Makejar bitcoin mining

18 comments

Neosurf bitcoin exchange

So unlike the Antminer D3, A3 and X3, where these ASICs caused a massive increase in difficulty for the associated coins, the effect of the E3 on Ethereum won't be as significant but there will likely be an increase in difficulty.

Now the release of the E3 isn't a surprise, there have been rumours about Ethereum ASICs being developed for several weeks, with 3 other companies expected to announce them over the coming months. The first batch of E3's is scheduled for delivery by the 16thst July There's been a lot of speculation on if Ethereum will become resistant to ASICs, with no clear decision yet.

If all Ethash-based coins decide to be ASIC resistant and the E3 turns out to be limited to this algorithm, anyone owning an E3 would likely struggle to get their initial investment back. Because Ethereum has such a high market cap, this could have big implications for ASIC companies like Bitmain - where if ASIC resistance becomes the norm they'll start seeing less interest in their hardware.

So depending on your outlook of Ethereum long-term this may offer a return on investment after 8 or 9 months, or skeptically it might never. See our hardware mining calculator to see how we got these values. We compare Ethereum mining using a GPU vs the Antminer E3 above, where certain GPUs are actually more efficient so more cost effective long-term , but the E3 is most cost effective upfront. So in general, there are two approaches to mining crypto.

One is where you have an individual or small group buying a few miners maybe because they're curious or want to earn some extra money. In this scenario, factors like upfront cost and power efficiency are very important, and factors like how much space this mining rig takes up aren't so much, where it can just be put in a garage or shed.

But other scenarios like larger-scale mining farms of 50 or more miners have other considerations, like space. Although GPU mining rigs are very efficient for mining Ethereum, they're also much larger.

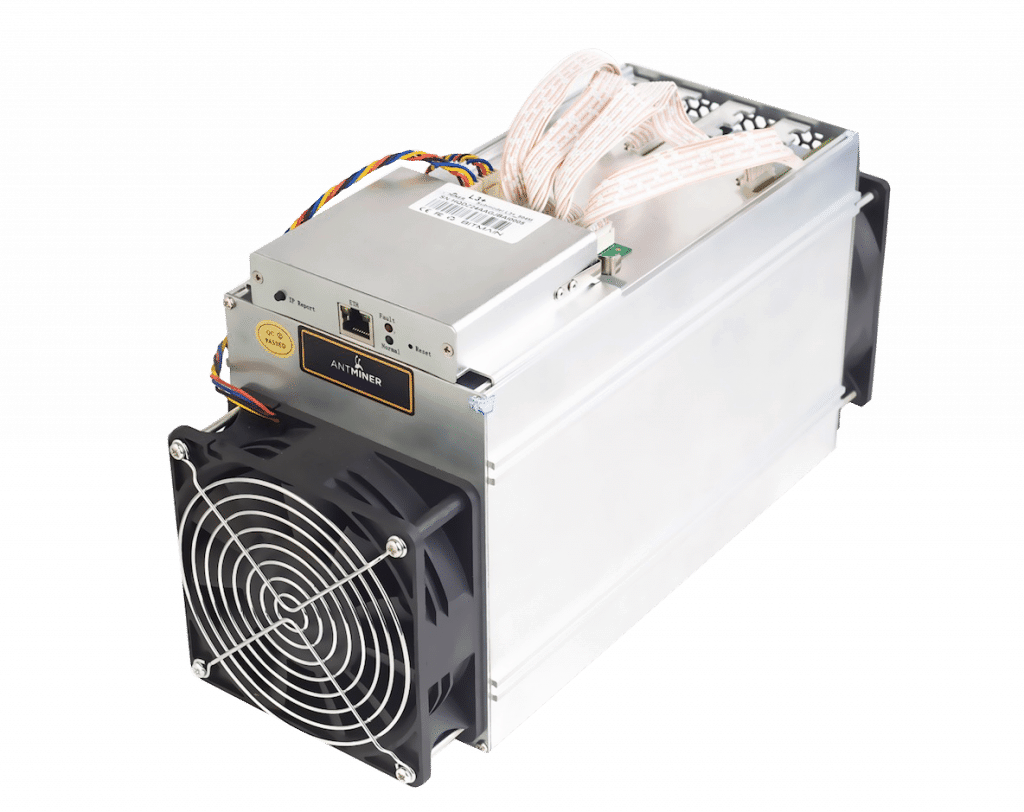

The Antminer E3 is several times smaller than a rig of 6 GPUs, where at scale this sould save a significant amount of space.

Factors like these make the E3 much more attractive to large-scale mining operations. Interestingly though, Bitmain have said that each user can only buy one E3. In the past they said this for Siacoin too, but actually limited it to 3 per address people got around this by delivering to different addresses. This may limit access large-scale operations have to the E3, although Bitmain may be selling directly to larger operations in private.

Long-term, GPUs are also more likely to hold their value, as gamers will still likely have a demand for them many years from now.

Once a better ASIC comes along that's cheaper and more efficient than the E3, its resale price will decrease significantly.

If either of these are correct, the E3 would be much more reusable, and so have a higher resale value. With Monero recently announcing that it will become resistant to ASICs in an upcoming hard-fork, many people are wondering if Ethereum will do the same thing. A section of Ethereum's whitepaper has people very curious, where it states that it's resistant to ASICs by design.

This makes Ethereum's Proof of Work ASIC-resistant, allowing a more decentralized distribution of security than blockchains whose mining is dominated by specialized hardware, like Bitcoin. And until now, this has been true. The Antminer E3 seems to be the first, so many are arguing that Ethereum doesn't need to do anything, it's already achieved that goal. Others are claiming it should have a fork where the mining is changed to deter the E3, where there's an expectation that Etherem's developers knew this would eventually happen and so should have a secondary mining algorithm ready just in-case although depending on the hardware design of the E3, it may be able to adapt to algorithm changes better than Bitcoin-based ASICs if it uses GPU hardware, and so more difficult to deter; firmware may limit this though.

We've seen many people keen for Ethereum to change it's proof-of-work algorithm to be ASIC resistant, but not many people talking about Ethereum changing to proof-of-stake. The real question is when this will be implemented, as ASICs are going to become a problem in several months, but Casper may not be implemented until months or even years after that - so a short-term solution may be needed although because the E3 isn't drastically more efficient than existing GPUs this may not even be necessary.

This site cannot substitute for professional investment or financial advice, or independent factual verification. This guide is provided for general informational purposes only. The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors.

Trading or mining any form of cryptocurrency is very high risk, so never invest money you can't afford to lose - you should be prepared to sustain a total loss of all invested money. This website is monetised through affiliate links. Where used, we will disclose this and make no attempt to hide it. We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. Don't rush into anything, do your own research.

As we write new content, we will update this disclaimer to encompass it. We first discovered Bitcoin in late , and wanted to get everyone around us involved.

But no one seemed to know what it was! We made this website to try and fix this, to get everyone up-to-speed! Click Here for more information on these. All information on this website is for general informational purposes only, it is not intended to provide legal or financial advice. What is the Antminer E3? Ethereum was originally designed to be ASIC resistant With Monero recently announcing that it will become resistant to ASICs in an upcoming hard-fork, many people are wondering if Ethereum will do the same thing.

Ethereum changing to proof-of-stake We've seen many people keen for Ethereum to change it's proof-of-work algorithm to be ASIC resistant, but not many people talking about Ethereum changing to proof-of-stake. May 14th, What is the Antminer B3?

Written by the Anything Crypto team We first discovered Bitcoin in late , and wanted to get everyone around us involved. Never invest money you can't afford to lose.