Bitcoin and cryptocurrencies – what digital money really means for our future

5 stars based on

66 reviews

There has been significant media attention focused on cryptocurrency in recent months. In Januarythe Australian Financial Review published an editorial on the link between cryptocurrency and interest rates. One of the key issues at the centre of all this attention is the question of the 'real value' of cryptocurrencies.

This is another way of asking: In the simplest terms, cryptocurrency is a digital token which represents value. The first cryptocurrency, Bitcoin, was assigned value which represented currency. This occurred for a range of factors, including: Since Bitcoin launched inmany other cryptocurrencies have emerged, all of which represent and are assigned different units of value. In the sense that cryptocurrency is a digital token, it is similar to our fiat money [footnote 4] system in that the actual units traded have no intrinsic worth—when we trade cash for goods and services, cash represents trust in a financial system of ascribing value which can then be traded or exchanged.

Cryptocurrencies differ, however, in that fiat money is backed by governments while cryptocurrencies are not. The 'value' therefore derives from what buyers and sellers in the market are willing to pay for the cryptocurrencies, rather than the value deriving from a centralised governmental regulator. Cryptocurrencies have different values as buyers and sellers in the marketplace buy and sell them for different prices.

Some people are entering these new markets in the shared belief that cryptocurrencies will retain value in the future, allowing them to be on-sold at a profit. Other traders may enter the market hoping to use cryptocurrencies to exchange for goods and services.

Inherent in the hopefulness of this activity is the idea that 'investment' in many cryptocurrencies is more akin to pure speculation. Observers have argued that cryptocurrency is a 'bubble', referring in particular to Bitcoin. To the extent that cryptocurrencies are speculative, these views are founded. They are also founded in the sense that Bitcoin is more accurately a token, as opposed to a 'currency'. To become a currency would require Bitcoin to be accepted as legal tender for public and private debts.

In a world-first in'titcoin' was recognised as a formally accepted unit of exchange by a major industry trade organisation in this case, the Adult Entertainment Industry. Despite these exceptions, most cryptocurrencies in their current forms are inherently speculative.

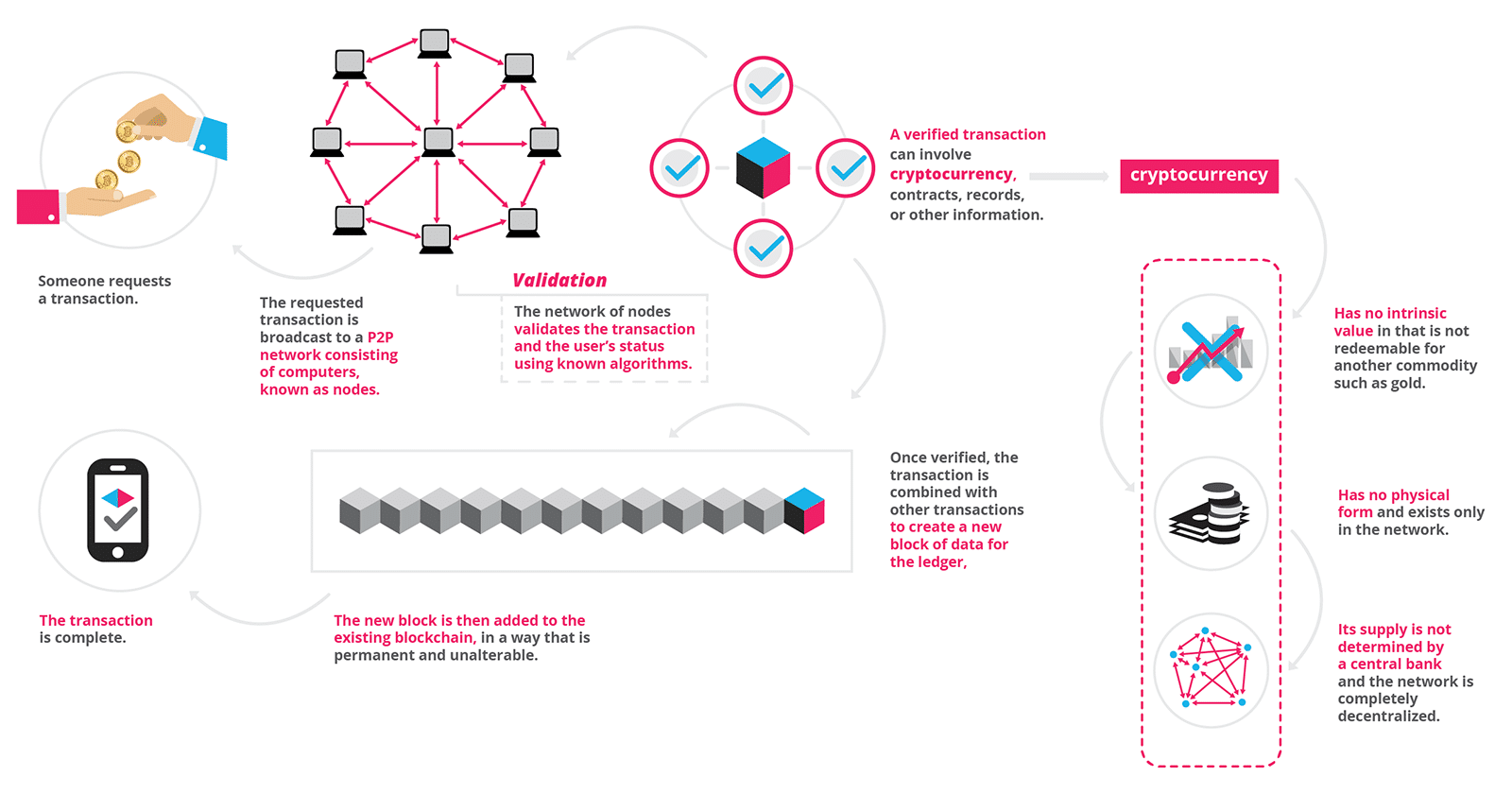

But if cryptocurrency is generally so speculative, why have people invested hundreds of billions of dollars into these markets? As above, part of the answer is most likely to do with the underlying technology, known as blockchain. Blockchain is an open-sourced computer protocol which allows for users to transact, peer-to-peer. It decentralised, public and digital, effectively making it a 'transaction-recording database' stored on many different computers at once.

Blocks are built by 'mining', a process in which computers are tasked with solving complex and random cryptography. As more miners attempt to build blocks, the faster the blocks are built and the blockchain becomes more secure. This is because to undo or alter a block, more miners would have to be allocated to that task than the task of building new blocks. In other words, in order to defraud the blockchain, more computing power must be allocated to defrauding the blockchain the total amount of computing power working on the blockchain.

This would be an enormous feat: Blockchains can be conceptualised as 'distributed ledgers' of trades. Each blockchain is a different ledger which has the potential to record any trade of information. The ledger is highly secure in that: Along with being a digital token, Bitcoin refers to one ledger of over a thousand blockchains or ledgers.

Bitcoin therefore describes a system of exchange. Because Bitcoin is a cryptocurrency, it also describes the monetary value which is ascribed to those exchanges. This is not always the case: Returning to the blockchain, traders can be either anonymous or named, depending on the way that each particular blockchain is set up.

This allows for users to trade even when they do not trust each other; when they do not know one another's identities, or; when they do not have the time to themselves verify the legitimacy of trades.

This is significant in that blockchains can be set up so that trades are completed only when certain conditions are fulfilled. These particular blockchains enable 'smart contracts', which can be used in situations such as a life insurance policy which is managed by a blockchain to pay the beneficiary only when a doctor submits a digitally signed death certificate to the blockchain. In the cryptocurrency context, the peer-to-peer nature of the technology has a libertarian application in that the blockchain removes the need for an intermediary which authorises and regulates individual trades, like a bank.

When used as a currency, blockchain also removes the need for a centralised authority which authorises and regulates the value of the unit of trade, like the Federal Reserves used to regulate fiat currency. In a currency context, this offers the potential for greater efficiency and freedom for people to trade as they wish. However, third parties such as banks are leading research into the ways in which some services will still be required to be performed by third parties to make transactions.

Other businesses already utilise blockchain in data management. Public entities are also turning to the technology. The Canadian Government has recently announced a pilot which will use blockchain to increase transparency in recording government grants. It is difficult to estimate the market capitalisation of cryptocurrencies in Australian 'exchanges', or cryptocurrency markets. It remains to be seen as to whether any cryptocurrencies will become recognised by governments as legal tender.

The 'value' of blockchain technology is easier to approach in that the technology has real applications, some of which have been listed above. The software is interesting in that it has the potential to disrupt information management and data security systems as we know them. The applications of the technology are many and varied. Coinmarketcap ' Cryptocurrency Market Capitalizations ', 31 January, coinmarketcap website. Decentralised News Network 'News by the people, for the people.

Berne 'The bitcoin and blockchain: Horizon State 'Redesigning democracy for the 21st century'Horizon State. Mr Money Moustache ' So you're thinking about investing in bitcoin? Don't'The Guardian15 January. October ', October, NAB. Titcoin 'Titcoin Digital Currency: The Official Crytocurrency [footnote sic] of the Adult Industry'.

Hanich 'How blockchain is strengthening tuna traceability to combat illegal fishing'The Conversation22 January. They provide analysis on selected components of new Bills and topical issues in response to, and in anticipation of, the needs of Members of the Victorian Parliament.

This research publication is current as at the time of printing. It should not be considered a complete guide to the particular subject or legislation covered. While it is intended that all information provided is accurate, it does not represent professional legal opinion. Any views expressed are those of the author s.

Some hyperlinks may only be accessible on the Parliament of Victoria's intranet. All links are current and available as at the time of publication. Telephone 03 www. Gibbs 'Bitcoin and Ethereum tumble after renewed fears of regulatory crackdown'The Guardian17 January. The value of the currency comes from the backing of a government and the stability of the economy it belongs to.

Almost all paper and coin currencies in use today are fiat money. Kshetri 'Can blockchain technology help poor people around the world? Gilder 'Early blockchain experiments point to jobs of the future'Commonwealth Bank of Australia29 November. Cryptocurrency and blockchain explained.

Civil 'What if the news were run by the people?