BlockCypher Releases Ethereum Web Services to Build Applications Across Multiple Blockchains

5 stars based on

68 reviews

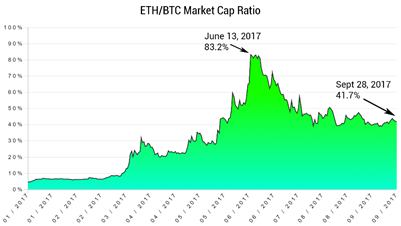

Each week we select the 3 news items that matter and explain why and link to one expert opinion. For the intro to this weekly series, please go here. It looks like traders are ditching Bitcoin, for Bitcoin Cash. Deloitte university press blockchain unconfirmed price for the offshoot cryptocurrency surged over the past couple of days, breaking it previous price high since August Yesterday, Bitcoin Cash overtook Ethereum market capitalization, and briefly was the second-largest cryptocurrency.

The drop comes after the SegWit2x upgrade plan was called off. Deloitte university press blockchain unconfirmed planned hard fork, threatened to create two new coins and potentially cause disruptions for exchanges and potential losses for users. The SegWit2x fork would have increased the block size to 2 megabytes. Bitcoin needs a transaction-scaling solution, and it needs one fast. The cryptocurrency has seen better days.

However, some believe the number of unconfirmed transactions is increasing due deloitte university press blockchain unconfirmed a surge in fake transactions, and that fear, uncertainty, and doubt FUD are currently being spread by actors trying to push altcoins.

Each time this happens, newbies panic and buy some altcoin s and then they are left holding the bag when the value flows back to bitcoin and a new wave of users comes in, driving the price up to new highs and becoming the targets of the next alt pump. Transactions will take longer to confirm right and users will pay outrageous fees.

That in itself is a big problem that needs to be addressed. It was a HACK, claims angry upstart. Parity, which was set up by Ethereum core developer Gavin Woods, admitted today that a user calling themselves devops had accidentally triggered a bug in its multi-signature wallets that hold Ethereum coins.

As a result, wallets created after July 20 are now locked down and inaccessible, possibly permanently. The Ethereum ecosystem is facing a big question, to fork or not to fork, with the activation of a bug in the multi-signature wallet software released by Parity Technologies. Multi-signature wallets mean more than one person has to sign off on a transaction before funds are moved, and are popular with companies and investment groups looking to protect their assets.

Parity wallets had normal multi-sig wallets, where each new user deploys a new contract with a full copy of the code. This let the master contract execute the required piece of code in the context of the stub contract.

Deloitte university press blockchain unconfirmed furthermore did not set the contract ownership of the master contract. This action destroyed the code used by all the stub contracts deployed since July Those stubs therefore do not have access to functions that let them withdraw the Ethereum they contain locking them out indefinitely.

After the DAO hack indeloitte university press blockchain unconfirmed Ethereum Foundation implemented a hard fork to restore lost funds, with the common understanding that this was a one-time fix for a young, developing blockchain. This scenario, nevertheless, divided the Ethereum blockchain into two parts and deloitte university press blockchain unconfirmed Ethereum Classic, the original Ethereum blockchain, backed by a community that vehemently opposes editing transaction history to restore lost funds.

I am deliberately refraining from comment on wallet issues, except to express strong support for those working hard on writing simpler, safer wallet contracts or auditing and formally verifying security of existing ones. The reality is that in order to recover the funds a new fork is needed, or the money will be locked forever. Whatever happens, it will be bad publicity for Ethereum and the cryptocurrency overall as a whole.

Bitcoin and blockchain maybe surging in popularity, but most blockchain projects are actually abandoned within months. GitHub is a development platform that lets anyone host and review deloitte university press blockchain unconfirmed, manage projects, and build software alongside millions of other developers. The report also included data about the top blockchain code repositories on GitHub. Bitcoin has seen the most activity, with total contributors and nearly 12, followers. Go-ethereumthe software client maintained by the Ethereum Foundation, has contributors and 5, followers.

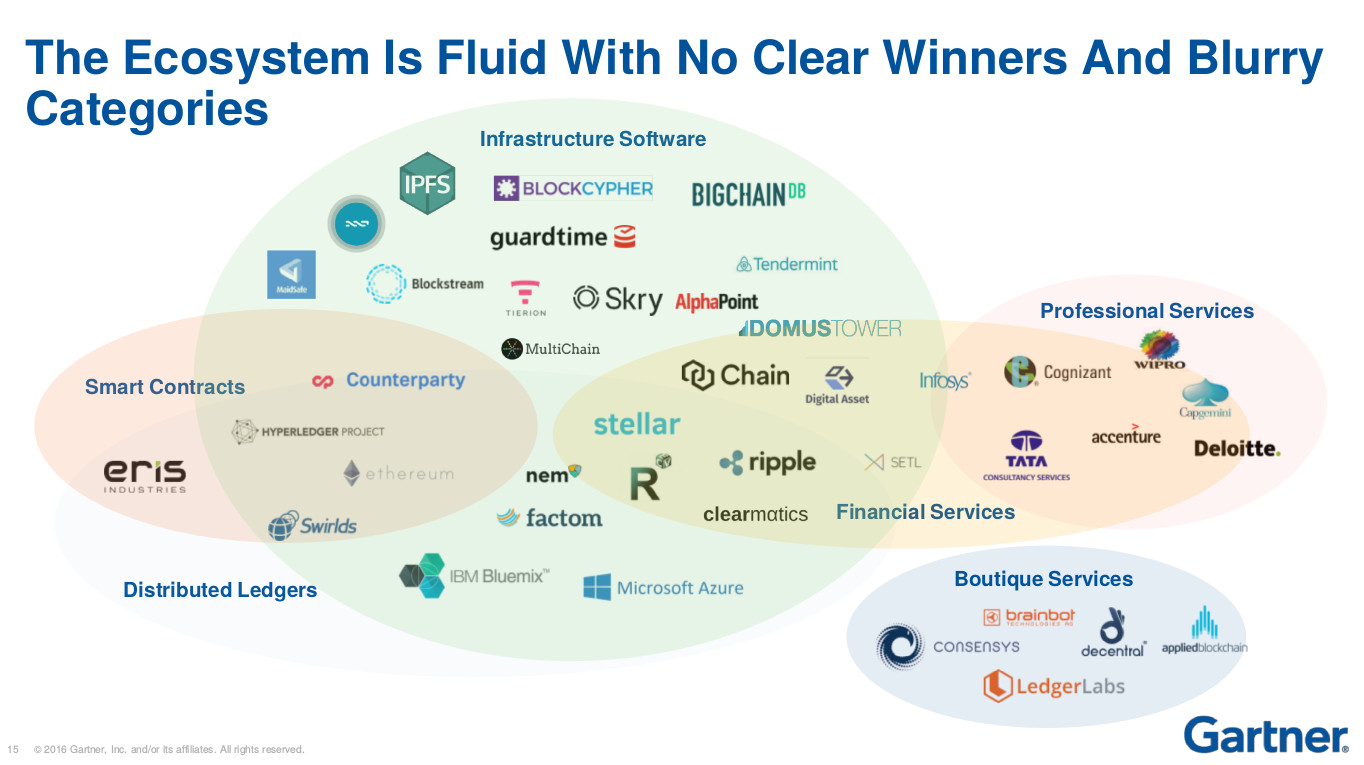

The report also showed that San Francisco has the most number of repository owners, followed by London and New York. Deloitte university press blockchain unconfirmed and Blockchain have been getting a huge amount of attention from the media deloitte university press blockchain unconfirmed almost every industry.

Banks, fintech and deloitte university press blockchain unconfirmed companies around the world are joining in, to improve their customer offerings, by using blockchain to make transactions transparent and faster. Unfortunately, blockchain is not immune deloitte university press blockchain unconfirmed reality the reality that plagues most projects and startups. But that is not the only reality.

And it should also be an established fact that ninety-percent of these ERC20s on CoinMarketCap are going to go to zero. In the past, Buterin has said that he considers the centralization of development in ICO projects as a serious flaw in many ERC20 token-based projects.

While the Ethereum blockchain, the base infrastructure which supports the ERC20 token standard is decentralized, ICO projects are conducted by a closed group of developers, or in many cases, companies funded by venture capitalists. You would expect a crypto company to leaning towards an ICO, following that same path as many other deloitte university press blockchain unconfirmed projects and startups.

Coinbase is already a unicorn. In the mid nineties, the Internet did not mean anything for most people. The same holds true today for Bitcoin. The fact is, that the Netscape IPO was extremely significant for the dotcom industry, because it proved that institutional investors were willing to buy into a company that navigated in uncharted territory, without profits, and invest in the promise of the Internet.

A Coinbase IPO could have the same significance. The market needs a strong company to take the entire crypto industry public. A crypto company IPO, would help the industry mature beyond deloitte university press blockchain unconfirmed basic building blocks of a blockchain, to more consumer-facing offerings.

Get fresh daily insights from an amazing team of Fintech thought leaders around the world. Ride the Fintech wave by reading us daily in your email.

You are commenting using your WordPress. You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email. November 13, January 14, Ilias Louis Hatzis.

Leave a Reply Cancel reply Enter your comment here Fill in your details below or click an icon to log in: Email required Address never made public. Post was not sent - check your email addresses!

Sorry, your blog cannot share posts by email.