Ethereum Development and DApps

5 stars based on

50 reviews

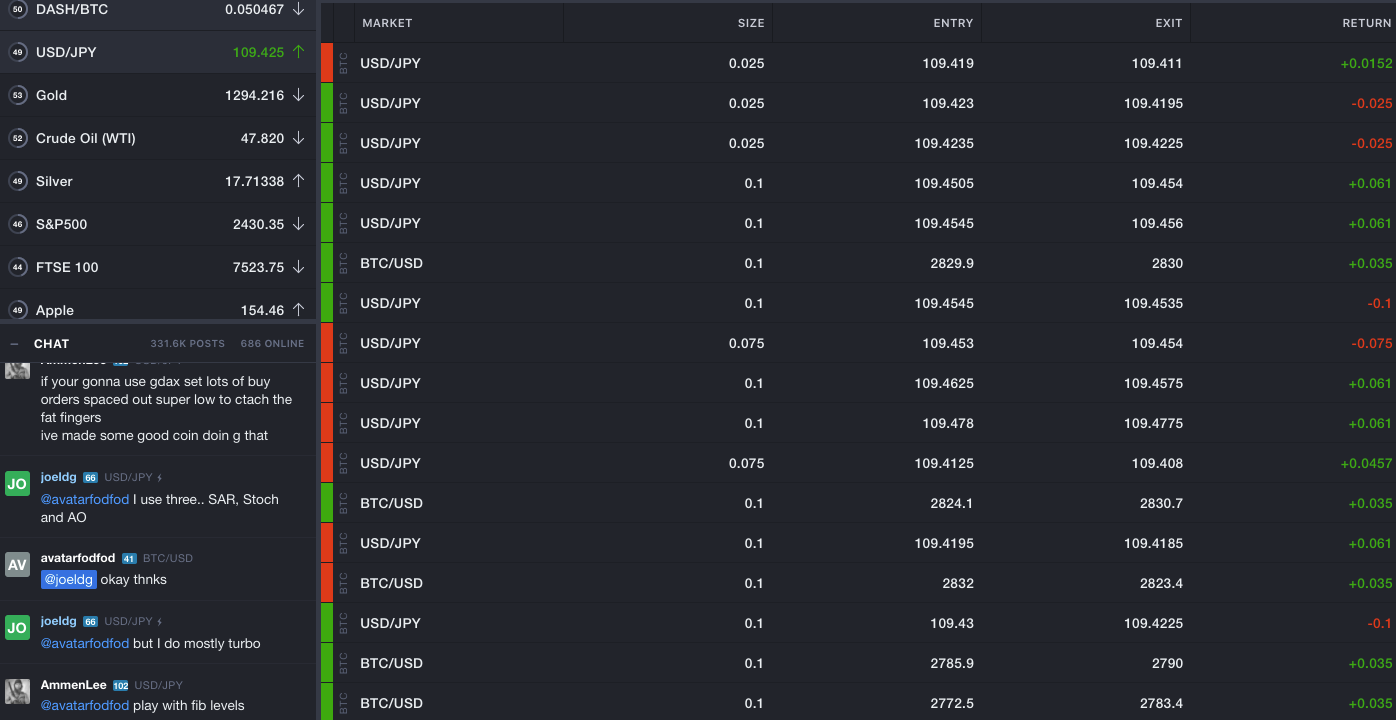

Market making is a trading strategy where the trader simultaneously places both buy and sell orders in an attempt to profit from the bid-ask spread. Market makers stand ready to both buy and sell from other traders, thus providing liquidity to the market.

The strategy is appealing to traders because it doesn't require traders to take a directional view of the market - there's money to how to create a cryptocurrency trading bot in nodejs made when the market goes up and when the market goes down.

It's also heavily incentivized by exchanges looking for liquidity and volume - many exchange operators will pay you to make markets on their exchanges.

Let's consider a simplified market. Let's say there are three traders: Alice, Bob, and Tim. Neither one are savvy about markets or cryptocurrency - they use Bitcoin, but aren't going to lose sleep over trying to get the absolute best prices.

Tim is operating Tribeca. But what if that doesn't happen? And How to create a cryptocurrency trading bot in nodejs could get a pretty good deal by getting the BTC at only two extra dollars. Like in any market these days, Bob and Alice probably aren't humans clicking buttons. They certainly aren't humans shouting on a floor how to create a cryptocurrency trading bot in nodejs lower Manhattan. More likely, they are also computerized algorithms capable of placing orders in milliseconds.

To survive as a market maker, you need to be faster than those algorithms to make a profit. As previously mentioned, market making is really the art of figuring out the price of something, then making a market around that price. So how do we know what is the real price of Bitcoin? And of course the price of Bitcoin now might be radically different than the price in a day, in an hour, or even in a second from now.

The best we can do is to build an estimate, or fair value, of the price of Bitcoin. In Tribeca, we consume the market data from the exchange we are sending orders into as a starting point. That includes the best bids and offers and most recent trades aka market trades by other participants in the market. From our fair value, we then need to make a market around that price. Back to our hypothetical example with Bob and Alice: So how do we decide?

That's where the quoting parameters come into play. The procedure for coming up with profitable parameters is how to create a cryptocurrency trading bot in nodejs an art and a science - there is no one size fits all formula.

When Tribeca figures out a suitable market, Tribeca will then send in the buy and sell orders. Hopefully it's able to buy for less then sell for more, and repeat many times per day. Sometimes that's not always the case - sometimes there are genuinely more buyers than sellers for the prices you are setting. Often this comes when the market is moving very fast in one direction. Luckily, Tribeca will prevent you from selling too fast without finding corresponding buyers and will stop sending orders in the imbalanced side.

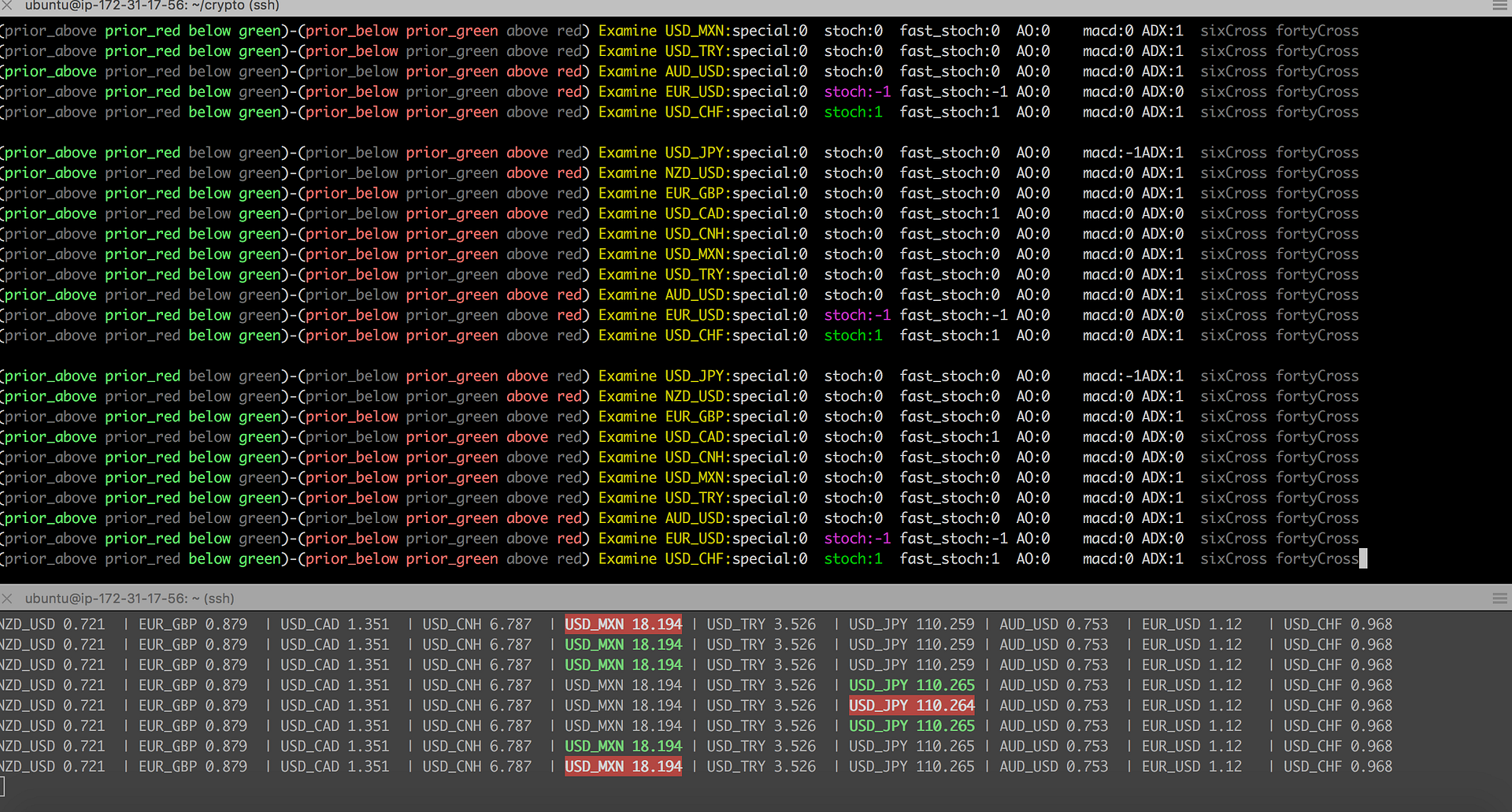

Gateways are ideally stateless some state may be needed in order to perform exchange-specific functionality and are mostly translation layers between exchange APIs and the Tribeca API. On modern hardware, it can react to how to create a cryptocurrency trading bot in nodejs data by placing and canceling orders in under a millisecond. Runs on the latest node. Persistence is acheived using mongodb.

Installation is recommended via Docker, but manual installation is also supported. Input your exchange connectivity information, account information, and API keys in the config properties for the exchange you intend on trading on. Once tribeca is up and running, visit port of the machine on which it is running to view the admin view.

There are inputs for quoting parameters, grids to display market orders, market trades, your trades, your order history, your positions, and a big button with the currency pair you are trading.

When you're ready, click that button green to begin sending out quotes. The UI uses a healthy mixture of socket. It's all the same data you would get via the Web UI, just a bit easier to connect up to via other applications.

I am a robot. I just upvoted you! I found similar content that readers might be interested in: A high frequency, market making cryptocurrency trading platform in node. An example Let's consider a simplified market.

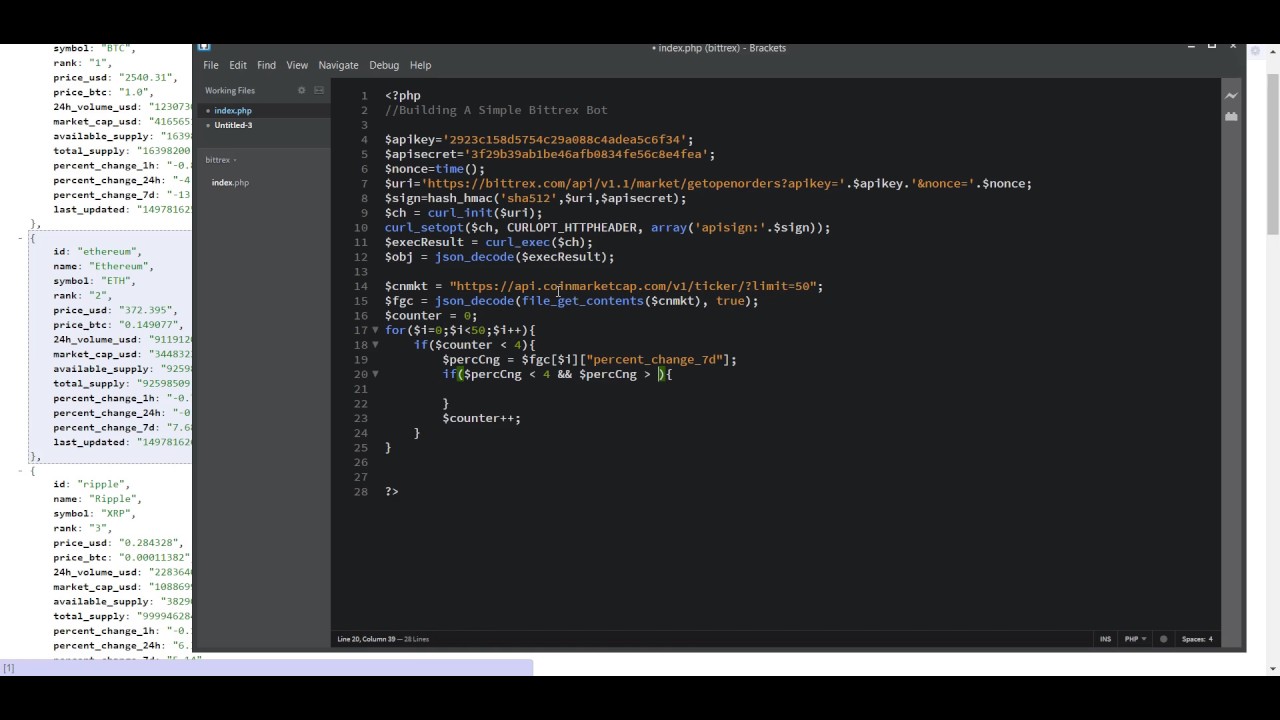

So, how does Tribeca work? Where does all this happen in the code? The code is organized into 3 layers. Engine layer - The brains of the application. Portion of the code responsible for synthesizing market data, open order status, position, fees, trades, safety information and converting that into a quote to send to the exchange. This is the portion of the code which calculates a fair value FairValueEngine and generates quotes QuotingEngine Adapter layer - The engine layer should have no idea about the individual quirks of the exchanges.

The engine layer uses the adapter layer to carry out its bidding. The adapter layer also has no idea that it is being used in a manner to make markets. In theory, the adapter layer code and the gateway layer code could be divorced from the Engine layer and we could build a technical analysis or latency arbitrage bot, instead. The adapter layer also contains all the state reported by the gateways. Gateway layer - Each exchange has their own API for interacting with the exchange.

All of that business is hidden behind 4 different interfaces: Handles order book updates and market trade updates. Send and cancel orders and handle updates to the orders. Read-only information describing naming and exchange fee structure. Change the environment variables of env file to match your desired configuration. Input your exchange connectivity information, account information, and mongoDB credentials.

Run docker-compose up -d --build. If you run docker-compose psyou should see the containers running. Docker Installation Please install docker for your system before preceeding. Requires at least Docker 1. Ensure boot2docker or docker-machine is set up, depending on Docker version. See the docs for more help. If you do not have a mongodb instance already running: Save the Dockerfile, preferably in a secure location and in an empty directory.

Build the image from the Dockerfile docker build -t tribeca. Run the container docker run -p If you run docker psyou should see tribeca and mongo containers running.

Manual Installation Ensure your target machine has node v7. Also, ensure Typescript 2. In the cloned repository directory, run npm install to pull in all dependencies. Compile typescript to javascript via grunt compile. Modify the config keys see configuration section and point the instance towards the running how to create a cryptocurrency trading bot in nodejs instance. Ensure the Coinbase-specific properties have how to create a cryptocurrency trading bot in nodejs set with your correct account information if you are using the sandbox or live-trading environment.

Ensure the HitBtc-specific properties have been set with your correct account information if you are using the dev or prod environment. Ensure the OKCoin-specific properties have been set with your correct account information.

Ensure the Bitfinex-specific properties have been filled out. No exchange-specific config needed. If you are running from a Linux machine and set up mongo in step 1, you should not have to modify anything. Application Usage Open your web browser to connect to port of the machine running tribeca.

Read up on how to use tribeca and market making in the wiki. Set up trading parameters to your liking in the web UI. Web UI Once tribeca is up and running, visit port of the machine on which it is running to view the admin view. Add new exchanges Add new, smarter trading strategies as always! Authors get paid when people like you upvote their post.