Seaborne trade is dominated by blacks

13 comments

Trading bitcoin options online btc usd using 5 minute bitcoin option trading strategy

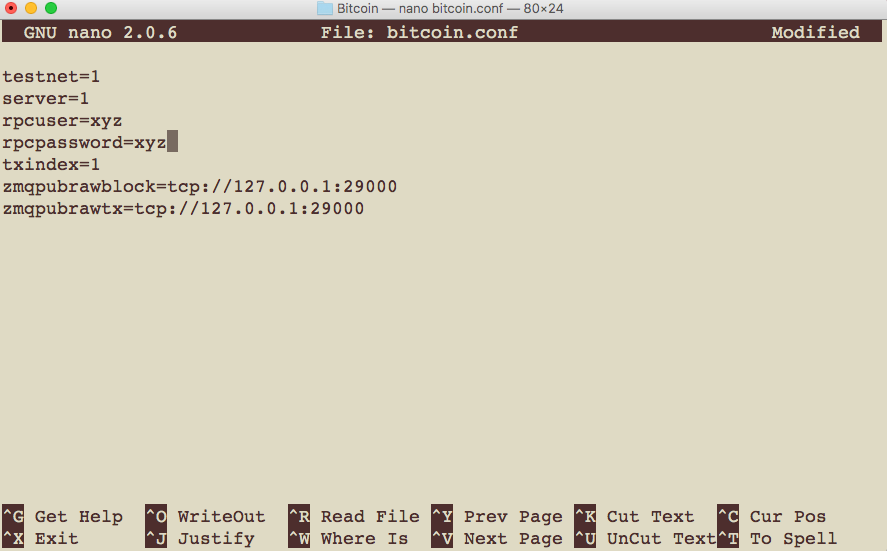

Demurrage is the cost associated with owning or holding currency over a given period. It is sometimes referred to as a carrying cost of money. For commodity money such as gold, demurrage is the cost of storing and securing the gold. For paper currency, it can take the form of a periodic tax, such as a stamp tax , on currency holdings.

Demurrage is sometimes cited as economically advantageous, usually in the context of complementary currency systems.

While demurrage is a natural feature of private commodity money, it has at various times been deliberately incorporated into currency systems as a disincentive to hoard money and to achieve more efficient allocation of capital in society. In particular, for long-term investment financing, it affects the dynamics of net present value NPV calculations. Demurrage in a currency system reduces discount rates, and thus increases the present value of a long-term investment, and thus gives an incentive for such investments.

Unlike inflation , demurrage gradually reduces only the value of currency held: A positive interest rate is a subsidy. Both inflation and demurrage reduce the purchasing power of money held over time, but demurrage does so through fixed regular fees, while inflation does it in a variety of ways.

Gresham's law that "bad money drives out good" suggests that demurrage fees would mean that a currency would suffer more rapid circulation than competing forms of currency. This led some such as German-Argentine economist Silvio Gesell to propose demurrage as a means of increasing both the velocity of money and overall economic activity. For such money is not preferred to goods either by the purchaser or the seller.

We then part with our goods for money only because we need the money as a means of exchange, not because we expect an advantage from possession of the money. So we must make money worse as a commodity if we wish to make it better as a medium of exchange.

On the other hand, influential British economist John Maynard Keynes contended that Gesell's proposed demurrage fees could be evaded by the use of more liquid competing forms of money and that therefore inflation was a preferable method to achieve economic stimulation.

Similarly, in , the Social Credit Party-led government in Alberta, Canada, introduced prosperity certificates in an attempt to alleviate the effects of the Great Depression , with holders having to affix to the back of a certificate a 1-cent stamp before the end of every week, for the certificate to maintain its validity. Local scrip systems, many of which incorporated demurrage fees, were also used across the United States during the Great Depression , and the Bankhead—Pettengill bill of 17 February was introduced in Congress to institutionalize such a system at the national level under the US Treasury, as documented in Irving Fisher 's book Stamp Scrip.

Bernard Lietaer also documents in his book "Mysterium Geld" the use of demurrage currency systems in Europe 's High Middle Ages ' bracteate systems and ancient Egypt 's ostraka — dated receipts for the storage of grain — and credits these currency systems with the prosperity of those societies.

One notable example of demurrage is the founder of the Mark of Brandenburg Albert the Bear. In earlier real-life experiments, demurrage on money has been demonstrated to significantly increase the velocity of money in circulation, even incentivizing people to pay their taxes in advance.

The major central banks ' post-World War II policy of steady monetary inflation as proposed by Keynes was influenced by Gesell's idea of demurrage on currency, [4] but used inflation of the money supply rather than fees to increase the velocity of money in an attempt to expand the economy.

In some instances, the demurrage fee is charged by some sort of central authority, and is paid into a fund. The application of this fund varies widely among both historical and proposed systems. In some cases, it is used to pay the costs of administering the tax. If the currency in question is run by the government, the demurrage fee can contribute to general tax revenue.

In mutual credit systems all positive accounts, or those over a credit threshold, are debited the demurrage fee if there is no trading purchasing after a certain period e. Typically the fee accrues to the administration account and so adds to the common credit pool. The Islamic system of zakat is a form of demurrage.

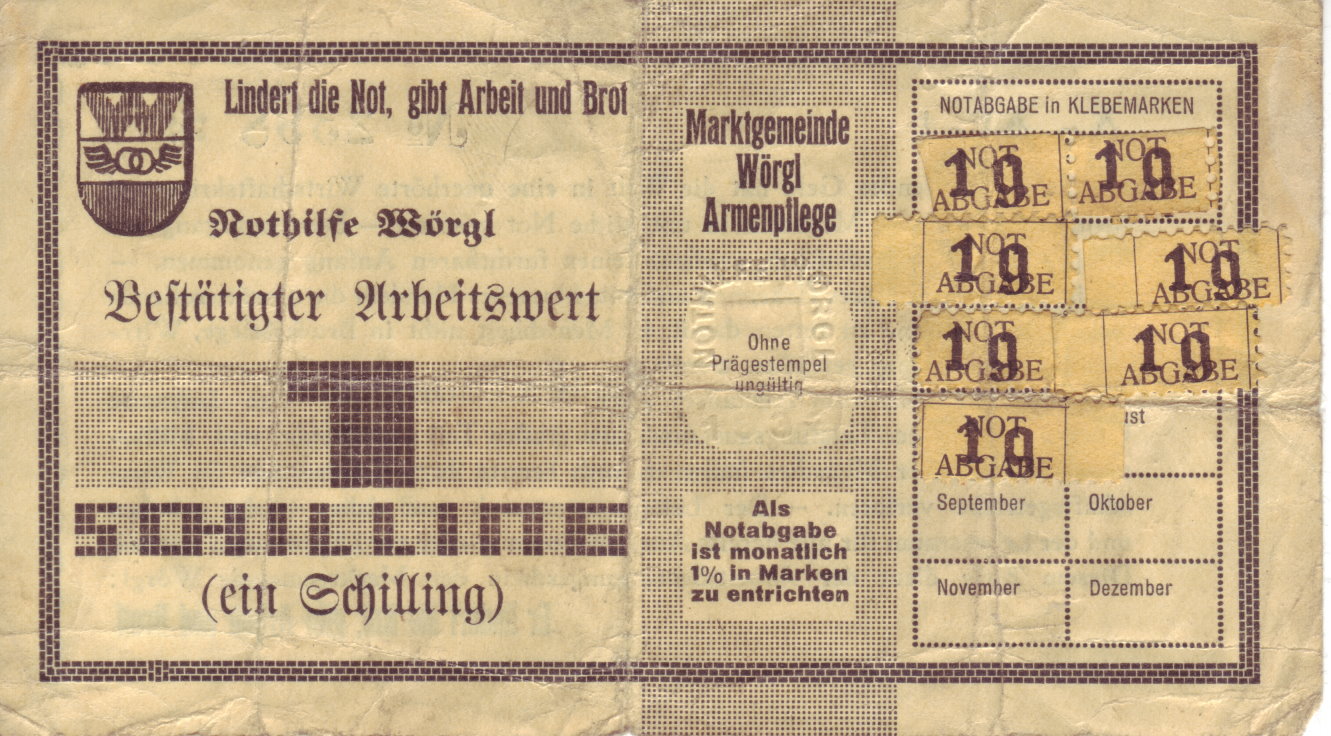

It applies to un-utilized assets on a per annum basis, at a rate determined by the nature of the asset. For cash and gold, for instance, the rate is 2. The chiemgauer is a regional community currency in a part of Bavaria, using a demurrage system. Freicoin is a cryptocurrency , in which demurrage is levied at approximately 5. From Wikipedia, the free encyclopedia.

A New Tool for the 21st Century. Zarazaga, Fed In Print, https: Retrieved from " https: Local currencies Currency Freiwirtschaft. Views Read Edit View history. This page was last edited on 15 April , at By using this site, you agree to the Terms of Use and Privacy Policy.