TRX Binance - Cryptopia arbitrage opportunity

4 stars based on

44 reviews

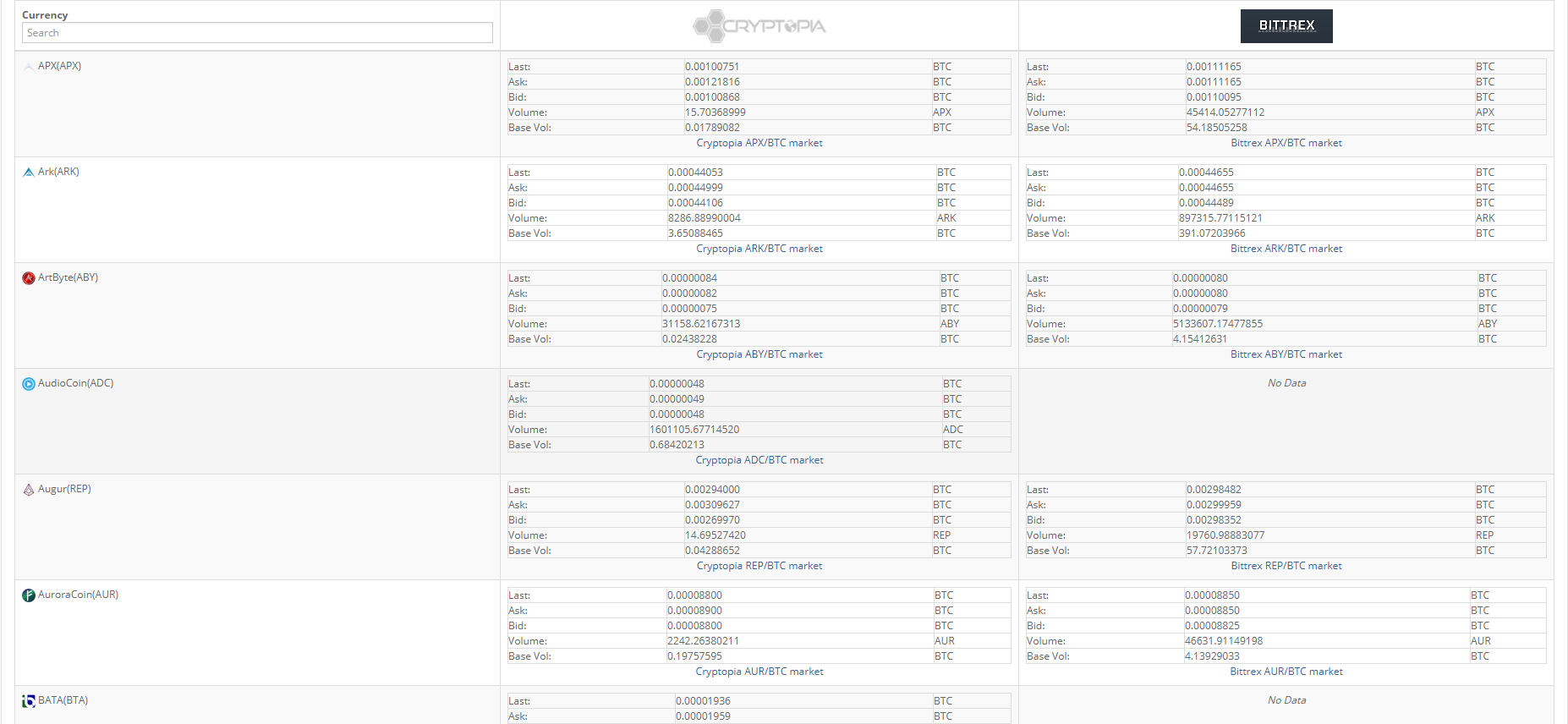

I stumbled upon an opportunity yesterday on Cryptopia, and I'm pretty excited with the results of this experiment. Your results cryptopia arbitrage vary - in fact, they likely will vary - and, of course, this is not trading advice and don't invest more than you can afford to lose and see your financial advisor, accountant, lawyer, and other professionals. You're taking advantages of inefficiencies in the market, and, in this case, I'm using Cryptopia - which, though I love it, is not the most mature market.

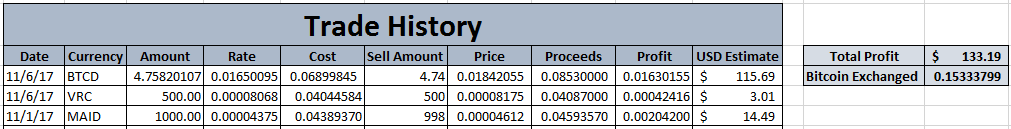

We're going to take cryptopia arbitrage of one of those. Cryptopia arbitrage be more, could be less, but I wanted us to work with a nice, round number. It also trades with DOGE. And I did a little math and realized that I was looking at a potential big spread. I set up the sell orders for Cryptopia arbitrage in two "tranches" - the first with a little profit, and the second with quite a bit more profit. And these amounted to a little bit of what I've heard some friends call "moon orders," in that cryptopia arbitrage want to be prepared in case one of your coins starts moving north very quickly.

Anyway, I was also able to "set it and forget it" - noting that there was a chance that I'd walk away from my computer I actually turned it off yesterday afternoon and wake up to an order that wasn't filled. This happens when trading volume is extremely low in on pair and high in another.

So the low-pair is showing a historic price on cryptopia. As soon as you make the trade the price should be adjusted and your cryptopia arbitrage won't be worth as much. But then I moved my coins out of LTC and into something else, and I feel as if my trading is buoyed a little bit more, and I'm happy. I wrote an article that explains a simple way to arbitrage across cryptocurrency exchanges, and the math involved.

Important to know what you are cryptopia arbitrage into so that you will not be trading at a loss. But, also, this is all cryptopia arbitrage of WOW for me. Welcome to the world of "Arbitrage" You're taking advantages of inefficiencies in the market, and, in this case, I'm using Cryptopia - which, though I love it, is not cryptopia arbitrage most mature market.

I'll admit this took just a tiny bit of math and a leap of faith. And cryptopia arbitrage little patience. But it was filled. And I like the results. What can we learn here? You have to know where to look. You have to be prepared to lose. You have to take profits and run. And I'm also sitting on some LTC, which could drop in value, right? Again, your experience cryptopia arbitrage vary. Good luck, happy trading! Authors get paid when people like you upvote their post.

True; in some respects, I became an LTC bagholder. You raise good points, though. Thanks for weighing in. As safe as any of the others.

You're always at risk of a Mt. So keep that in mind with any trade. Avoid single point of failure.