin has ever been. The Pump - They buy a lot of the currency, hype it up, some may even inflate the volume by doing trades with themselves. The Dump - Then when the coin is significantly higher they sell dump all their coins.

They profit from the increase and the price plummets. The trader buys the currency at exchange A and sells it quickly at exchange B. Market Depth The market depth graph can help visualise the demand for a currency and where the price might be headed.