Blockchain investment australia

43 comments

Ethereum cloud mining calculator gpupdate f1

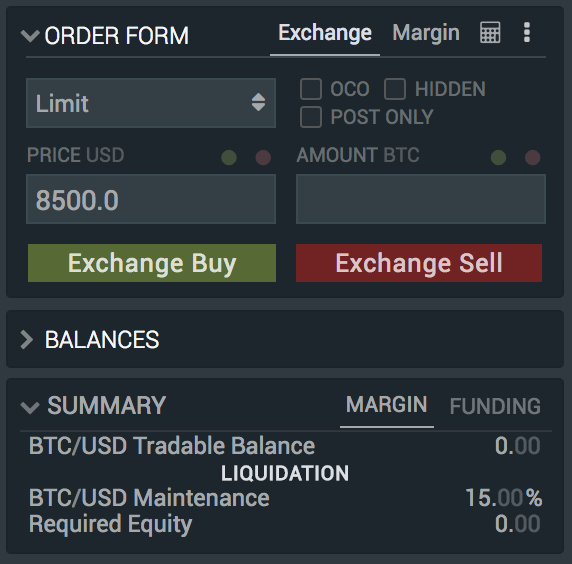

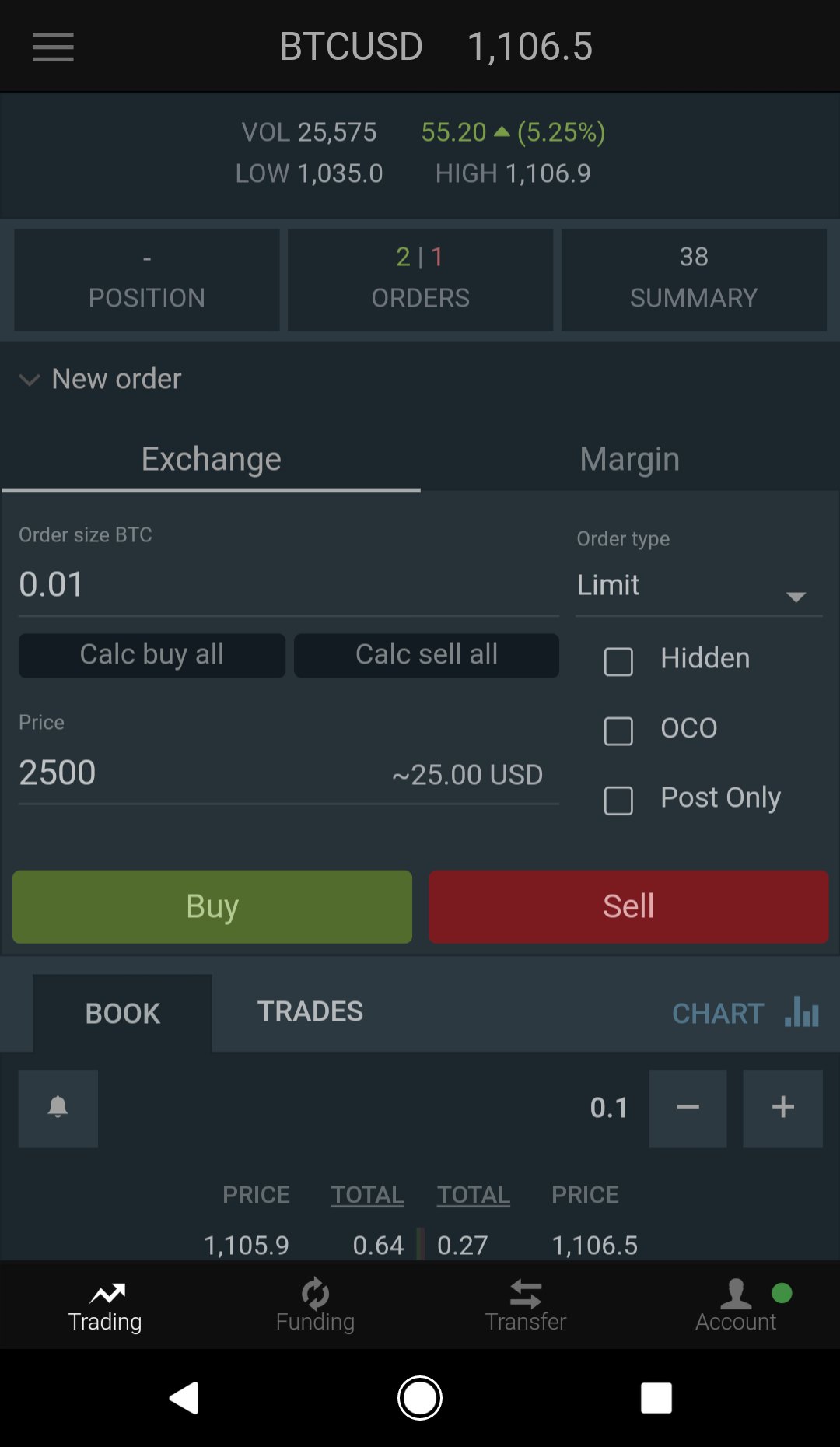

Features include standard exchange trading, 3. Questions Tags Users Badges Unanswered. Tagged Questions info newest frequent votes active unanswered. Learn more… Top users Synonyms. Why does Bitfinex allow shorting with BTC as collateral? Why is this even possible, I cant figure out why someone would want to do that? Muis 1, 1 9 I can't understand what count means here.

I would have assumed that it was the number of orders at that price, but the total column does not seem to reflect this. Can't find any info in the This is a response example: Question is whether this limit is related to: Steef Gregor 61 1 The data I receive looks like this: Stijn Martens 5. I have posted a simmilar question on the main Stack Overflow page: Mustard Tiger 3. I would like to know if it's possible to do this short order without having to manually add the stop loss after it's opened.

Sean Chapman 1 11 Does Bitfinex support B2X? I know, we should hold them in cold storage, etc, but I can't know for sure whether Bitfinex will credit the B2X on a 1: Thank you for your answers! Hollossy 2 I started writing code for the Bitfinex api yesterday and I've been struggling quite a lot with this. I am using jndok's python implementation. I added my pyblic and secret keys and wrote this line Can I by any chance get my BCH back?

Karen Marie Steffensen 6 3. On Bitfinex, what is FRR? NIX 25 1 3. Tracking the Bitfinex hacked coins How can someone like an exchange track the Bitfinex hacked coins to make sure the hacker cannot exchange them? Does a service exist to make it easy for the exchange to call an API with the deposit Brandon 1 6.

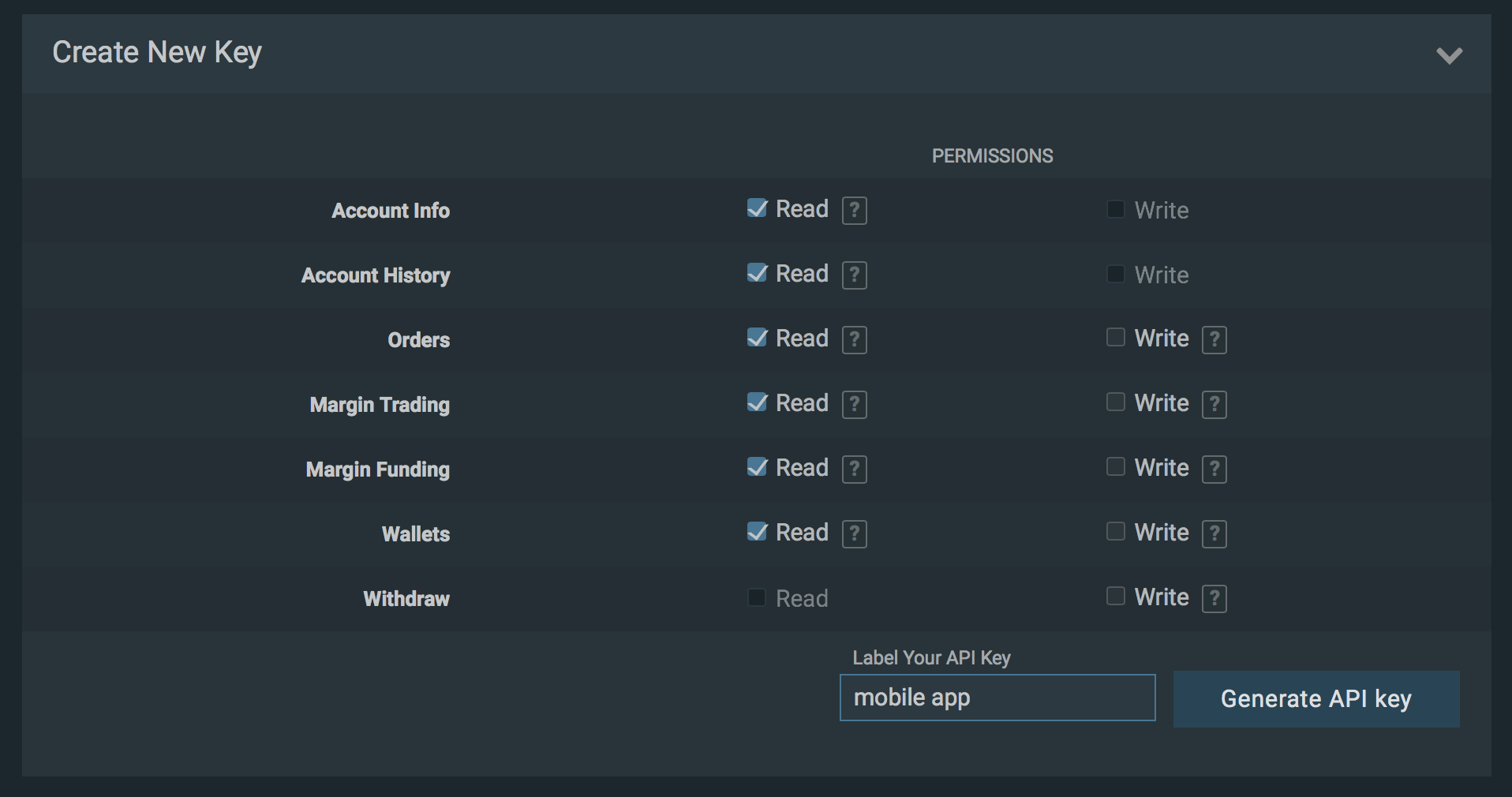

Has anyone experienced money wire from Bitfinex to a european bank? How are the fees applied? I try to find the best way to cash-out when needed. I use Bitfinex lately and I see that they have a good fee structure https: I am developing an application which accesses Bitfinex data and also should be Stack Overflow for Teams is Now Available.

Bitcoin Stack Exchange works best with JavaScript enabled.