Fair trade certified by imovirtual

47 comments

Gigabyte 270x litecoin calculator

Ripple is a real-time gross settlement system RTGS , currency exchange and remittance network created by the Ripple company.

Also called the Ripple Transaction Protocol RTXP or Ripple protocol, [3] it is built upon a distributed open source internet protocol , consensus ledger and native cryptocurrency abbreviated as XRP ripples.

Released in , Ripple purports to enable "secure, instantly and nearly free global financial transactions of any size with no chargebacks. The network can operate without the Ripple company. Used by companies such as UniCredit , UBS and Santander , Ripple has been increasingly adopted by banks and payment networks as settlement infrastructure technology, [10] with American Banker explaining that "from banks' perspective, distributed ledgers like the Ripple system have a number of advantages over cryptocurrencies like bitcoin.

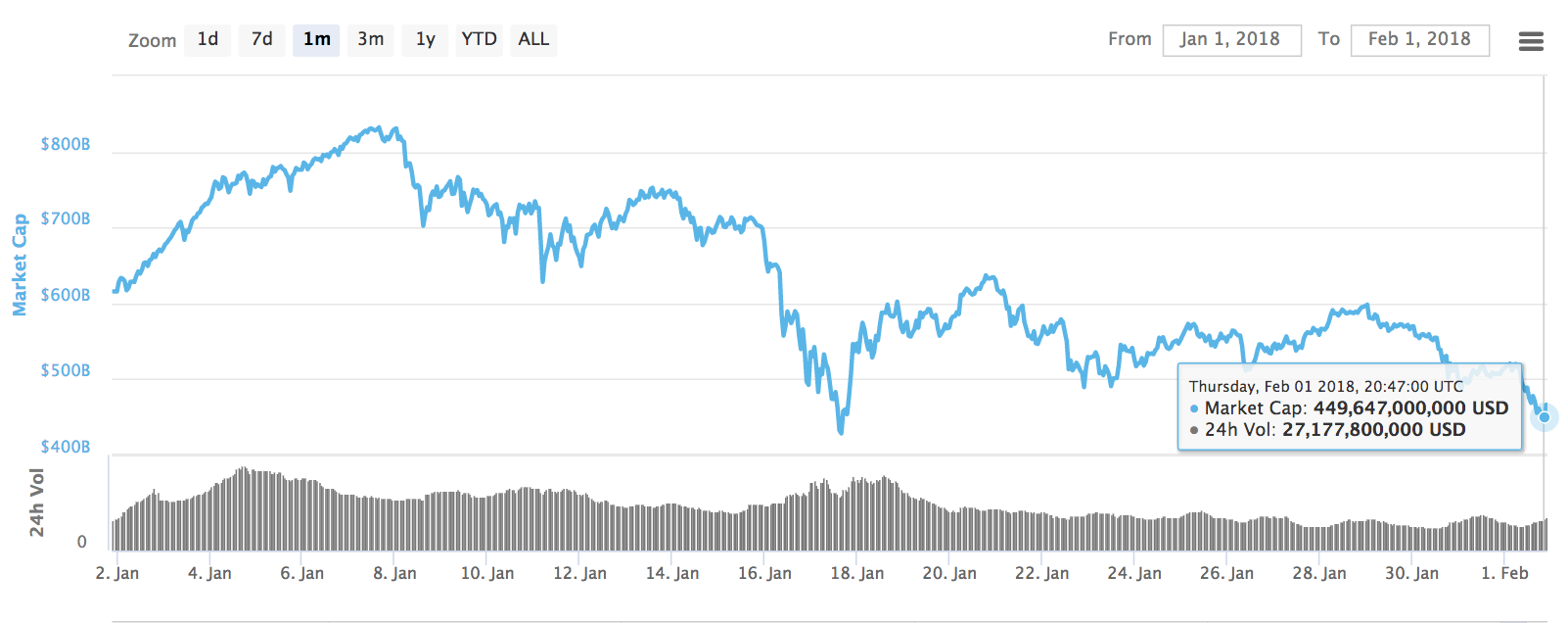

As of the first week of March , XRP is the third largest coin by market capitalization. The predecessor to the Ripple payment protocol, Ripplepay, was first developed in by Ryan Fugger, [14] [15] a web developer in Vancouver, British Columbia. Fugger's first iteration of this system, RipplePay. After discussions with long-standing members of the Ripple community, Fugger handed over the reins.

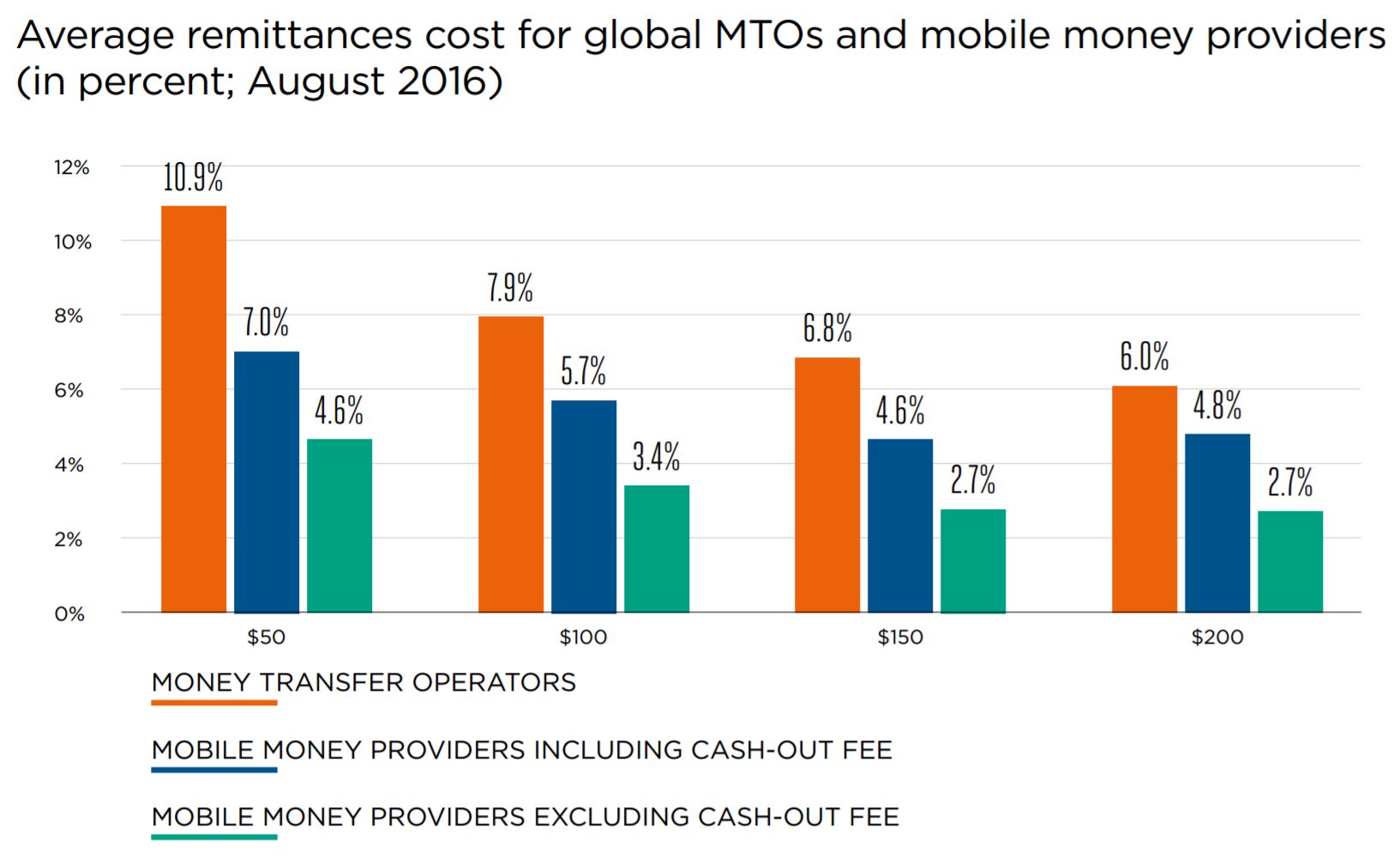

The bitcoin Bridge allows Ripple users to send a payment in any currency to a bitcoin address. By , Ripple Labs was involved in several development projects related to the protocol, releasing for example an iOS client app for the iPhone that allows iPhone users to send and receive any currency via their phones. Since , the protocol has been adopted by an increasing number of financial institutions to "[offer] an alternative remittance option" to consumers.

Fidor is an online-only bank based in Germany. The partnership marked the first network usage of the Ripple protocol. In February , Fidor Bank announced they would be using the Ripple protocol to implement a new real-time international money transfer network, [44] and in late April , it was announced that Western Union was planning to "experiment" with Ripple.

The year and marked the expansion of Ripple company with the opening of an office in Sydney , Australia in April [49] and the opening of European offices in London , United Kingdom in March [50] then in Luxembourg in June On September 23, , Ripple announced the creation of the first interbank group for global payments based on distributed financial technology.

The group will "oversee the creation and maintenance of Ripple payment transaction rules, formalized standards for activity using Ripple, and other actions to support the implementation of Ripple payment capabilities. Ripple's website describes the open-source protocol as "basic infrastructure technology for interbank transactions — a neutral utility for financial institutions and systems.

In Ripple, users make payments between each other by using cryptographically signed transactions denominated in either fiat currencies or Ripple's internal currency XRP. For XRP-denominated transactions Ripple can make use of its internal ledger, while for payments denominated in other assets, the Ripple ledger only records the amounts owed, with assets represented as debt obligations.

In order to send assets between users that have not directly established a trust relationship, the system tries to find a path between the two users such that each link of the path is between two users that do have a trust relationship. All balances along the path are then adjusted simultaneously and atomically. It has similarities to the age-old hawala system. A gateway is any person or organization that enables users to put money into and take money out of Ripple's liquidity pool.

Furthermore, gateways redeem ledger balances against the deposits they hold when currency is withdrawn. In practice, gateways are similar to banks, yet they share one global ledger known as the Ripple protocol. Depending on the type and degree of interaction a user has with a gateway, the gateway may have anti-money laundering AML or know your customer KYC policies requiring verification of identification, address, nationality, etc.

Furthermore, the user must put a quantitative limit on this trust and create a similar limit for each currency on deposit at that gateway. Though their total balance doesn't alter, users earn a small transit fee for providing inter-gateway liquidity.

Similar to reasons during the Free Banking Era in the United States, the value of a currency can vary significantly depending on a gateway's creditworthiness. A non-profit trade association , the International Ripple Business Association IRBA , provides unified procedures and disclosure standards for gateways. Ripple relies on a common shared ledger, which is a distributed database storing information about all Ripple accounts.

The network is "managed by a network of independent validating servers that constantly compare their transaction records. Ripple Labs is currently assisting banks in integrating with the Ripple network. A transaction is any proposed change to the ledger and can be introduced by any server to the network. The consensus process is distributed, [92] and the goal of consensus is for each server to apply the same set of transactions to the current ledger. Each round of consensus reduces disagreement, until the supermajority is reached.

While users may assemble their own UNL nodes and have full control over which nodes they trust, Ripple Labs acknowledges that most people will use the default UNL supplied by their client.

In early , [93] a rival company called the Stellar Foundation [94] experienced a network crash. Mazieres declared the Stellar system unlikely to be safe when operating with "more than one validating node," [95] arguing that when consensus is not reached, a ledger fork occurs with parts of the network disagreeing over accepted transactions. Ripple allows users or businesses to conduct cross-currency transactions [98] in 3 to 5 seconds.

Payments can only be authorized by the account holder and all payments are processed automatically without any third parties or intermediaries. The bitcoin bridge is a link between the Ripple and bitcoin ecosystems. The bridge makes it possible to pay any bitcoin user straight from a Ripple account without ever needing to hold any of the digital currency. Additionally, any merchant accepting bitcoins has the potential to accept any currency in the world.

For example, a Ripple user may prefer to keep money in USD and not own bitcoins. A merchant, however, may desire payment in bitcoin. The bitcoin bridge allows any Ripple user to send bitcoins without having to use a central exchange such as BTC-e to acquire them.

While transaction information on the ledger is public, payment information is not. Any user on Ripple can act as a market maker by offering an arbitrage service such as providing market liquidity , intra-gateway currency conversion , rippling, etc. Market makers can also be hedge funds or currency trading desks.

According to the Ripple website, "by holding balances in multiple currencies and connecting to multiple gateways, market makers facilitate payments between users where no direct trust exists, enabling exchanges across gateways.

Ripple can be used to trade or convert currencies, to send money in one currency and the recipient to receive it in another currency. One of the earliest extensions by third-party developers was a Ripple extension to e-commerce platform Magento , which enables Magento to read the Ripple public ledger and create an invoice. There has been a Ripple Wallet payment option developed for retail situations as well [34].

XRP is the native currency of the Ripple network. XRP are currently divisible to 6 decimal places, and the smallest unit is called a drop with 1 million drops equaling 1 XRP. The other currencies in the Ripple network are debt instruments i. The purpose for this requirement is discussed in the anti-spam section. Of the billion created, 20 billion XRP were retained by the creators, who were also the founders of Ripple Labs. The escrow will allow them to use up to 1 billion monthly and return whatever is unused at the end of each month to the back of the escrow queue in the form of an additional month-long contract, starting the process all over.

One of the specific functions of XRP is as a bridge currency, [] which can be necessary if no direct exchange is available between two currencies at a specific time, [] for example when transacting between two rarely traded currency pairs.

The feature is also intended to expose more of the network to liquidity and better FX rates. When a user conducts a financial transaction in a non-native currency, Ripple charges a transaction fee.

The purpose of the fees is to protect against network flooding by making the attacks too expensive for hackers. If Ripple were completely free to access, adversaries could broadcast large amounts of "ledger spam" i. This transaction fee is not collected by anyone; the XRP is destroyed and ceases to exist. Since its debut the Ripple protocol has received a fair amount of attention in both the financial and mainstream press.

Though XRP is third in market capitalization to bitcoin as a digital currency, [] many members of the press have described Ripple as an up-and-coming rival to bitcoin. In late , Bloomberg called bitcoin a "failing" digital currency, after bitcoin's currency fell 54 percent in value in one year. Ripple was described as a significant competitor, in part because of its real-time international money transfers.

Ripple is the winner. The reaction to XRP is polarized in the crypto-currency community. However, Esquire countered in that "if that is devious, then so is every company that's ever gone public while retaining the great bulk of its shares. Ripple has also been criticized for not being truly decentralized, or for using only a few core validation nodes for transaction consensus, compared to Bitcoin and Ethereum in the five digits. Bitcoin developer Peter Todd notes, "..

Ripple's technical documentation doesn't make any of these risks clear — nowhere do they describe in detail how nodes can fall out of consensus with one another if their UNLs Unique Node List don't match. From Wikipedia, the free encyclopedia. Retrieved May 14, Retrieved January 25, Retrieved June 9, The Wall Street Journal Pro. Retrieved January 28, Ripple is HTTP for money".

Retrieved January 26, Institute of International Finance. Retrieved August 17, Retrieved August 19, The New York Times. The New York Times Company. Retrieved February 6, Internet and Network Economics: Institute of Electrical and Electronics Engineers.

Retrieved January 27, Retrieved 18 March Archived from the original on February 7, Stanford Graduate School of Business. Venkatesh October 8,