Bitcoin charts usd mtgox i song download

27 comments

Ripple sole work shoes

For one, I simply felt like breaking things up a bit for my own enjoyment. Therefore, introducing some second trades into my blog can serve to lend some advice on how I would approach these.

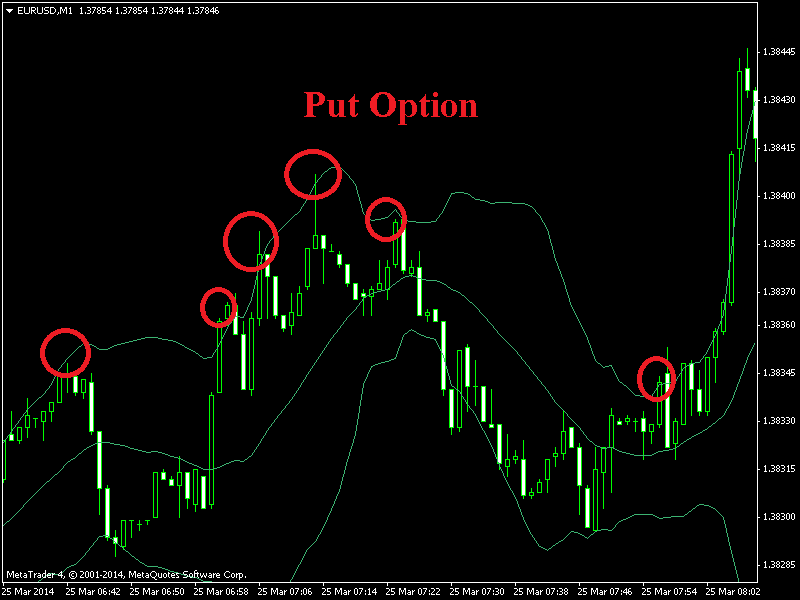

Also, it is more difficult to be as accurate with these trades as the minute trades, due to the inherent level of noise on the 1-minute chart, in my opinion. Find support and resistance levels in the market where short-term bounces can be had. Pivots points and Fibonacci retracement levels can be particularly useful, just as they are on other timeframes while trading longer-term instruments.

Take trade set-ups on the first touch of the level. For those who are not familiar with the way I normally trade the minute expiries from the 5-minute chart, I normally look for an initial reject of a price level I already have marked off ahead of time. If it does reject the level, this helps to further validate the robustness of the price level and I will look to get in on the subsequent touch.

Expectedly, this leads to a lower volume of trades taken in exchange for higher accuracy set-ups. To provide a baseball analogy, a hitter who normally maintains a batting average of. On the other hand, in that same span, he might hit. Continue to consider price action e. But without further ado, I will show you all of my second trades from Monday and I how I put all of the above into practice. To avoid confusion, I will briefly describe each trade according to the number assigned to it in the below screenshots.

On the first re-touch of 1. Similar to the first trade I took a put option on the re-touch of 1. This trade also won. A third put options at 1. This trade lost, as price went above my level and formed a new daily high. Price formed a newer low at 1. I took a call option on the re-touch of 1. Basically the same trade as the previous one. Price was holding pretty well at 1.

On a normal move, I would take a put option there, but momentum was strong on the 2: Several put options almost set up on the 1. So my next trade was yet another call option down near where I had taken call options during my previous two trades. I felt this was a safer move as just half-a-pip can be crucial in determining whether a second trade is won or lost. Call option down at 1. However, the minute after this trade expired in-the-money, the market broke below 1.

This trade was a put option at 1. Nevertheless, this trade did not win as price continued to climb back into its previous trading range. I decided to take a put option at the touch of 1. This trade might seem a bit puzzling at first given a new high for the day had been established and that momentum was upward.

But by simply watching the candle it seemed that price was apt to fall a bit. It was also heading into an area of recent resistance so once it hit 1. For this trade, the high of day initially made on the 2: I had intended to take a put option at this level on the 3: And then for maybe seconds, my price feed was delayed and by the time it the connection was recovered it was over a pip above my intended entry.

I did end up using the 1. I took a put option on the touch of the level. Once again, I used the current daily high of 1. But price busted through and this trade lost. Another fifteen minutes passed by before I was able to take another trade set-up.

This time, I used 1. This trade was probably my favorite set-up of the day and was aided by the fact that the trend was up. It turned out to be a winner. For put options at this point, I had an eye toward 1. So I decided to take a put option at the touch of 1. This trade turned out to be a nice four-pip winner. My final trade of the day was a call option back down at 1.

This was another good four-pip winner. After that I was waiting for price to come up and see if 1. Also, I was feeling a bit fatigued by this point and decided to call it quits for the day. But, in general, I have faith in my strategy to predict future market direction with a reasonable level of accuracy, and my ability to apply it to any market or timeframe.

I also enjoyed toying around with the 1-minute options, as it was a new experience, and I would definitely consider adding more second option days into my regimen in the future. Basic 60 Second Strategy My basic strategy toward second options goes as follows: Trade History Using 1 Minute Expiry 1: Put option back up at the 1.

Another put option at 1. Similar to 12, I used 1. Where Do I trade?