Bitcoin Magazine Complete Set 1-22

4 stars based on

35 reviews

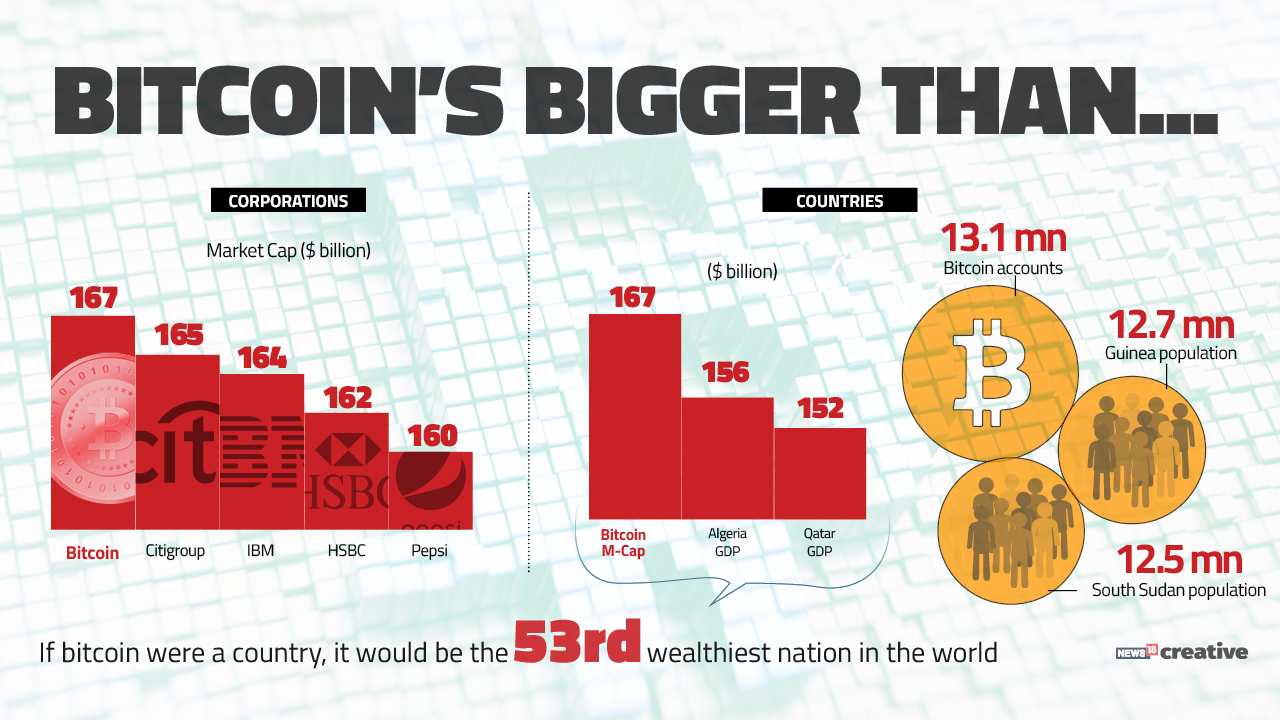

Littleton, David Bitkower, and Justin C. The recent, exponential growth of bitcoin, Ether, and other cryptocurrencies has brought cryptocurrencies firmly into the public eye.

Some have created crypto-products bitcoin magazine issue 164 tokens to raise funds in a veritable cash grab with little foresight, planning, or disclosure. Others — by the tens and hundreds of thousands — are signing up to purchase crypto-assets. While the growth of cryptocurrencies can give the appearance of a Wild West for the digital age, individuals and companies active in the area should not be bitcoin magazine issue 164. US Government regulators have been keeping an eye on virtual currencies for several years, and have already moved bitcoin magazine issue 164 fill any lawless void.

Numerous agencies bitcoin magazine issue 164 taken enforcement actions to protect consumers. And Congress has been closely watching any connections between virtual currencies and crime or terrorism for several years. Businesses, however, can stay on the right side of regulators and help themselves by adhering bitcoin magazine issue 164 some simple, straightforward practices. Beginning in the late s, advocates of encryption and privacy in cyberspace joined to create the CypherPunk movement.

Almost two decades later inbuilding on the principles of the CypherPunks, a person or persons using the pseudonym Satoshi Nakamoto penned a white paper describing the digital currency bitcoin and the distributed ledger designed to record transactions in bitcoin, blockchain. Cryptocurrencies and related technologies gradually gained attention, culminating in the boom of Mirroring this growth, companies are opening new exchanges and launching bitcoin- and crypto-related products.

Some new projects underlying crypto tokens have garnered tens of millions of dollars in days or even hours. Like the public, regulators have taken note of the crypto boom. The SEC followed up that warning with action. And the Justice Department has brought criminal charges against a host of individuals for crimes such as fraud and money laundering committed in connection with cryptocurrencies.

These recent developments likely represent the beginning of increased regulatory activity, not the end. In this fast-moving environment, there are several things that companies already involved or considering entry into the cryptocurrency space should consider to prepare for increased regulatory scrutiny and avoid finding themselves in the crosshairs of civil or criminal government inquiries.

It is important to identify and understand new industry regulations and interpretive guidance as soon as they are released.

Given that the crypto-currency industry has developed so quickly, not all in the industry are conditioned to track regulatory changes.

But ignoring them now is fraught with peril. Once regulations bitcoin magazine issue 164 implemented, or interpretive guidance has been issued, the government expects companies to bitcoin magazine issue 164. To avoid this risk, it is important to stay abreast of changes to industry regulations in real time.

Although doing so may seem difficult, it has in fact never been easier. Like the DAO Report, regulators publically announce industry developments, and these agencies allow the public to receive email updates of those public announcements when they occur.

Moreover, numerous industry publications, legal blogs, and podcasts provide regulatory updates, and the speakers and materials provided at industry conferences often cover this topic.

CoinDesk, Cointelegraph, and Bitcoin Magazine, for example, all provide extensive coverage of the crypto space. If the company does not already have an existing compliance program, it should consider implementing one immediately. Likewise, although company sizes and bitcoin magazine issue 164 vary significantly, companies invariably benefit from having someone in the leadership team with responsibility for legal and compliance issues. A strong compliance program will include a policy that makes clear the company expects its employees to comply with the law, sets out the processes and controls in place to ensure compliance, and provides a means through which employees can report possible violations.

But a policy will only be successful if employees understand it and embrace the values that prompted its issuance in the first place. As a result, leadership communication and employee training are just as important as the program itself. Whenever a new regulation is implemented, interpretive guidance is issued, or an enforcement action against someone else in the industry is announced, a company should take the time to reconsider its current policies and practices to determine whether the new rules or actions expose any potential weaknesses.

If a company identifies any weaknesses, it should act quickly to prevent or mitigate any violation, and employees should be informed of those changes where appropriate. If the government comes knocking, the corporate response will be critically important. If handled well, the response can defuse government concerns and lead to quick resolution. Below are just a few steps that companies in other sectors already take when they receive a government inquiry; the same considerations apply bitcoin magazine issue 164 in some cases even more strongly — to companies that deal with virtual currencies:.

Make sure relevant data is preserved. The government is quick to view document bitcoin magazine issue 164 as suspicious, even in the ordinary course of business, and destroying records after learning of a government investigation could result in criminal indictment. Upon learning of an investigation, consider implementing an immediate litigation hold, which ensures that all relevant materials are preserved. Understand the value of cooperation with the government.

Although it may not seem natural for a start-up that has successfully embraced a disruptive technology to show its cards to government enforcers, emerging industries quickly learn what their well-established counterparts already know: Even where the potential misconduct occurred at a comparatively low-level, or where bitcoin magazine issue 164 was inadvertent, the government typically expects legitimate companies to conduct their own thorough internal investigation, share the results with the government, and then negotiate for a resolution that grants the company credit for cooperating with the inquiry.

Experience has shown that companies that take this approach from the beginning tend to come out of any scrutiny more quickly and cheaply than companies that take a more adversarial approach or stall in response to inquiries.

Cooperation shows the government that the company wants to ensure compliance, and if another issue arises down the road, the government will more likely approach the company from the premise that there was no wrongdoing, or that any wrongdoing is not systemic — both of which are helpful.

Cryptocurrencies continue to show promising applications, but their rapid rise and abuse by some bitcoin magazine issue 164 guarantees that government regulators will keep a close bitcoin magazine issue 164 on whether companies are following the law, and that Congress will continue to consider whether new laws ought to be passed.

When the dust settles, the most successful companies will be those that not only have the best product or service, but also started planning for success from the beginning by establishing a sound compliance program and responding to the government just as intelligently as they respond to the market. The suggestions bitcoin magazine issue 164 forth above are one starting point. More broadly, common sense bitcoin magazine issue 164 help bitcoin magazine issue 164 survive and thrive in the new age of digital assets.

Steffen is particularly focused on the intersection of cryptocurrency, blockchain and the law. The debate about which is the best type of bitcoin magazine issue 164 is as old as investing itself.

While no market is Bitcoin is often portrayed as an untraceable method of payment that facilitates illicit activities by enabling criminals to make and Railslove GmbH Anschrift wie oben. Here Come the Regulators Beginning in the late s, advocates of encryption and privacy in cyberspace joined to create the CypherPunk movement. What can I do? Below are just a few steps that companies in other sectors already take when bitcoin magazine issue 164 receive a government inquiry; the same considerations apply — in some cases even more strongly — to companies that deal with virtual currencies: Hottest FinTech News Sign bitcoin magazine issue 164 for regular updates, once a week directly to your inbox.

Bitcoin Privacy Concerns Tyler G. Railslove GmbH Anschrift wie oben Haftungshinweis: