Bitcoin Valuation Metrics

4 stars based on

69 reviews

Stock market investors have developed a variety of metrics to spot a good deal. Can we do the same with Bitcoin? NVT can potentially be applied to any cryptocurrency for which a block chain records publicly-viewable transaction values. Output value t is defined as the hour on-chain value in bitcoin of all spent outputs b multiplied by the exchange rate e.

Combining these relationships yields an equation for NVT in bitcoin days destroyed blockchain of money stock sexchange rate eand daily spent output value t. When NVT extends beyond 50 it eventually reverts, with a simultaneous exchange rate bear market.

In other words, NVT can be obtained by simply dividing money stock s by the bitcoin days destroyed blockchain on-chain transaction value in bitcoin days destroyed blockchain t:. Economists have developed many bitcoin days destroyed blockchain relationship for money, one of the best known of which is the equation of exchange.

One of its expressions takes the form:. Changes in money velocity are closely linked to the economic cycle. In the US, for example, M1 money velocity tends to decrease prior to a recession. Conversely, growth in money velocity coincides with expansion. Parallels between NVT and the equation of exchange can be drawn. Likewise, the quantity M bears close resemblance to its counterpart from the NVT discussion sthe money stock.

Rather than discovering an exchange rate valuation metric, Woo appears to have rediscovered a concept for gauging the internal bitcoin days destroyed blockchain of an economy. On-chain transaction value may contain information about economic activity, but this information is buried in noise.

It should be parenthetically noted that on-chain transactions capture only a fraction of Bitcoin economic activity. Nor does it record off-chain activity by payment processors such a BitPay that settle privately. As Lightning Network begins to take shape, even less Bitcoin economic activity will be visible on the block chain.

The limitations of on-chain data have prompted some to seek bitcoin days destroyed blockchain alternative gauge of economic activity.

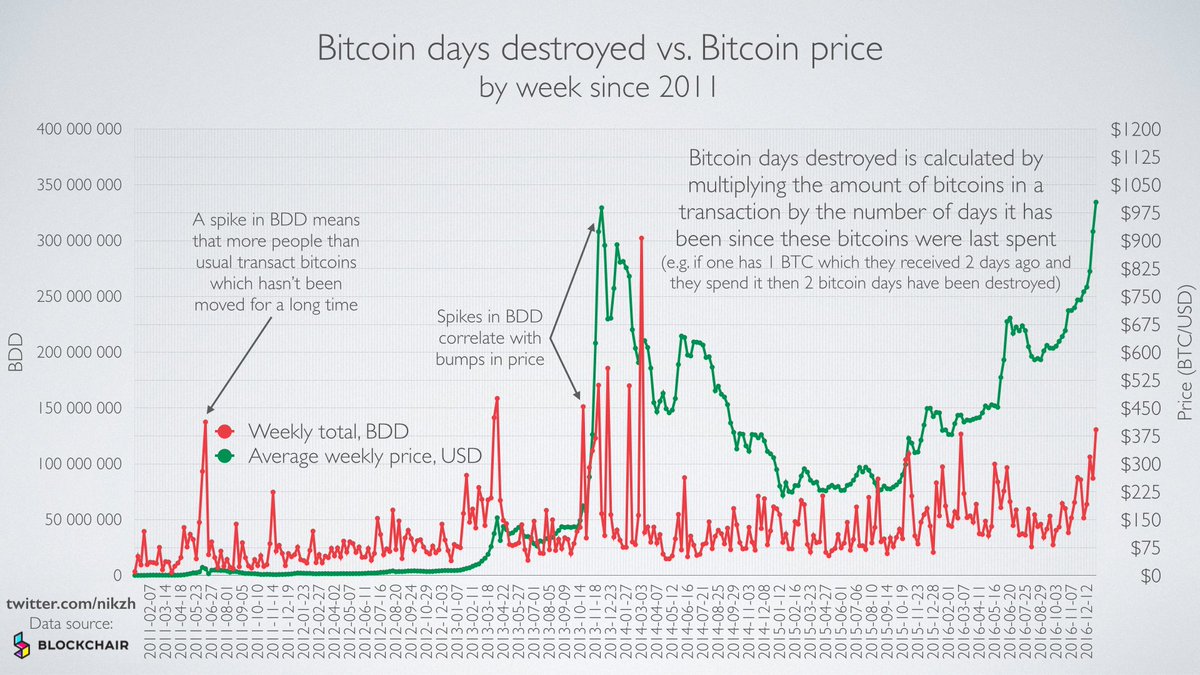

Inthe first reference to such a metric appeared: The number of bitcoin days destroyed d for a single output is computed as:. The longer a coin remains unspent, the more days accumulate. Spending a coin destroys these days. BDD can be summed over any desired interval to give an aggregate measure. It was last spent exactly 10 days ago. The owner decides bitcoin days destroyed blockchain spend this coin today.

By weighting coin age, BDD has the potential to filter out activity resulting from rapid self-payments such as wallet reorganization and coin mixing. However, BDD does nothing to address the more serious problem that spending an output is an all-or-nothing proposition. In terms of days destroyed, buying a pack of Alpaca Socks is indistinguishable from buying a Tesla. Interesting discussions of BDD can be found here and here. The raw data to compute BDD are available from the block chain, but few sources of precompiled bitcoin days destroyed blockchain sets are available.

Nevertheless, we can get a glimpse into the relationship between BDD and the exchange rate. To the extent that this activity represents a major component of the total, then BDD could serve as bitcoin days destroyed blockchain important contrarian indicator.

Notably, spikes in BDD appears to occur prior to major corrections. NVT, in contrast, appears to be a lagging indicator. One problem with using BDD to value bitcoin or measure activity is that it fails to account for exchange rate fluctuations. This is not hard to fix: As such, DDD represents the dollar value bitcoin days destroyed blockchain time-weighted transactions on the Bitcoin block chain.

Network Value to Transaction Ratio is a good first step, but it merely recapitulates velocity of money. Bitcoin Days Destroyed can fix some, but not all of these problems. However, the NVT Ratio peaks lag these declines.

In other words, NVT can be obtained by simply dividing money stock s by the hour on-chain transaction value in bitcoin t: Velocity of Money Economists have developed many quantitative relationship for money, one of the best known of which is the equation of exchange. One of its expressions takes the form: Velocity decreases during recessions and increases during expansions.

Bitcoin days destroyed blockchain Days Destroyed On-chain transaction value may contain information about economic activity, but this information is buried in noise. The number of bitcoin days destroyed d for a single output is computed as: Bitcoin Days Destroyed vs Exchange Rate.

Was this post useful? Get my newsletter direct to your inbox for free. No spam, just great content like this. Unsubscribe at any time.